How much educational content is enough?

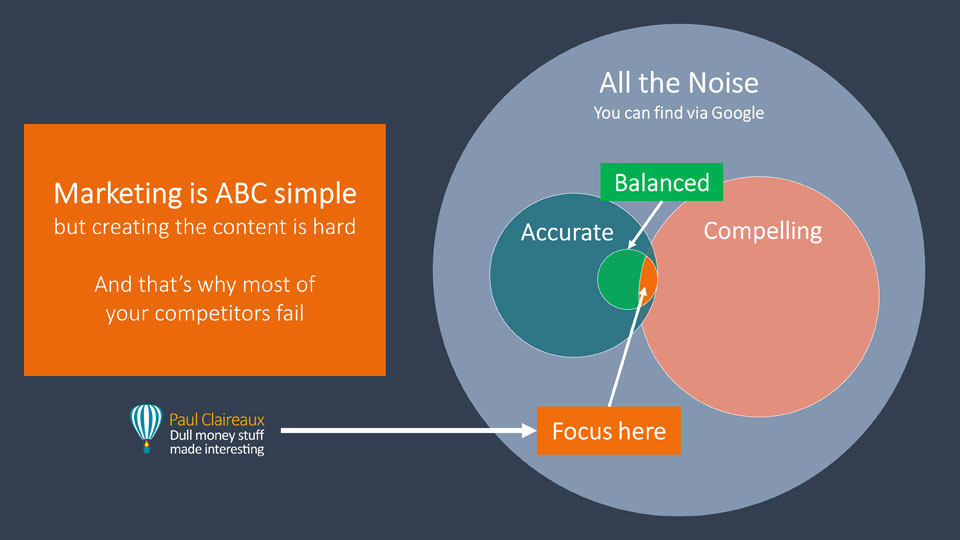

What's essential for success in content marketing?

This is the first of three posts for owners (and content marketing managers) of financial planning and advice firms.

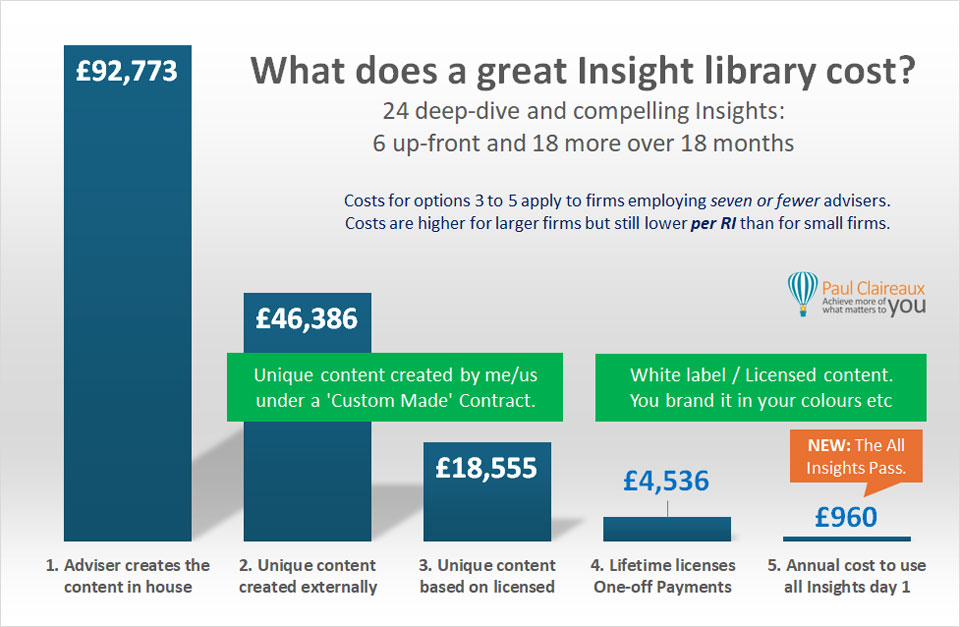

In this series, you’ll learn why a great consumer-facing educational library could cost £100,000 to £200,000 over time.

