Is your mood being manipulated?

To get you spending *all* your money today?

In this extract from Chapter 1 of my book, ‘Who misleads YOU about money?’ we’ll learn how we’re tricked into spending all our money today.

This matters because the result is our failure to save for our big, long term financial life goals – for ourselves and our loved ones.

If you’d like more help with your money, download the complete chapter of my book, ‘Who misleads you about money?’ (from which this is taken) by signing up to my occasional newsletter here.

The challenge here is best summed up by Errol Flynn in this famous quote:

My problem lies in reconciling my gross habits with my net income!

The real enemy lies within

In his book, The Three Most Important Lessons You’ve Never Been Taught, Martyn Lewis says that you should:

Know your enemy,

a company is not your friend

He argues that companies are simply out to make money which involves parting us from ours. And that stops us from saving for our future.

What do you make of that?

I agree, that we do well to know our enemies, and Sun Tzu (A famous Chinese philosopher from 2,500 years ago) advised us, in The Art of War that:

If you know your enemies and you know yourself then you need not fear the results of a hundred battles.

Indeed, this is what my work is all about.

In the first part of my first book, ‘Who can you trust about money?’ I expose all the big external enemies to your money and this mind manipulation issue is just one of many.

Then in the second part of that book, I help you get to grips with your internal enemies that can mess up your money management; the enemies inside our own heads, if you like.

So, this behavioural science that everyone’s talking about.

In a nutshell, it’s our own irrational behaviours that often lead to our biggest money mistakes.

Now, I’ve listed most of the enemies to your money, that I can think of, in the video here

If you’re in a hurry, scroll to 4 mins 47 secs on the timer bar for the list of enemies to your money.

So, yes, I really do know what Martyn Lewis is driving at, especially when it comes to the cheap tricks played by some supermarkets, like putting the sweets at child eye height at the checkouts, although I think that activity was banned a while back.

Now they focus only on emotional manipulation of adults!

However, I do not agree with Lewis that all companies are our enemy:

- I love the computer I bought to write this Insight for you.

- I adore the big curved screen I’m looking at right now – which enables me to research and write in parallel with several big windows open at once.

- Where would I be without a good printer for printing out my first draft work (to be covered in red ink edits) or

- My fantastic mobile phone for staying in touch with friends and being able to clear e-mails and phone calls whilst out and about – saving me time when I get home…

- Or my car for getting around or, most important of all…

- My back massaging machine – that relieves the pain that comes from sitting too long at the desk when I get carried away with this writing.

Yes, like many people I have a dodgy back, but thanks to the high tech medical companies (and a great surgeon) I now have two titanium joints in my neck where two painful and collapsed discs used to live.

So, I reckon there are plenty of good companies out there offering great products and services.

They only survive by doing so.

Let me know, in the comments below, which of your gadgets (or other stuff) are the most valuable to you?

My point here is that if you buy the right technology (or the right financial planning lessons) you can achieve a whole lot more (and earn more) in less time.

Buying the right stuff doesn’t prevent you from saving.

It helps you earn, and potentially save more!

Yes, I know, it’s not that simple.

Given that most of us have access to the same technology, we’re all just working more efficiently for longer hours.

And we now have to compete with vast numbers of highly skilled people on lower wages from developing countries who can do our administrative and creative tasks over the internet.

Then again, the internet also allows us to sell our products and services to a worldwide audience. So, it’s not a one-way street – but that’s another story.

And, let’s be honest, we really can’t expect to perform more effectively if we spend half the day on Facebook watching soppy videos of furry animals.

I really don’t understand people who do that, do you?

Mind you, this is an exception, and I especially like the cat checking the piano is in tune – at 2:36 😉

One thing we can agree on

I guess we can all agree, however, that one of the biggest enemies to wealth building is our tendency to spend all our money today on things we don’t need.

Or, worse still, on things we don’t even want after we’ve bought them.

Ever experienced purchase regret?

