About you and me

This page is for leaders of financial service firms (of all sizes) offering advice, planning, coaching, financial products, platforms and investment fund management.

This page will help you decide if we share a vision for the future of personal finance.

This is a ten to twenty-minute read – depending on your speed.

Who is Paul Claireaux?

In addition to this page, you may wish to explore my About Me page to see if I’m the right person to help you develop consumer-facing Insights for your business.

There you’ll find:

- Testimonials for my educational works: books, guides, and video explainers.

- The story of my accidental start in financial services.

- How I acquired a passion for financial planning – that still drives me today.

- Some brief notes on my personal life and interests.

You may not have heard of me, but my educational content now reaches around 5 million people across the UK via my blue-chip financial service firm clients.

Does education-first marketing work?

I must answer this question before exploring if we have the same vision.

Of course, it’s extremely effective to put education at the heart of your marketing.

That’s proven in most business sectors these days – and the leaders in financial services have now caught on to this trend.

My first corporate client told me that the video Insights and guides I created with them were the ‘clincher’ for landing TESCO and other FTSE firms as clients for their services.

Two of my clients were finalists for the prestigious Workplace Savings and Benefits ‘Financial Education Provider’ award.

Two others (a Service provider and a Fund Manager) tell me their chartered financial planner clients ‘love the Content’ I’ve created for them.

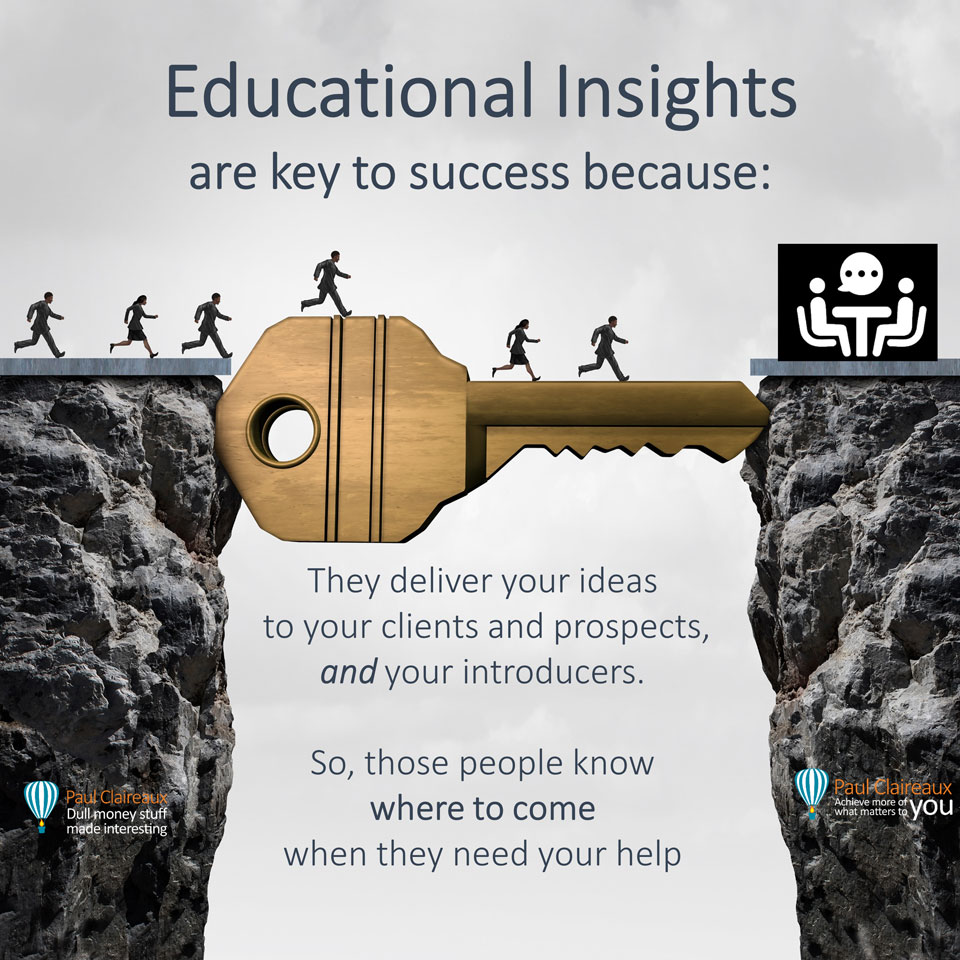

There are three core benefits to offering great educational content.

The testimonials on my ‘About Me’ page and home page confirm this

In fact, I’ve counted 25 benefits of an education-first approach to marketing for financial advice/planning firms.

For a colourful slide deck on these benefits, e-mail me at hello@paulclaireaux.com with the message, ‘Send me the 25 benefits’

Do we share a vision for consumers?

