What exactly is ‘Education-First’ Marketing?

And why is it the key to YOUR business success?

A 10 to 20 minute read, depending on your speed.

In this Insight, I’ll explore why leading firms (in all professional services) now take an education-first approach to marketing.

And we’ll see why this is crucial to your firm’s long-term success, regardless of how you obtain enquiries for your services.

Do you ask clients to save all their questions till you meet?

We all know that marketing changed dramatically when ‘digital’ took off about 20 years ago, but let’s face it, not everyone in our sector got the message!

And I think life will get increasingly hard for them, because there’s a rapidly declining number of people who are happy to wait days (or weeks!) for a meeting to have some basic questions answered.

Why?

Well, in 1980, less than 8% of UK school leavers went to University.

Now it’s nearly five times higher – at more than 36%.

So, we have an increasingly educated and digitally able population who see (smartphone-enabled) ‘self-serve’ as the normal way to engage with services.

Are the older generations different?

In some ways, yes, but this group has rapidly become ‘tech savvy’ too.

About 90% of those aged 55 to 64 now own a ‘smart’ phone – and many know how to switch them on!

So, most people can now instantly find answers to money questions online. And that’s a challenge if your website is not on their radar when those money questions pop into their minds and they want guidance or advice.

Fancy a quick thought experiment? (It’s less costly than full-blown market research!)

Imagine you asked your clients (and any spouses, adult children and friends) to list three websites that they ‘go to’ for answers to money questions.

Would your website be on their list?

Should it be?

The truth, today, is that we all expect Insights from service providers before we hire them.

And while percentages vary between service providers, we know that most professional people decide on their supplier before they make any contact.

How do we know?

Because it’s what we all do!

Why content is *more than* King now!

Bill Gates, founder of Microsoft, famously said, “Content is King” way back in 1996.

He predicted that content would be the primary revenue driver on the internet, just as it had been in broadcasting.

And he said the low cost of distribution would help small firms and individuals to reach global audiences.

It’s hard to predict anything about the impact of technology on our lives, but Gates was right on both points almost 30 years ago.

And today’s respected business gurus agree on the importance of education-first (aka ‘Inbound’) marketing – as these quotes illustrate well:

- “Marketing is no longer about the stuff that you make, but about the stories you tell.” – Seth Godin

- “If you have more money than brains, you should focus on outbound marketing. If you have more brains than money, you should focus on inbound marketing.” – Guy Kawasaki.

- “Content is the atomic particle of all digital marketing.” – Rebecca Lieb.

- “Marketing is telling the world you’re a rock star. Content marketing is showing the world you are one.” – Robert Rose.

- “Instead of selling, you educate and inform.” – David Meerman Scott. This is my favourite!

- “The best marketing doesn’t feel like marketing.” – Tom Fishburne.

- “Selling to people who actually want to hear from you is more effective than interrupting strangers who don’t.” – Seth Godin.

- “Content isn’t king, it’s the kingdom.” – Lee Odden.

Of course, large firms with big budgets have more marketing options than the rest of us, so it’s worth knowing what leading small business advisers, like Marcus Sheridan and Gary Vaynerchuk, suggest should be our focus.

Perhaps none of this is new to you, but it is new to many advice business owners.

Marcus Sheridan: They ask, you answer.

Marketing and Sales consultant, Marcus Sheridan, rose to fame with his books, ‘They ask, you answer,’ and ‘Endless Customers’

And for years, Marcus has advised business owners to stop deferring basic questions from prospective customers.

His view is that telling people to ‘wait until our meeting’ is now seen as an ‘old-school’ sales device – and a big turn-off to potential clients.

In any event, there’s no reason for us to wait if we can easily find others who are willing to give us immediate answers to common, fundamental questions.

The explosion of AI makes it even more urgent to adopt this ‘helpful’ approach.

What sorts of questions could you answer?

That’s a big topic for another day.

Suffice to say, you need to plan your content library carefully, or it’ll cost you a fortune to build and become a maintenance cost nightmare in the bargain!

Spoiler: One trick is to create lots of Evergreen content that answers the fundamental questions about money – that we should have learned at school, but didn’t.

That sort of content (if you know how to write it) will require little or no maintenance.

As an example, Marcus suggests one essential consumer question to answer up front is about whether people need our type of service at all.

Let’s remember that prospective financial planning clients face a bewildering array of terms to describe financial advice and planning services.

We have:

- Financial Adviser/Advisor

- Financial Planner – and Holistic Financial Planner

- Financial Coach

- Life Planner.

- Wealth Manager.

- Investment Adviser.

- Retirement Planner.

