What’s the cost of a go-to financial education library?

And how could you significantly reduce those costs?

This is the second of several insights on the potential benefits and costs/risks of putting financial education at the heart of your business.

This series is for you if:

- You lead (or influence) a business offering financial planning, advice, coaching, products, or fund management.

- You want your firm to become (or hold its position as) a go-to place to help consumers make better money decisions.

Yes, it’s a reasonably long read, at 15 to 30 minutes, depending on your speed.

However, if you’re considering this kind of project, the ideas here could save you from a great deal of stress and up to £100,000 in fees.

So, you might want to take a look.

What I’ve covered, and what’s coming up?

In the first insight in this series, I explored the drivers of human motivation and happiness – to show how focusing on educational work can help us personally on those fronts.

Over the coming weeks, I’ll outline twenty-five wider benefits (to your clients, team and business) of an education-first approach to marketing.

To see those benefits now, e-mail me at hello@paulclaireaux.com with the subject line ‘Send the 25 benefits’ – and I’ll send you a slide deck of those.

You don’t need to wait to learn the proven benefits of this type of marketing to your business.

In future insights, I’ll explore the ‘How to’ questions for planning a new (or redesigning your existing) learning hub.

It’s essential to plan this kind of development carefully; if you get this wrong, you’ll waste tens of thousands of pounds.

First, in this Insight, we’ll explore the following – click to jump to that section.

- Why your content library needs to work like a shop.

- How your content creates stepping stones to your services.

- How to choose your content categories.

- How to label your core content categories

- Other, more complex, topics you could cover

- Why Money Mindsets is a must-have category

- How big could your learning hub be?

- How broad and how deep will you go?

- What will good look like?

- What’s the time cost of content creation?

- What will a good programme cost you?

- Taking control of your video costs.

- What about content maintenance costs?

- How to reduce your costs – by 90% or more!

- How could I help you with this?

The bottom line

Given the potential to save 90% or more on the cost of building a high-quality learning hub, you clearly don’t need to worry about the cost of this marketing.

Provided that you get it right.

If you offer genuinely high-value content to the right people, you’ll make a fantastic return on your investment.

My clients who completed their programmes are extremely pleased with the results.

Just e-mail me at hello@paulclaireaux.com with the subject line ‘testimonials’ for the evidence of that.

OK, now let’s explore what it costs to build a good store – of engaging educational content.

‘How hard can it be to write a bit of content?’

That’s a question I sometimes hear.

And, if you’re a good content creator, you’ll know the answer.

Writing an ‘odd bit’ of content to fill a page on your website is easy.

The far harder task is to design and build a navigable and valuable library of content that delivers:

- High quality (ABC: see later) insights to your clients, their family and friends.

- Clarity on who you can help and how – so wins you more ideal clients.

- Signposts to other reliable sources of help – for those you can’t help right now.

It’s genuinely hard work to build (and keep) a reputation as a trusted place for answers to vital money questions.

I know because that’s what I help firms achieve. So, let’s dive deeper into this now.

Why your content library must work like a shop.

A ‘go-to’ place for insights is like a great clothes shop, and to design or enhance your shop, you must decide on:

- The audience (or audiences) you wish to attract.

- The style of

clotheswriting you’ll focus on. - The

departmentscategories of content you’ll offer.* - The particular

clothingitemsInsights you’ll stock in each category. - The formats (text and images, video, webinars) you’ll use to deliver the insights.

- The people you’ll need to help you build all of this.

* There are many categories to choose from, as I list below, and an endless list of topics you could cover in each category.

So, you must decide early on your initial (or next) content focus, and the order to offer those insights.

How your content creates stepping stones to your services

If you cover the basics first, you can refer back to these insights in all your later works.

Do this, and you’ll avoid the classic trap of trying to squeeze basic ideas (like investment risk vs reward) into more advanced insights later on.

I’d also suggest you avoid writing highly complex explainers – unless you’re sure your target audiences want those.

If you’re a financial planner, adviser or coach, your primary aim with your learning hub is to help your audiences get a clearer view of what you do, and the enormous value of your work.

