Why financial planning is not common sense

And why that’s a good thing!

A 10 to 20-minute read – depending on your speed.

Most of us look for common-sense answers to various questions in life.

In this Insight, we’ll explore why that is often a bad idea, particularly when it comes to money.

Of course, common-sense answers to simple questions can be helpful. But with complex questions (like making plans for our lives and our finances), common sense thinking can lead to enormous mistakes.

Here, we’ll explore why we fall into the common-sense trap and what we can do to avoid it.

Surely, it makes sense to use our common sense?

It’s certainly common to believe that common sense is a valuable and rare personal strength.

It’s certainly common to believe that common sense is a valuable and rare personal strength.

The French philosopher Voltaire bemoaned its scarcity in society when he said, “Common sense is not so common.”

The mathematician René Descartes clearly shared that view when he joked: “Common sense must be the most common commodity because everyone is convinced they have it!”

What’s odd is how some attribute this (alleged) scarcity of common sense to us having too much information or education!

Writer Gertrude Stein said, “Everybody gets so much information – that they lose their common sense.”

Victor Hugo allegedly claimed, “We have common sense despite our education, not as a result of it.”

However, not everyone is so enthused about the value of common sense.

Writer and Philosopher Henry Thoreau said,

There is no common sense. It is just common nonsense.

Albert Einstein said,

Common sense is just the collection of prejudices we acquire by age eighteen!

And the psychologist and Nobel Laureate Daniel Kahneman is no fan of common sense either.

In his book, ‘Thinking Fast and Slow’, Kahneman describes common sense as being more about judging than thinking.

And that’s clearly true.

How often do we fact-check what we read or hear?

Or do we tend to make snap judgments about an idea based on whether it feels or sounds right and whether it agrees with our current beliefs?

Rhetorical question!

Psychologists call this trap confirmation bias.

And some describe it as the mother of all behavioural biases, so we’ll return to this (and other) biases in future insights.

Sign up for our newsletter if you’d like to see those.

For now, perhaps we can agree that we are not always the best person to judge our own ideas!

And we can create many problems for ourselves and those we care about if we believe in flawed ideas.

So, is the answer to keep an open mind?

Well, as Carl Sagan observed, the answer is yes and no!

We can certainly benefit from a Sagan-like devotion to the evidence.

So, let’s explore this further, starting with some common-sense ideas we’re regularly ‘fed’ by mainstream media.

If we spend all day listening to the news, we might easily conclude that the world is constantly going backwards.

And yes, it’s true that there are always places where people suffer devastating setbacks, particularly when ravaged by war.

However, the news tends to focus on one area at a time, so we do not get a perspective on how widespread these problems are. For that, we must step back and scan world progress over time—like the last 200 years.

Then we see a very different picture, as beautifully illustrated in these charts by Max Roser for World in Data.

In short, these charts tell us that 200 years ago:

- 90% of the world’s population lived in extreme poverty. Now it’s 10%.

- 83% received no education. Now it’s 14%.

- 88% were illiterate. Now it’s 15%.

- 99% did not live in a democracy. Now it’s 44%.

- No one was vaccinated against diphtheria, whooping cough, and tetanus. 86% of people now receive those vaccinations.

- 43% of the world’s children died before the age of five. Now it’s 4%.

Watch this video by Hans Rosling for a powerful visual representation of how living standards have risen across the world in recent years.

Can we honestly say that these facts are commonly known to many?

Of course, these vast improvements in health and living standards have come from advances in Science, Technology, Engineering and Mathematics (The STEM areas) and were enabled by modern (democratic) capitalism in economies open to trading and exchanging ideas.

That said, the real breakthrough (and the basis for the scientific method) came around two thousand years ago from a Greek philosopher who offered us an incredibly simple idea!

Socrates said we must challenge each other in cooperative but argumentative dialogue.

Our progress has come from following the ‘Socratic’ method. By questioning and testing our beliefs, not by trusting everything we’re told.

Of course, it took hundreds of years before we had many useful tools to test some basic ideas.