- Financial Consultant.

- Insurance Adviser

- Mortgage Adviser.

- Discretionary Fund Manager.

- Robo Adviser!

And these all assume the prospective client has completely discounted the increasingly popular DIY approach to money management?

Have they?

Either way, it makes complete sense to follow Marcus’ advice – and help people deal with this question.

Here’s an Insight I prepared earlier – to do precisely that.

‘Should I pay for financial advice?

And, if so, what’s a fair price?‘

Our goal, Sheridan argues, must be to establish ourselves as a ‘go-to place’ in our sector for great Insights.

Does education-first marketing help in an AI-Search world?

It’s still (relatively!) early days, but things are moving fast, as you’ll have noticed when you search on Google.

Some leading marketing agencies are deeply concerned about the direction of travel with AI search – but the good news (I think!) is that it seems to be extending the trend established by Google to find content that meets users’ needs for reliable and valuable insights.

So, great quality education-first marketing will become even more important in the AI search world.

For some time, Google has used EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) factors to assess the quality of our websites.

And those EEAT filters are applied more rigorously to content on “Your Money/Your Life” (YMYL) topics – where accuracy and balance are essential for people’s wellbeing and safety.

The top YMYL topics include:

- Medical / health advice.

- Financial advice.

- Legal information.

- News and Political/Economic events.

- Other topics with risks to our safety.

Thankfully, the best marketers in the Financial Advice sector know that high SEO scores are not vital for smaller advice firms – or any small professional service firm.

So, I doubt SEO rankings are your primary marketing aim, but they are a helpful side effect of building a ‘Trustworthy’ brand with great content.

What moves the dial on trust?

This is far more important to understand – and this research into social cognition (by Cuddy, Fiske and Glick, 2007) can help us with this.

The research shows how our assessment of others (individuals and groups) is primarily driven by our perception of their warmth and competence.

So, I drew on that research to create this simple equation on the drivers of trust.

You’ll note it’s similar to (but simpler than) the Trust Equation in ‘The Trusted Advisor’ book by Charles Green et al.

You’ll also note that, like Green, I’ve added a multiplier of reliability (R), which is essential for maintaining trust in relationships.

Other trust equations include an item for ‘Integrity’, and I could have added that too, but I think Integrity is a given with genuinely warm and competent people.

Don’t you?

If you accept these drivers of trust, the question about your marketing boils down to this:

Is there a better way to demonstrate your warmth and competence to your existing and prospective clients, than giving them high-quality and relevant financial planning insights?

Replace ‘financial planning’ with ‘health planning’ or any other advice service to see why education-first marketing is the approach taken by all leading professional service firms.

It’s also why ‘Influencers’ are making such a killing!

And they’re not all con-artists either.

Check out Dr Julie Smith (the Psychologist) with c. 5 million followers on TikTok – to see this working well, in the mental health space.

How many ideas should you share for FREE?

So, you must plan your content library carefully.

If you don’t, and many do not, you could waste an enormous amount of money.

That said, in terms of deciding whether to ‘push hard’ into educational marketing, I guess the first question is this:

‘How do you feel about giving away any valuable financial planning ideas?

Are you familiar with the quietly spoken 😉 Business guru, Gary Vaynerchuk?

He suggests we give away all of our best ideas for FREE.

And yes, I know, that sounds crazy, until you learn that by working this way, ‘Gary Vee’ has built a tribe of around 45 million followers across his Social Media channels.

That’s quite a following, right?

But here’s the point. Gary says that 99% of people who consume his content never apply the ideas on their own.

They want business advice that’s tailored to their unique situation.

Would the same apply to any (brilliant) financial planning ideas you share?

Yes, of course it would.

However, this only works if you avoid the content messaging trap, which some Financial Planners fall into when they suggest that financial planning is simple common sense.

That messaging fails for two reasons.

First, it’s simply not true, and building trust is about telling the truth!

Second, if you tell people financial planning is simple common sense, why would they pay you to help them do it?

You’ll just put people off your service!

The fact is, your content readers (or viewers) will value good quality (and relevant) generic money guidance.

But, as Gary Vee notes, most will need professional help to apply those ideas to their personal situation.

And, all else being equal (which many services are), who will your readers (or video watchers) call if you provided them with the Insight on how to fix their problem?

So, please don’t view ‘giving away’ ideas as cutting you away from your valuable clients.

Sharing great Insights builds a bridge that keeps you connected to your clients, prospects and professional introducers.

Great Insights (whether you write them or hire someone to create them for you) remind people who to come to when they next encounter the financial (or life) planning challenges you talk about.

