Six ways to rate a content creator (Part 3)

Do they expand your Insight library, and are their fees fair?

What we’ve covered and what’s coming up

In the first Insight, I outlined the first three tests, which suggest you demand content that’s Accurate, Balanced and Compelling.

In the second insight, I dived deep into why you need content with real depth!

And now we’ll explore the need for a broad range of content, and ask if the fees are fair.

I’ll also share some example Insights designed to help you with the unique marketing challenge you face as a Financial Planner or Adviser.

So, let’s crack on.

We’ve already asked about the ‘Depth’ of the content you receive from your supplier. So, this next question asks about the ‘Breadth’ of content you’ll need.

Of course, the next letter in our A to F checklist is ‘E’ – so I’ve gone with ‘Expansive’ instead of ‘Broad’ !

‘E’ asks: Can this supplier help you *expand* your conversations?

As a professional adviser, you need content to help you (or your team) have expansive (and fascinating) client conversations.

The problem is that content creators vary in the breadth and depth of their offerings.

Very few cover (or plan to cover) a wide range of topics, and some only plough a narrow content furrow.

Consider the increasingly popular topic of Money Psychology.

Is your content supplier capable of supplying genuinely sound content in this area?

What Insights do they offer now, and what more do they have planned?

Are you entirely sure that their posts on these complex and sensitive topics are grounded in psychological science?

Accuracy and Balance in these areas are essential, but sadly, misleading ideas (on matters of the mind) are still shared around the financial services sector.

We know this topic fascinates and engages people far more than pension planning and asset allocation pie charts.

We need to take more care with the facts and acknowledge that in many questions, there are no simple, black-and-white answers.

We humans are complicated – and each of us is unique, as outlined in this guide.