How to choose your content categories

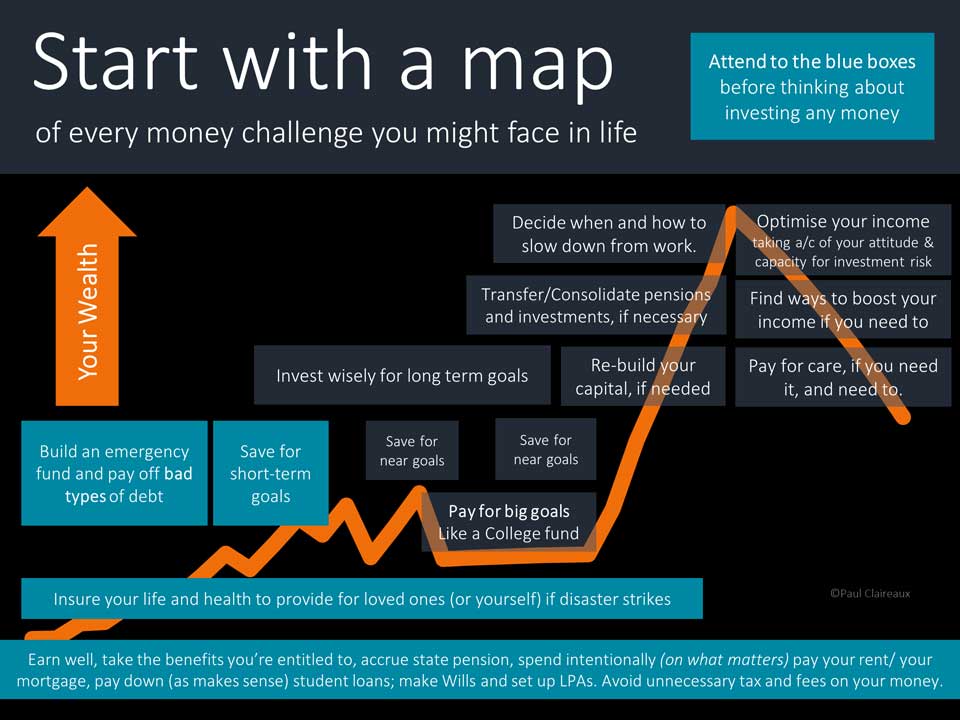

Take a good look at this map of the potential money challenges we all face over our lifetime.

(I’m told by consumers and financial planners that it’s helpful)

In which areas of this map do you want to offer some (or more) insights?

And, in answering that question, consider whether you’d like to engage a slightly younger generation – in addition to your typical clients.

What about your clients’ 30 to 40-year-old adult children* and their friends?

* Research from Schroders and Adviser Home shows that 65% of these inheritors intend to switch advisers after their parents are gone.

So, if you plan to be in a business for several years or want to help solve the financial literacy and advice gaps, perhaps the best way is to offer more high-quality insights for this younger group.

I guess we’d agree that they’re not served well by every financial tip they’ll find on TikTok today!

The problem with quick and simple answers!

It’s tempting to think that designing a learning hub is easy when you see all the money challenges laid out in one picture, like that above.

It might seem like a 5-minute job to list the titles of the insights you want, right?

But that’s only because you and I already understand the nature of those challenges. We have ideas that immediately spring to mind on how best to approach them.

Most non-experts (those most likely to seek advice!) don’t know how to deal with those challenges.

So, we need to slow down our thinking and consider (as best as we can) the questions our audiences will want and need answers to.

- The hard money challenges around money management, spending control, financial planning, personal insurance, investing and more.

- And the so-called soft issues around money, which cause unhappiness, relationship issues and other emotional difficulties.

You may want to offer content in both of these areas.

Highly technical explainers on pensions, tax or investing can be useful for sure, but generally only once the client is engaged in the idea of working with you.

That engagement (via your content) is unlikely if your site visitors are bored or confused by painfully technical content.

To engage people, we must offer a balance of factual and emotionally engaging ideas which are explained in full.

We earn little or no respect by offering daily, short-and-flippant ideas on Social Media platforms.

Sorry, peeps but let’s be honest, that stuff is for those in the FS echo chambers only!

Your audiences deserve substantial educational meals.

We can leave the ‘attention-grabbing messages’ to the TikTokkers, surely?

Don’t get me wrong; there’s a place for short-form content in our outreach marketing – for attracting people’s attention.

However, when we’ve got someone’s attention, we must offer something of significant value.

If we don’t, they’ll feel that we’ve wasted their time, and it’s unlikely they’ll come back to our website!

