Six ways to rate a content creator? (Part 2)

Does the content go deep enough to fascinate your audiences?

What we’ve covered and what’s coming up

In the first Insight, I outlined the first three of these A to F tests, which suggest you demand content that’s Accurate, Balanced and Compelling. If you’ve not read that Insight, start there.

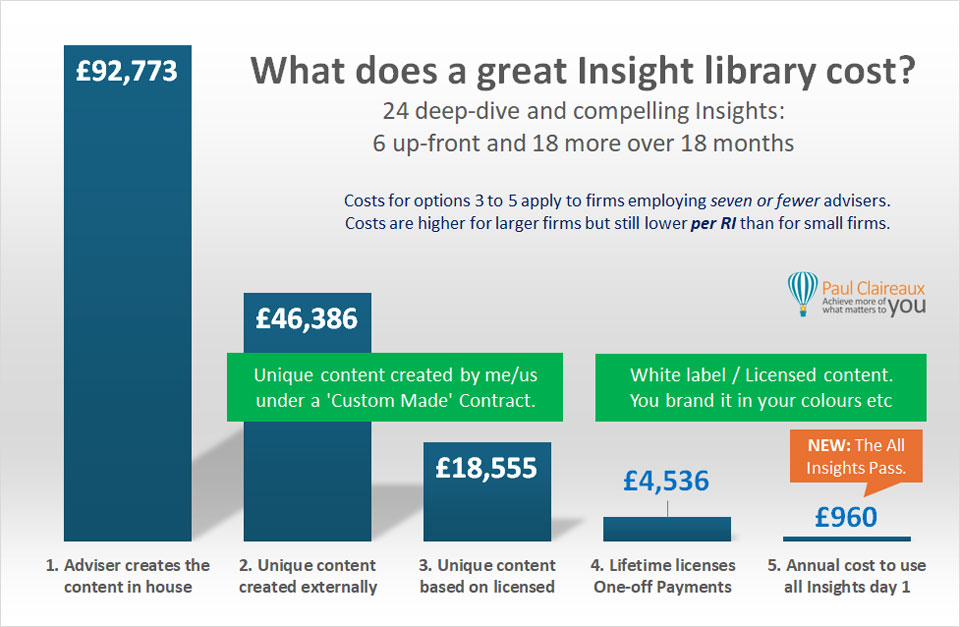

In the first Insight, I outlined the first three of these A to F tests, which suggest you demand content that’s Accurate, Balanced and Compelling. If you’ve not read that Insight, start there. The green boxes cover my two core services.

The green boxes cover my two core services.

First, where I work with you to create ‘Custom Made’ content, which could be either brand new or derivatives of my existing works. Second, where I supply lower-cost licensed ‘Content to Go’.

The assumptions behind this chart reflect the realities of creating high-quality content with images.

Now, let’s get back to those ‘A-F’ questions for your content suppliers.

We covered the ABC tests in the first Insight, so this next test begins with the letter ‘D’.

‘D’ asks: Does the content have depth?

I outlined the 25 benefits of education-first marketing in another post.

I outlined the 25 benefits of education-first marketing in another post.

Read that if you’re not familiar with the benefits that accrue to all these groups of people.  On this page, I’ll explore the particular value of high-quality, in-depth content, which could complement shorter works if you post those.

On this page, I’ll explore the particular value of high-quality, in-depth content, which could complement shorter works if you post those.

Not all suppliers agree that deep-dive content is essential, especially if they only offer short posts!

Here, however, you’ll find the evidence to help you design a sound (educational) content strategy.

Of course great educational marketing offers a mix of long and short-form content.

However, there are two ways to approach this challenge and, if you’re smart, you can have most of your short posts for free!

Can you see the need for deep dive content?

The need for long-form content becomes obvious if we try, for example, to create high quality (accurate, balanced and compelling) Insights which explore:

The need for long-form content becomes obvious if we try, for example, to create high quality (accurate, balanced and compelling) Insights which explore:

- How financial planning can contribute to human happiness.

- The many dimensions of ‘Human Uniqueness’ to show they’re key to financial planning.

- The many issues around Estate and Inheritance Tax Planning.

You know you will have to craft a lot more than a few hundred words for Insights like these.