The question is why don’t we resist this kind of spending?

Why are most of us, so useless at saving for the future?

Well, there are many reasons for this and it’s not just because we’re weak-willed or foolish.

As you’ll see, much of it is down to our natural emotions and hardwired behaviours. We really struggle against that army of marketers with their multi-million-pound advertising budgets.

Too many are too determined to suck us into buying stuff, regardless of our need for it.

So, to stand any chance of winning the battle with these marketing folk we need to understand what they’re doing and how they can control our minds.

Our fascination with emotion and personality

The weather and my mood have little connection.

I have my foggy and my fine days within me.

My prosperity or misfortune has little to do with the matter.

That was easy for Blaise Pascal (the physicist, mathematician and inventor) to say (his early life was dominated by a search for truths through scientific method and logic), but this is not how most of us ordinary mortals operate most of the time.

Many of our actions, and for some people their whole lives, are dominated by emotional responses to external events.

To varying degrees, we’re fascinated by the moods and personalities of ourselves, our friends, family, work colleagues and the characters in books and films.

But what exactly are we fascinated about, what are these things we call emotions?

Well, according to Robert Plutchik (Professor Emeritus at the Albert Einstein College of Medicine in New York),

more than 90 definitions of emotions have been offered over the past century,

there are almost as many theories of emotion,

not to mention a complex array of overlapping words in our languages to describe them