The time cost may be invisible, but it’s real nonetheless.

Do you ever bounce away when you visit a website offering nothing of substance – or find yourself watching an unpopular LinkedIn live?

The point is you must decide which content categories to offer – to add real value to your audience’s lives.

How to label your content categories

Your website visitors want clear category labels to find the information they need.

Your website visitors want clear category labels to find the information they need.

So, these labels must work in a drop-down list under your insights or learning hub tab on the top menu of your website.

You’ll also want to choose labels that people can relate to – or you’d like them to relate to.

Imagine your clients (or their family members and friends) saying this to their friends:

‘Oh, if you want to learn about money, try the XYZ Financial Planning site.

It’s brilliant, and I’m learning about Money Mindsets* at the moment.

* Replace money mindsets with any of the categories I’ve listed below – or others you develop.

Here’s the list of category label ideas I give to all my clients – to help them think about this:

(Each client decides which categories to cover and the precise words for the labels)

- Money Mindsets

- Financial Planning

- Borrowing & Credit Scores

- State Pensions & Benefits

- Intentional Spending (aka budgeting!)

- Life & Health Insurance

- Emergency Funds

- Home Buying & Mortgages

- Investing

- Building a Pension Pot

- Taking Income from Pensions

- Later Life Planning

You and I know there are many topics we could write about under each of those categories.

And to show the scale of this task (to develop a library of insights), let’s just open up one of those twelve categories: Money Mindsets.

Do you think we could interest your clients (or prospects) with insights into:

- How our ability to manage our money can affect (and be affected by) our personality, outlook, resilience, attention, work performance, relationships, motivations, life satisfaction (general happiness), habits, emotionality and several hundred behavioural biases!

- How each of us is unique – because of those dimensions, and why that makes the personal nature of financial planning so valuable.

- How our life story and experiences have forged many of our money scripts (what we tell ourselves about money), and how we might undo any unhelpful beliefs.

- Worries about money and how this affects people all the way up the income and wealth scales. And, again, how financial planning helps enormously with that.

- The psychological evidence on the value of looking for and facing our financial challenges.

Of course, there are many more subjects we could add to this list. For example, we might decide to cover twenty (of the 200 or so) behavioural biases that are highly relevant around questions of spending control and financial planning engagement more widely.

I’ve only touched on one of twelve categories of content here, but you can see there’s a limitless list of potential insights we could offer around money. And every single insight can be linked back to a need for your valuable financial planning, advice or coaching services.

Developing your own (or using some of those) content categories is, therefore, one of the first tasks on your list – if you want to build an acclaimed financial education library.

And I’m ready to help you if you’re keen to do that.

Just book some time in my diary here.

Other, more complex, topics you could cover

I’ve not mentioned business financial planning questions in the twelve categories listed above. And if you offer advice in this area, you’ll want to write about Key Man and Shareholder Protection Insurances – and the options for Directors to extract profits from their business.

Nor have I listed tax planning for high earners or the wealthy who are either not resident or domiciled in the UK. Again, if this is your specialist area of advice, you may want to offer insights on these topics.

In both areas (and others like defined benefit pension transfers), you’ll either have the expertise in-house or have adviser partner firms who could supply content as guest posts on your website.

It makes sense to highlight the value of advice in these areas, of course.

Just ensure the content isn’t so technical as to turn off your readers.

Your aim is surely to offer stepping stones to your valuable services – not prepare clients for exams!

Money Mindsets – the must-have category

Whatever categories you choose for your ‘learning hub’, I’d encourage you to include a category on money mindsets.

Most people are more fascinated by questions of human behaviour and happiness than they are by the intricacies of tax charges for exceeding the pension annual allowance!

Not everyone, of course, but most.

And if you offer money mindset insights, you can refer to these within the more mundane-topic insights.

There’s invariably a behavioural bias (or three!) to mention when highlighting the tripwires in every corner of financial planning. So, well-written Money Mindset explainers can significantly boost your readers’ interest in your financial planning or coaching services.

If you only cover the hard (dull?) facts on personal finance, you may lose most of your potential clients (or influencers) soon after they arrive on your website. They’ll just head off to other, more engaging places.

When we talk about money mindset issues, people tend to stay longer and read more.

Examples of Money Mindset Category Insights

You might be interested in these guides I wrote for Fidelity Adviser Solutions, which have been well-received by Financial Planners.