You’ll need to have read a lot about Psychology to unpack those first two questions.

And, assuming you’ve studied the issues around Taxation and Trusts, you know you’ll need a great many words and pictures to bring questions of Estate and IHT planning to life, in plain English!

A comprehensive book on saving IHT alone can run to 100,000 words, and to outline the key planning issues for consumers (in a picture-rich guide) requires 6,000 to 10,000 words.

I know because I’ve written one, and I plan to create a new series of high-impact (and licensable) Insights around IHT soon.

Email hello@paulclaireaux.com with the subject title ‘IHT Planning Guide’ if this interests you.

Short posts are great for grabbing people’s attention via Newsletters and Social Media.

And, if you’re followed by thousands of other advisers, then short posts might drive some nice ‘impression’ and ‘engagement’ metrics.

However, such posts (without links or calls to action) rarely deliver valuable leads from potential clients.

Some leading financial planners tell me they post hundreds of times a year on LinkedIn – without gaining any enquiries.

In fairness, some do this to prompt discussions, and I often engage with those posts. So, I absolutely see the value in sharing ideas with (and being challenged by) fellow professionals – assuming we can have polite debates on ‘The Socials’.

Connect with me on LinkedIn here or in the LifeTalk Group on Facebook.

Just consider what your social media time costs you.

If you create 200 short posts a year, that’s 1,000 posts over 5 years, which will consume 1,000 (or more) hours of intense work time and cost you £200,000 to £400,000, depending on your effective hourly earnings rate.

Is that a reasonable price to pay for little or no client engagement?

The outcome would be better if a brilliant book came from that effort.

However, you’d need to do a lot more work to structure and write a book from 1,000 disparate posts, so the eventual cost of your book would be significantly higher than those scary numbers I’ve quoted.

Do you want to attract or retain more clients?

This is what interests most business owners.

This is what interests most business owners.

Or perhaps you want to engage more of the inheriting family members, like spouses and adult children of your existing wealthy clients.

That certainly makes sense given the research, which shows up to 70% of those people plan to remove the current adviser when the wealth holder dies.

Either way, to attract, engage and retain more clients, you need something very different from a daily short post aimed at fellow financial planners.

The evidence suggests that high-quality, in-depth, relevant, and helpful content is most effective.

Does that sound like a lot of intense work?

Well, it is, if you choose to do it all yourself.

But why would you shoulder all that work alone, when others can create (or supply) great consumer-facing Insights for a lot less money than you can earn from client (or other) work in that time?

This is basic economics, as outlined by Adam Smith in ‘The Wealth of Nations’ in 1776.

When we focus on doing what we do best, we boost our collective productivity, which (along with innovation) is what has raised living standards for hundreds of years.

That said, I’m not aware that life fulfilment, enjoyment of work, or even skill development were high on Adam Smith’s agenda!

So, if you want to become a great writer, I understand you’ll want to write some of these insights yourself.

I would, however, urge you to have your work reviewed by a proven writer before publishing, while you develop your skills.

Why would you focus on long-form works?

Aside from increased engagement (which I’ll evidence below), the key benefit of having long-form works in your library is that they provide most of your short posts for free.

