How many ways are you unique?

And why is this the key to planning your money?

When we recognise we’re unique, we stop wasting time looking for ready-made financial plans – from bloggers, influencers or the money pages of the Press.

Instead, we focus on designing what we need – a plan for our unique circumstances and financial life goals.

We are unique in many ways, as we’ll see, but we also have much in common with others – and can learn from their experiences of the challenges we face.

What’s more, when we understand these truths, it helps us build better financial life plans.

So, let’s get into this now.

What’s coming up?

This is the first of two Insights for people of all ages and wealth levels.

This is the first of two Insights for people of all ages and wealth levels.

In the second Insight, we’ll see how our financial circumstances differ and how that drives the need for a unique financial plan.

And we’ll touch on a behavioural trap (of over-stating our uniqueness) which can make financial planning unnecessarily hard!

First, however, we’ll explore the human factors that make us unique – and note how these could affect our money plans.

Here’s what’s coming up

- What type of person are you?

- What are the problems with personality labels?

- Why do we use labels to describe people?

- What are the valuable tools for learning about ourselves?

- Do you have any special projects?

- Are you aware of your emotional styles?

- What about your emotional agility?

- What about your work-related skills?

- What about your needs from your work?

- What about your character strengths?

- What about your values – and what you value?

- What about your attitudes – to everything?

So, yes, there are lots of ideas in this 10 to 20-minute read.

Important note:

We’re touching on psychology topics here. So, you’ll be pleased to know these Insights have been checked for accuracy and balance by a Doctor of Psychology with 20 years of clinical experience.

That said, these Insights are not designed as health guides, so if you’re dealing with depression, anxiety, or any other mental health challenge, please talk to your doctor, who will direct you to an appropriate support service.

And, if you’re struggling with financial worries, you may find this general guidance from the NHS useful.

Otherwise, let’s start to explore the ways you’re unique and what that means for your money.

What type of person are YOU?

What type of person would you say you are?

If you ask that question to a clinical psychologist, you will not get the answer you might expect from some popular ideas about personality types shared online or in some workplaces.

And that’s because psychologists do not label people as particular types.

Instead, in clinical work, they follow a process known as formulation, where they explore those aspects of our circumstances and past experiences that might be challenging us.

They aim to help us understand and deal with those challenges.

Yes, they develop an initial working theory on what may have contributed to our (presenting) challenges, but they readily adjust that theory as more information emerges.

Their ideas about what’s affecting us are NOT carved in stone.

Psychologists seek to understand us as a unique person. They want to hear our story and learn about our challenges to inform any interventions they might suggest.

OK, but what does this have to do with your money?

Well, it might surprise you, but good financial planners work in a somewhat similar way.

Like psychologists, they do not label their clients as particular types.

They acknowledge and respect that you are unique – and know that labels are unhelpful.

What are the problems with personality labels?

“There is no such thing as a pure extrovert or a pure introvert.

Such a person would be in the lunatic asylum”

[Carl Jung]

There are various risks of using ‘archetype’ or personality type tests, like the Myers-Briggs Type Indicator – MBTI.

First, we might start to believe these labels describe our identity.

Why would we use such tools if we didn’t believe they did?

So, if we buy into a label, we may stop noticing when it’s wrong – or as Harvard psychologist and mindfulness expert Dr. Ellen Langer said:

“If something is presented as an accepted truth, alternative ways of thinking do not even come up for consideration… ”

Second is the risk that a label becomes self-fulfilling. We start acting and deciding in ways that confirm the label or limit ourselves by discounting ideas or actions that don’t fit with the label.

Third, these models ignore the fact that we may act differently in different contexts (e.g. work vs at home, as a leader vs an employee and when we’re exhausted compared to when we’re full of energy.

These are not trivial risks, and that’s why some social scientists are trying to stop these people-labelling tools from being used – especially by employers to assess people’s suitability for roles or promotions.

Read about the lack of science with the MBTI from Professor Adam Grant here.

The fact is – we’re unique in a great many ways

That image shows about 25 ways in which each of us is unique – and it’s not an exhaustive list!

Let’s prove just how unique we are!

Think about that first dimension of how we’re different to other people – our personality.

