Can we build more trust in financial planning?

And feel good about it - all at a minimal cost?

In this Insight for leaders of financial planning, advice and coaching firms, I explore a proven way to build more trust with consumers – while reducing costs and risks in your business.

This is a 10 to 20-minute read – but it could save you £100,000 in content creation costs over the next few years.

So, it might be worth a look.

By helping others, we help ourselves.

Every business leader I’ve worked with says it feels great to build an educational programme.

And that’s because it’s all about improving people’s lives.

Most people in this sector want to do something to fill the enormous gaps in financial literacy, advice, and trust. And if you’ve read the recent Lang Cat report – you’ll know that the Advice Gap is growing!

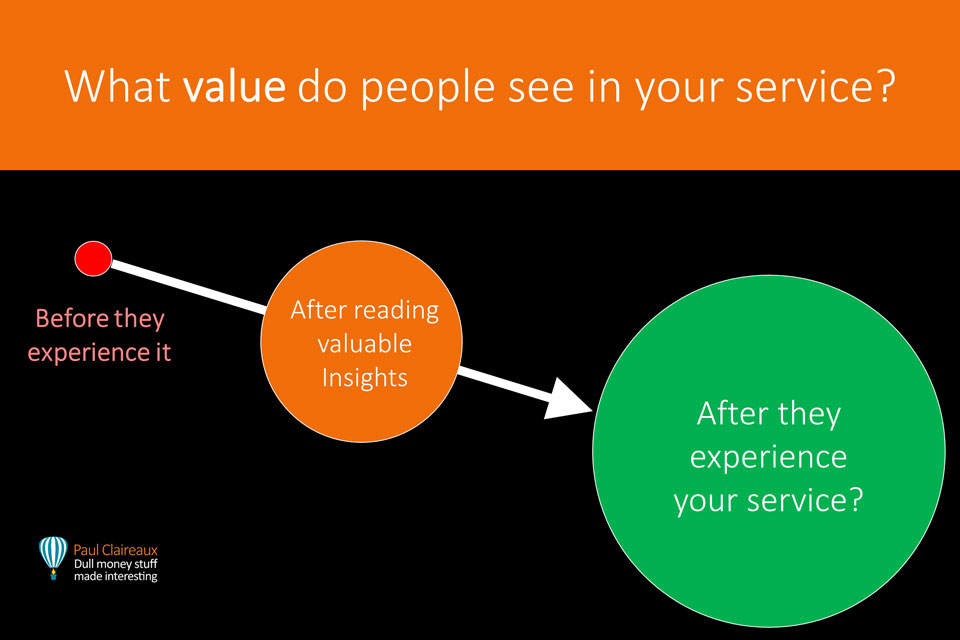

The only question is how you gear up to help more people achieve the transformation shown in the picture above.

How can we help millions more people make better financial choices, and make ourselves happier too?

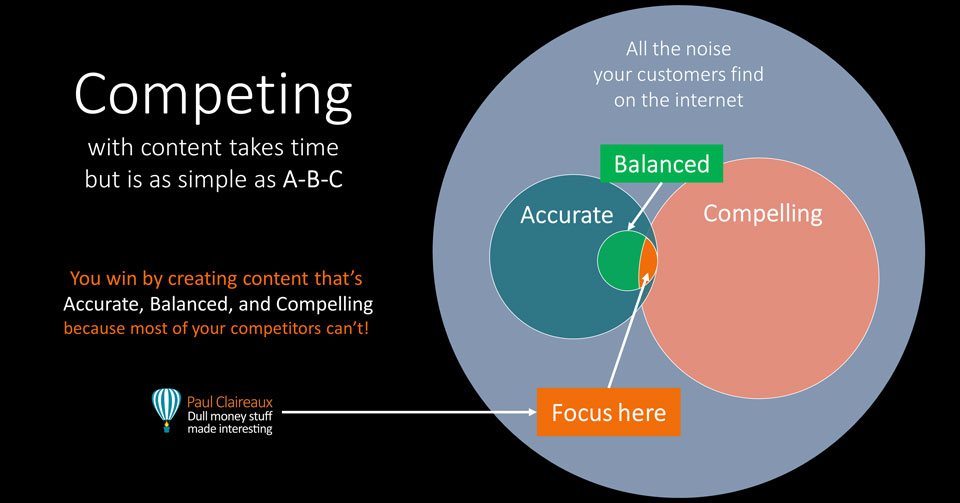

You need great content – which passes the ABC tests

I’m sure we agree that all educational content must pass these ABC tests.