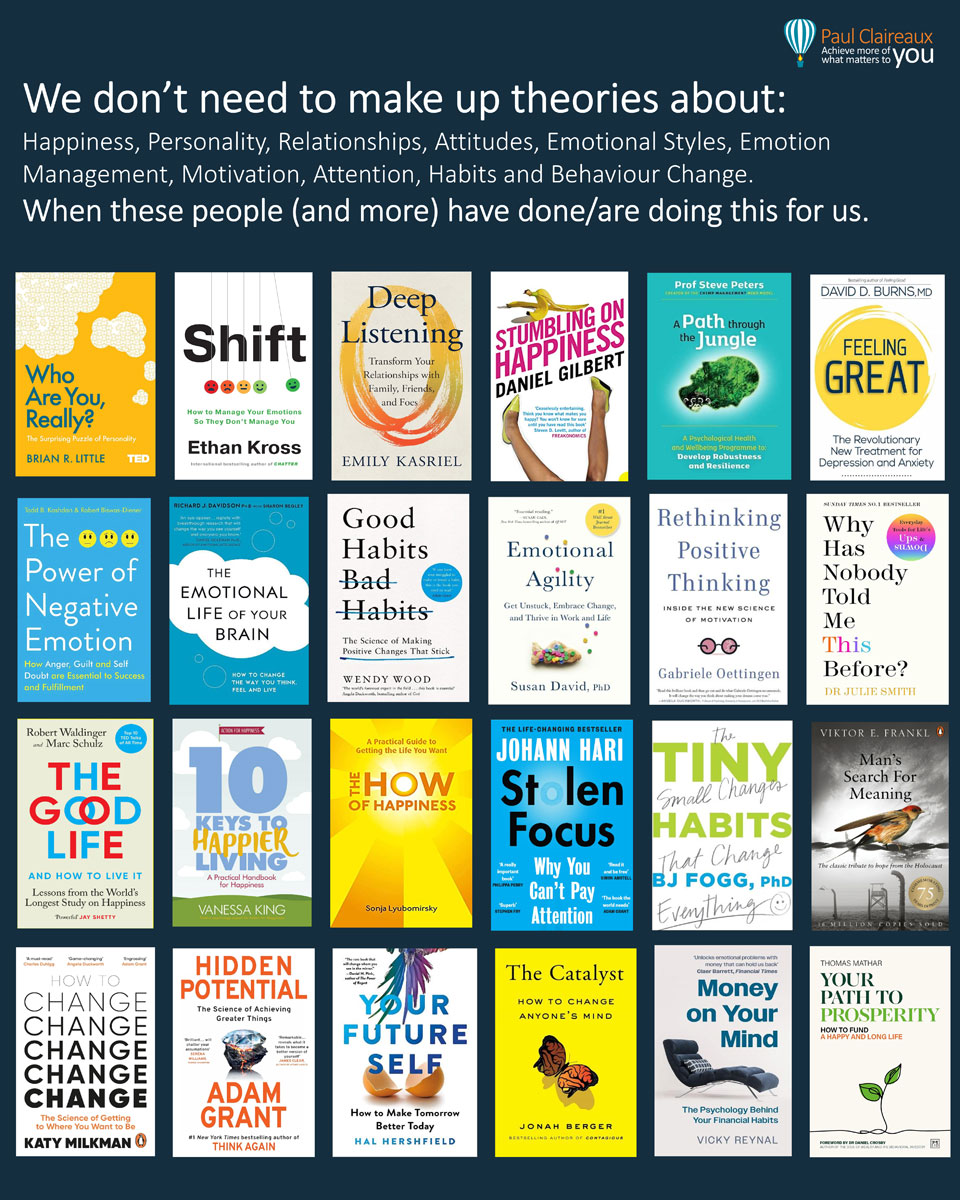

Therefore, I encourage you to collaborate with a content creator who follows the work of leading practitioners and researchers, such as these.

It turns out that many ideas from the macho motivational school of Psychology of the 1980s and 90s are just nonsense.

Who’d have guessed!

Anyway, if you’d like to share more Money Psychology Insights, let’s talk.

I’m happy to outline what I offer and my plans to expand this part of my licensable library.

What content categories will you cover?

Money Psychology is just one of fourteen categories I plan to cover with consumer-facing Insights over the coming months and years.

So, again, if you’d like to learn about (and influence) my broader content plans, let’s talk

I’m aware that some content suppliers tend to focus on the wonders of stock market investing, and I agree that everyone should understand these concepts.

That’s why I offer these lessons:

Number 2 covers Pound Cost Averaging and Ravaging – in plain English – by the way.

I’m told by leading financial planners that these two Insights cover all the basic concepts of investing that most (non-expert) people need.

I also offer a series of Insights to help people understand how to choose a suitable money box (we call them tax wrappers!) to hold their investment funds.

So, I’ve got you covered if you want to share foundational lessons with your audiences.

Do you need to offer multiple versions of these basic lessons?

I don’t think so – and that can be confusing.

I think it’s best to explain vital concepts once and well.

This way, you can point your clients (and prospects) back to the same foundational lesson each time you talk about another fascinating aspect of personal finance.

Strong foundations are essential for any educational library.

FYI: I’m happy to tailor my foundational lessons to your business needs, working together under a custom-made contract. This adds very little to the cost.

So, I’m building an ‘Expansive’ range of Insights for you, for two reasons:

First, to support you and your team in having engaging conversations with your clients, prospects and professional connections.

Second, to support you in offering fascinating consumer-centric training for your team.

We both know that financial planning encompasses much more than investing.

We just need more prospective clients to understand this.

Make sense?

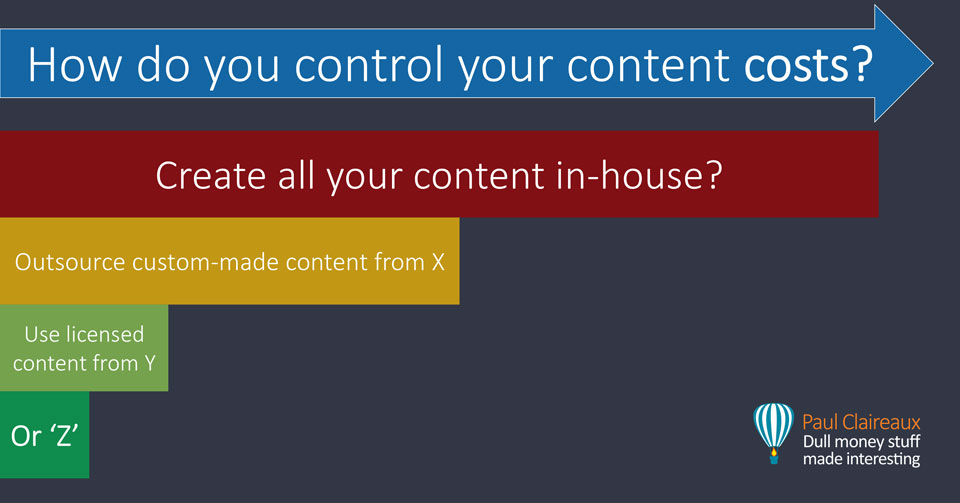

‘F’ asks: Do you pay ‘Fair Fees’ for your content?