And, as we’ll see shortly, we could have 25 aspects (or facets) to our personality alone.

Some models suggest more!

Now, let’s assume that each of us sits on a scale of 1 to 5 on each of those 25 facets.

Here’s the question.

How many different *types* of personality (combinations of those scores) are there?

Hint: The answer is not four – and it’s not 16 either!

No.

The answer is 5^25.

That’s five to the power of 25 or 5x5x5… 25 times.

And the answer is 298,023,223,876,953,000 – or nearly 40 million times the earth’s population.

Now, bear in mind we’re only accounting for personality differences here.

Imagine multiplying that enormous number another 20 or 30 times – by the numbers of variations in each of the other ways we differ – listed in the picture above!

Sorry for all these numbers – if they’re not helping you grasp this uniqueness concept, try these words instead.

Here’s what Professor Steve Peters (Psychiatrist, author of Chimp Paradox, and mind coach to the Multi-Gold-Medal award-winning British Olympic Cycling team) explained to Steven Bartlett on this (two-hour!) Diary of a CEO podcast.

We must remember that there can be a multitude of reasons why we react the way we do to different challenges.

Everyone is unique.

That’s what’s intriguing. And it’s fantastic that each of us is different,

The bottom line is that each of us is unique.

It’s not mathematically possible for things to be any other way.

OK. So, why do we use labels to describe people?

That’s a good question!

And the quick answer is that our brains are energy-saving devices.

So, we like to grab quick answers!

We like simple (common sense) answers to many complex challenges – and that habit tends to land us in trouble on various questions of life, love, and money, as we explored here.

In particular, it seems we evolved to make quick judgements about people when we first meet them.

We want to know if they are friend or foe, right?

We also want to know if they’re capable of helping or harming us.

Of course, life was brutally hard for most of human history, so we evolved to be cautious about others.

Indeed, research into social cognition (Cuddy, Fiske and Glick, 2007) suggests our judgement of others (individuals and groups) is primarily driven by our perception of their warmth and competence.

As an aside, we’ve drawn on that research to create this simple equation on the key drivers of trust.

You’ll note we’ve added a multiplier of reliability (R), which we believe is essential for maintaining trust in relationships.

FYI: Other trust equations include an item for ‘Integrity’ – and we’re happy to add it here, but we think Integrity is a given with genuinely warm and competent people.

So, we seem to have an inbuilt (protective) urge to judge people quickly – and single-word descriptions enable us to do that!

Some argue that labels appeal to our desire to belong to a particular group.

We’re not sure many people feel they belong to the group of ENTJs (or any of the other 16 MBTI types), but group identity is certainly attractive to some people.

Either way, our advice is to avoid believing that vague information (that could describe anyone) could completely describe one person – you or anyone else.

This classic trap for the unwary is called the Barnum (or Forer) Effect) and it explains the appeal of astrology and fortune-telling!

So, please avoid personality labelling models if you can OR, if you can’t avoid them (because your employer uses them), don’t take them seriously.

You could even send your employer a link to this post.

Are there any valuable tools for learning about ourselves?

Yes, absolutely, and we’ll look at some of these now.

Most psychologists now agree that the Big Five (or OCEAN) model is a reasonable basis for helping us understand our personality because:

- It’s backed by extensive empirical research.

- The facet scales give us a more nuanced analysis of our personality.

- It measures our traits on a continuum, while MBTI ignores the spectrum of differences.

The word ‘OCEAN’ is a mnemonic for remembering the traits of:

- Openness

- Conscientiousness

- Extraversion

- Agreeableness

- Neuroticism (emotionality – in plain English)

Various teams of psychologists have developed expanded versions of the Big Five/ OCEAN assessment to give us deeper insights into our personalities.

For example, The HEXACO Personality Inventory (HEXACO PI) includes a sixth dimension of honesty and humility. And despite the big name change (from OCEAN), the HEXACO model is broadly the same.

The Psychologists swapped the ‘E’ for an ‘X’ for eXtroversion and replaced the ‘N’ for ‘Neuroticism’ with an ‘E’ for ‘Emotionality’ because that word is more readily understood.

