About Paul Claireaux

Hey there,

If you’re anything like me then you’ll be completely fed up with all the fake news that’s posted online these days. And you’ll certainly want to learn the facts around money matters.

So, that’s what I focus on here – and the short video above will tell you what to expect from this site.

However, if you’d prefer not to listen to me just yet 😉 … here’s what others say about my work:

And here’s what people who’ve worked with me have said

Of course, you could always Google me or my work

Try ‘Googling’ smarter pension ideas or smarter investment ideas and see what results you get.

Just click on those links and I’ll do the searches for you… Seriously, try it!

Okay, so that was just a bit of fun, and let’s be honest, Google is simply a search engine which won’t reliably rate the quality of information you find. And quality matters when the stakes are high.

So, be sure to get genuine and solid reviews on the value of a book or website you follow, and take note of truly independent and expert comments … like those about my work (above) from industry leaders.

Now, what do you need help with?

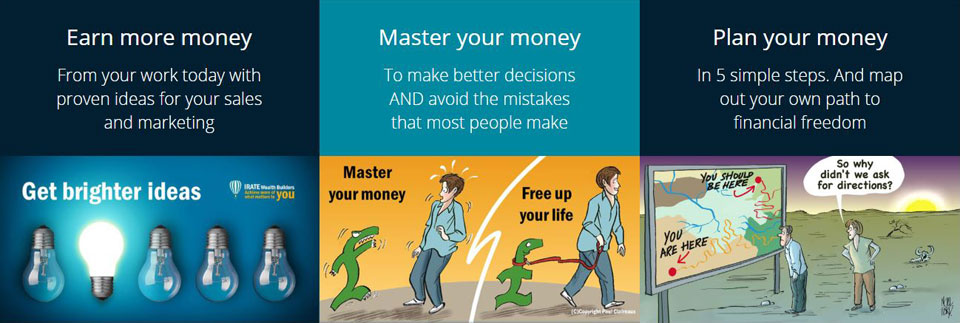

Do you need ideas for a) Earning more money, b) Making better decisions about money or c) Planning your money for the long term… or all three?

This site is about sharing ideas to help you with all of these areas… to help you achieve more of the things that really matter to you.

This is about education – pure and simple

There are NO adverts for financial products here because I do NOT sell those things, so, you can relax about that.

I simply take out the mysteries around money – and take on the people who might mislead you about it.

So, that includes exposing the scammers or anyone else who might try to sell you an expensive or stupidly risky investment, and that includes exposing the misleading writers in the Press and Blogs too!

Who is Paul Claireaux?

Well, I’m a writer and educator and a consumer champion of the personal finance world.

And I’m on a mission to turn our ideas about money upside-down – as outlined in this feature article on my work.

So, whether you want to:

- Understand your money – to make better decisions about it

- Plan your money – in a way that connects it to what really matters in your life – or

- Earn more money from the work you do – by changing what you do or how you do it

More than qualified to help

Unlike many writers and coaches in this area, I’ve actually passed the exams – and qualified with a diploma in financial planning.

I also have 25 years’ experience on the inside of the financial services industry… and another 10 years studying it and writing about it 🙂

I’ve dealt with hundreds of financial adviser firms over many years during my ‘corporate’ days … and was the highest performing B2B Sales Consultant for a blue-chip investment and pensions company.

I also headed up Investment Product developments (onshore and offshore) for that company… and directed the projects that took our products to number one in their markets.

So, on top of offering sales and marketing ideas, to help you earn more in your job or your business… I can help you navigate the minefield of investing and pension planning too.