I’m sure we agree that all educational content must pass these ABC tests.

Content is not valuable unless it’s Accurate, Balanced and Compelling.

It’s just a waste of your budget.

So, I’m deeply saddened to see some service providers and fund managers supplying advice firms with grossly misleading content to share with consumers.

If you’re interested, I can tell you how I persuaded the executive team at a world-leading fund manager to stop sharing some misleading content – but that’s for another day.

The critical point here is that by focusing on ABC content, advice firms position themselves as different – and better than others.

There are not enough advisers to go round

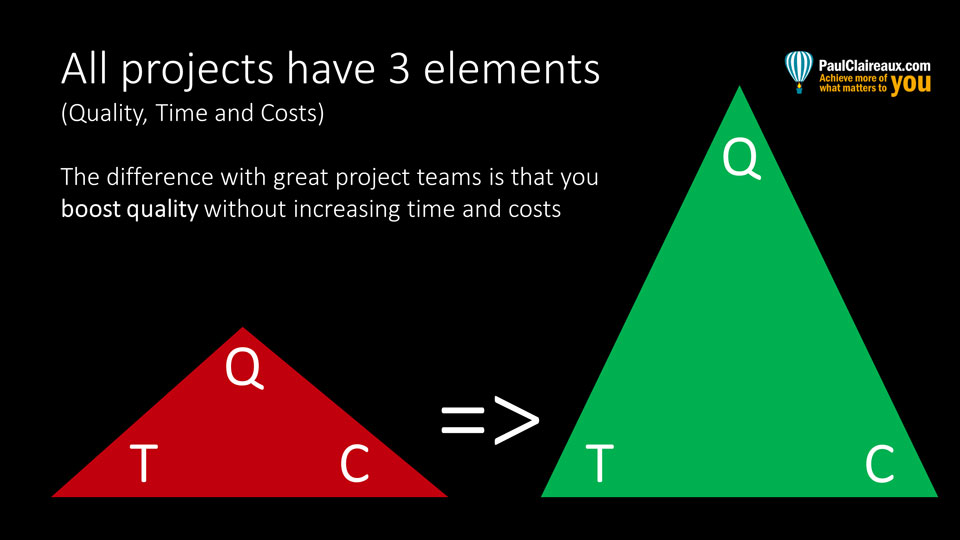

So, from ABC to QTC!

Some say it’s impossible to help many more people make better financial choices without:

Some say it’s impossible to help many more people make better financial choices without:

- Regulatory change to cut the time-cost of giving advice.

- Simplifying the tax and pensions landscape – to cut the time required to advise wealthier people.

- Vastly more efficient processes – to cut those costs.

- Working longer hours.

- Taking on more (lower cost) advisers.

I understand those arguments, and I suspect the government will not do much to help with point 2 (on tax simplification) in the short term!

However, there is good news on point 3 – with a new breed of advice-tech firms enabling enormous improvements in advice efficiency.

Ask me which tech firms can enable advisers with 50 clients to look after 200 or more!

However, even before you start to explore new (advice) technologies, I’d say it’s worth exploring how you can:

- Reduce the time it takes to onboard clients.

- Reduce the time it takes to complete the advice cycle.

- Give sound guidance to hundreds or thousands more people – inc. the adult children of your clients.

- Reduce the advice risks in your business.

Those are just four of the 25 benefits* (to advisers and consumers) of putting education first in your business.

So, if you build a sound educational programme – you’ll have more time to focus on those big ‘tech stack’ and other business development and training needs questions!

* e-mail me at hello@paulclaireaux.com to request this list of 25 business and client benefits of education-first marketing.

It’s a popular document with financial planners, advisers and coaches

Or book directly into my diary here to explore those benefits.

Can we build trust without talking to people?

Well, no… obviously.

But it’s worth saying – because I think we’ve gone mad in this ‘outbound’ digital marketing world.

