The Price is Right is a game show

Not a reliable guide to the stock-market

If you’ve only ever heard the theory of investing that says, ‘the price is always right’… then you’ve only heard half the story.

And that can be dangerous at times like this.

Economists can’t forecast for good reason

Economics is not a regular science subject like Chemistry and Physics which allow us to accurately predict the motion of objects on earth, the motion of planets around the sun and even the fuel required to send a rocket ship to the moon and bring it back to earth.

No, the direction of economies (and the prices of company shares and properties that sit within them) are highly unpredictable – for two reasons.

First, economic systems are complex and unstable. That’s to say when you nudge them in one direction they tend (up to a tipping point) to keep moving in that direction rather than trending back to their previous position.

Second, economic activity depends on a great many unpredictable inputs – largely the choices we make (as individuals, companies, governments or other groups) about what we buy and where we invest. We can’t predict how we’ll make those choices because our moods (our ‘animal spirits’, as Keynes called them) change all the time.

At one moment the mood of a group (of consumers, for example) might be optimistic. The next it might turn to despondency and pessimism and when that happens, we often start saving more for our predicted rainy days. The trouble comes, of course, when we all decide to save more (and spend less) at the same time. Mass or herd behaviour like that can cause real economic hardship as it did during the global financial crisis of 2008-09.

This is what economists call the ‘paradox of thrift’ – saving for our future is a great idea for us individually but bad for the economy (and our jobs) if we all stop spending at the same time.

Why do moods shift?

It’s not always easy to see the reason for a collective change of mood. Short term mood changes can arise from sudden unexpected events: a terrorist attack, a natural disaster, a stock market set back or interest rate rise. Whilst longer-lasting mood changes – as workers start worrying about their jobs – tend to come after long periods of economic growth.

At times like this (like now?) low unemployment might have started pushing up wages and squeezing company profits. Some companies are then forced to slow down or stop further expansion plans and/or cut back on overtime work or even cut their workforce, in an attempt to survive.

This is all normal but painful economic cycle stuff that we might have forgotten about as the developed world has not, in aggregate, seen a recession for a long time.

Hyman Minsky summarises the risks well here:

Moods change the other way, of course, from negative to positive although mood upswings tend to be slower than the downturns, which can be violent and catch us off guard.

Economic forecasters cannot predict mood swings

Obviously, economic forecasters cannot predict these mood swings (and especially not any random events that might trigger them) with any accuracy. So, in the past they’ve tended to ignore them, assuming that over time they’ll probably just balance out.

Economists generally assume that we humans act rationally, So, in a simple world (all other things being equal) they assume that when things get cheaper, we tend to buy more of them, and vice versa.

This is a nice neat model which results in the idea that whilst prices (of goods and services) may wobble around over time, they’ll bounce back after each wobble.

Taking that idea – a step too far

You may have heard about this idea that market prices are always right – at least, roughly so, and, if we’re trying to predict the prices of goods we buy in our day-to-day lives, this can be a reasonable assumption.

If the price of butter goes up, we’d expect sales of it to fall a bit, especially if there’s a substitute like margarine we can buy instead. Fair?

But we hit a problem when economists take this idea about our day-to-day shopping behaviour and assert that it applies to how we buy and sell investment assets.

You and I might think it’s obvious that the price of company shares (or residential property) move for very different reasons to the prices of milk and butter. But, to the Economists who first developed ideas in this area, these things were all much of a muchness!

According to George Cooper, in The Origin of Financial Crises, it was the economist, Paul Samuelson, who, in his work, Economics: An Introductory Analysis, said:

“What is true of markets for consumer goods

is also true of markets for factors of production

such as labour, land and capital inputs”

Cooper says that Samuelson gave no evidence or reason why this should be so, he simply asserted that it was.

Why Samuelson said this we can’t know. Perhaps it was simply because the idea (that markets are generally stable systems) was at the heart of economics from its birth – with Adam Smith and his Inquiry into the Nature and Causes of the Wealth of Nations (1776)

According to Mark Buchanan, in his book ‘Forecast: What Physics, Meteorology, and the Natural Sciences Can Teach Us About Economics’, it was Eugene Fama who played the key part in developing this idea that asset prices are normally about right.

Samuelson’s paper (‘Proof That Properly Anticipated Prices Fluctuate Randomly’) had only shown that market predictability would be wiped out (if any existed, to begin with) if we assumed that investors had access to and used all information – and that they acted rationally.