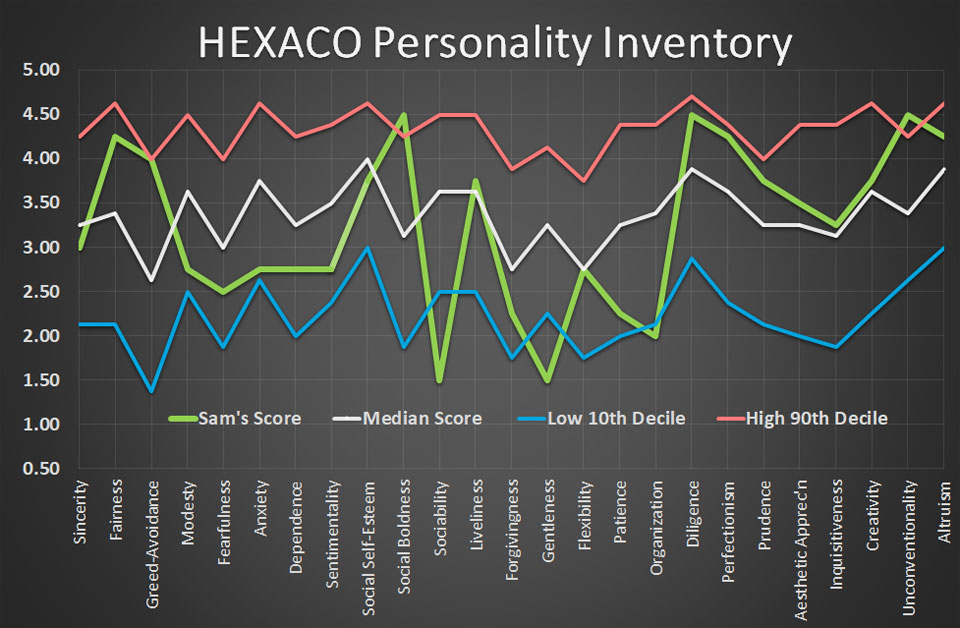

The HEXACO model unpacks each of the main traits into four facets – as shown here:

1. Honesty-Humility: Sincerity, Fairness, Greed-Avoidance and Modesty.

2. Emotionality: Fearfulness, Anxiety, Dependence and Sentimentality.

3. eXtroversion: Social Self-Esteem, Social Boldness, Sociability and Liveliness.

4. Agreeableness: Forgivingness, Gentleness, Flexibility, Patience.

5. Conscientiousness: Organization, Diligence, Perfectionism and Prudence.

6. Openness to Experience: Aesthetic Appreciation, Inquisitiveness, Creativity, Unconventionality.

The model also has altruism as a standalone facet to give a 25-point scale

You can take the HEXACO PI here for FREE if you’d like to.

And if you plot your scores on a chart, you’ll get something like this – which we’ve plotted for an imaginary person called ‘Sam’.

What’s the value of knowing these scores?

If you look at the Green line (of Sam’s scores compared to the median of those who took this assessment), you’ll see how it might help Sam to be aware of their tendencies to be highly socially bold while less than gentle in their communications with others.

Sam may also find it useful to see how those extreme scores compare to the top or lowest 10% of people, too – as shown here.

You can read the fascinating scale descriptions for the HEXACO PI here.

Just be aware that these are self-assessment tools for helping us understand ourselves. We don’t need to tell anyone else our scores.

That said, swapping your insights with trusted friends and family members may help to maintain bonds of mutual understanding.

Please note:

There are no right or wrong (or good or bad) scores associated with these inventories. They simply help us see how we differ from each other (and from the ‘average’ person) on these various aspects of personality.

There are, of course, other versions of the Big Five personality assessment, like the NEO Personality Inventory, which explores six facets for each of the five OCEAN traits. So, it gives a slightly deeper picture than the HEXACO model.

Just be aware that, like many questions in psychology, personality is a complex subject – but psychologists broadly agree on these 5 or 6 core traits (OCEAN or HEXACO) for describing it.

And exploring the many facets of our traits can be valuable.

We hope it’s clear from the chart above that putting anyone into one of four, twelve or even 16 personality boxes makes no sense.

