Insights ready now and coming soon

This page is for financial planners, advisers and coaches.

Click here to find two lists of consumer-facing Insights designed for you to ‘white label’ and use in your business.

First is a (title-picture-based) list of Insights you can license from this site today.

Second, there is a bullet point list of the licensable insights that are coming soon.

In terms of accuracy and balance, a highly qualified and experienced financial planner checks all these Insights.

And the money mindset pieces are being checked by Felicity Baker, a Doctor of Psychology with 20 years of clinical experience.

So, you’ll have no worries about the accuracy and balance of these Insights.

What’s available?

You can jump to the lists of licensable Insights here or read on (10-minute read) as I explain:

- How I’ve written these Insights to help Financial Planners and Advisers to engage and retain more clients.

- Why educational content is essential for engaging clients in the modern world.

- The scale of this project – and the time and money savings available to you.

So, let’s get right into this.

Insights written to help you help others

These Insights are written to encourage your clients and potential clients to:

- Learn about the value of proper financial planning.

- Learn how to approach the significant money questions in their lives like:

- ‘How do you plan your money – for the long term?’

- ‘How do you choose the right boxes (or strategies) for your money?’

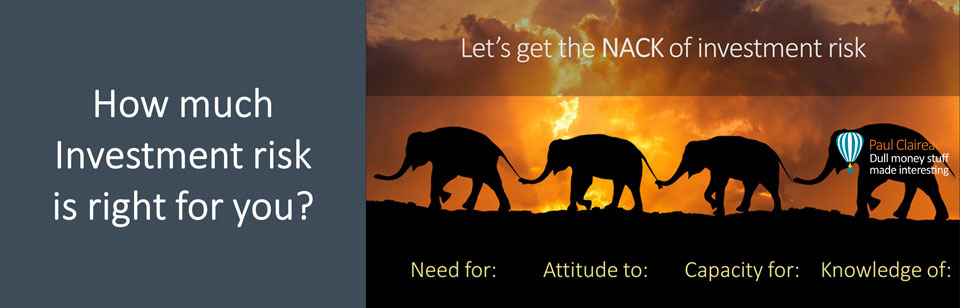

- ‘How do you choose the right level of investment risk in each of those boxes?’

- Share these ideas with others in their family – and their friends.

- Be more aware of the Psychological traps around managing their money.

Research into financial literacy and anxiety about money clearly shows that most of the adult population (in most countries) needs this help.

Research into financial literacy and anxiety about money clearly shows that most of the adult population (in most countries) needs this help.

So, these Insights teach people enough about financial planning and products to:

- Feel more control around money questions.

- Know when they might need help from a professional.

- Engage effectively in the awesome process of financial planning.

Why do our money skills matter?

The crazy thing about educational marketing is that we’ve known since the 1970s (from Psychologist Albert Bandura’s ideas on Self-Efficacy) that people engage more in activities where they feel they have some ability.

We don’t accept invitations to play competitive tennis if we’ve never held a tennis racquet!

And the same applies to personal finance.

We all have financial goals, but achieving those goals efficiently (without wasting a ton of money) is hard without a sound plan.

And if we don’t know how to plan – we’re unlikely to engage in the process.

Simples!

We’re more likely to avoid talking about money matters altogether – although there are many reasons we do that, as outlined here!

Bandura and other Psychologists found that when we don’t feel skilled enough, we focus more on our failings, lose confidence, and avoid those complex tasks.

On the other hand, as we become more capable, we:

- Develop more interest in those activities and commit more strongly to them.

- Recover quickly from setbacks, and re-frame our problems as tasks to be mastered.

To learn more about the drivers of behaviour change, look at this brilliant model from Social Scientist and author of ‘Tiny Habits’ Dr B.J. Fogg.

It shows how our capability is critical for our success because it reduces the need for that elusive power called ‘motivation’!

How’s YOUR motivation for marketing?

Do you need to engage more people in financial planning?

I guess the answer depends on whether you have all the work you want today – and how your pipeline looks.

And how concerned you are about the new lower-cost advice models coming down the track from the Advice Guidance Boundary Review.

There are opportunities there for planning firms – and I’m happy to discuss them with you.

The evidence is clear enough.

And it points to a decades-long failure in our sector to engage consumers in this most valuable service.

FYI: The blue line is also at the bottom of that chart if you change the search to ‘Financial Advice’ or Financial Coaching’ or restrict the data to one country like the UK or USA.

More worryingly, research (from Schroders UK and Cerulli US) shows between 40% and 70% of inheritors (adult children and spouses) to wealthy advised clients say they plan to change their adviser when the wealth holder dies!

So, we have enormous awareness and trust issues to solve here:

- Most people are not even aware that financial planning is a service!

- More than 90% of UK adults don’t receive regulated advice from a qualified financial planner.