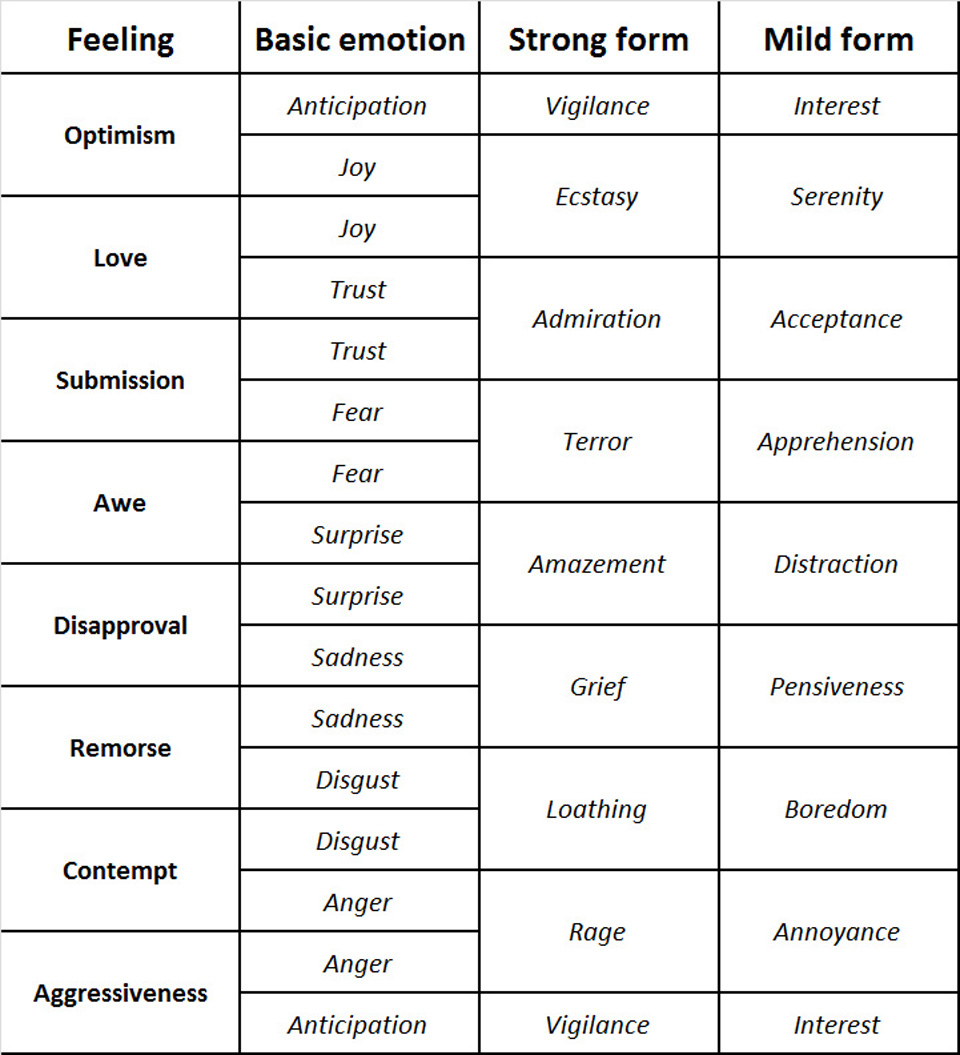

In Plutchik’s own model – which I’ve simplified in the table below – we have eight feelings (or advanced emotions), each of which is derived from a combination of two basic emotions.

So, for example, we see that the feeling of optimism is derived from a combination of joy and anticipation. And love comes from having both joy and trust together.

Plutchik’s model also suggests there are strong and mild forms of each basic emotion, as shown in the table below.

That’s a really neat table, but it doesn’t go anywhere near quenching our thirst for words to describe how we feel.

Here are just a few more of the thousands of words we use for that.

At any given time we might be feeling:

alarmed, angry, anxious, apathetic, bashful, defeated, depressed, despairing, devastated, disappointed, disbelieving, disgruntled, distrustful, dreadful, dumb, embarrassed, envious, foolish, frustrated, grief-stricken, grumpy, guilty, horrified, hostile, hurt, lonely, mad, nervous, outraged, overwhelmed, pessimistic, pity, pitiful, remorseful, sad, scared, shamed, shocked, shy, sick, sorrowful, sour, startled, stupid, tearful, tired or weak.

Whilst at other times we may feel:

animated, attracted, attractive, bold, calm, cheerful, confident, content, courageous, eager, engrossed, enlightened, excited, festive, fortunate, free, gorgeous, happy, hopeful, intelligent, jolly, joyful, loved, loving, lucky, lustful, open, optimistic, passionate, playful, proud, relieved, relieved, satisfied, serene, smart, surprised, thrilled, understanding, or just wonderful!

Of course, life can be very frustrating for us, and those around us, if we pay too much attention to how we’re feeling rather than what we’re doing all the time.

That’s especially true if we allow ourselves to flip back and forth between strongly positive and negative mood states for no good reason.

Our fascination with ad hoc emotional states extends into personality too.

Do we read too much into personality models?

The last time I counted, psychologists had developed about thirty different psychometric models to pigeon hole us by our behavioural traits.

The ‘OCEAN’ model is one of the most widely accepted these days, and has 5 dimensions which define us as being generally either:

1. Open to new ideas or more closed-minded

2. Conscientious or less so

3. Extraverted or Introverted

4. Agreeable/accommodating, or less so, and

5. Neurotic or not.

Neurotics are less emotionally stable, more anxious, moody, worried and envious… and, in my experience, often more talented too!

If you’re interested in taking an OCEAN self-assessment, you’ll find a link to one of the best tests available here.

Some of these tests (especially the one I’ve linked there which further divides each of the 5 OCEAN elements into two) can be super useful for helping us understand ourselves and those closest to us.

However, you need to be careful with some of the other tests that are used.

As Dean Burnet says in this Guardian article, there’s a serious lack of science behind the Myers Briggs Type Indicator (MBTI) and that’s one of the most widely used tests!

“It’s used by countless organisations and industries, although one of the few areas that doesn’t use it is psychology, which says a lot.

Many people who have encountered the MBTI in the workplace really don’t have a lot of positive things to say about it.

For some organisations, use of the MBTI seemingly crosses the line into full-blown ideology”

Now, don’t get me wrong, I personally think that we can learn some useful things about our behavioural preferences from MBTI and a few other assessments, but I also think that we need to accept that some of these models can give misleading indications.