We cannot build real trust with people unless we talk with them and are believed to be listening. And, at the least, to send them something of genuine value.

Marketing that says, ‘Look at us – aren’t we wonderful?’ won’t cut it now – and I’m not sure it ever did!

This is the age of being helpful, of putting consumer understanding at the heart of everything we do.

The idea is now embedded in the Consumer Duty regulations.

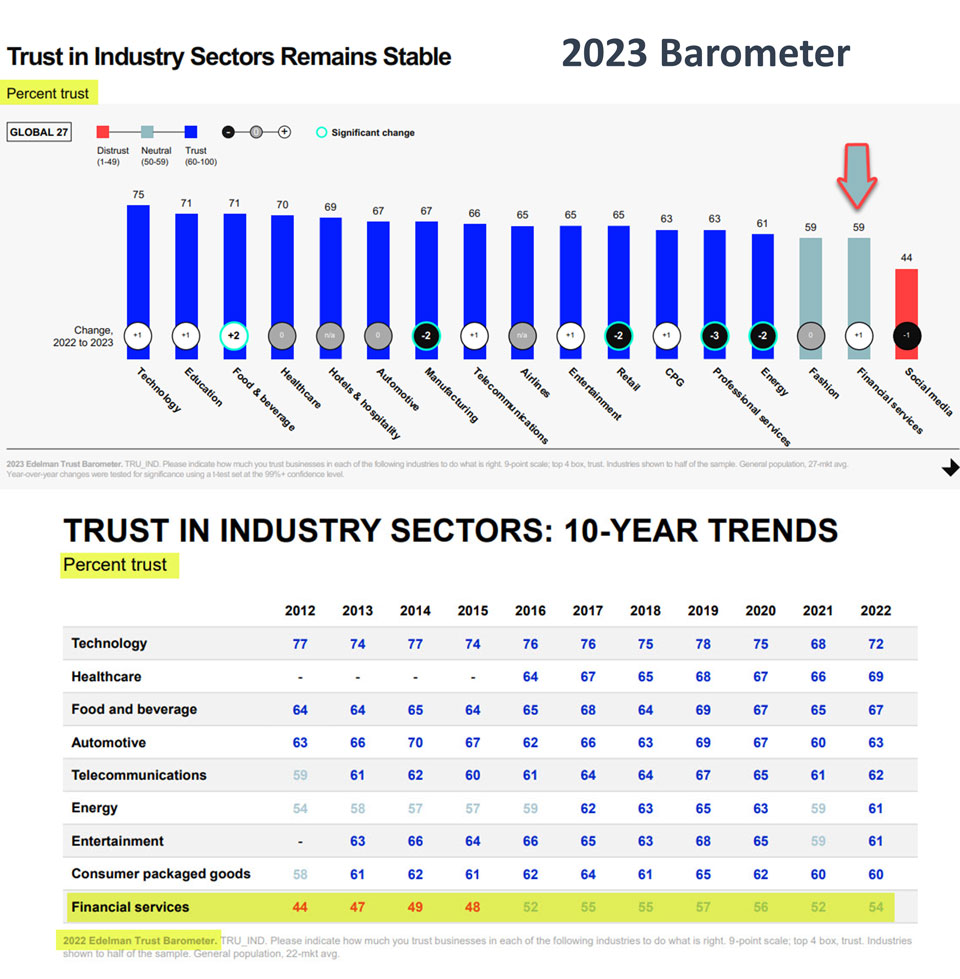

How ironic then that the 90% drop in adviser numbers post-RDR is one reason the UK sits near the bottom of this Trust table.

Perhaps we Europeans are less trusting than those in the USA, India, Far East or Africa.

Perhaps we Europeans are less trusting than those in the USA, India, Far East or Africa.

That’s my observation, at least. We Europeans can be Grumpy!

Is this just an adviser gap issue?

I don’t think so, and I can’t see how we’ll ever build trust with consumers unless we tell them the truth (and the whole truth) about their money challenges and the solutions we offer.

I don’t think so, and I can’t see how we’ll ever build trust with consumers unless we tell them the truth (and the whole truth) about their money challenges and the solutions we offer.

Don’t get me wrong, I know plenty of firms working hard to offer high-value, trustworthy content.