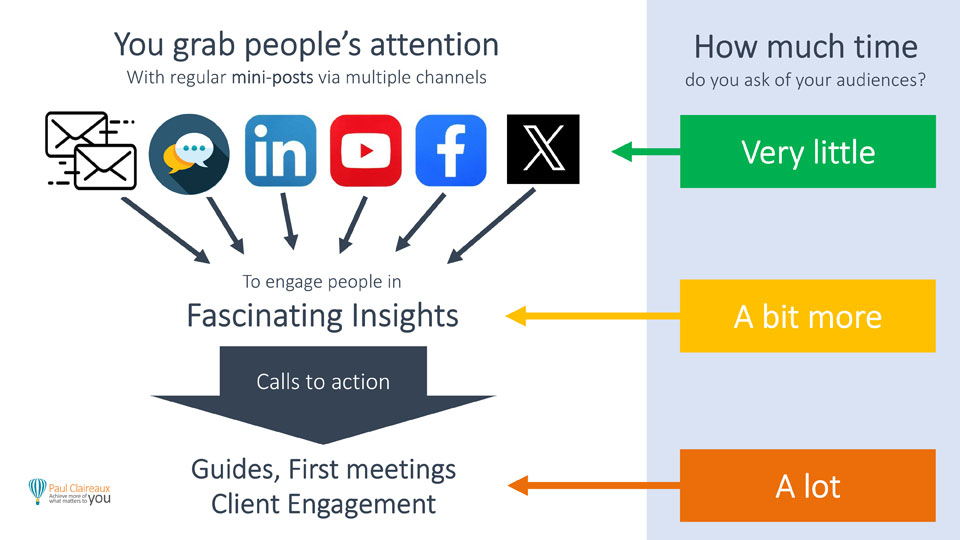

This picture illustrates how this works. I speak with many business owners, and it seems that few are aware of this trick – which is easy once you have long guides on your website.

I speak with many business owners, and it seems that few are aware of this trick – which is easy once you have long guides on your website.

So, ask your web manager for guidance.

In a nutshell, you add links (called anchors) to various sections in your (long-form) works. Then, from each of your short posts (or from within another post, as here!), you can draw your readers directly into any of those sections.

Are you trying to do this the other way round?

Don’t worry if this is you – many advisers do.

Don’t worry if this is you – many advisers do.

The problem is – this requires enormous ongoing effort to create daily (or even twice-weekly) short posts.

And this only creates more work if you want to convert those valuable (but disparate) short posts into one valuable guide (or book?) to showcase your knowledge and skills. So, remember:

Going short is not only a high-risk investment strategy.

It is a risky and costly content strategy, too!

Here’s how to remember it! Your content strategy works best if you go from long to short – not the other way around.

Your content strategy works best if you go from long to short – not the other way around.

Yes, it requires more investment upfront – but that’s true of everything worthwhile.

If this were easy, everyone would do it – and they don’t.

In any case, a long-form-first approach could save you a fortune over the medium term.

And you could save even more money if you buy or rent licenses to some content, rather than struggling to create it all in-house.

The vital point is that once you have some long-form content, the rest is relatively easy.

It’s like you get all your ‘funnies’ (short posts) for nothing, and your clicks for FREE?

Volume up!

Offering long-form guides will also save you time in dealing with your Social Media and PR Managers because they’ll have less need to trouble you for new ideas.

You can tell them to create numerous short posts from the sections of your guides, as shown above.

Or perhaps your content creator can supply those short ‘outreach’ posts for you, too!

Short posts alone are a road to nowhere

You offer vastly more value when your short posts invite your clients and prospects to continue their journey into deeper-dive thought pieces – regardless of who creates those works.

You offer vastly more value when your short posts invite your clients and prospects to continue their journey into deeper-dive thought pieces – regardless of who creates those works.

Short posts, on their own, have little marketing value.

You might think there are exceptions, such as the high-quality 30- to 90-second Insight videos from Dr Julie Smith, the Psychologist.

However, Julie’s short video strategy is built on solid ground.

She has published two brilliant books and is a regular guest on various podcasts, which typically last 50 to 80 minutes.

So, behind her short videos is a wealth of deep content, as you’d expect from a Dr of Psychology!

Are you aware it’s time to EEAT?

In 2014, Google began sharing the guidelines it follows for prioritising search results.

And, unsurprisingly, they now look for content which demonstrates Expertise, Experience, Authority and Trustworthiness.

Short posts can’t showcase all of those strengths, but they can nudge your audience to visit your website for those valuable, in-depth lessons.

Or rather, your short (outreach) posts can do that *if* you aim them at the right people on your chosen Social Media platforms or via your newsletter!

Click here to learn more about Google’s EEAT and other key factors.

In other words, short posts can be great in a classic two-stage marketing approach.

You only ask strangers for a small amount of their time.

Then, if you grab their attention, you can invite them to your website to learn the whole story.

That’s what builds trust and enquiries over time.

Could you show people you’re ‘here for the journey’?

Whatever you think of Lloyds Bank, it’s interesting to know that their ‘Here for the journey’ campaign delivered the best return on investment in their marketing history.

Apparently, the campaign helped them build customer relationships, increase brand recognition, foster positive sentiment, and expand market share for key banking products.