You might be interested in these guides I wrote for Fidelity Adviser Solutions, which have been well-received by Financial Planners.

If you’d like some colourful guides on similar topics to post on your website (with your branding and your unique calls to action), I’m happy to discuss creating some of those for you.

Book a time in my diary if that’s of interest

(You can’t white-label the Fidelity Guides)

How big could your learning hub be?

That depends on the number of categories you’ll have and how many topics (and angles on those topics) you want to cover.

That depends on the number of categories you’ll have and how many topics (and angles on those topics) you want to cover.

Angles?

Yes, let’s take the financial planning category as an example.

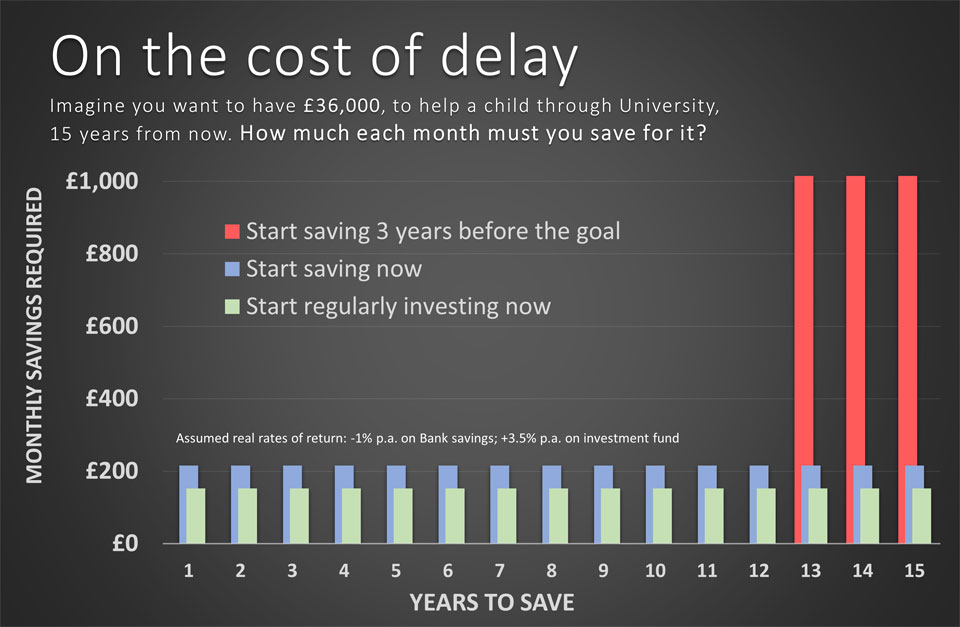

One of the classic topics in this category is ‘The cost of delay’.

This insight draws attention to the problems that arise if we’re slow (which most of us are) to set up regular savings or investment plans for our goals.

And to engage people in this issue, we could point to the ‘cost of delay’ being:

- A substantial downgrade in our goal – like a 2-week holiday in Spain compared to that dream of a 6-week cruise around the world.

- Relationship problems with our partner (or children) if there’s a big shortfall in the funds available for an agreed goal.

- That our goal becomes impossible to achieve – as I’ve shown here. And how this problem is compounded by the need to use cash / low-return funds if you start late / close to the end date.

So, there are various angles we can take on this single topic.

Alternatively, we could create a longer form insight that draws all of these ideas together and explains how:

- Long-term regular savings give us more capacity to take investment risk* – so potentially lowers the cost of reaching our goal – as shown above.

- By reaching our life goal sooner, if we start investing sooner, we can then relax (perhaps with our money moved to less volatile funds) as we approach the goal end date.

* I would, however, suggest you cover the difference between ‘attitude to’ and ‘capacity for’ investment risk in a separate insight – as you’ll need this foundation concept in various other insights.

