What’s the right box for your money?

Could this Insight help your clients, potential clients – and their family and friends?

On this page, I answer six questions:

- What will your audiences learn from this series of Insights on ‘How to choose the right boxes for your money?’

- How will you decide if these Insights are right for your business?

- How evergreen (long-lasting) are these Insights?

- Where in the world can you use these Insights?

- What assets do you receive when you buy a license to use these Insights?

- What’s the cost of this content compared to the cost of creating it in-house?

If you’re new here, read this page first to decide, in general terms, if my content-to-go service could be right for you.

1. What will your audiences learn from this series?

Among other Insights, this ‘money-box’ series answers the following questions:

- Why are checklists essential in all complex environments?

- How complex is the landscape for money boxes and money strategies?

- Where does the task (of selecting money boxes) fit in the wider process of designing your financial life plan?

- How do your life goals affect the money boxes you need?

- What are the eight (FILTRATE) checks for choosing the right money box?

- Why is there no such thing as a perfect money box for everyone?

- How could the FILTRATE checklist save you (and your friends and family) from losing your life savings to scammers?

2. How might you decide if this ‘money-box’ series is right for your business?

Start by reading the series of insights, which starts here.

Rest assured that preparing the content for your business will only require minor edits.

You apply your preferred term (‘adviser’ or ‘planner’ or ‘coach’, etc.) and your own call to action to the content, and you’re ready to go.

If you want to make significant changes to this content, please contact me to explore that option before you purchase a license.

Minor changes that do not affect any core message should be fine, but please check with me first if you want to change some of the messages. And please be aware that a highly qualified Chartered Financial Planner has checked (and is happy with) this Insight.

Subject to my availability, we may be able to create derivative versions of this content if you feel you need those. Just be aware that such custom-made pieces will cost more than this ‘ready-to-use’ content, and we’d need to agree on how we work together to create them.

3. How evergreen (long-lasting) are these Insights?

Most of the messages in this series are ‘evergreen’ and will not be affected by changes in tax or interest rates, movements in markets or the winds of change in politics or economics.

In the few areas where updates may be required, I’ll amend the Insight and issue the new version free of charge to all license holders.

If you spot any out-of-date information, feel free to notify me, and I’ll update them ASAP.

4. Where in the world can you use these Insights?

This particular series of four insights has been written primarily for financial advisers, planners, and coaches who work with UK-resident clients.

However, the structure and most of the core messages in these Insights are applicable to savers and investors worldwide.

In any event, if you’re a non-UK-based adviser or coach, you may license the content and edit the financial product examples to those relevant in your country.

In the future, I hope to partner with a qualified and experienced US-based financial planner to create a US-ready set of these Insights. If that project interests you, don’t hesitate to e-mail me at hello@paulclaireaux.com

5. What assets do you receive when you purchase a license?

Once you purchase a license to use this content, you’ll receive an e-mail with a link to a folder containing:

- The series of four consumer-facing educational Insights comprising c. 10,000 carefully crafted words. That’s equivalent to 20% of a typical non-fiction book!

- 39 high-quality and website-optimised images to bring the Insights to life. Images are essential for boosting engagement and where you choose to present this content as a slide deck within or outside your business.

- A 1,800-word summary of the FILTRATE money box checklist – perfect as a reference for your clients and prospects and for keeping you in the front of their minds. You can also use this checklist as a lead magnet to build your Newsletter mailing list and for training with your team – if you have one.

If you prefer to offer shorter lessons, you could slice this series into more (say 6 to 8) Insights. And please let me know if you’d like help with that.

You need to ensure that each Insight has an ‘intro’ and ‘outro’ – when they’re part of a series.

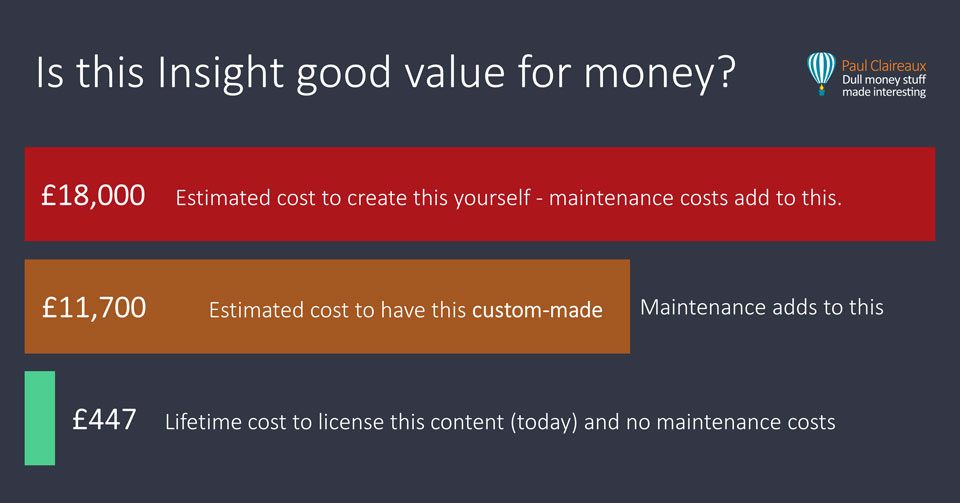

6. What’s the cost of this content versus creating it in-house?

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 60 and 120 hours of intense work to develop ideas like this, research the facts and create these four Insights with all the images and the summary guide.

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 60 and 120 hours of intense work to develop ideas like this, research the facts and create these four Insights with all the images and the summary guide.

Yes, it might take less (or more!) time, depending on how many drafts are needed before you’re happy with the result.

For your information, I typically create 7 to 10 drafts of my Insights before I’m happy with my work. So, content creators (like authors and songwriters) work at different paces.

The pace varies between songs Insights, too.

Assuming you charge that person’s time at the average adviser rate of £200 per hour (Source: Vouched For), this content set would cost you between £12,000 and £24,000 to create. So, I’ll assume a midpoint estimate of £18,000.

Double those estimates for a £400 hourly rate. Halve them for a rate of £100 per hour.

If you hired a professional writer to create this content, you might save a third of those costs if the writer can create high-quality content faster than your in-house adviser, and their fees are less than those of an adviser – which they generally will be.

My fee today for a lifetime license to use this content (with free updates) is 97% less than the mid-point estimate cost of creating your own content.

This launch offer price equates to around 2 hours of work for an average financial adviser – and is c. 50% off the normal price for this series of Insights.

This ‘giveaway’ offer is only available to a limited number of firms (worldwide) who license this content – and will be withdrawn without notice.

So, if you feel your clients (or their family and friends) would value this series, please grab this lifetime license now.

The price shown is for firms offering financial advice, planning, or coaching and employing less than eight client-facing staff.

If your firm is larger or you offer other financial services, please e-mail to request a price quote for this license at hello@paulclaireaux.com

Return to the store