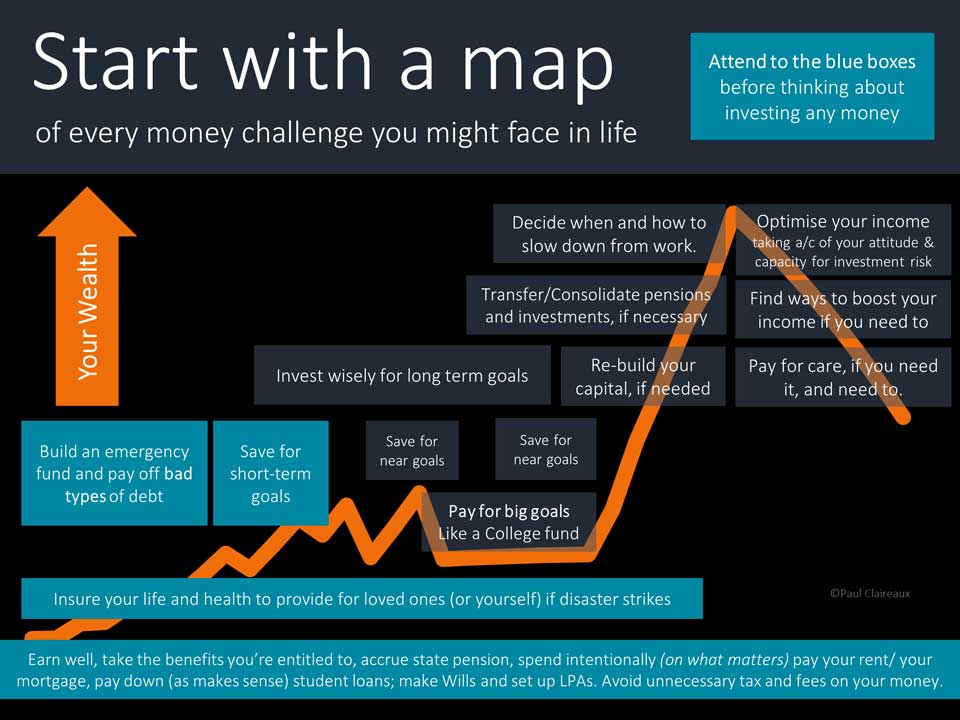

Do you, like me, want to see a world in which most people understand and know how to approach their priority money challenges – shown here?

A world in which non-experts know how to deal with the big external (and behavioural) tripwires around money?

And know how to find sound financial guidance or advice to answer the hard questions about money, develop a detailed plan, and find great-value financial products and investment funds.

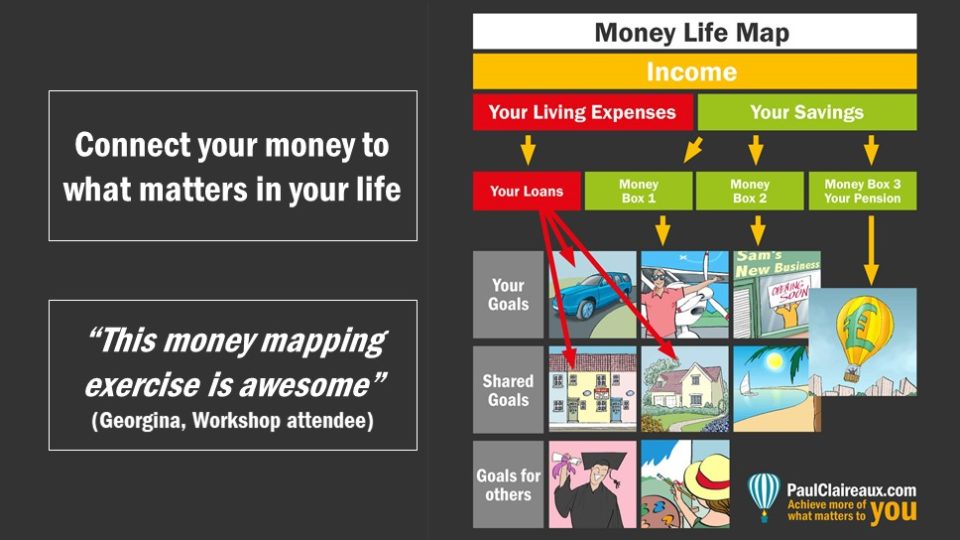

A world in which most adults know how to start mapping out a (rough) plan for their future financial life goals – like this.

I have taught this mapping exercise in person at a workshop to professional managers – and they loved it.

I have taught this mapping exercise in person at a workshop to professional managers – and they loved it.

I also touch on this process in a series which explains the SECRET of financial planning which is licensable from my content shop.

At the heart of my educational work is a lesson on how to plan your money (on a single sheet of paper), like the image above, which connects our money to what really matters in our lives.

Every good financial planner knows this is the best way to start a financial plan.

It can be a challenging question, but is vital to consider:

What do we want to have, do and become (for ourselves and our loved ones) in the future?

And how can we use our money effectively to achieve more of the goals that have a financial cost attached?

This is not rocket science, but it is the most engaging part of the financial planning process, right?

Do we share this vision?

I’m building great working relationships with business leaders who share this vision—of a world in which consumers:

- Are equipped to make better financial decisions.