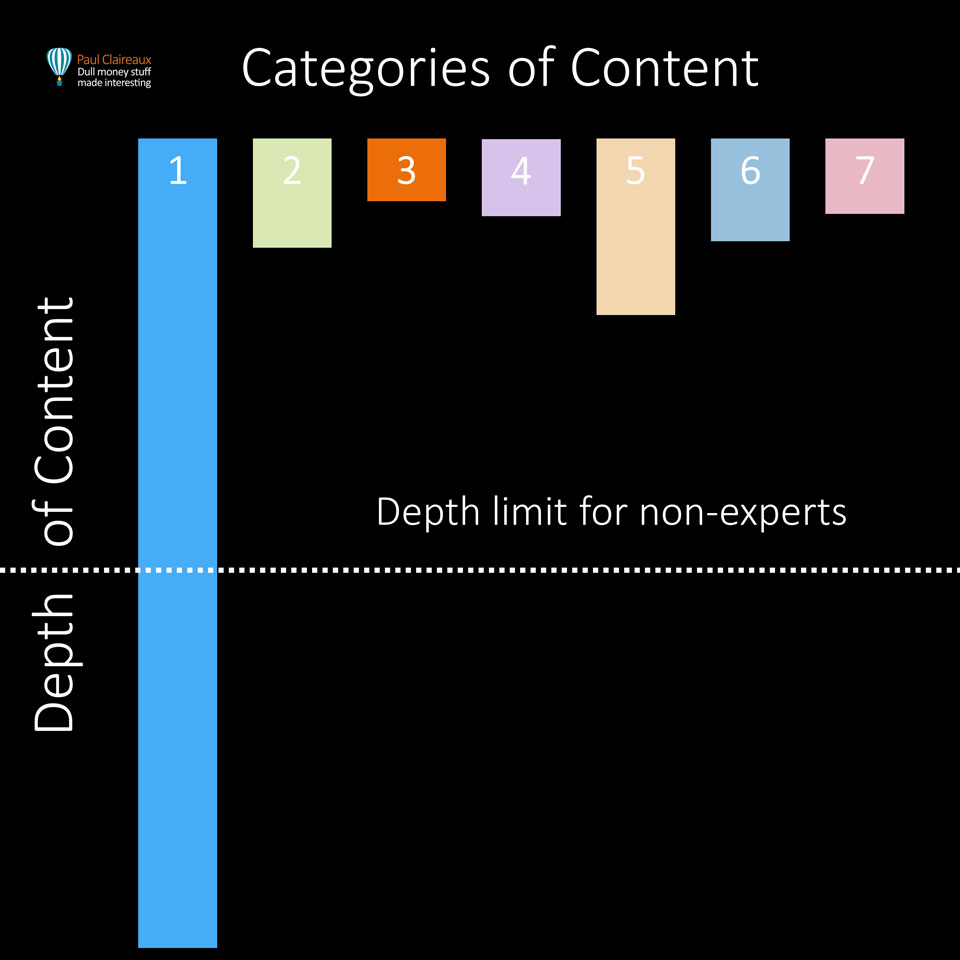

How broad and how deep will you go?

You may need fewer insights in your library than other firms if your business is focussed on a particular client type (like Doctors or Teachers, for example) and/or by an area of financial advice (like ‘at-retirement’ planning),

That said, your insight count will also depend on your content depth, and assuming you have limited time to apply to content creation, you must choose between offering a narrow range of deep-dive content versus a wider range of more basic explainers.

Some planners dive deep into complex topics within their learning hub, but I’d not generally recommend that for a non-expert audience.

Some planners dive deep into complex topics within their learning hub, but I’d not generally recommend that for a non-expert audience.

My aim here is to offer a useful (plain English) post on the potentially horrendous costs of content creation.

And there’s a difference between the complexity and length of a post, of course.

You’re probably aware that the most famous ‘unfinished book’ is ‘A Brief History of Time’ by Stephen Hawking.

That book is quite short, at just 53,000 words, and yet it’s estimated that less than 7% of people who start reading it finish it.

Most of us admired Hawking and loved the film, ‘Theory of Everything’, which focussed on Hawking as a person and his relationships rather than his theoretical physics ideas.

The film’s success, no doubt, helped push sales of the book to over 25 million copies.

That’s a lot of unread books!

And, if you’ve studied Physics at A-level or above, you’ll know that the world of Physics (and the Maths required to model what we think is going on) is extremely complex.

Perhaps too complex to be explained in simple terms to a mass market?

Interestingly, Daniel Kahneman’s book ‘Thinking Fast and Slow’, (often cited in financial service circles) suffers from the same problem, with more than 92% of starters not finishing it.

Mind you, that book is over 150,000 words, so perhaps its length, the topics he covers and the writing style are the challenges there.