Generational groups

Nor is it useful to suggest we know much about someone from the period of time in which they were born.

This idea (much loved by marketers) places us into groups like Baby Boomers vs Generation X vs Millennials, etc – which implies that someone whose birthdate falls a few days too early (or too late) to be a Gen Exer is an entirely different person!

That’s just silly!

Yes, we may be somewhat like some others in some respects.

And yes, we can look at data to see how people’s ages may offer clues to how they use mobile phones for example.

No surprise there – younger people grew up with those things.

Likewise, the personal finances (and attitudes to money) of some people will have been heavily influenced by the dot-com stock market bust (2000-2003) or by the global financial crisis (GFC: of 2007-09)

However, we recognise that many older people now embrace technology, and not every young person uses it productively.

And we know that the hard financial times mentioned affected different people differently.

Most importantly, as we’ve shown, there is almost no chance you will have the same shaped personality profile – across 25 facets as someone else.

And you’ll differ across the other (30 or more) dimensions, like background, experiences, interests, etc.

Does our personality change?

Finally, in this section, we should note that our personality is considered relatively stable over time – albeit some traits may moderate more than others with age in absolute terms.

It’s important to note, however, that our default behavioural traits do not dictate how we act.

Every situation we’re in is unique – and we can override our typical traits to achieve the goals we care about – as Professor Brian Little talks about in the video below.

Are there other dimensions to our uniqueness?

Yes, there are many dimensions to being unique.

Yes, there are many dimensions to being unique.