It was 1543 before Nicolaus Copernicus published his theory that positioned the Sun at the centre of our Universe.

Prior to that, it was quite obvious (common sense) to most that the Earth was at the centre of the universe.

What else could most of us have concluded from seeing the sun move around us overhead?

Sadly, a lot of nonsense ideas are still common.

At the cutting edge of science – in all its domains – our knowledge is constantly growing and changing.

Our common sense is enhanced over time, too, because most people now go to school, and many (though not enough) schools take science seriously.

This is not to say that everyone gets the message. And a great many people hang on to disproven beliefs.

For example, the ancient Greeks discovered that the world was not flat around 300 BC, but with so few people educated until recently, most people assumed that the Earth was flat throughout history.

And despite us now having photographs of Earth from space – some people still believe that!

Researchers have found that up to a quarter of people in developed countries cite “common sense” as their reason for believing that climate change is not caused by human activity.

Another quarter cite “common sense” for believing it is!

If common sense is useless, why use it at all?

Hold on.

Let’s not throw the baby out with the bath water!

For simple and common questions, we only need common sense answers.

What Daniel Kahneman describes as our fast-thinking mode is perfect for answering the question: “What is 2 x 2?”

Two times two is easy because we grab the (hopefully correct!) answer from memory.

On the other hand, our slower, problem-solving mode of thinking needs more time to work out the answer to the question of what is 16 x 23.

The answer to this question is not common sense to anyone.

We can literally feel our brain strain as it switches from fast to slow thinking mode – to work this out.

(The answer, if you don’t fancy doing that, is 368)

In short, common sense quickly fails us – even on questions that are only slightly difficult.

Of course, we can answer tricky questions – like 16 x 23 =?

Some can solve that in their heads, some with a pen and paper, and most by pushing buttons on a calculator.

The point here is that we need a solid process, and we need to follow the process!

But what if we don’t know a good process?

Right, well, this is exactly where we most often trip up.

We very often make mistakes on problems where we don’t know (or don’t follow) a sound process.

Try this puzzle – as an example:

A bat and a ball together cost £1.10.

The bat costs £1 more than the ball.

How much does the ball cost?

The question is simple, and the answer is common sense, isn’t it?

Or is it?

What answer did you get?

Be sure to check your answer.

How much do you think the ball costs?

Now add £1 to the price of the ball (to get the price of the bat) and then add those prices together.

Do you get £1.10?

Try sending this post to a friend to see what answer they get.

Now, try this puzzle – the answer will surprise you!

Imagine a class of thirty children.

What is the chance that any two of them have the same birthday?

Do you know the process for solving this problem?

Very few people do, so don’t worry if you’re struggling.

Everyone finds it hard unless they’re a ‘whizz’ at probability calculations – and very few of those people can work this one out in their heads.

You need to know the process, have the right tools and have some time to work this out.

What’s the answer to the ‘same birthday’ riddle?

Well, we think the answer will surprise you.

Indeed, it shocks most people to learn that the chance of two or more children (in a class of thirty) having the same birthday is…

… more than 70 %!

Yes, seriously.

In a group of 30 people, it’s very likely that at least two people will have the same birthday.

How amazing is that?

The proof is available here – if it interests you.

A fun riddle to ask your friends or colleagues at work?

The next time you’re out in a big group, try asking your friends to call out their birthdays – one by one.

You’ll be amazed to see this work in practice.

Just remember, the chance of two or more people having matching birthdays is high, but it’s 70% (not 100%!) for a group of 30 people.

So, you won’t get a match every time, and your friends might think you’re mad for asking them if you don’t get a match!

After all, common sense tells us there’s little chance of finding matching birthdays in such a small group of people, right?

What do these riddles tell us?

This is not about learning to work out the answers; interesting, though that is for some.

These riddles show how our intuition (or ‘gut’ instincts) are useless for solving tricky problems.

It’s hard for anyone (including those who are good with numbers) to shift into the ‘slow-thinking’ mode to solve problems.

Our brains are energy-saving devices, so we skip the hard work and grab at what feels like a good answer whenever possible.