I can’t be sure; I’ve got a copy on my bookshelf, but, like most people, I haven’t read it all!

It’s up to you as to how you approach the depth vs breadth question.

You can try to teach people about horrendously complex topics, but you might lose many potential clients before they’re halfway through your insights.

Either way, you must decide on the financial planning and other (e.g. money mindset) areas to cover in your learning hub.

And I’m happy to help you:

- Think through which categories would be best for your business.

- Develop some signature content ideas.

One thing is certain, given how many money-related questions there are to answer. You’ll need between 30 and 40 explainers to have a learning hub of substance.

What will good look like?

You will, of course, want to build (or maintain) a reputation as a go-to place for solid and fascinating answers to key money questions.

There’s no point in having a (content) reputation for anything else.

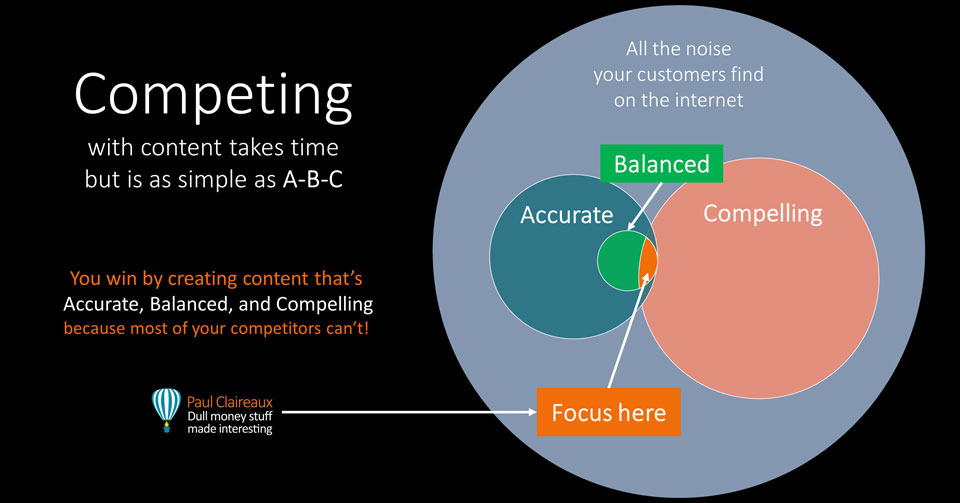

So, your posts have to pass the ABC tests.

They must all be Accurate, Balanced and Compelling. And that’s critical if you’re talking about matters of the mind and human behaviour.

How much of the (allegedly) educational content on the internet passes those ABC tests today?

No, not very much.

And as unchecked AI-generated content explodes in volume, the situation is only going to get worse!

What’s the time cost of content creation?

Sadly, millions of nonsense ideas are shared every day about financial planning, human performance, diet, health and all manner of other (vital) questions.

Sadly, millions of nonsense ideas are shared every day about financial planning, human performance, diet, health and all manner of other (vital) questions.

Your clients deserve vastly better quality content, and there’s an opportunity for you to stand out from your competitors if you offer it.

If you love to develop ideas, carefully research the facts and write your own works, you’re in a better position than most.

However, before we start building a learning hub, we must open our eyes to the potential costs (in money and time) of creating this content ourselves.

I see many business owners (advisers, planners and coaches) enthusiastically start a content creation project. But many give up after producing a handful of works – when they realise the time it’s taking up.

I’m keen to help you avoid that costly mistake.

Shall we explore the numbers?