Great Insights (whether you write them or hire someone to create them for you) remind people who to come to when they next encounter the financial (or life) planning challenges you talk about.

What if you already have plenty of work?

If that’s you, it’s great news.

It’s proof that you offer excellent services, which are the foundation of every good business.

You might, however, want to think about how you deal with potential clients who tell you:

‘Things are pretty good as they are’ or ‘there’s no need to rock the boat’

Bert Lance, adviser to US President Jimmy Carter in the 1970s, at the US Budget Office, said:

If it ain’t broke, don’t fix it !

But I think in today’s fast-changing world, a better maxim is this:

If it ain’t’ broke, you still have time to fix it.

And I’m sure that’s what you tell your clients about the need to plan for and build assets for the future.

A great content library can transform the reputation and fortunes of any business.

And if you choose not to build, buy or rent one, there’s a real and growing risk that your audiences will start to see other firms as the ‘go-to’ place for their questions.

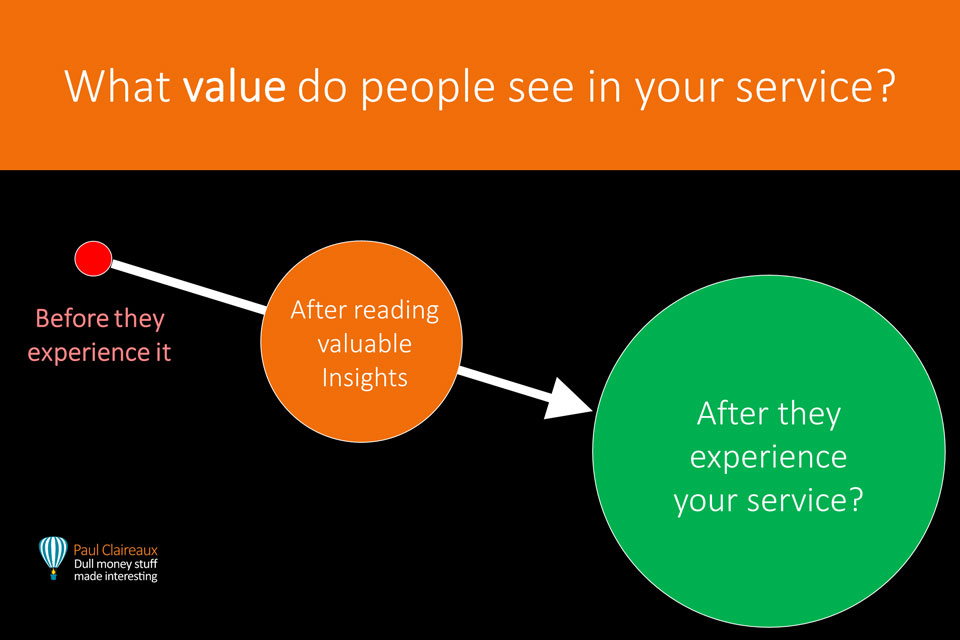

Great Insights are also awareness stepping stones. They give your prospective clients a closer view of what you do – which means they see more value in your work.

Fascinating money Insights also remind your existing clients of your valuable work. And that helps to keep them on board, too.

Who benefits from education-first marketing?

You’ll be familiar with the idea of a ‘Win-Win’ deal in business.

The difference with education-first marketing is that six groups of people can win big, including you and your writer if you have one.

In working with leading financial firms over recent years, I’ve identified 25 benefits to the stakeholders in this matrix when education is put at the heart of a business.

Education-first marketing can help you to:

- Reduce or eliminate business risks. Some firms face risks where advice is either incomplete (e.g. fails to take account of capacity for risk) or, as revealed in research from Oxford Risk, is inconsistent between advisers in the same firm. Your Insights become your house way to explain various concepts – from your financial planning process to how you recommend suitable wrappers and investment funds at suitable risk levels to hold in those wrappers.

- Attract and convert more clients. Assuming your content is relevant and compelling, your existing clients will share it with family and friends.

- Give clients more value in your initial meeting. Prospective clients who grasp a key (financial or behavioural) concept before you meet will generally progress faster on their plan in the time you have together.

- Help your clients see more value in ongoing services. This reduces the number who move to other advisers or give up on advice and become DIY investors.

- Protect your clients (and their family and friends) from scams and other money mistakes they might make between meetings.

- Equip clients and prospects to make better basic money decisions.

- Engage your future (inheriting) clients before it’s too late. (Did you know that c.65% of inheritors plan to leave their spouse’s/parent’s adviser when the wealth-holder dies? Source: Schroders UK and Cerulli Associates USA)

- Obtain a stream of engaging ‘outreach’ marketing messages – from your new content for FREE!