However, those who happily share misleading ideas keep this sector at the bottom of the trust tables… or in second-bottom place since ‘Social Media’ was added in 2023!

So, I imagine we agree that we must do something to build more trust with consumers.

And this is why I do what I do.

I focus 100% on creating ABC educational content because I believe in the value of sound financial planning.

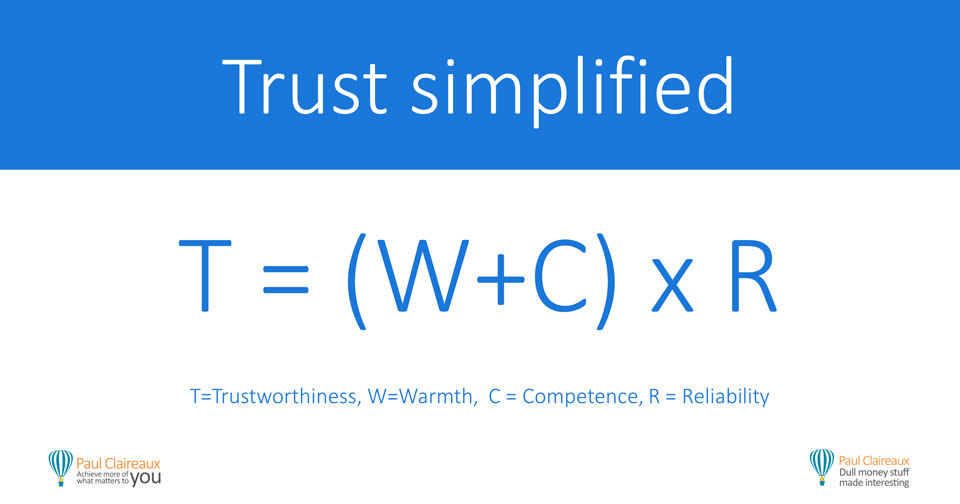

I also developed this new equation (loved by financial planners) to build trust in any service business.

FYI: The ‘Warmth’ and ‘Competence’ factors come directly from research into social perceptions (from Cuddy, Fiske and Glick).

I’ve added ‘Reliability’ (as a multiplier) for a business context.

In my experience, reliability (and responsiveness) are essential for building trust and working with (and selling to) other firms – and inside a business when developing new products and services.

The equation may look familiar because it is similar to (but simpler than) the equation in The Trusted Adviser book.

What’s obvious is that Accurate, Balanced and Compelling content demonstrates our warmth and competence.

So, this sort of content is essential for planners, advisers and coaches to:

- Build trust with those they’ve not yet met.

- Attract and retain more clients.

- Provide valuable educational guidance to help those not yet ready* for advice.

* Staying close to these people is essential, given the research from Schroders/Adviser Home, which shows that: 65% of wealth inheritors (including spouses) plan to change advisers when the wealth holder dies.

Education is simply a stepping stone to guidance or advice.

Most professional firms now work with the realities of our digital age – and recognise that most* people decide on a service provider before contacting them.

Most professional firms now work with the realities of our digital age – and recognise that most* people decide on a service provider before contacting them.

* Marketers debate the proportion of buying decisions made before we contact a supplier. The number varies between business sectors – between 50% and 80%.

Again, it’s self-evident – because it’s how you and I buy products and services.

So, offering valuable insights to attract people to an advice service makes sense.

We know that conversational Insights start the advice process – and are what clients value most.

We know that conversational Insights start the advice process – and are what clients value most.

Every experienced adviser knows this – and yet, the research (from Lang Cat or Boring Money) shows that many potential financial planning clients go elsewhere (to friends, family, #finfluencers) for financial Insights.

Sadly, as we know, too many of those are poorly advised, and some suffer severe financial losses (if they listen to those idiot Spread Betting promoters, for example).

Meanwhile, almost no one knows what financial planning is about – here’s the proof.

Virtually no one searches for this (the most valuable) service in personal finance.

(FYI: The search numbers for ‘Financial Advice’ are on the floor, too)

So, is this a sign of successful communication?

Or is it a sign that our sector fails to engage people in financial planning?

To be clear, I don’t blame firms with as much work as they can cope with.