This is perfectly reasonable… in a theoretical world. No one would argue that, if investors knew that the price of shares in, say, ‘Microsoft’ would rise by 5% tomorrow, they’d pay extra for them today thus eliminating any ‘wrong’ prices immediately.

The jump in thinking seems to have come from Eugene Fama who took Samuelson’s purely mathematical theory (of unpredictable markets) and, as Buchanan says, ‘asserted that something like it is true in the real world’

The key point here is this:

Mainstream theory about investment prices assumes that the investors who drive market prices all have good information and act rationally, even in groups.

The question is whether the evidence supports that – and on that question, even Noble Prize-winning economists can’t agree

What we know for sure are these three things:

First, we’re human and, amongst other emotions, we act on greed and fear.

So, in complete contrast to our behaviour with consumer goods, when investment assets get more expensive, we tend to buy more of them!

Second, we look for quick and easy answers in life.

So, rather than doing our homework on complex questions, we tend to take shortcuts by following the actions of others.

Or, as Charles Mackay observed, we think and go mad in herds.

You might also say that any investment theory which says prices are always at a fair level – simply adds to this tendency to ignore risks in horribly ‘overpriced’ markets.

Third, asset buying is supported by banks and other (e.g. Margin) lenders who are happy to lend umbrellas in the sunshine but withhold them when it rains!

These are the reasons (made worse in recent years by Central Bank distortions of interest rates) that we see almighty booms and busts in asset prices – over and over again.

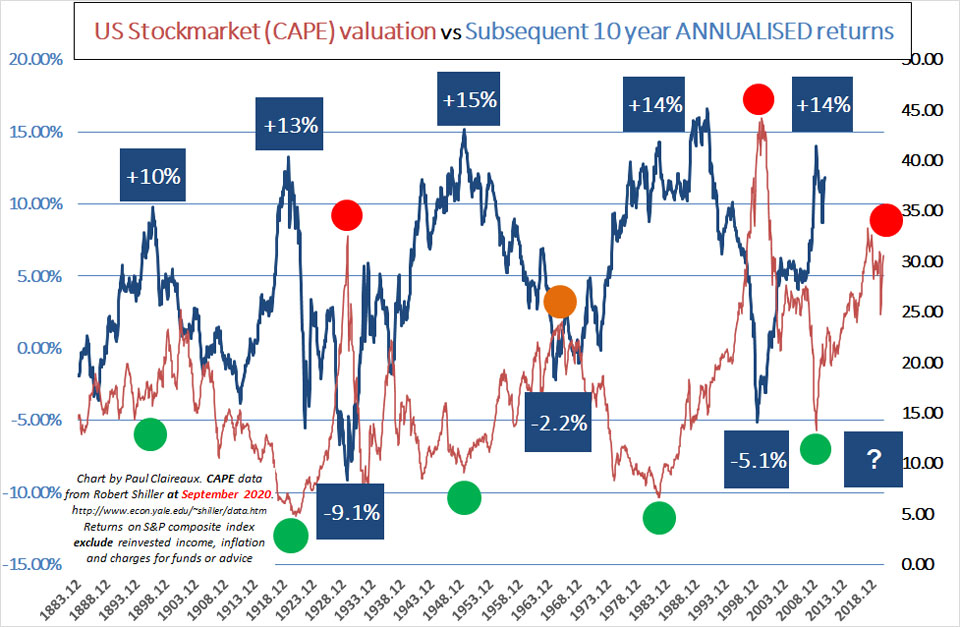

And the price roller coasters are there in the data to see – whether you look at the prices of properties or shares, as here:

Notice how following the Covid-19 induced falls, prices look slightly better value now.

Does this mean they’re now great value or cheap?

Well, from this metric no. So, tread carefully.

The bottom line

We need to be careful about what we conclude from these truths.

What we can say for sure is that we have no idea which way stock market prices will go in the short term, no one does.

However, there are also clearly times when it’s riskier to assume that the price is just right.

As Jack Bogle, the legendary father of Index Tracking investing said – just before he died in January 2019,

“Trees don’t grow to the sky”

If your wealth manager says different (and cites Samuelson or Fama for evidence) send them a link to this page.

Or if they insist you stay heavily invested at all times (perhaps citing the hideously misleading ‘missing the best days’ story to convince you) remind them of the truth about that too

The truth matters, right?

Whether it’s about investment risk (or anything, as far as we can determine it) … it really does matter.

And, as we’ve just been reminded again, we often only find out how much it matters in a crisis.

So, let’s focus harder on finding the truths now.

Follow along if that matters to you.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article