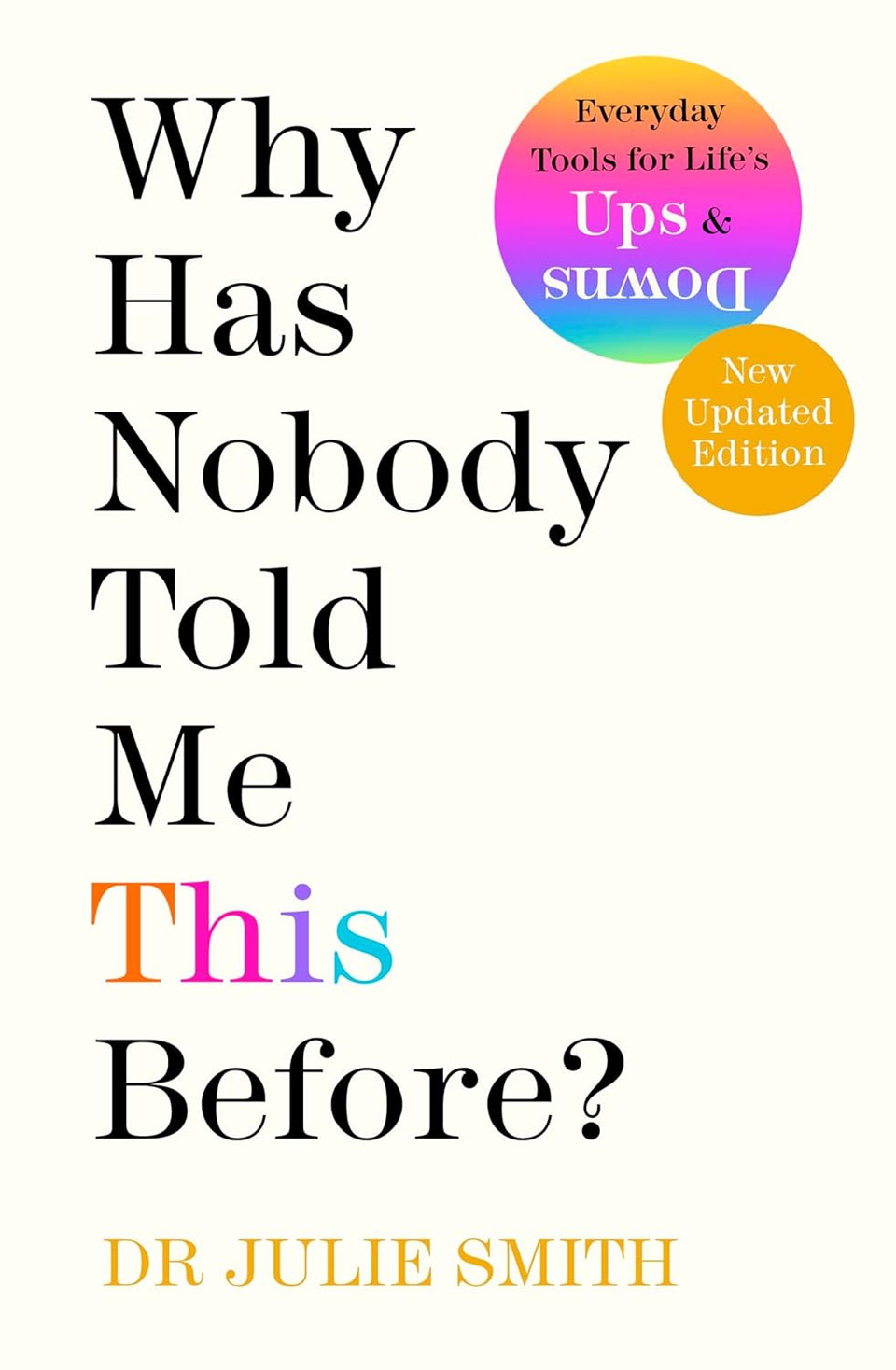

Our mind’s rational and emotional workings are hugely complex, so we’d need a large book to outline what’s known about these things today – without even touching the questions under investigation (or re-investigation) in the world’s psychology and neuroscience labs.

And, if you’d like to read such a book, here’s one we’d recommend as a starter for some excellent (plain English) answers to key Psychology questions – that you might ask why you’ve not heard before!

For now, here are a few other dimensions of our uniqueness that might fascinate you.

Do you have any special projects?

Who are you – really?

Sorry, we don’t wish to sound rude – that’s just the title of Psychology Professor Brian Little’s book – and his superb TED talk shown here.

In his book, Brian Little talks about ‘Personal Projects: The Doings of Personality’ and suggests two ways to think about our personality.

The first (covered above) relates to our relatively stable (OCEAN) traits of Openness, Conscientiousness, Extraversion, Agreeableness and Neuroticism.

The second relates to our personal projects or goals – the things that matter most to us at particular times.

These are the things we want to have, become or do (or do less!) in the future.

“What we do affects who we are”, says Little – which seems to confirm what Aristotle thought thousands of years ago!

Of course, we cannot simply watch someone train for a marathon, learn to play the piano, teach yoga or write a book to know what’s motivating them.

Our motivations are another enormous dimension of our uniqueness, too!

To truly understand each other, we must learn why we’re driven to do what we do.

And to learn those things, we need to listen to the answers to questions like these:

- What personal projects or plans do you have now?

- What others would you like to start in the future?

- And why are they special to you?

Again, it might surprise you – but good financial planners will ask you those questions.

What if you don’t have any special projects?

No problem.

We don’t all have special projects on the go all the time.

Some of us complete most of the projects we want to before we get involved in any financial planning.

Still, most of us face risks to our financial futures that could be avoided with some care and attention, and competent planners help us address those challenges, too.

Now… how else might you be unique?

Are you aware of your emotional styles?

According to Dr Richard Davidson*, we have six emotional styles:

- Resilience: Our ability to recover from negative emotions arising from adversity.

- Outlook: Our ability to sustain and savour positive emotions over time.

- Social intuition: Our ability to read nonverbal cues (like facial expressions) and infer social information from others’ emotional states.

- Self-awareness: Our attunement to our own physiological and emotional states.

- Sensitivity to Context: Our ability to adapt our emotional responses to our social environment.

- Attention: Our ability to screen out distractions and stay focused.

Davidson also suggests here that Resilience, Outlook, Generosity and Attention are the four constituents of our general well-being – which, thankfully, can be shaped (to varying degrees) by training and experience.

The idea that attention is vital for our well-being is also supported by research (Killingsworth & Gilbert, 2010), which shows how wandering minds are seldom happy minds.

So, there is great value to be gained from mindfulness work – if we’re not that way already.

You can learn more about emotional styles, take the questionnaire and receive wellbeing tips here and in the book ‘The Emotional Life of Your Brain’ by Davidson and Sharon Begley.