- Around 60% of the families of advised people are unhappy with their parent’s / spouse’s adviser.

And, of course, high-quality, engaging educational content shows you’re helping with all of this without investing a ton of time doing in-person educational work.

However, if you enjoy giving educational talks, this (conversational) content is perfect for that, too.

What content gaps do you want to fill?

If you offer outstanding educational content, your clients (and their families and friends) will feel better informed and served.

So, more will return to YOU when they need financial planning help.

And more of those who don’t know you will have their eyes opened to the value of your services.

All of my licensable insights are designed to do that.

Here’s an example – on the classic consumer question of ‘Should you pay for advice – and what’s a fair price?’

I’ve been told by various Chartered financial planners that this Insight beautifully answers that question.

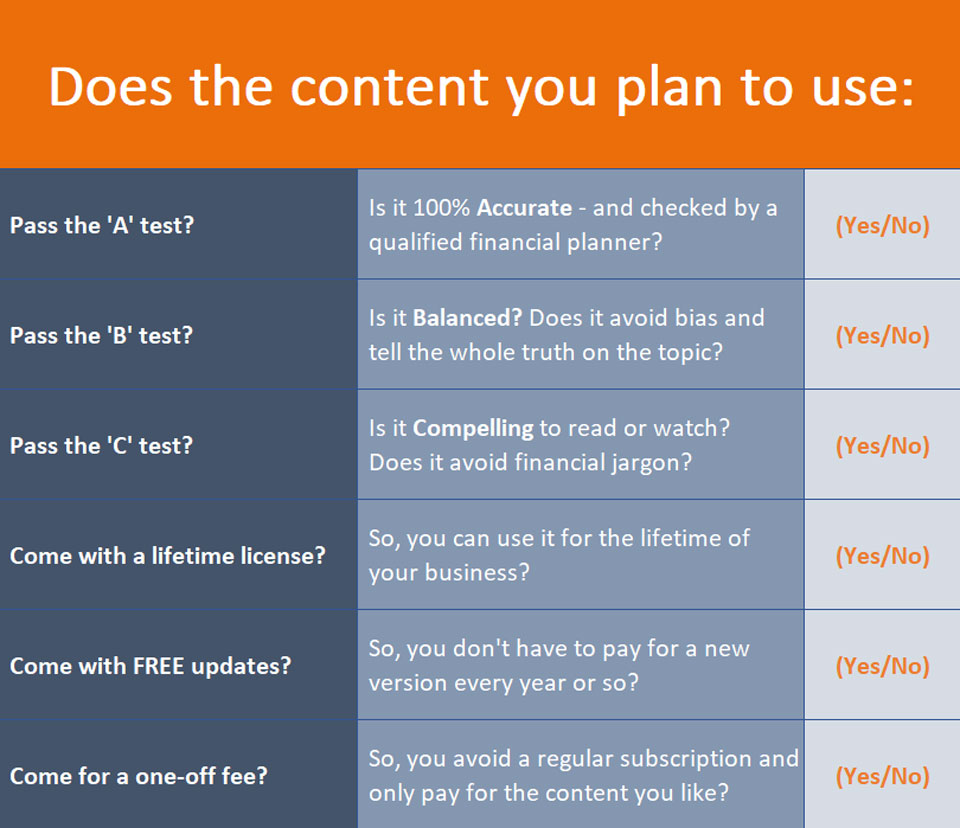

Is your writer or content supplier good enough for YOU?

Of course, if you plan to use (or continue using) a content service, you must decide if that service is good enough for your business.

So, you’ll want to apply the ABC quality tests – and check these other features, too.

In terms of quality – the ABC tests are a great place to start.

Here’s a question for you.

How much of the content issued by financial service firms (of any sort) do you (and your clients) believe passes all three of the ABC tests?

Most people I ask give a very low percentage answer to this question.

And the number is lowest from those who work – or have worked – in financial services!

Do we need to change this situation?

I’m sure we agree that we do.

Does your content deliver real benefits to your business?

Working with my clients over the years, I’ve collated a list of 25 benefits (to firms and their clients) of an education-first approach to marketing.

If you e-mail hello@paulclaireaux.com with a simple message, ‘Send me the 25 benefits’, I’ll send you a colourful pack with all of those 25 benefits.

My financial planner friends tell me this is the most helpful document I offer – because it makes the business case (for education first marketing) for them.

So, e-mail me if you’d like me to send you that list of benefits.

Of course, no one can enjoy the benefits of great content unless they offer it!

And I urge you to look out for those ghastly, glossy, but misleading sales aids supplied by some content firms (and fund managers!) that could damage your reputation.

So, please be choosy about your content partners.