Assuming their fees are fair for the works supplied, this is the last factor to consider when assessing a new or existing content creator/supplier.

Assuming their fees are fair for the works supplied, this is the last factor to consider when assessing a new or existing content creator/supplier.

And that’s fortunate, because ‘Fees’ are also the last item on our A to F checklist!

Fees do matter, of course, and it maddens me to find some businesses being crushed by various marketing fees.

So, I’ve set my fees to compete strongly with the very best content providers.

And here’s what they might look like if we worked on (or I supplied) a whole program of content.

For custom-made content (options 2 and 3 here), I charge around one-half (or less) of what an average financial adviser earns per hour, according to VouchedFor.

For custom-made content (options 2 and 3 here), I charge around one-half (or less) of what an average financial adviser earns per hour, according to VouchedFor.

For licensed content, I set my prices to save small firms more than 90% compared to the cost of creating content in-house.

My best value option (the ‘All Insights Pass’) is coming soon, and will cost just £80 per month* for early adopters.

This is a crazy low-priced launch offer, and the price will increase significantly for new subscribers at some future date.

So, if this interests you, e-mail me at hello@paulclaireaux.com with subject title ‘All Insights Pass’ for more details

Do you need more than one content creator?

With the super-affordability of my licensed content options, you can try out my consumer-facing Insights alongside those you create in-house or use from other suppliers.

Option ‘Z’ is is the NEW low-cost ‘All Insights Pass’ – the content rental option – that I’m about to launch.

Option ‘Z’ is is the NEW low-cost ‘All Insights Pass’ – the content rental option – that I’m about to launch.

You can then gauge the feedback you receive (from clients, prospects and professional connections) on these Insights and revise your content strategy from that.

I’m told by leaders across the Financial Sector that my Insights are highly engaging.

So, you may want to take advantage of this deeply discounted offer when it launches. It won’t be repeated.

The £80 per month payment equates to 24 minutes of fee-earning time for an average adviser. Or 5 minutes of work per month for each adviser in a firm employing five.

So, this is nothing compared to the cost of working dozens of hours to craft high-quality, engaging content in-house.

Does my content pass the A to F tests?

Well, that’s not for me to say 😉

Well, that’s not for me to say 😉

What do you think?

Have you read some of the consumer-facing Insights I’ve linked throughout this piece?

- Do they look Accurate?

- Do they look Balanced?

- Were they compelling?

- Do they pass the ‘Deep Dive’ test?

- Could my Insights help you (or your team) to have more ‘Expansive’ client conversations… on questions of Money Psychology and more?

Do my fee scales look fair?

And here’s one final question…

Do you believe our goals are aligned?

If you’re anything like me, then you’re keen to:

- Help more people make sound financial choices.

- Protect more people from scammers and other bad agents.

And regardless of your life mission, I imagine you want to:

- Build (or maintain) an excellent reputation for your firm.

- Be seen as a go-to place for trustworthy and helpful answers to vital money questions.

- Offer Insights that engage more of the adult children of your wealthy clients?

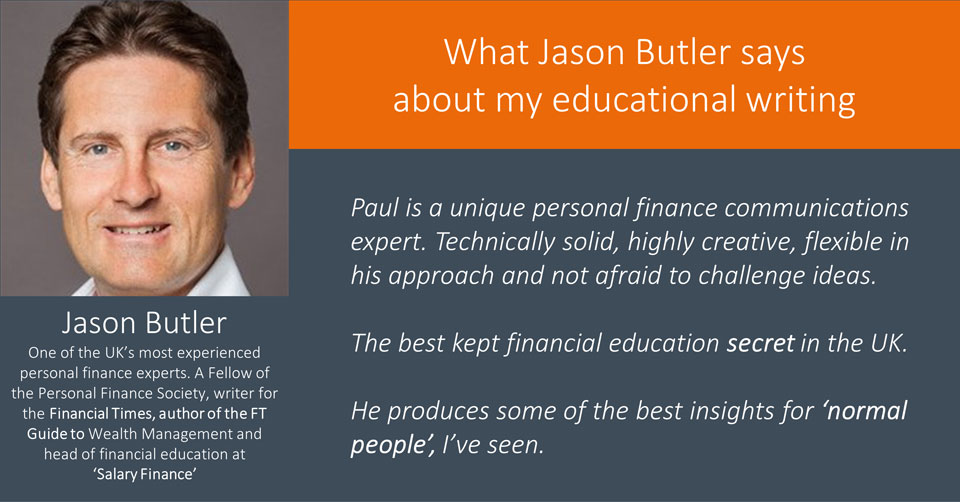

What do others think about my work?