For example: According to the MBTI test, I sit in the middle of the extrovert / introvert scale.

Anyone who knows me, however, will tell you that this presents a completely misleading idea about my personality.

It turns out that I’m an ambivert, which simply means that at times I can be extrovert – in short bursts at least – whilst at other times, like now, when I’m writing, I’m very introvert.

So, I don’t sit in the middle at all… I flip between states depending on what I’m doing.

Quite a lot of other people are ambiverts too.

Are you?

While we’re on the subject, did you know, that ambiverts make truly great salespeople?

If that interests you, grab Professor Adam Grant’s fascinating research findings on Ambiverts

Or an outline of key points on Ambiverts from Travis Bradberry here

And remember this personality feature for the next time you’re recruiting a salesperson, or when you want someone to give a talk on sales skills.

That’s something I can offer if it’s of interest.

The question is, why has an industry of, partly flawed, personality profiling grown so large?

I think it’s because a lot of big corporations are boring or, rather they, understandably, want to reduce their risks of getting the wrong ‘type’ of person when recruiting.

What they forget is that Risk is a two-way street

By relying too heavily on these ‘tests’, they risk ending up with a homogeneous set of vanilla employees; a veritable ‘beige army’ as Marianne Cantwell might call them, of less talented folk – recruited because they won’t rock the boat.

My experience is that most companies could use a few more “boat-rockers” – and a few less beige types!

So, I don’t think we help ourselves or our businesses very much by labelling people as a certain ‘type’ that we like or don’t like!

Indeed, the risk of labelling people is that they spend their lives living up to (or down to) the label.

What we really need is for people to stretch themselves to achieve more.

Labelling can lead to ‘fixed’ mindsets that are no use for growth at personal or corporate levels, and that’s a big point to remember for parents of course.

As for that extrovert/introvert scale? I think too many companies get the wrong idea about which of these traits are more useful.

Let’s hear it for the quiet folk

Susan Cain, in ‘Quiet: The Power of Introverts in a World That Can’t Stop Talking’, asserts that,

it’s the extroverts who’ve taken over the western world.

And, from many painful years of experience of the banking and financial services sector, I’m inclined to agree.

Shyness, sensitivity, seriousness and realism are often seen as weaknesses, and introverts may feel reproached for being the way they are.

Blind optimism, on the other hand, seems to be a highly valued personality trait in some organisations!

Our labels about personality and mood mislead us.

As Cain says,

There’s zero correlation between being the best talker and having the best ideas

I’d go further and suggest that the correlation might even be negative.

In other words, that the best ideas tend to come from the quietest people and that the most stupid ideas come from the noisiest.

No, I have no data to prove this and I accept that most rules have exceptions but I do have a lot of experience of working in large teams of people in big companies and I’d guess there’s a correlation there!

Here’s an example:

When I was running the investment product development team for Clerical Medical – back in the day – I was keen to ensure that we got the best ideas on the table for discussion.

Unfortunately, my brightest team member (An Actuary) seldom said very much in our team meetings.

So, to encourage him to ‘share’ more – I asked him (privately, of course) why he said so little – and here’s what he said

“Oh that’s easy… I see no reason to prolong the pain of those meetings any longer than necessary

and, unlike some others – I don’t see a need to use ten words…

when none will do!

Rob is a quite brilliant guy, with a great sense of humour – two attributes that often go hand in hand in my experience.

And I’m pleased to say that we’ve remained friends for the 25 years since then.

Shall we shut up and listen?

Perhaps the lesson here, for the noisy ones amongst us (and, as I’ve said, I can be both at times) is simply to shut up and listen occasionally!

We might then benefit from the humour, the insights and the incisive questions of our quieter friends and colleagues.

Interestingly, Susan Cain, an introvert herself, used to run a business called the ‘Negotiation Company’ that trains people in negotiation and communication skills.