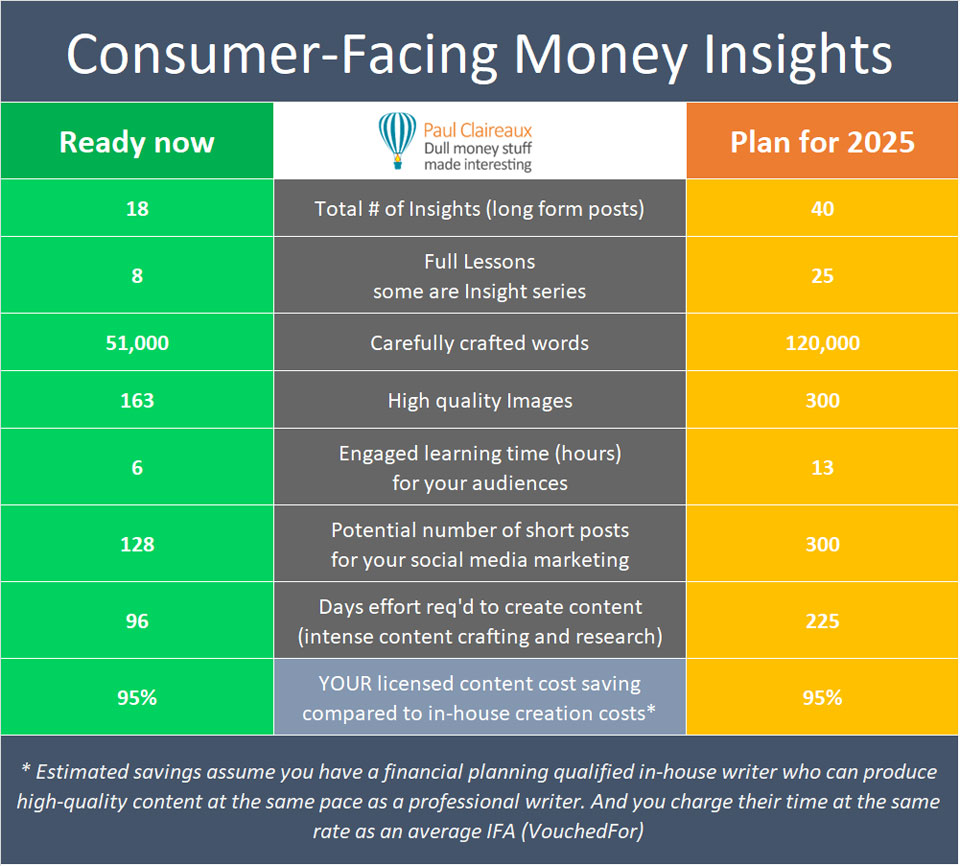

How much content can I offer you now?

This table answers this question and shows you my plans – in numbers.

Key points to note:

As most advice business owners discover at some point – creating (and maintaining) an extensive library of Accurate and Balanced insights is ruddy hard work.

And that’s just the start.

The immense challenge is to take those ideas and create content that people find compelling to read or watch.

Building a solid library of ABC content requires hundreds of days of effort – even for experienced and proven content creators.

And yes, you can now use AI tools to speed the process – but you must take care when you do so.

AI tools are useful for recording conversations, and meeting notes – and also for grammar checks.

However, the text generators hallucinate (spit out nonsense), and you cannot afford to share rubbish with clients.

So, if you plan to create all your content in-house, you’ll need someone qualified in financial planning and a good content creator to spend a year doing almost nothing but this!

This is the level of effort I’m putting into creating this library.

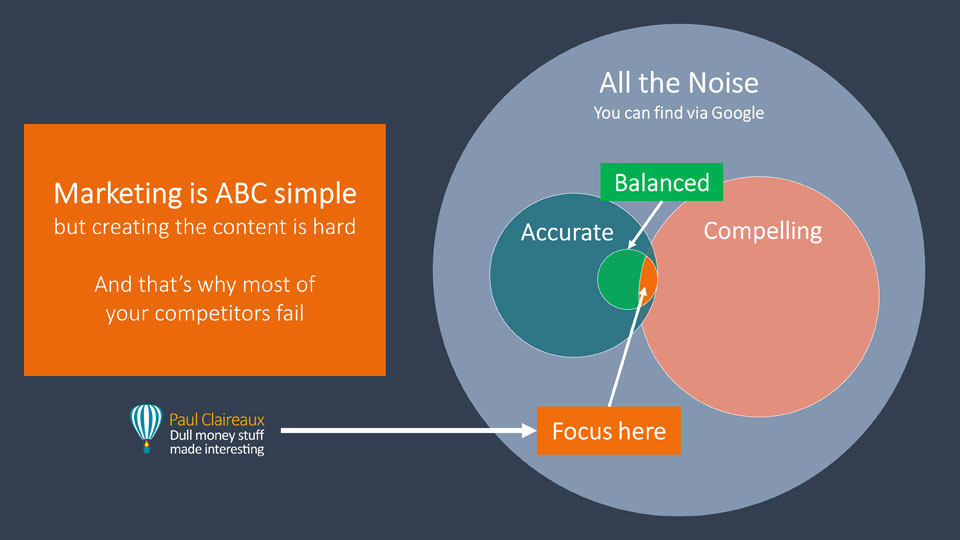

The truth is that most content fails to engage the target audience.