Of course, no firm of Financial Planners or Advisers has a marketing budget like a big bank. Still, you can absolutely show your commitment to supporting people in their financial life journey.

You do this every day by offering sound advice and excellent customer service.

And you can attract people before you meet them with valuable Insights on how to manage and plan those journeys.  I’d also argue that YOU are better placed than many Banks to share great Insights into your clients’ financial planning options.

I’d also argue that YOU are better placed than many Banks to share great Insights into your clients’ financial planning options.

And it’s when your potential clients are actively considering their financial challenges that they will read (or watch) content that answers basic questions, like this:

Should I pay for advice, and what’s a fair price?

Click the link and see what you think!

FYI: I offer two versions of that Insight: One with the charts about excessive fees and one without. Both are included in the license price.

One of my clients (a leading financial planner) says they share a link to that Insight (on their website, not mine!) with prospective clients who ask lots of questions about fees. And I imagine that proportion is rising every year, right?

Could you help more people engage with financial planning?

‘Should I pay for Advice’ is one of many Insights I’ve designed to help potential clients overcome an aversion to advice.

Another issue, identified by acclaimed psychologist Albert Bandura (in the 1970s), is that we don’t tend to engage in complex and risky challenges when we don’t feel at all capable in that area.

And that’s one of ten reasons people don’t talk about money.

So, it’s obviously a bad idea to keep people in the dark about financial planning.

Yet it seems this is what we’ve done as a sector for decades.  Sadly, despite being aware of awareness and advice availability gaps for decades, the problem persists, and the advice gap has recently got worse!

Sadly, despite being aware of awareness and advice availability gaps for decades, the problem persists, and the advice gap has recently got worse!

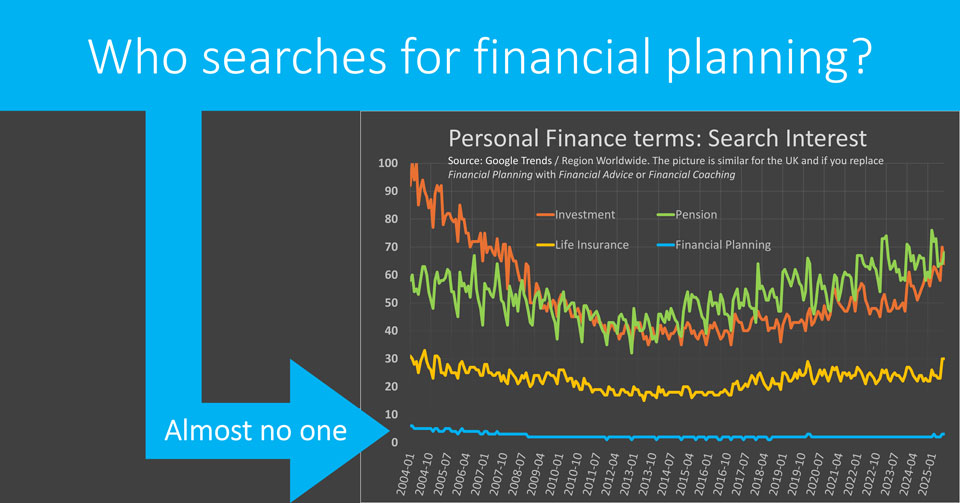

So, our challenge is to lift that blue line off the floor and boost awareness of sound financial planning.

And the truth is that we will never achieve this with daily short posts.

Can deep dive content generate more leads?

As I’ve said, some suppliers claim that inbound marketing is all about sending frequent, short posts, because that’s the type of content they offer.