And thank goodness our brains work this way!

Just imagine how exhausted we’d be if we had to stop and think about everything we did each day.

Do you remember your first day of driving lessons?

Or, if you don’t drive, perhaps you remember learning to play a musical instrument or learning to navigate a new set of systems at work.

Imagine if everything you did all day was as ‘brain achingly’ hard as those first lessons!

What about our bigger life challenges?

Just be aware that our brains are energy-saving devices.

So, we also tend to seek simple, common-sense answers to more complex questions about life, love, and money.

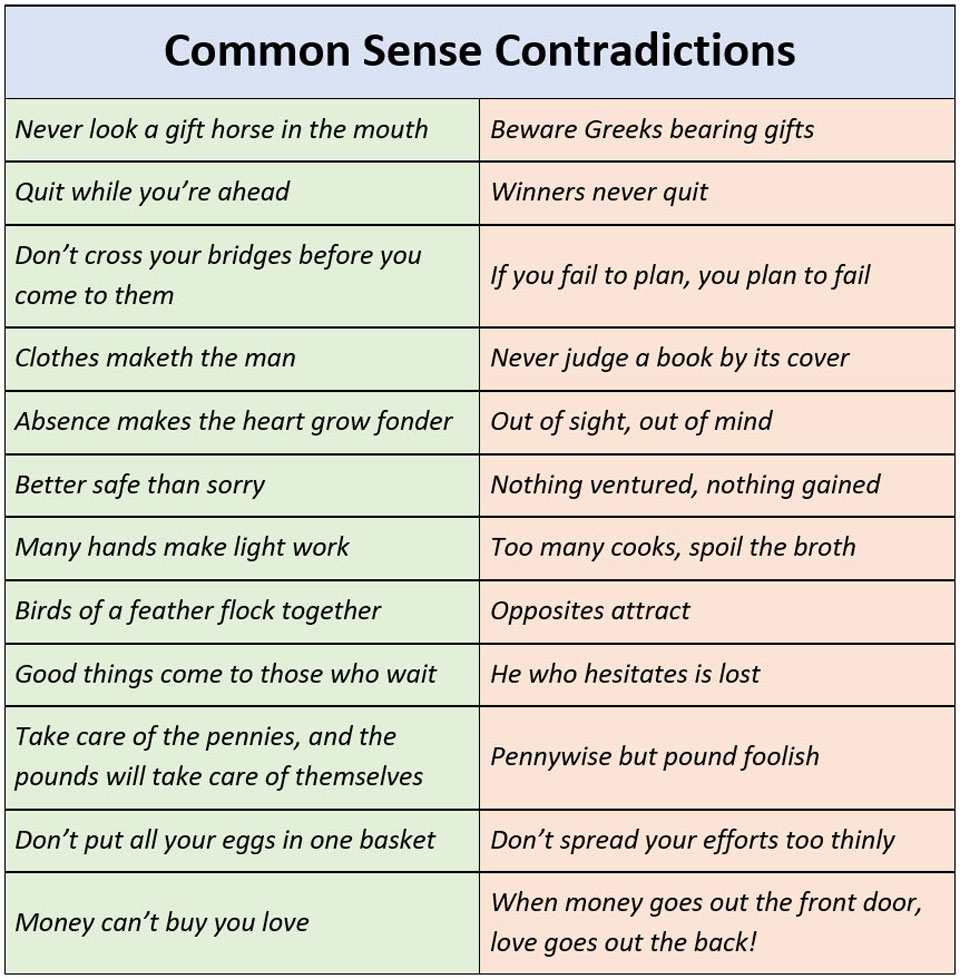

You’ve almost certainly heard people say:

- Never look a gift horse in the mouth.

- Don’t cross your bridges before you reach them.

- Better safe than sorry.

- Money can’t buy you love !!!

And perhaps you thought that was useful guidance – that has stood the test of time.

But how useful is it… really?

The astonishing thing about each of those common-sense maxims is that there’s another which gives the precisely the opposite advice!