* Dr. Richard Davidson founded the Center for Healthy Minds at the University of Wisconsin–Madison; is a friend and confidante of the Dalai Lama, leads conversations on well-being worldwide, and is best known (among academics) for his groundbreaking studies into human emotions.

What about your emotional agility?

Susan David describes ‘Emotional Agility’, as our ability to deal with our thoughts, emotions, experiences and self-stories – with courage and compassion.

She urges us to learn and grow from our challenging thoughts and emotions rather than have them hold us hostage or cloud our interactions with others.

And she notes how developing our Emotional Agility aligns with the ideas of Victor Frankl (the Psychiatrist and Nazi death camp survivor) for a life in which we fulfil more of our potential.

You can take Susan’s Emotional Agility Insights Quiz here – to receive a personalized report on how to be more effective with your thoughts and emotions.

The quiz is free and takes just 5 minutes to complete.

You can learn more in Susan David’s acclaimed book, ‘Emotional Agility: Get Unstuck, Embrace Change and Thrive in Work and Life.’

* Susan David, Ph.D., is an award-winning Harvard Medical School psychologist whose TED Talk on emotional agility has been seen by more than 10 million people. She frequently contributes to the New York Times, Washington Post, and Wall Street Journal and often appears on national radio and television.

What about your work-related skills?

The quote in this image is from Alan Pickering CBE.

The quote in this image is from Alan Pickering CBE.

Pickering previously advised the UK government on pension policy – and that’s one of the wisest pieces of financial advice we’ve seen.

If you have *enough* wealth and wish to stop work altogether, that’s fine, but remember that everyone’s path through life is unique at this stage, too.

You may choose (or have a need) to stay ‘work-active’ in your later years.

And, if you don’t own a bulletproof business (where your skills are not questioned!), you may want some knowledge and skills beyond those you use at work today.

For example, if you think you’ll pivot your work life towards coaching, mentoring, or educational writing – you might want to explore what’s required for that type of work ASAP – because those roles are not suited to everyone.

What about your needs from your work?

Given that we spend most of our waking lives at (or thinking about) work, this is a vital question to get right, and we may come back to this for a deeper dive in the future.

For now, let’s just be aware that our preferences are (again!) unique to each of us.

If you have a family, you’ll want to make choices that accommodate your family’s financial and time needs from you.

And don’t forget to consider your own needs regarding your work.

Yes, again, everyone has a unique profile of what they want from their work – and this changes at different stages of life.

So, which of these potential features of work matter most to you – right now:

- Autonomy and control of what you do?

- Mastery of skills that excite you?

- Work that has a real purpose?

- Influence in the organisation?

- A good quality work environment?

- Social contact and affiliation?

- Solitude? (not everyone wants to be sociable all day – especially Sam!)

- Creative work opportunities?

- Learning and development opportunities?

- Recognition for your work?

You can probably think of other needs, and we’d love to hear what they are.

What about your character strengths?

As with personality, social scientists have developed a (culturally common) language of character strengths to help us explore what’s best about us.

The character strengths are grouped under one of these six virtue categories,

- Courage: Bravery, Honesty, Perseverance, Zest.

- Wisdom: Creativity, Curiosity, Judgement, Love of learning, Perspective.

- Humanity: Kindness, Love, Social Intelligence.

- Justice: Fairness, Leadership, Teamwork.

- Temperance: Forgiveness, Humility, Prudence, Self Regulation.

- Transcendence: Appreciation of Beauty and Excellence, Gratitude, Hope, Humour, Meaning.

We all possess these strengths to varying degrees, so we each have a unique character strengths profile, too!

You can find the full character strengths list and undertake a FREE self-assessment to discover yours here.

Of course, applying ourselves to make the most of our strengths is the real challenge – but knowing our strengths is a good first step – right?

What about your values AND what you value?

Search the term ‘How to work out your values’, and you’ll find nearly 3,000,000,000 (three billion) results on Google!

The question is, how many of those pages offer any wise guidance?

Identifying our values is challenging when there are hundreds of ‘things’ we might value.