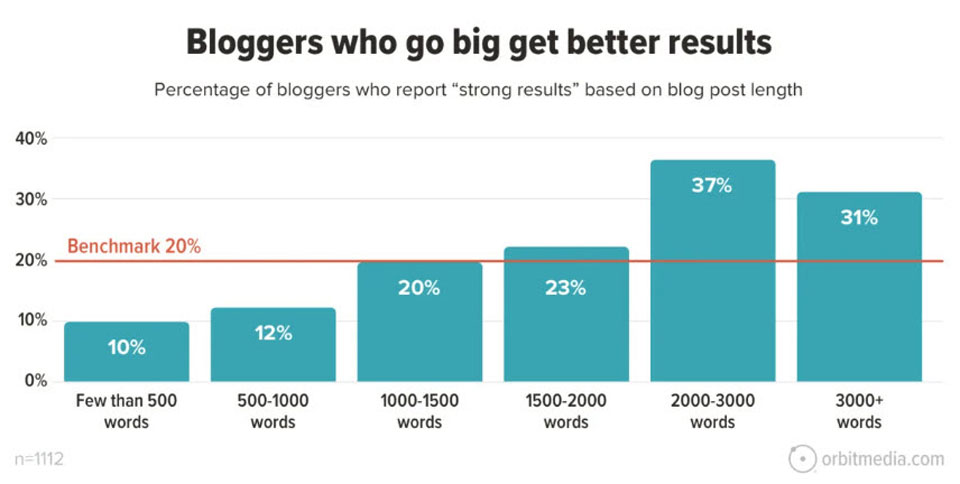

However, the evidence clearly suggests that they’re wrong!  This bar chart (from a survey of blogging statistics run by a respected marketing firm for 11 years) shows a sweet spot for engagement of between 2,000 and 3,000 words.

This bar chart (from a survey of blogging statistics run by a respected marketing firm for 11 years) shows a sweet spot for engagement of between 2,000 and 3,000 words.

Separately, the leading US marketer, Neil Patel, says he consistently publishes Insights of between 3,000 and 4,000 words.

And his strategy drives 100,000+ visitors a month to his Website. Patel also cites these other leading firms for evidence on the value of long-form content:

- WordStream (the leading Online advertising software and services provider) said that after switching to long-form content, they tripled their on-page time from 1.5 to 4.5 minutes. And their most popular article (c. 2,500 words) became a top traffic driver.

- CoSchedule (a leading provider of tools & training for marketers) say their top 10 performing blog posts have an average word count of 4,000 words.

- BuzzSumo (who provide a leading content marketing tool for creators) also found that, on average, in-depth articles (3,000–10,000 words) receive 6,000 shares. And that’s three times the rate for content with less than 1,000 words.