Barely anyone reads or watches it.

We are overwhelmed with content.

Most of it is dull nonsense, and that proportion is growing rapidly as AI robots now generate random-unchecked content 24/7.

What’s the answer?

I guess it’s obvious – we need to offer a high-quality (ABC) content library.

Only then can we (and our clients) enjoy all those 25 benefits – including enormous savings in marketing costs.

Creating a stream of outreach posts is easy with a good-quality Insight library.

And you need that stream of messages to share via social media, newsletters, or WhatsApp to attract people to your high-value ideas, right?

Of course, your short posts must be aligned to your longer-form Insights – and they will be if you take this approach.

This is where it gets exciting!

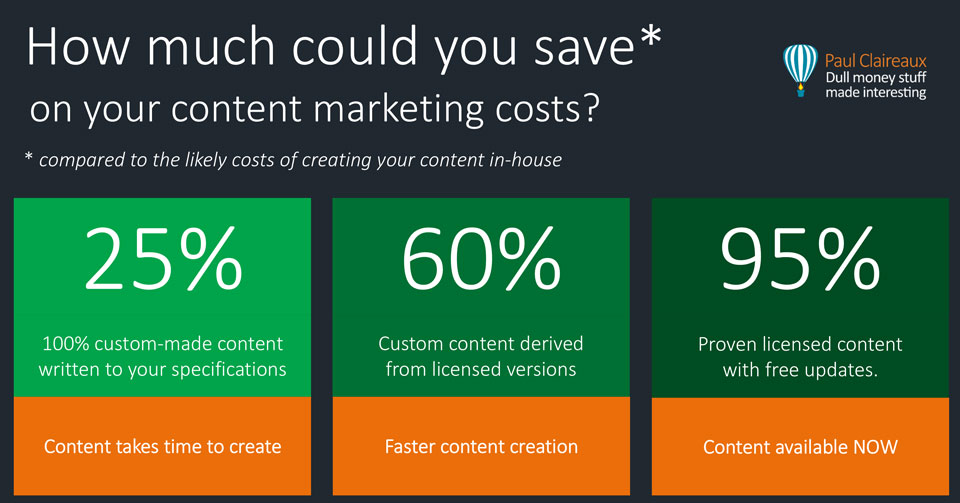

You can license my long-form Insights (for the life of your business) for about 95% less than it would cost you to create them in-house.

You’ll have no ongoing costs or hassle for content maintenance either – because the updates are provided for free!

So, this new service could equip you with a large slice of the (long and short-form) engagement content you need.

Here are the Insights you can white-label today

Click any image below to read that Insight – or series of Insights:

More Money Mindset Series – Coming Soon

More Money Mindset Series – Coming Soon

Most people I speak to are fascinated by the Psychology of managing and investing money.

So, I hope you’ll love the Insights I’m writing now, especially as they are being checked by a Doctor of Psychology – with 20 years of clinical experience.

The first title, ‘How many ways are you unique?’ is now available.

And here are the working titles and subtitles of further titles in this NEW Money Mindset series.

These will all become available during 2025:

- How do we form our attitudes to money – and how might we change them?

- What motivates us, and how important is willpower?

- How can we boost our happiness – and how could financial planning help?

- Why do most people worry about money – and what can we do to worry less?

- How could you achieve more of what you care most about?

- Why do we get stuck on our goals – and how can we get unstuck?

- What are behavioural biases – and how might they mess up our money decisions?

Next steps for boosting your Educational Insight library

If you’d like to learn more about my consumer-facing content, let’s talk.

Book a time here – that suits you.

You can ask me any questions about this licensed content service or my plans for the future.

I’m happy to talk about all that – and more!

I offer a custom-made content service for a few firms each year, and the estimated cost savings from my services are shown here.

Oh, and don’t miss the special launch offer.

If you feel that any of the Insights listed above could help you engage your existing and prospective clients (and their friends) in your services, you can purchase licenses to use that content right now – from my content shop.

I hope this is helpful – but please just call me if you have any questions 0n (M) 07590 694 079

Click here to be added to my educator’s newsletter.

Click here to be added to my educator’s newsletter.

That way, I can tell you when NEW Insights become available.

And thanks for dropping in.

Paul