How could you take more control of your spending?

Hi there, Eugen/Alex here,

And, in this post/video, we’ll explore a powerful and proven idea for taking more control of your spending – when you need to – which we all do, at times.

Why does this matter?

A sound financial plan ensures we have enough money for our futures – whether that’s for specific life goals or for income in retirement.

And we risk failing to achieve that if we spend all our income today.

So, in simple terms, this wealth management part of your plan comes in 2 stages.

First, you must build it – then you can spend it.

And taking control of your spending is key to your financial success in both of these phases…

Especially if you might need significant sums of money in your middle years to invest in your children’s education or start a business, for example.

The full picture is more complicated

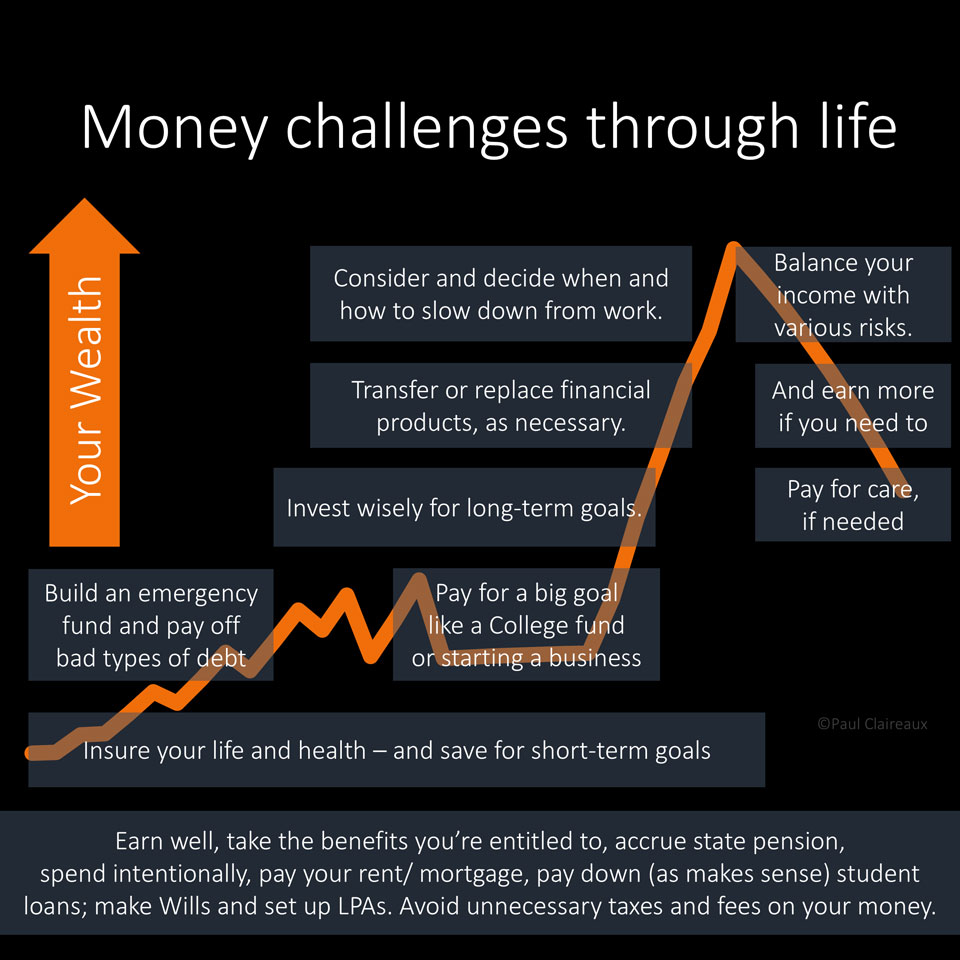

Of course, the reality of financial planning is more complicated, as we can see if we add all the Money Challenges you might face in life to that basic picture.

Of course, the reality of financial planning is more complicated, as we can see if we add all the Money Challenges you might face in life to that basic picture.

And that’s a lot to think about, even without adding unpredictable challenges – like a divorce or a serious problem at work.

Thankfully, you don’t have to deal with all of these challenges at once, and your central aims remain the same.

To build your wealth and insure your life (and your health) against disasters, where it makes sense to do so.

Worried about Wealth Taxes?

Of course, you may worry less about your spending and more about taxes on your wealth if you’ve already built more than enough to last you a lifetime.

In which case, it could make sense to spend more than you do now – or make lifetime gifts to people or causes you care about.

And those are just two of many ways (on which we can advise you) to reduce the impact of Inheritance Tax on your family.