I blame the regulator for cutting adviser numbers by c. 90%.

(an error they’re now rapidly trying to unwind with the Advice Guidance boundary review)

OK, but who wants basic money lessons?

I imagine we also agree that the need for financial education extends across the income and wealth scales.

Most people need a much better understanding of the basics.

That’s easy to see if we look at some extreme cases, like Bernie Madoff’s Ponzi scheme – a scam of such epic proportions that this documentary and this film were made of it.

Thousands of institutions and wealthy individuals lost billions to Madoff, including these people:

- Steven Spielberg: The Academy Award-winning director.

- Jeffrey Katzenberg: Co-founder of DreamWorks Pictures with Spielberg.

- Eric Roth: American screenwriter for “Forrest Gump” and “A Star Is Born”.

- Larry King: Emmy-winning American television and radio host.

- Kevin Bacon and Kyra Sedgwick: Golden Globe-winning actors.

- Zsa Zsa Gabor: Former Miss Hungary (1936) who starred in Moulin Rouge (1952).

- John Malkovich: American actor, director and producer.

That information is all in the public domain.

The financial institutions that invested with Madoff were foolish because the warning signs were obvious to anyone who knew anything about investment risk and reward.

However, those famous people were not foolish – just vulnerable to the behavioural bias of trusting the man.

They did not have a sound money-box checklist like this to consider Madoff’s offer.

And that lack of knowledge cost them their fortunes.

Some would say that Spielberg and these others could afford qualified financial advisers and not wish to ‘trouble themselves’ by learning about such dull matters.

That’s true, but they still handed their fortunes to Madoff. So, perhaps they’d change their minds about the need for financial education if they knew how easy it was to learn a basic process.

Of course, ignorance of money box choices is not limited to the US.

Many famous actors and sportspeople lost fortunes here after being advised to invest in ‘edgy’ tax-avoidance schemes.

Schemes that no one would have gone anywhere near – if they’d known a simple process for checking a money box before putting money into it.

So, everyone (rich and poor) is vulnerable to scammers (or bad or excessively expensive advice), which means everyone should learn the basics about money.

And I’m happy to share my thoughts on what a basic set of lessons should cover.

(I’ve delivered these lessons in a live workshop to an audience of professionals – who loved them)

Just be aware it’s hard to make dull money topics interesting.

If it were easy, there’d be no financial literacy problem, and no one would fall for scams.

But fascinating content is what I strive for, and if you share this ambition, let’s talk.

Unpacking the cost and value questions

The evidence shows that financial firms thrive and enjoy substantial growth in their client numbers by teaching basic money concepts – and showing how embracing our financial challenges can transform our lives.

Progressive firms now offer guidance and planning to those without significant wealth – and with high-quality (educational) content, they help thousands of other people, too.

The educational content programs I’ve written have helped my client FS firms grow like a rocket, and I want to help others do the same.