I imagine this is also important to you?

I imagine this is also important to you?

So, be sure to read my client testimonials for the views of others on the quality of my ideas, written posts, colourful guides and video scripts.

Here’s how my clients describe their clients’ responses to my educational work.

Based on 11,000 responses, Money Alive (a leading Fintech) says that 97% of adviser clients valued the video series (on Equity Release) that I scripted.

The ‘C’ suite team at Salary Finance (a business with purpose, award-winning Fintech) described the education program I wrote for them as ‘Outstanding’.

They also said it helped them win TESCO and other FTSE 100 firms as clients for their services.

Yes, Salary Finance offer first-class services, but they said the educational program was, at times, the clincher in their negotiations to win these massive clients.

E-mail me at hello@paulclaireaux.com with ‘Sample Works’ as the title to see examples of the videos and guides I wrote for Salary Finance or other clients.

Finally, check out these Five Financial Wellness guides I wrote for Fidelity Adviser Solutions.

This series has been described as ‘brilliant’ by various Chartered Financial Planners.

Now, that’s quite enough about me.

Let’s get back to helping YOU!

Let’s face it, YOUR marketing challenge is unique

The issue you might face with some content writers is that they don’t fully understand you.

The issue you might face with some content writers is that they don’t fully understand you.

I’ve worked with advisers for (coughs) decades now. And, in addition to that ‘Broker Consultant’ role and several years in Product Development running large projects, I’ve worked as a Wealth Manager for a leading private bank, too.

So, I know your market is different from other professional services.

You and I know that some clients have a peculiar approach to investing.

We know some people avoid investment shops when the sales are on. And then rush into them when the prices are sky high!

We also know most consumers don’t have a clue about the valuable work you do.

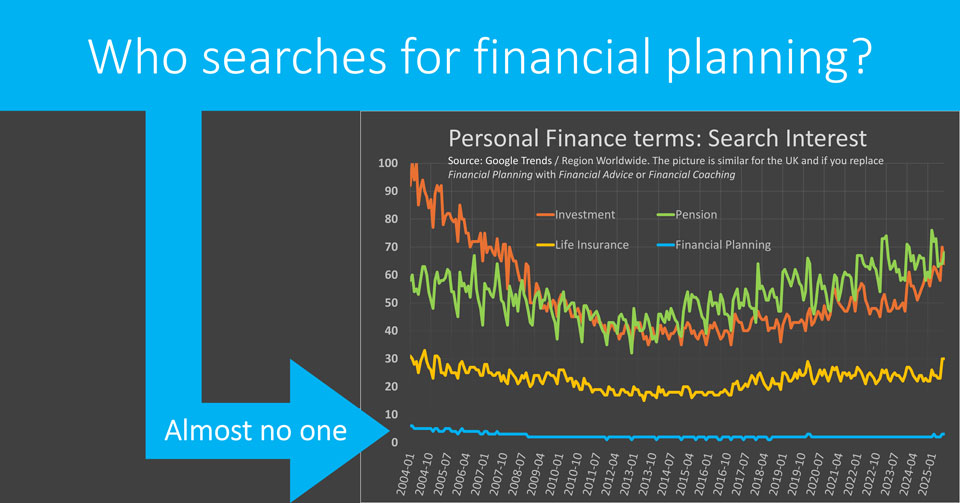

The evidence, as seen in Google Search Trends, is here again.

In short, this awareness gap is as bad, if not worse, than it was 20 years ago.

In short, this awareness gap is as bad, if not worse, than it was 20 years ago.

So, we clearly need to do some different things.

Does this matter?

I think it does because it undermines trust in your sector.

And despite well-intentioned talks by industry leaders at conferences, awareness and trust levels have stayed low for decades.

That’s why I focus on creating a different type of consumer-facing content – designed to help ordinary (non-expert) people see the value of your services.