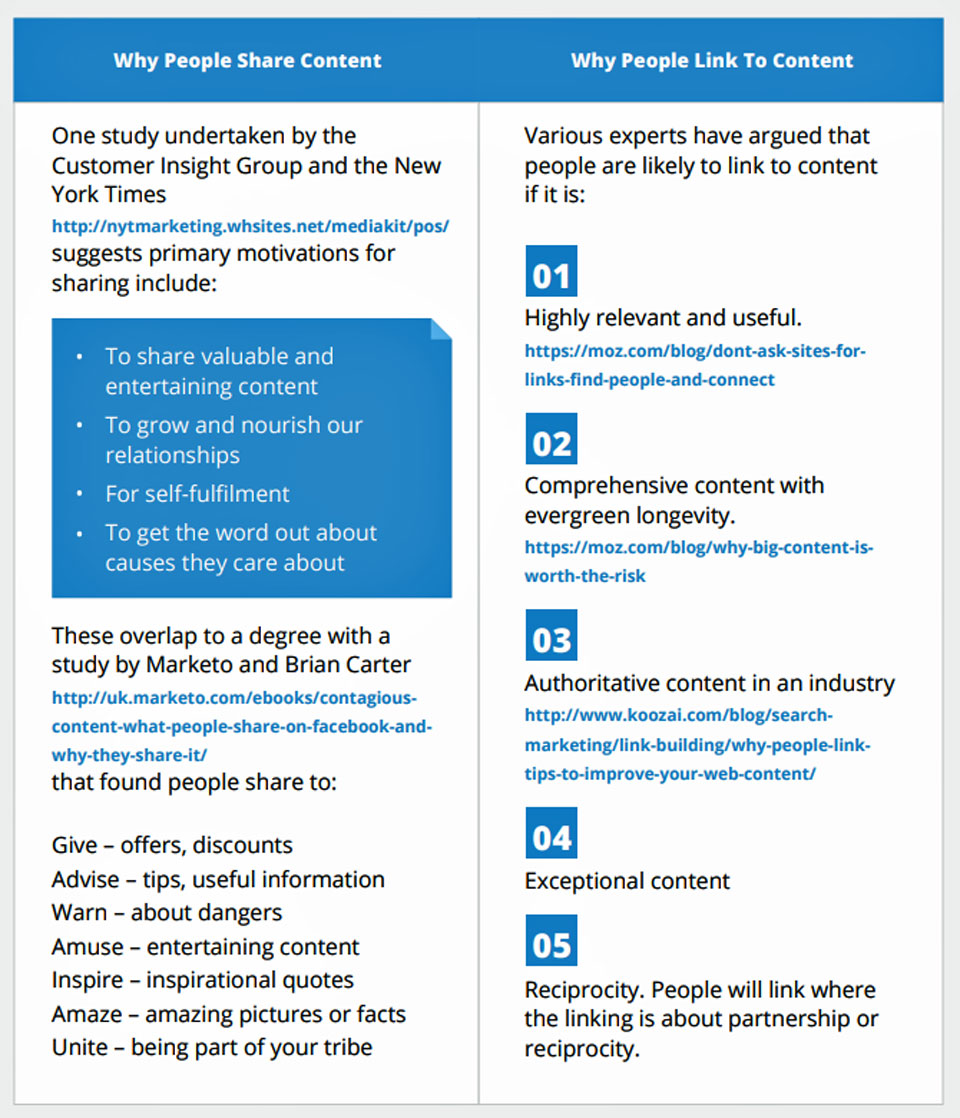

This Buzzsumo/Moz research paper examines the factors that drive content sharing and linking. It’s well worth a look – and includes this quote and table:

The shocking news, given the consistent findings that long-form content enjoys more shares and links, is that over 85% of content continues to be less than 1,000 words.

Can I ask you some questions now?

Can I ask you some questions now?

What was your view about deep-dive content before you read this post?

What was your view about deep-dive content before you read this post?

And what’s your view now?

What type of content do you, your family and friends consume?

Do you read (or listen to) many books and long-form guides?

Do you watch informative documentaries, like this one on the dangers of Social Media?

That’s just the (short form/attention grabber) trailer, of course.

The fascinating full documentary is 94 minutes long!

And, if you believe these Social Media Giants are unstoppable, watch the documentary. They face trouble now, given that many people want their powers (to control our attention) curtailed.

Do you enjoy learning from podcasts?

How long do your favourite podcasts last?

Are they genuinely valuable?

Some are better than others, for sure.

For start-up or growth-seeking advisers seeking business development ideas, this series of hour-long videos from Financial Planner Life is worth a look.

TED talks are the ultimate example

For years, TED Talks have been the benchmark for educational presentations, and these talks are 18 minutes long for a reason.

18 minutes is long enough to unpack a complex idea but short enough to hold people’s attention.

Research suggests we may experience a cognitive backlog if we’re given too much information.

We may struggle to stay attentive for 20 minutes, although our personal limits vary and depend on the quality of the content.

So, that brings us back to our ‘C’ test of a good content supplier.

Is their content truly Compelling?

As content consumers, we demand compelling talks, books, films and music.

So, presenters and content creators work extremely hard to capture and hold our attention.

What’s most interesting about TED talks is that (at an ideal pace for learning new concepts), an 18-minute talk requires a script of 2,000 to 3,000 words.

Remember that wordcount – it’s the same as the optimal length of a blog!

The bottom line on deep-dive content is this:

We all consume it!

So, why would we expect our prospective clients to be any different?

Final thought on lead magnets

Finally, in terms of the value of deep-dive content, it’s worth thinking about lead magnets.

Finally, in terms of the value of deep-dive content, it’s worth thinking about lead magnets.

Great value content prompts more people to sign up for our newsletters.

See what I did there?

So, lead magnets (where we offer guides and a promise of more ideas in the future) are a great way to build an email list—and are proven to be a powerful marketing tool.

Generally, people don’t share their e-mail address with strangers, esp. those offering financial advice.

So, when they do, it’s a good sign of interest in your guide and that some trust has been built with YOU.

Those who download your guide clearly want those specific ideas.

So, they’re also quite likely to accept a contact call from you.

The question is:

Do you go deep enough, on a wide enough range of topics, to interest enough people in the idea that your firm is the right one to advise them?

And that’s the test we’ll cover in the final Insight in this series.

Discuss this article