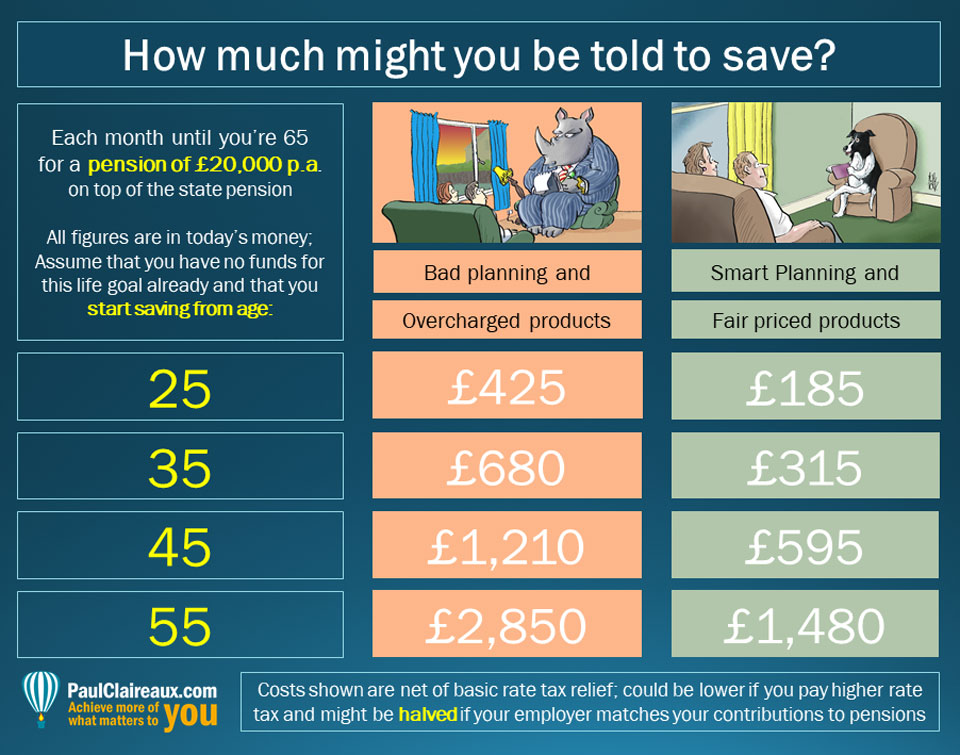

I know precisely how financial products work and can tell you what ‘reasonable’ looks like – when it comes to financial product charges.

I know how financial advisers ‘tick’ too

So, I can show you how some of them could mislead you, and how you can protect yourself from bad or expensive advice.

Don’t get me wrong, there are some great advisers out there.

However, you’d be amazed at how the quality of advice, and the price you can pay for it, varies across the market.

How am I different?

Well, while I’m qualified in financial planning, I’ve chosen NOT to join the tribe selling financial products. And the simple reason is this:

Financial products are the last thing you need – when planning your financial life.

What you need first is to develop your ideas about your financial life goals.

And then to understand your financial choices – for achieving those goals. And how your money could get chewed up by hidden charges or exposed to crazy risks.

The truth is that you’ll struggle to make good financial decisions unless you understand the basics around this stuff…

And you need to understand the psychology of money too. So, that’s about understanding our natural but irrational human behaviours (the ‘enemies inside our heads’ if you like) that can quite often lead to our biggest money mistakes.

The good news is that I can help you to get to grips with all of this – and more.

One educational workshop – two lessons

In group workshops or private coaching, I can teach you:

- A powerful (proven) process for planning your money – to connect it to what matters in your life.

- And a second process for rating any investment that anyone could ever put to you – before you jump into it.

And here’s the best part

And here’s the best part

You don’t need to tell me anything about your money – or your personal circumstances – to learn all this stuff.

If you simply want to learn these ideas – that’s just fine by me.

Finally, some more about me

I’m a father to three adult boys (Harry, George and Ed) who inspired me to start writing… and to focus my efforts on helping younger people (aged 25 to 50!) to make better choices about money.

Academically, I studied electrical engineering (briefly!) at Loughborough University. So, I’m pretty quick with numbers and can help you to ‘see through’ anyone who tries to bamboozle you with percentages or complex risk models too.

And two curious facts!

I used to fly aeroplanes for a hobby and held a private pilot’s licence for 25 years.

And I’ve had surgery to replace collapsed discs in my neck with titanium joints.

So, when I talk to someone with my head tilted to one side it does not (necessarily) mean that I don’t believe what they’re saying!

Hope that’s useful background

Next steps

If you’re not yet familiar with personal coaching… and want to understand the benefits – and what to look for from any coach, start here

Or, if you understand the benefits of coaching… and just want to understand how my particular type of coaching could help you, head over here

Or, to simply stay in touch with updates and future ideas, sign up to my occasional newsletter or join my growing Facebook group; the links are below.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.