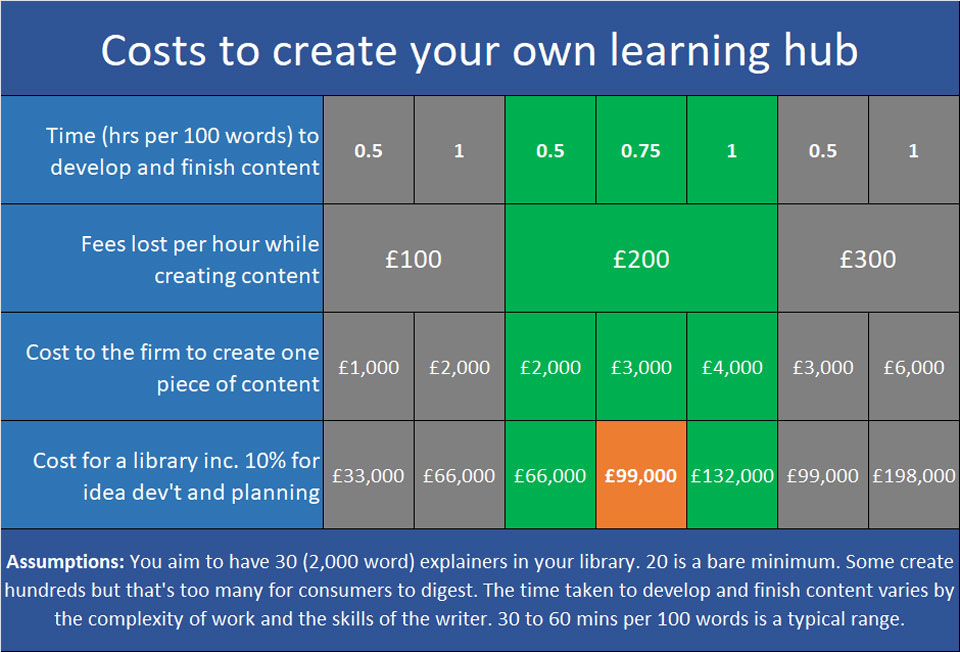

I also want business owners to understand the time and money costs of developing a sound content program.

I’ve seen several firms start creating educational content with good intentions and enthusiasm – only to give up when they discover the enormous and ongoing workload.

So, I urge you to use this table to consider the cost of creating (all) your content in-house.

The costs look scary, but they’re realistic.

The numbers in the Green and orange boxes relate to typical advice firm fees, and the pace of writing (for properly researched and finished works, with images) draws on my experience of writing c. 400,000 words (in books, blogs, guides, and videos) and from talking to other (leading) content creators.

So, if you want to create a robust programme of insights (and there’s little point in offering anything else), you must take a lot of time away from running your business or advising clients.

Or you must take a competent adviser/paraplanner away from their day job.

And if you account for that time, at the average (Vouched For) adviser charge-out rate of £200 per hour, a single (high-quality, long-form) Insight will cost you around £3,000 to develop and finish.

This converts to a cost of c. £100,000 to build a good programme of 30+ Insights – rising to c. £200,000 (with content maintenance) over, say, ten years.

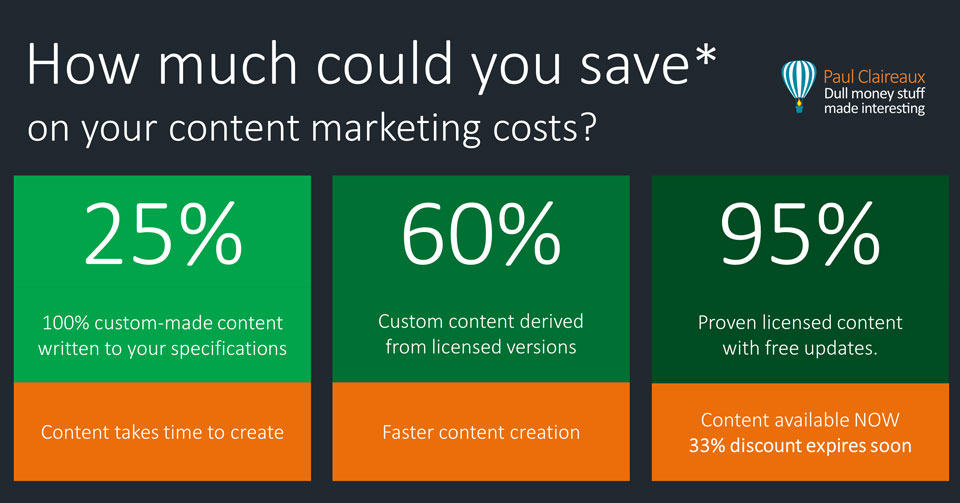

What proportion of those costs could you save?

The numbers above assume that you or your nominated team member are good content writers, but not every firm has these skills in-house.

In any event, as this next table shows, it’s possible to save a fortune by working with a professional writer—and if you’re not a good writer, you’ll benefit from better content, too!

TBH, I only work on 100% unique content programs with one or two clients each year – because these projects require an immense amount of work.

However, few firms will need that service now that I can offer a c.60% savings (compared to in-house costs) for unique content derived from my new licensed library.

Moreover, I can now serve small advice firms with high-quality content for c. 95% less than the cost of creating it in-house.

The downsides to licensed content are overstated.

Some firms will say they don’t want visitors to their website to see the same content elsewhere.

And I get that, but how big is this risk?

Unless your potential clients review multiple websites besides yours, they’ll have little chance of finding similar content elsewhere.