For example:

- ‘Never look a gift horse in the mouth’ – is completely at odds with – ‘Beware Greeks bearing gifts.’

- ‘Don’t cross your bridges before you reach them’ – argues with – ‘If you fail to plan, you plan to fail.’

- ‘Better safe than sorry’ – suggests the opposite strategy to – ‘Nothing ventured, nothing gained.’

And the idea that ‘Money can’t buy you love’ is clearly at odds with the evidence and with this other common sense saying that:

‘When money goes out the front door, love goes out the back’!

Here are some more examples:

The golden rule for complex problems

To be clear, we absolutely accept that some rules of thumb and common sense answers are helpful in some situations.

Shortcuts save us from getting overwhelmed.

We cannot run a rational, multivariable analysis of every little decision we make.

And that’s a key problem for the rational human theory of economics, by the way, but that’s another story!

Take choosing a basic product to buy online, for example.

Our ‘analysis’ might only consist of counting the 5-star ratings on the products we’re considering.

We know those reviews offer no guarantee of quality, but they’re often a useful guide on popular products.

So, noting the crowd-view can save us a great deal of time.

However we need to know when to stop taking shortcuts or ‘trusting our gut’ – another overused maxim.

Although, if you really want a simple golden rule for solving complex problems, try this one from George Bernard Shaw!

Our lives are too complicated unique to be managed with golden rules.

So, be wary of common-sense guidance on how to achieve more of what really matters in your life.

Your life goals, for yourself and your loved ones, deserve more attention than that.

Financial planning is about what really matters.

Sadly, thousands of unqualified but self-proclaimed gurus (‘wannabe finfluencers’) wish to convince you that they have the answer to all your money worries.

Too many of them push the message that personal finance is simple—perhaps you’ve seen some of their posts and videos?

To be fair, some are informative if you know who to follow, but in many cases, we’re given only one-liner top tips in exchange for our ‘likes, follows, and subscribes’ to their social media channel.

A one-liner tip isn’t financial advice, but our #finfluenza friends are not offering us that.

Their goal is to get tens (or hundreds) of thousands of hits on their YouTube or TikTok channels. So, they can earn a nice income from advertising.

And YOU (or your attention) is the product they’re selling to the advertisers.

Financial planning is not common sense.

Managing all aspects of your money is seldom simple, and those who research financial literacy are clear about that.

Most of us find it hard to manage our money consistently:

- To keep our income above our expenditure.

- Juggle mortgage repayments with those to pay down other debts charging higher interest, as interest rates vary, sometimes a lot.

- To build funds in accessible savings accounts to cover emergencies.

- To save and invest for our medium and longer-term life goals.