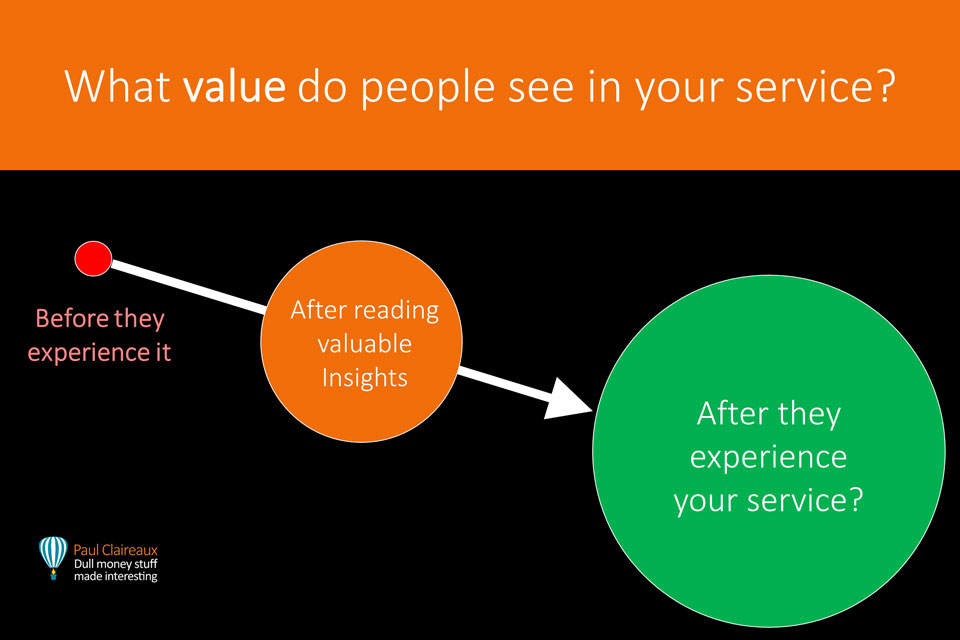

Do you need more stepping stones to your services?

Research (from LangCat and others) suggests that most advised clients recognise the value of financial planning after they’ve experienced the service.

Research (from LangCat and others) suggests that most advised clients recognise the value of financial planning after they’ve experienced the service.

The marketing challenge is to explain that value before any meetings take place.

The evidence shows that most potential clients are standing on that red dot.

They’re too far away from your services to understand what happens.

They cannot hear the valuable insights you share with clients, and have no idea about all the back-office work needed to implement a sound financial life plan.

And the result is disastrous – with far too many people realizing too late that their financial challenges could have been solved with sound advice.

Prospective clients need more engaging, educational stepping stones to see the value of advice.

I imagine you want more people to consider and confront their financial challenges. And we all know it’s vital to do so early.

It may be possible to solve some money problems later, but too often that’s too late!

Here are four examples of these stepping-stone financial Insights:

- How could you approach financial planning – in 7 awesome steps?

- How could you choose the right boxes for your money?

- How do you work out the right level of investment risk for each of your goals?

- Should you pay for advice – and, if so, what’s a fair price?

The fourth Insight in that list is perfectly aligned with advice from a leading marketing and sales expert.

The fourth Insight in that list is perfectly aligned with advice from a leading marketing and sales expert.

Have you heard of Marcus Sheridan?

Marcus is the author of ‘They Ask, You Answer,’ and he regularly urges business owners to focus on the first question people have when considering a new service.

What’s the first question on the minds of your potential clients?

Well, if they have been referred to you, it might be about how your firm compares to other advice services.

Otherwise, the first question in many people’s minds is this:

Do I need advice at all?

Or can I sort this all out by myself.

So, those four Insights are all designed to help people see the value of your sound advice.

Just be aware, they can only work their magic if you purchase the license to white label them – and then offer them from your website.

Do YOU need help with content?

I imagine your first question is similar to that on the minds of your potential clients.

I’m sure you know you need great content to build or maintain trust with consumers, but:

Do you really need any help with this?

Or should you create all your content yourself?

Well, we already explored your cost options in this bar chart.

You have five choices, and I could potentially help you with any of them, including the first, where I could act as a content writing coach.

You have five choices, and I could potentially help you with any of them, including the first, where I could act as a content writing coach.

And, if you’d like to explore these options, let’s talk

I’d love to help you design a great (potentially award-winning) educational program for your business.

You may need a mix of those options – and you might not need any help from me, which is fine.

You can still book a meeting, as I love helping people to plan their educational marketing.

I don’t do hard-sell, but I will encourage you to find suppliers that tick all these boxes.

Want to stay in touch?

You can sign up for my Educators Newsletter here, and I’ll send occasional updates on my services.

For earlier news and my daily thoughts, connect with me on LinkedIn here.

And message me on LinkedIn or email hello@paulclaireaux.com with any questions on my current or soon to launch NEW ‘All Insights Pass’

Thanks for dropping in.

Paul

Discuss this article