However, Professor Steve Peters (A psychiatrist and one of the most respected performance coaches in the world) offers us a different perspective on this challenge – and urges us to distinguish between “what we value” and our “values” as a moral guide to our conduct:

The things we value might include:

- Having fun, being entertained at a live music or comedy gig.

- Entertaining others!

- Being mindful.

- Being content – and accepting of others.

- Being a good friend and/or partner, parent, child, sibling, grandparent etc.

- Being creative.

- Having personal space.

- Looking after our health.

- Looking after our pets.

- Various possessions.

- Making a home.

- Our other assets – and special keepsakes.

- Our skills – and our knowledge etc.

This list can include objects, people, practices or habits, and some states of mind, so it can run into thousands of items.

These are things we believe will make us feel secure and happy, so it helps to know what they are – and give them some priority in life.

On the other hand, when we think about our values – as a moral guide to our conduct – the list is likely to be a lot shorter.

We each need to develop our own set of ‘values’, of course, but in his book, ‘Path through the Jungle’, Peters gives these examples to show what he means by personal values.

We think they’re a helpful starting point – but be in no doubt (as Peters himself says in that Diary of a CEO Podcast) – not everyone adheres to these values.

- Respect for others

- Justice and fair treatment.

- Loyalty.

- Compassion and kindness.

- Integrity.

- Respect for diversity (uniqueness!)

- Equality without prejudice.

- Promotion of peace and goodwill.

These values are based on societal and personal beliefs and form a moral code to guide our behaviour in all situations.

Yes, they’re judgement-based, so they give us a moral compass, a way of knowing we’re doing the right thing.

They’re measured by the behaviours we display and actions we take.

Peters says we should not muddle up these two lists.

The first, he says, is more of a happiness list – of the things we’d like to have, become and do (or not do!) for ourselves and our loved ones. And this is the list that best informs our financial life plans.

The second list (of our values) is about what gives us peace of mind – and inner strength in challenging times.

What about your attitudes – to everything?

We might think we know what an ‘attitude’ is – but psychologists say our attitudes have three parts.

Attitudes encompass our beliefs and thoughts about things (objects, people, groups, events, ideas and more) and the emotions and behaviours that result.

So, yet again, we see that each of us has a unique mix of positive and negative attitudes towards most things – whether it’s:

- The foods and drinks we consume.

- Political parties.

- Government policies.

- Sports teams.

- The personality (or behaviours or attitudes!) of each of our work colleagues.

- Ditto for every other person in our life!

- And so on – and so on.

Our attitudes vary across a whole range of money questions, too.

Some people see more value than others in saving for the long term and adequately insuring their lives and health to protect their loved ones from financial disasters, for example.

In a future Insight, we’ll outline a powerful exercise to help us explore where our attitudes to money might have come from and what we can do to change them if we need to.

For now, be aware that our attitudes are not fixed.

We learn them at school, work, home, and our local (and online) communities.

So, while it’s hard with some beliefs, many can be changed. And it makes sense to change those which don’t serve us or others well.

Bottom lines and coming up next

In this first of two Insights, we’ve looked at the non-financial aspects of how we’re all different.

In this first of two Insights, we’ve looked at the non-financial aspects of how we’re all different.

This is NOT an exhaustive list, but we hope it shows clearly how each of us is unique on multiple levels.

Mathematically, you can’t be the same ‘type’ of person as someone else.

Coming up – in the second Insight, we’ll:

- Dive deeper into the financial aspects of what makes us unique.

- See how those aspects (with those we’ve covered here) are what should inform your financial life plan.

- Touch on a behavioural trap of over-egging our uniqueness, which makes financial planning unnecessarily hard.

See you in there when you’re ready for that.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up for my newsletter here

You can comment as a guest (tick that box) or log in with your social media or DISQUS account at the base of this page.

You can comment as a guest (tick that box) or log in with your social media or DISQUS account at the base of this page.

For financial advisers, planners and coaches

This educational insight is one of many we’re creating for you to use in your business under lifetime licences.

These works aim to help people make sound financial decisions and recognise the value of professional advice.

You can, of course, brand these insights to your business style and add your firm’s calls to action.

For financial advisers and coaches

To use this or other educational insights in your business.

Discuss this article