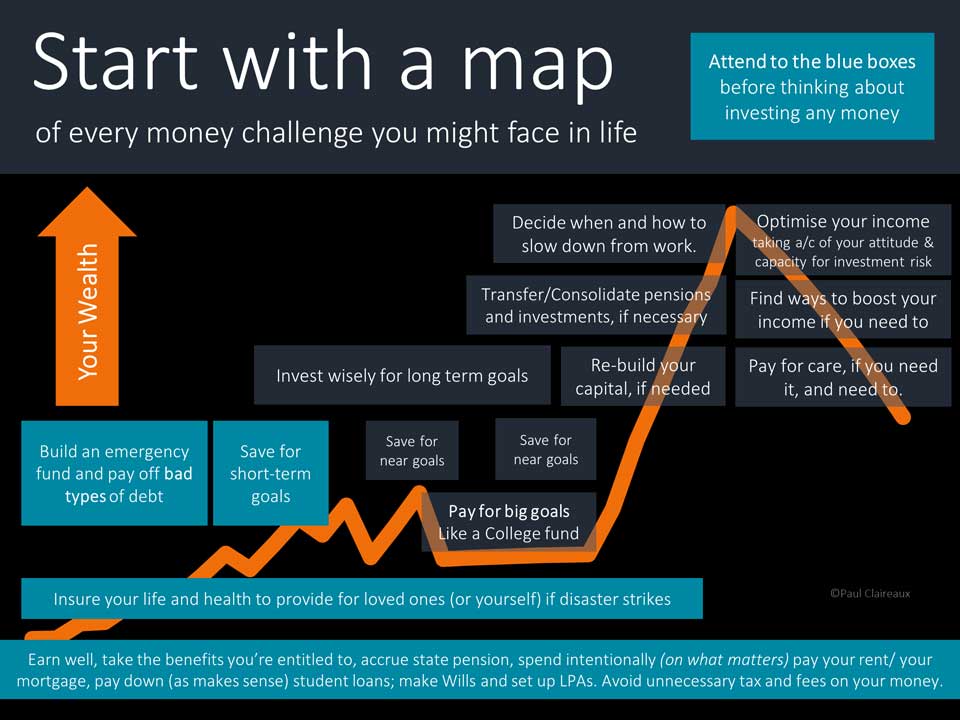

And this map shows the money challenges most of us might face throughout our lives.

Thankfully, we don’t have to deal with all of these challenges at once

Thankfully, we don’t have to deal with all of these challenges at once

But please, let’s not pretend this is simple.

As Nobel Prize-winning economist Daniel Kahneman regularly points out:

Common sense answers to complex questions (about money, work, life and love!) are very often wrong.

Financial Planning is not common sense – and we must remember that.

There’s no common-sense way to calculate how much you need to save for your goals. You need to know how to run the calculations using sensible assumptions.

There is no common-sense design for a financial plan to achieve your financial life goals.

There are no common-sense solutions to your unique set of personal financial challenges!

And there is certainly no single solution (summarised in a 20-second video on TikTok) that takes account of your unique financial circumstances, attitude to money (and risk) and your ambitions in life.

The idea that these tasks are common sense – is simply nonsense!

What’s more, you need to know how to choose the right insurance, pension and investment products.

You need to know what level of risk to take on your investments and how to find the right funds to put inside your investment boxes.

And there are many traps for the unwary if you:

- Fail to set up those life and health insurance plans, and the worst happens.

- Fail to make a will or set up your powers of attorney.

- Pay far too much interest on your mortgage or other loans.

- Allow your wealth to be dragged down – by inflation, poor investment performance, or excessively expensive funds.

The only financial plan you need

The only financial plan that’s of value to you is one tailored to your personal needs.

No video, book, podcast or article can give you that because the author of those works knows nothing about you!

On the other hand, a good Financial Adviser will get to know you and listen to what you want for your future.

They’ll explain your financial challenges and the possible solutions in plain English.

And they will not pretend anything is common sense if it’s not.

What will you take away from this?

If you need it, we hope this Insight encouraged you to explore financial life planning.

If you need it, we hope this Insight encouraged you to explore financial life planning.

If you don’t need it – please share this page with someone who does.

We’d love to hear your takeaway messages from this – in the comments or by e-mail.

We’re here for you on this journey and will offer more Insights over time.

The truth is that there are very few (genuinely useful) common sense maxims in financial planning.

But you should know what a good financial plan delivers – when you act on it.

A good financial plan puts the right amount of money in the right hands at the right time.

And, for the most part, those hands will be yours in the future.

So, you’ll have the money you need to pay for what matters to you – your goals for yourself and your loved ones.

If you keep that as your aim, you won’t go far wrong.

Just talk to a good financial adviser about designing or reviewing your financial life plan.

And, thanks for dropping in

Paul

Notes for financial advisers, planners and coaches

This Insight is just one of a new 40-piece library of content I’m writing to make available to you (under lifetime licences) to use in your business.

These pieces are designed to engage and educate people about the value of financial planning – and to help them make better financial decisions.

You will, of course, be able to brand these insights to your business.

E-mail me here to request early (discounted) access to this type of content

Just add a subject line: Register my interest for Licensed Content.

Lifetime licenses to use this content (with access to all updates) will cost a fraction of bespoke content.

For everyone

For more ideas to achieve more in your life and make more of your money, sign up for my newsletter here

Share your comments here.

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article