- Focus your messages on ideas (and services) your clients value most.

- Decide which services to build or enhance. This becomes easier when you write about the value from the consumer’s perspective.

- Decide which services to discontinue. Also, easier when you realise the value is hard to define!

- Shorten client meetings. This reduces the risk of stress from rushed meetings for those clients who’ve learned the basic concepts before you meet.

- Give your clients more comfort with your advice. Psychologists tell us that we feel comfortable with advice that’s consistent with (reinforces) what we’ve learned previously. We tend to reject advice that causes cognitive dissonance / goes against our prior beliefs.

- Reduce your firm’s lead time for prospects to become clients. Your content builds trust before and after client meetings. So, you need fewer meetings.

- Show the FCA your commitment to ‘Consumer understanding’.

- Waste less time on unsuitable enquiries. This assumes your content is clear about who you can help and signposts other reliable services for those who need them.

- Save time on preparing to train your team. (What’s better than client-facing content as training material?)

- Have more fun in your training sessions. Learning from engaging consumer-facing content is always more enjoyable and memorable than trudging through the dry technical stuff (too often) shared by fund managers and product providers.

- Recruit and retain more great team members. Bright individuals prefer working for purpose-driven businesses that prioritise education and development.

- Gain more client referrals from professional connections. These people can be hard to please, but they will share high-quality insights with their clients on your behalf. And by doing so, they expand their proposition too!

- Expand into (or win more) Employee Well-being work. There’s a lot of demand for this, and only a few truly competent players.

- Enhance your reputation as a firm that helps others. You could win a prestigious award as ‘Financial Educator of the Year’ or become known as a firm committed to improving financial literacy.

- Become known as a consumer champion. If you warn people about the scams and lies of bad actors outside our sector.

- Make financial planning less scary. And let’s face it, this topic is a monster for many people, who’d rather not talk about it.

- Help clients (and their families) become more capable and confident with money.

Why does Capability and Confidence matter?

Before we get to that question, look at this picture of the financial planner’s marketing challenge.

The truth is that almost no one – worldwide – has a scooby doo clue of what you do!

So, marketing is different and harder for financial planners and advisers.

You have to engage people in a complex process that almost nobody knows much about!

And it gets harder!

Evidence (from leading Psychologists) shows that we do not tend to engage with complex and risky projects unless we believe we’re capable and/or will have some sense of control.

We know this intuitively from a young age, and thank goodness for our natural caution.

We don’t want people feeling confident to drive cars on the road (or repair a gas boiler) without training!

Acclaimed Psychologist Albert Bandura revealed how we learn to engage in complex tasks in the 1970s.

‘Self-efficacy’ is his term for our belief in our abilities, and he found we acquire it in four main ways:

First, and most significantly, in Mastery experiences, where we practice and successfully perform tasks.

Second, in Social Modelling, we observe others succeeding at a task. And this strengthens our self-belief most if those other people are ‘like us’.

Third, through Social Persuasion. When we receive positive feedback or encouragement from others, we acquire more belief in our abilities.

Fourth, through our emotional and physiological responses to situations. We feel good when we make progress in developing skills.

The leading financial firms I’ve worked with recognise that people engage more and become more resilient when we help them build skills.

What’s the bottom line?

Most of us have goals of one sort or another.

The issue is that we don’t always convert our ideas into action. And, while there may be many reasons for this, Bandura found these keys:

- As we become more capable in complex tasks, we develop more interest in those activities and commit more strongly to them.

- We also recover quickly from setbacks and reframe our problems as tasks to be mastered.

- Conversely, we tend to avoid tasks where we don’t feel capable or in control.

We all want to have a sense that we can succeed – and we really don’t like to expose our failings.

So, here’s another question for those in charge of content marketing at your firm.

How does your content help prospective clients (and their family members) to build confidence in their money skills?

What essential life and financial planning ideas or exercises (not Apps!) do you teach people?

What amazes me is how we (as a sector) invest millions to develop and share ideas between ourselves – between financial planners, product and platform providers and fund managers.

What saddens me is how so very few of those ideas are converted to content that a consumer could understand – let alone use!

Is this just me?

Do you want to help more people on this journey?

To make a real impact on people’s mindsets towards their money (and advisers!), you need great content.