For most of us, however, the key to a sound financial plan is to spend less than our income (from work, pensions, or investments) throughout our lives.

Controlling our spending is essential.

- In our younger years, it enables us to save for our future life goals.

- In our later years, it helps ensure our income lasts a lifetime.

There’s nothing new about spending control

We know there’s nothing new or clever about this idea.

We know there’s nothing new or clever about this idea.

Charles Dickens wrote about it in his 1850 story about David Copperfield, where, to paraphrase the advice from Wilkins McCawber, we’re told that:

Happiness comes from spending less than our income,

And Misery arrives when we don’t!

What’s NEW is the battle to control our minds

In 1929, a Public Relations Adviser, Eddy Bernays (a nephew of Sigmund Freud, the famous Psychoanalyst), changed the world of marketing forever.

Bernays is famous for the PR campaign that, to the delight of his Tobacco company client, persuaded women to start smoking cigarettes!

Very few women smoked before that time, but Bernays was able to change the mindset of millions by promoting cigarettes as ‘Torches of Freedom’.

And that was a compelling message for women, who’d only recently won the right to vote.

So that’s how psychology came to dominate the marketing world.

And sadly, billions are now spent each year to sell us products and services we don’t really need!

How (exactly) are we being played?

There are too many psychological marketing tactics to explain in one video.

There are too many psychological marketing tactics to explain in one video.

However, it’s worth noting that marketers now tap into a wide range of our behavioural biases – and flawed beliefs.

They also work hard to hook us into bad spending habits – especially with subscription services.

Their particular focus, however, is on exciting our emotions – because doing so tends to switch off our rational thinking mind!

(You can learn more about this in the books Chimp Paradox and Path through the Jungle by Psychiatry Professor Steve Peters – the mind coach to the multi-gold medal award-winning British Olympic Cycling team)

For now, we’ll simply note how marketers might emotionally motivate us.

Psychologist Steven Reiss suggests we have these 16 different motives…

And, as with most aspects of human behaviour, these motives vary in strength between us and according to what’s going on in our lives.

So, marketers adjust their messages to focus on specific motives, depending on who is being targeted with what particular product or service.

What else matters about motivation?

There are many theories of motivation, so we can only skim the surface here.

But we should mention the work of Psychologists Edward Deci and Richard Ryan, who found that, once our basic needs are met, we’re all motivated by the same three needs.

We want to feel a sense of:

- Relatedness

(connection and belonging) - Competence

(mastery and effectiveness), - And Autonomy.

(being in control of free to choose our actions)

So, when we add in our preference for having things now rather than later, you can see why we’re tempted to buy more things today rather than save for our rainy days.

What are the classic Motivational tricks?

Modern Marketers don’t tend to sell features.

Their messages focus on how we will feel – once we’ve bought their product.

And if you study the promotions for luxury products, from Perfums to Cars, you can see the emotional strings they’re trying to pull.

In short, they highlight the emotional pain of not buying their products and the emotional gains if we do.

So, they might suggest we’ll feel:

- Admired

- Attractive.

- Rich

- Powerful

Or that we’ll enjoy more freedom and good times with family or friends, once we’ve bought that holiday or that incredible new car!

Alternatively, they tell us we’re special.

That we’re worth it!

How can you fight back?

Knowing you’re being played with Psychological tricks is a great place to start.

And the good news is, we can use the same techniques of emotional selling on ourselves when we need to take back control of our spending.

Just ask what really matters.

The best way to plan your finances is to think about building enough wealth to pay for the things that really matter to you, as shown in this Money-Life Map.

These are just examples of financial life goals.

These are just examples of financial life goals.

And your map will be unique to you.

So, while you may have similar goals to others, like stopping (or slowing down at) work, each goal is unique to you.

You say when you want to reach it, how important it is and what you’re willing to spend on it.

And that, by the way, is why no blogger or YouTube #finfluencer can offer you a sound financial plan.

Your plan must be tailored to your particular circumstances and ambitions.

Which is why all good financial planners will ask you about these things – and work with you to design your unique plan.

They know that your best chance of financial success comes from asking:

What really matters in your life?

What do you want to be, have or do (for yourself or your loved ones) over the medium to long term?

And how much of what you buy each year is helping you achieve those goals?

Next Steps

We hope you found this video helpful.

And, if you did, please share it with your family and friends – because these Insights are designed to help everyone.

Also, if you feel you need help to take more control of your money – and achieve more of your longer-term life goals, feel free to call or e-mail us.

You’ll find the contact details below.

And thanks for watching.

Discuss this article