Why financial planning is not common sense.

and why that's a good thing.

12th April 2025

Why financial planning is not common sense.

and why that's a good thing.

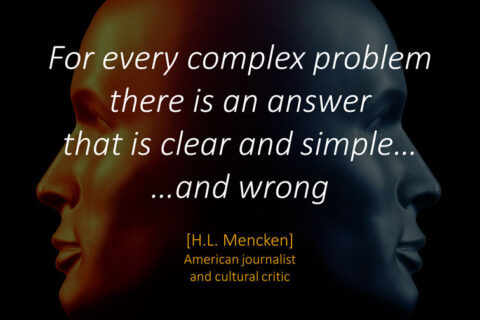

12th April 2025A 10 to 20-minute read – depending on your speed. Most of us look for common-sense answers to various questions in life. In this Insight, we’ll explore why that is often a bad idea, particularly when it comes to money. Of course, common-sense answers to simple questions can be helpful. But with complex questions (like…