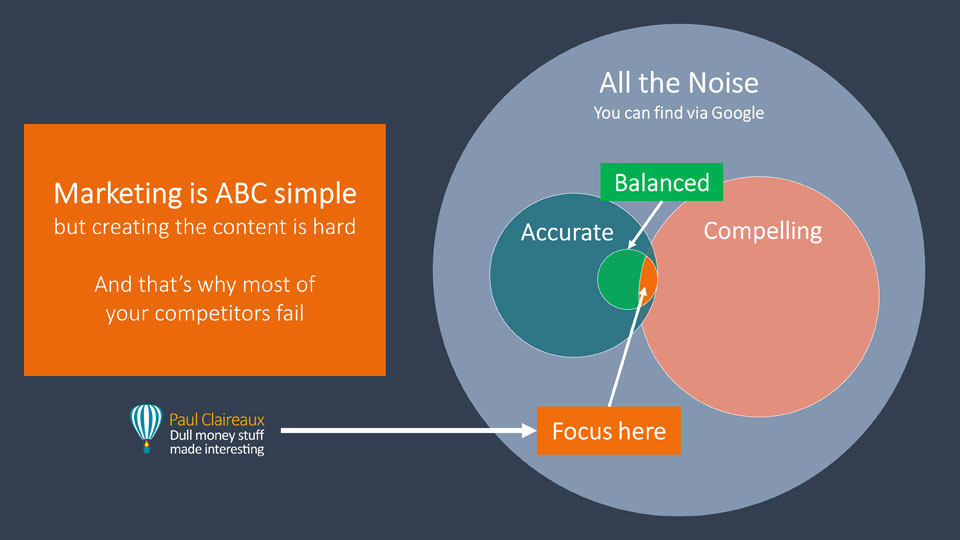

My view (in line with my Chartered Financial Planner friends) is that great content passes three (ABC) tests.

It must be Accurate and Balanced, of course.

To build trust, we must tell the truth, the whole truth and nothing but.

The far more challenging task is to create compelling content.

Content that grabs your audience’s attention, holds it to the end and leaves them wanting more.

This is what all good content creators aim for, whether they write books, compose music or script films.

And we know that (in all these areas) success follows a Pareto distribution.

So, only a few (admired) players get most of the attention – and the income!

This means we have to work very hard to outshine the competition.

We must be laser-focused on creating content that hits this intersection, to offer content that’s Accurate, Balanced and Compelling.

Anything else is misleading or Dull Money Stuff, and I suspect we agree that the world has enough of that?

Anything else is misleading or Dull Money Stuff, and I suspect we agree that the world has enough of that?

Have you heard of the four ‘C’s of content success?

Clearly, our content must be Compelling, but it must deliver other things too.

And it helps to think of written (or video) Insights as Conversation openers.

The funny thing is, if we write (or speak) in a conversational style, we naturally include questions in the headings – like in this post!

We might also include thinking tools and exercises in our library to help people consider and reflect on the challenges we can help them address.

We can also enable these self-assessment tools in various apps, including ScoreApp, Typeform, Outgrow, and SurveyMonkey.

Of course, questions can only open a conversation.

To be a truly valuable conversation, we need attentive (deep) listening to what’s being said.

And what’s not being said.

Listening (deeply) is a hard skill to learn, so it’s quite rare… but that’s a topic for another day!

So, are ‘Compelling’ and ‘Conversation Openers’ the first two Cs of content success – what are the third and fourth?

Well, I already mentioned them in the trust equation – they’re about how we’re perceived.

We must demonstrate ‘Competence’: knowledge and skills are vital – and many firms do this well.

However, we must also show we’re genuinely ‘Caring’: that we have warm intentions, that we’re not cold fish, and I’m not sure many firms do this quite as well.

The research shows that it’s our warmth towards (care for) others that makes us attractive. And, like so many Insights into human behaviour (as revealed by Psychologists), we can usually find a famous quote (from a Philosopher, Preacher or Politician from bygone ages) to show we’ve always known these truths.

So, perhaps we could remember this quote.

I think we can use it to adapt our communications – at work and with friends and family.

Is your firm on track to be a ‘go-to’ place for consumers?

Perhaps you’ve already achieved this status?

But if you’re starting on this journey or want to check if you’re on the right track, I can help.

Just remember: it’s possible (and quite common) for firms to waste tens of thousands of pounds on unplanned and low-value content.

And I do NOT want you to do that.

So, if you’d like to know how you could build, buy or rent a great education program, let’s talk and explore these options.

I’ve helped a few firms reach the finals for prestigious ‘Financial Educator of the Year’ awards – and am happy to help more.

You can email me at hello@paulclaireaux.com or book directly into my diary here.

I look forward to talking with you.

Thanks for dropping in.

Paul

Click here to be added to my educator’s newsletter, so I can tell you when NEW Insights (for you or your clients) become available.

Discuss this article