And so what if they do?

If the Insight they gain from your website is accurate and balanced (like this one), won’t they be reassured in the unlikely event that they chance across similar (sound) messages elsewhere?

It’s OK to receive sound educational ideas from more than one place.

We expect to receive similar health advice (get some exercise and eat ‘five helpings of fruit and veg a day’) from any doctor worldwide, right?

It’s just sound advice, and the reinforcement is helpful.

Of course, most of us want to develop a unique service proposition. Still, there’s no need to spend a fortune to differentiate our proposition in one area (money insights) of one element (communications) of our business.

We don’t need to depart from sound financial planning messages – when we can lean into and reinforce widely agreed-upon ideas.

There’s plenty of room to differentiate our proposition in those other three areas and our communications about them.

So, there’s little downside to using licensed educational content, provided it’s excellent quality – and passes those ABC tests.

Unfortunately, not all of it passes those tests – and too much (especially from those relying heavily on AI !) contains errors in the words or the graphics—or both!

So, choose your supplier with care.

For your information, my educational content is checked by one of the most qualified financial planners in the UK—a guy who used to mark exams for the IFP.

I’m also working on a new series of ‘Money Mindset’ pieces, which will be checked by a Doctor of Psychology with 20 years of clinical experience.

So you can be sure all of my licensed content is sound.

Also, if you decide to use some of my licensed content, I assume you’ll format it to fit with the brand style of your site.

So, it won’t even look the same as another site’s content – especially once you’ve added your unique call to action that ties the lesson back to your services.

You can also change the images in (my) licensed content if you really want to, although those images are carefully chosen, so be careful with that, too.

Of course, I have no axe to grind on whether you use licensed content – because I also offer a custom-made service.

I’m just keen to help you get the best educational content at a fair price.

And to focus on what matters – which is the quality, right?

So, let’s talk about price vs value.

Pricing levels matter for any service, but what matters most is value for money.

So, yes, there is a threshold price above which it makes no sense to use licensed content.

You’ll want to go for unique content – if you can have it for a little extra cost.

This chart (well-received by various financial planners) may help you consider this question.

Where would you distribute a random selection of 100 advice firms (and your business) on this map?

Explanation of Zones:

Zone 1 is a nightmare situation in which ad hoc (and low-quality) content damages a firm’s reputation with consumers or professional introducers.

In Zone 2, modest in-house content efforts only have a limited effect.

While Zone 3 is where many committed content providers arrive over time. And, a select few, like Pete Matthew (PM), who dedicate their lives to it, achieve more than most.

The hard truth is that few small advice firms enjoy much reputational return on their investment in content marketing.

So, it makes enormous sense for firms in Zones 1, 2, or 3 to move to Zones 5 or 6 to boost their brand while spending less.

OR to boost their brand for significantly less cost with licensed content in Zone 4.

In Zone 4, you use high-quality licensed (white-labelled) content to boost your brand while cutting your content costs—by 90% to 95%!

In Zone 5, your content creator writes bespoke (derivative) Insights from their licensed and other libraries – if they have any.

And Zone 6 is where your content creator writes custom-made content for your firm from scratch. This option is not cheap but offers more impact at less cost than sitting in Zone 3.

Could I help you take your content to where it needs to be?

If you’d like to know more about me and my content creation credentials, read the ten points at the top of this page.

In recent years, I’ve helped some leading FS firms boost their brand and win enormous clients (like TESCO) to their services – by helping them create a world-leading (custom-made) educational programme.

As I’ve said, I don’t expect to undertake many more 100% custom-made contracts now because I can help firms get the same brand boost with Zone 4 or Zone 5 (derivative works) options. And those will be the best value for most FS firms of any size.

Still, it’s your budget, and you must decide where you want to be on that reputation map.

You must also decide who is best qualified, experienced (and equipped with re-writable content) to help you get there.

I’m happy to talk to help you explore your options for escaping those red zones on the map above.

For information, I’m also developing these two talks and workshops if you’d like these for your team.

I trust some of this is of interest.

I trust some of this is of interest.

Feel free to grab some time in my diary if you’d like to explore these ideas further.

Or give me a call on 07590 694079

Discuss this article