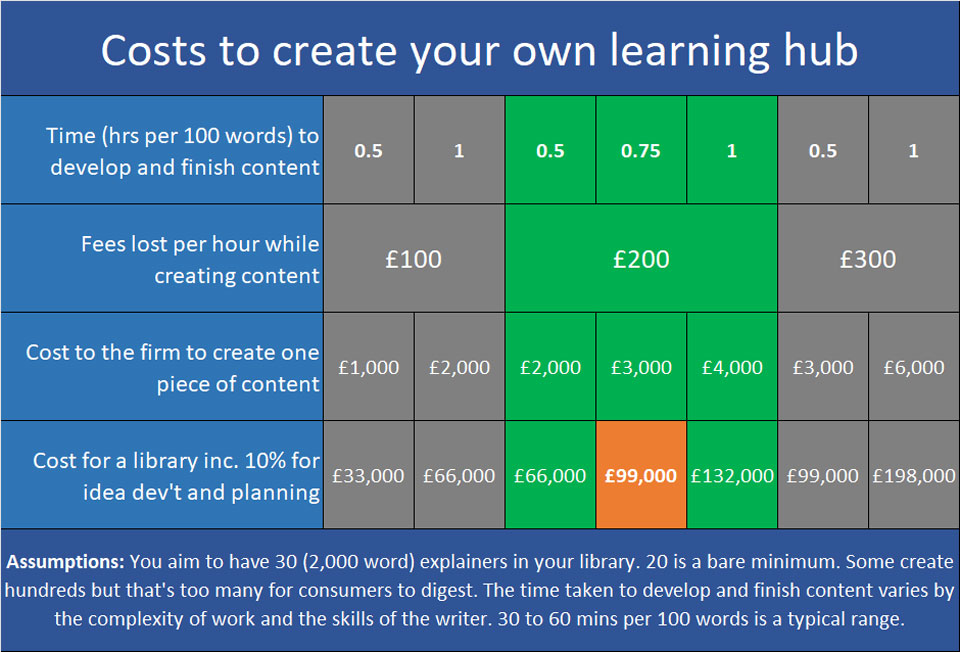

Do you know what it will cost to create a library of, say, 30 educational explainers?

Very few do!

So, let’s make some assumptions and work this out.

First, I’ll assume you’ll only create high-quality (ABC) content:

- The concept is compelling.

- The ideas have been painstakingly researched and fact-checked.

- The words are beautifully crafted and edited.

- There are colourful images to keep people engaged.

I’ll also assume that each explainer contains about 2,000 words.

Why?

Because articles of that length or more tend to deliver the most engagement.

Indeed, research from leading digital marketing agency Wordstream shows their best-performing blogs to have an average of 2,700 to 3,000 words.

Of course, as Semrush neatly outline here:

- Some of your (news-type) articles might only be 500 to 800 words.

- Your ‘how-to’ guides, which position you as a thought leader, must offer a lot of value, which requires 1,500-2,500 words.

- Your signature (‘Pillar’) pages are likely to be well over 3,000 words in length.

If your aim is to educate, think about why TED talks are the length they are.

Their researchers found that an average of 18 minutes (2,500 words) is an optimal length for an important talk to an audience who want to listen.

Building such an audience is another challenge, of course. And yes, you’ll need to attract people to your longer-form insights with short and high-impact Social Media messages.

Thankfully, you can create whole lists of short messages (complete with images) for a multi-month campaign from a single long-form Insight if you use a clever APP.

Happy to provide more marketing efficiency ideas if you’d like to talk.

Anyway, with 30 insights of c. 2,000 words each, you’ll have c. 60,000 words of content when the first stage of your library is complete.

Did you know this is about the same as a modestly sized non-fiction book?

How long will it take to create that content?

If you have the right skills (or you have them in-house), a 60,000-word library of around 30 insights will take between 300 and 600 hours of (intense, concentrated) work to complete.

If you have the right skills (or you have them in-house), a 60,000-word library of around 30 insights will take between 300 and 600 hours of (intense, concentrated) work to complete.

Trust me on that for now; I’ll explain why it can take this long in another post soon.

Yes, some AI tools *can* be helpful for generating ideas if you’re struggling to work out what to write about.

And other AI-based tools can help you check the quality of your grammar.

But you cannot simply use chat GPT or Gemini to write the content.

Leading digital marketing agencies will tell you if you do that, you could destroy your brand.

Anyway, I’ll come back to this hot topic soon.

So, stay tuned for that post if this interests you.

Also, be aware that if you’re not an experienced and disciplined writer, you may need a lot more than those 600 hours.

You’ll develop your writing skills on the job, and if you seek (unbiased) reviews of your content, you may find that your early works require rewrites.

Just don’t rely on your employees or friends for feedback on draft content. For obvious reasons, they might not wish to criticise your works.

However, a good editor or content creator should offer valuable feedback on how to polish the content before publishing.

Creating a great learning hub is a marathon, not a sprint. And if you aimed to complete the first stage in, say, two years, you’ll need to:

- Allocate around 8 hours each week to this work.

- Find uninterrupted two-hour blocks of time – to immerse yourself in the idea development, research, crafting and editing of every insight you write. You’ll need to ‘Get in the flow’ as Csikszentmihalyi might say.