And I show you how to eliminate most of those costs and the immense work that these projects can demand of you.

This first post is about a 5-minute read and explores how much content you might need for a good (go-to) library of Insights.

Then, in the second and third posts, I’ll show why financial education content is so expensive and how to avoid most of that cost.

Why do you need a library of educational content?

Of course, the first question is this:

Of course, the first question is this:

Why bother offering educational content at all?

And the short answer is that this type of (inbound) marketing is proven to help firms attract, engage, and retain more clients.

As an extreme example, one of my clients (Salary Finance) advised me that they secured ‘TESCO’ and other FTSE 100 firms as clients for their services because they offered a high-value educational program that I helped them create.

Yes, their core proposition is superb, but it was the educational program that made the difference and clinched that deal.

So, I’m in no doubt that educational marketing can yield incredible results for most firms.

Indeed, it’s generally accepted that valuable (helpful) content is now the only marketing game in town. And based on conversations with my clients I’ve listed 25 benefits of this approach.

If you doubt the immense value of Education-First Marketing, you can read about those 25 benefits here.

In this series, I’ll focus on the potentially immense costs of building a great library, and how you can minimise those costs – while still sharing the very best Insights.

What could it cost to acquire a good library?

These numbers come as a shock to many financial advice/planning business owners.

They are, however, a fair estimate of your (create, buy, or rent) cost options to acquire a good-quality but modest-sized library of Insights.

Do good content libraries really cost c. £100,000?

Yes, that cost is real if you build a good library from scratch, on your own or with a qualified financial planner from your firm.

And I’ll explain the numbers below.

Of course, if you already offer half the library you need, you can halve the costs in that bar chart.

How much content might you need?

‘How much is enough?’ is the classic financial planning question – and it applies to your library of Insights, too.

How much content do you need to attract, engage and retain your audiences?

Or, to put that another way…

How much do you need to reach the tipping point – where your content marketing ball keeps rolling – without more effort from you?

Short answer?

Size isn’t everything – but it matters!

Now, I’ll come back to the size question in a second, but first let’s briefly talk about content quality.

After all, there are no cost-saving shortcuts available here. Only risks to your reputation if you get this wrong.

If your content is inaccurate or imbalanced/biased, you risk losing the valuable trust you’ve built with your existing clients.

If your content is inaccurate or imbalanced/biased, you risk losing the valuable trust you’ve built with your existing clients.

And you’ll struggle to build the trust you need with prospective clients and professional advisers, who wealthy clients retain.

For information: I have been that close family member helping my parents to find a great financial planner and reject the rest!

That’s what most professionals do.

Remember the John West Adverts?

You may be aware that there’s worrying evidence of a adviser-trust problem within wealthy families from Schroders UK and Cerulli in the US.

Their research shows that 60% to 80% of spouses and adult inheritors plan to sack the current adviser when the wealth holder dies.

Of course, there could be many factors driving this intention, and many of those inheriting clients might not be a good fit for the existing adviser’s services.

But clearly, those shocking numbers are not helped by a lack of engagement with the spouses and adult children of wealthy clients.