The value of asking simple honest questions was a key part of her message.

And her clients included investment banks and other firms in the financial sector – so perhaps that industry is learning.

Let’s hope so, because the quiet and thoughtful personality types are, in many contexts, more useful than the noisy and quick-acting types.

We now know that we never really needed their machismo style of management in banking.

And that style doesn’t help us manage our personal finances either.

So, one thing is clear: if we allow ourselves to be dominated by our moods – whether they’re low or high – we’re asking for trouble.

Ideas for taking back control

It’s tempting to think that we can’t control our moods and, whilst this may be the case for some people with certain psychiatric illnesses, Dr David Burns will tell you that this is not the case for most of us.

He explains, in his quite brilliant book, ‘Feeling Good: The New Mood Therapy’, how most people can do something about their low mood and even mild depression.

He shows us how it’s often simple errors in our perceptions that cause our low mood.

And he outlines ten types of cognitive distortion (ways in which we distort the truth) that can trigger our upsets.

For example, we might overgeneralise a current challenge in our lives to be a repeating problem from our past, whilst in reality there is no comparison.

Or we might have a tendency towards ‘all or nothing thinking’ in which we look at things in absolute black-and-white categories.

So, we might decide that unless we’re a total success in what we’re doing, then we must be a complete failure.

But reality is not black and white, it’s full of shades of grey – and no, that’s not another book recommendation!

Burns’ model of cognitive behavioural therapy (CBT) will sound tough to many as he rejects the idea that our lives have to be dominated by every emotion that hits us.

But he is a highly experienced and qualified psychiatrist whose ideas are supported with scientific evidence.

This is no voodoo self-help nonsense.

Feeling Good is now thirty years old and has helped millions of people to deal with low mood and mild depression – including me. It’s acclaimed by mental health practitioners around the world as one of the best books of its kind.

But overcoming low mood isn’t enough to beat the marketers and curb our unnecessary spending.

To do that, we need to get a handle on ALL our emotions – negative and positive – and, thankfully, help is at hand.

The Chimp Paradox on emotional management

The Chimp Paradox is another wonderful book by Dr Steve Peters, the psychiatrist and mind coach to the incredibly successful British Olympic cycling team.

Peters offers a powerful but deliberately simple model of how our mind works to help us learn how to improve our lives through better management of our emotions.

In his model, the chimp is that part of your brain that interprets the outside world with feelings and impressions.

So, it determines your mood as either low or high, excitable, angry or anything else on the emotional spectrum.

It uses emotions to decide how to react to external events, and when it’s out of control, it can sabotage your successes and generally cause chaos.

Peters makes the point that your chimp is significantly stronger than the ‘human’ part of your brain – the part that deals with facts, truths and logical thinking.

So it’s no good trying to fight with your chimp – you won’t win – better to learn some techniques for managing it.

And, interestingly, Peters says it’s okay to let it out for good rant sometimes when it’s upset about something.

“Don’t bottle it all up” is what I think he means.

Of course, ‘bottling it up’ is exactly what we British do most of the time right?

Obviously, you need the ‘human’ (logical) part of your brain to manage more complex and longer-term issues in our lives, and that includes all that stuff we might put under the general heading of financial life planning.

That stuff really is best tackled with a calm and considered approach, and I’d hope that no (reasonable) person would argue for making an investment, or even day-to-day spending decisions based on heat of the moment emotions.

But that’s still what most of us do, most of the time.

It’s also how those marketing tricksters get us to spend all our money today.

There is a way to fight back

The good news is that there is a way to fight back and, what’s more, you can use your emotions to your advantage around money.

If you’d like to learn more about that, and the Freudian history to the tricks used to sell us stuff we don’t need, sign up to my (very occasional) newsletter to download the full chapter of my book for FREE.

You’ll also get a host of other great ideas straight to your inbox – for making more of your money and earning more of it too

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article