- Find another 10% to 20% of the total time spent writing these works – for discovering and developing your ideas and planning all the work.

What’s the financial cost?

Well, you can’t allocate the time you spend on intense creative writing work to your client or business management work.

So, this is a very real cost to your business, which I’ll price at the average (Vouched For) adviser charge-out rate of £200 per hour.

In that case, using the assumptions above, a good learning hub will likely cost you about £100,000.

Which is not a figure most people expect until they work it out, as we’ve done here.

Of course, if your charge-out rates (or creative writing speed) are significantly different from these (typical) numbers, your estimated costs will also be different.

So, in this table, I’ve laid out a realistic range of costs for creating a good quality learning hub in-house.

In short, creating a great-quality (unique) learning hub requires a significant investment upfront.

You may have other costs, too, if you convert your insights into attractive downloadable guides, presentation slide decks or videos.

Taking control of your video costs

You need to be aware that video production can be extremely expensive, depending on your chosen format.

You need to be aware that video production can be extremely expensive, depending on your chosen format.

Your production options are changing rapidly with new AI-based software. Still, as ever, you need to choose carefully and have a competent designer (or animator if that’s your choice) lead the work – working closely with your content writer – to ensure the messages are not distorted in the production process.

So, be sure to explore the various formats to consider which would work best for you.

I’m happy to advise you on those options.

Just book into my diary to discuss them – and keep a firm lid on these costs.

Another common (and expensive) trap is to create multiple versions of the same explainer content.

- For a blog post.

- For a presentation slide deck.

- For a video.

You don’t need three sets of text for the same insight; your core explainers need only be written once.

They just need to be written well – in a conversational style – so you can use them in all those formats.

They’re easier to read if written this way, in any event.

Don’t you think?

Book a meeting if you’d like to explore this further.

What about content maintenance costs?

Yes, any content that goes out of date must be removed or updated.

The time you’ll need for this work will depend on the proportion of your library that’s ‘Evergreen’ – so it won’t change over time.

Content maintenance could easily add 10% to 20% to your initial creation costs each year.

So, you may need to allocate £200,000 of your time costs to the creation and maintenance of a good learning hub – over a period of ten years.

Yes, that sounds like a lot if you’re unfamiliar with content creation.

However, at c. £20,000 a year, it’s less than half the cost of an average marketing manager -and is clearly a bargain if it transforms, builds or maintains your business reputation.

Think about what Martin Lewis offers.

Money Saving Expert is entirely about education – and he’s done reasonably well from that…

As have my clients with their learning hubs.

Education-First marketing works extraordinarily well for your business. And becoming an educator makes us happier and more motivated in our work, too.

So, there’s really nothing not to like!

Could you significantly reduce these costs?

Yes, absolutely, you could, and there are two ways to do that.

First, if you want to have your own unique set of educational insights, you could outline your ideas and then ask a skilled and proven writer in your sector to create that content for you.

If they’re good, they’ll even suggest some images to bring the words to life – and liaise with your web designer to ensure those images are all on brand.

Depending on how you (and your writer) price your time, this approach could save you 25% to 50% on the costs of creating this content yourself.

If you don’t have the creative writing skills or desire to spend time on these works, you’ll probably get more engaging content, too.

The second option is to use a ‘licensed content’ service.

Here, you might save 90% or more compared to the cost of creating your content in-house.

With the right service, you might avoid ongoing maintenance costs for several years, too!

How could I help you with this?

Later this month, I will offer:

- A NEW licensed content-to-go service for those seeking the quickest and best value way to engage their audiences.

- A bespoke content creation service for a small number of clients – as I do now.

My ‘Content to Go’ service will be extremely easy to use, and the content updates will be FREE for early users of this service.

When I launch around mid-March, there will be several vital explainers on key financial (and life planning) concepts in the shop. And I plan to add more insights every month throughout 2024 and beyond.

If you’d like to talk about either of these services, let’s do that.

There are a great many ways to build a valuable content library.

And a (no cost) conversation could help you explore your options.

If you’d like to talk, book directly into my diary here.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up for my newsletter here.

You can comment as a guest (tick that box) or log in with your social media or DISQUS account, below.

You can comment as a guest (tick that box) or log in with your social media or DISQUS account, below.

Discuss this article