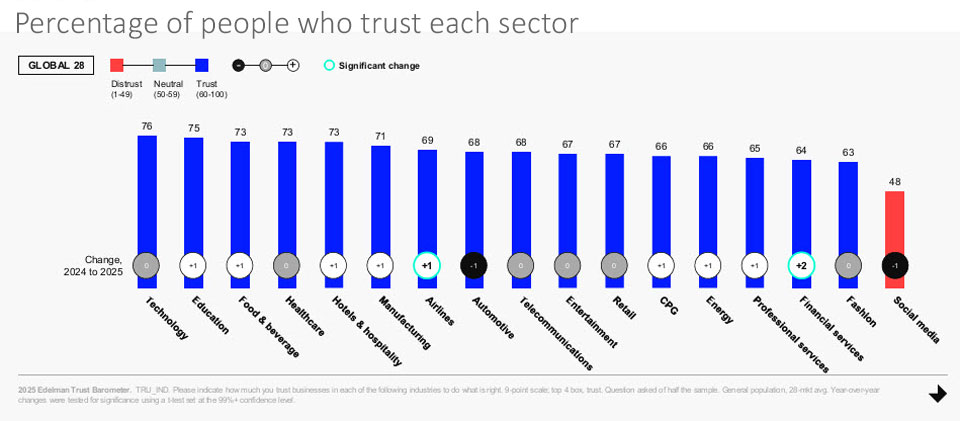

So, trust is the perennial challenge across Financial Services.

Indeed, this sector only recently got off the bottom of the Edelman trust league table, when they added two new categories:

Fashion and Social Media!

More recently, in the 2025 Advice Gap Report from LangCat, we learned the following.

When consumers were asked why they might not take regulated advice:

- 25% cited a ‘lack of trust in advisers’.

- 20% cited a ‘lack of trust in the process’.

And, sadly, both reasons are growing in importance.

So, this work is not optional, and we must get on top of this trust problem.

Of course, most (advice) firms can create or source accurate and balanced Insights.

You just need enough time for content creation or to review what your content suppliers send you because some don’t pay nearly enough attention to accuracy or balance!

For most advice/planning firms, however, the real challenge is less about content quality and more about being heard at all.

And to attract and engage people in Money Insights, you need two things:

- Highly compelling content.

- Plenty of ‘outreach’ messages to grab people’s attention.

If your Insights are not in plain English and Compelling, almost no one will read them.

Which means your enormous efforts (or costs) to ensure accuracy and balance may be wasted.

We have all the evidence we need about that.

However, you also need enough content to keep people coming back for more.

You can’t gain and maintain traction with a few ad hoc insights each year – which brings us back to this question:

How much educational (helpful) content is enough?

If you follow the business growth guru Daniel Priestley, you’ll know he talks about a (4-7-11) idea for content volume.

Daniel suggests that to become a ‘go-to’ place for answers, in most service businesses, you may need to:

- Maintain a regular presence in 4 different online locations.

- Offer 7 or more hours’ worth of high-quality Insights.

- Have 11 interactions with your ideal clients.

Seven hours’ worth of content!

Is he serious?

Yes, and while his seven-hour rule may vary between sectors and firms, the general idea is accepted by leading marketing and sales professionals.

Repeated multi-format sharing of great insights builds trust and authority – especially around high-consideration services like financial planning.

So, you need to share deep-dive and wide-ranging content—as evidenced here.

And you need a great deal of content to educate, inform, and entertain people for 7 hours.

At a modest, 200 words per minute, pace (of reading or listening), this equates to 84,000 words.

That’s enough for a good-sized non-fiction book!

Could you set aside a year of your time?

If so, you could start your content library by writing a book.

If so, you could start your content library by writing a book.

You could then draw all your shorter consumer-facing Insights from that.

Indeed, there’s no better way to establish yourself as a thought leader than by publishing a book that receives good reviews – and Dan Priestley often reminds us of this.

If you’d like to explore what’s involved in writing and publishing books, I’m happy to talk about that.

I’ve published two, and keep an eye on developments in this space too.

There’s one particularly powerful AI-based tool that can guide you on your book-writing and marketing journey.

But take note, this tool makes it clear that you must still do most of the writing.

Of course, book writing is not for everyone. And, even where it is, you might want to write on something other than personal finance!

Either way, I imagine you’ll want a proven way to create a library that offers 5 to 10 hours’ worth of educational content – and to have a good idea of the cost.

So, that’s what I’ll explore in the next post.

Discuss this article