- Know when to seek financial coaching, planning or advice.

If we’re on the same page, I’d love to hear from you.

So, please connect on Linkedin or drop me a line to hello@paulclaireaux.com

Either way, I’d guess we agree on three things:

First, most people (including experts) can benefit enormously from expert advice or guidance on one or more of these financial challenges at various points in their lives.

Second, to make the vision a reality, we must stop talking and start doing things differently.

Third, we have a mountain to climb to realise this vision, given that so little basic financial (and no long-term planning) education is offered in schools and universities today and because what’s provided is not consistent across the country.

This is probably why almost no one is aware of Financial Planning – the most valuable financial service available.

The evidence is here – and note the problem is worldwide.

So, it’s bad enough that schools and colleges don’t teach this stuff – but how much worse is the situation for adults?

Yes, there are some useful information sources, like Money Helper and charities advising on debt and state benefits.

Then there’s the government’s free Pension Wise service, where you can make an appointment for up to an hour to obtain general information on your pension questions.

However, even where the consumer is aware of the Pension Wise service, for example (and not enough are), they’ll not obtain any recommendations on how to use their pension pot or invest their other money. One hour is not enough time to develop a financial life plan.

So, people spend a lot more time being exposed to ideas about investing online – and that’s like the Wild West—stuffed full of grossly misleading, get-rich-quick promotions.

Yes, it’s the regulator’s job to resolve this, but do any of us expect the Consumer Duty (or the new guidance on financial promotions from Social Media influencers) to stop all the misleading noise out there?

After all, we’ve had rules that say promotions must be ‘fair and not misleading’ for decades, but that’s not stopped unregulated (and even some regulated) firms from promoting investment and other ‘gambling’ activities with grossly misleading claims.

I’m happy to discuss live examples of misleading promotions. In my view, the FCA should hang its head in shame on this.

They’ve been told about the grossly misleading promotions often enough. But they seem to do little to stop the misleaders, which makes life hard for those offering sound financial advice.

What do consumers need – and value – most?

We can’t wait for the financial regulator (the FCA in the UK) to police its rules.

In any event, they can never:

- Protect everyone from being misled about money by scammers and other bad agents

- Protect us from misleading ourselves – from our behavioural biases and ignorance of basic financial concepts.

How many consumers realise this?

We must equip consumers with powerful educational content to inspire them to make better money choices, and protect themselves from these characters.

The technology we use to communicate has changed a lot in recent years, but one thing remains the same.

Consumers value money Insights more than anything else they get from financial service firms.

And this might be why Martin Lewis has had such enormous success.

As a sector, our first challenge is to demystify essential money concepts.

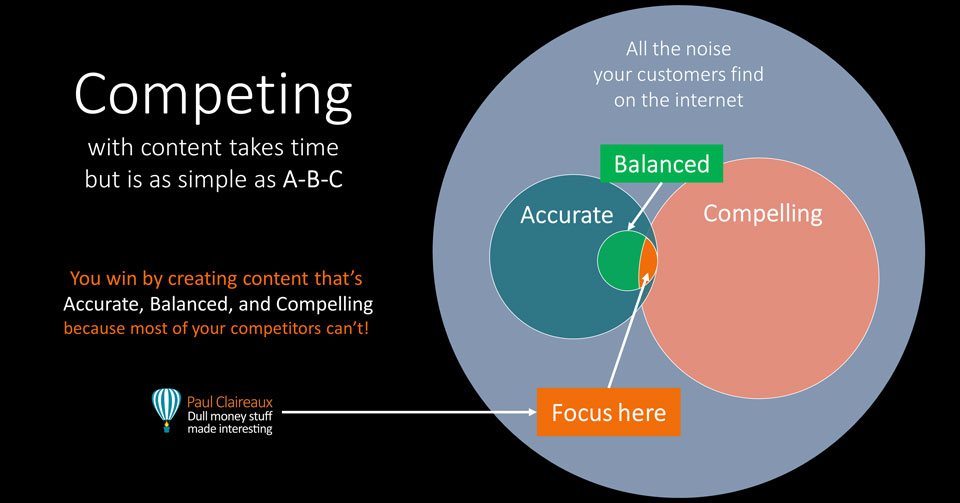

People are bombarded (24/7) with inaccurate, imbalanced or boring content – and much of it fails all three of these ABC tests.

Of course, it’s hard work to create content that passes those tests.

However that’s okay if it results in you standing out in this dull financial world.

And I can help you with that – it’s what I do.

What is our responsibility?

Our responsibility – as financial educators is simple.

We must tell the truth, the whole truth, and nothing but the truth.

Ask your clients or family and friends how much of the content from financial service firms they trust to do that.

I’ve asked that question to many people, including many who work in the Financial Services sector. And their percentage estimate is particularly low!

I’ve asked that question to many people, including many who work in the Financial Services sector. And their percentage estimate is particularly low!

The only questions are:

- Do we have the right skills to create compelling content?

- Do we want to change this situation?

We certainly must if we’re to build more trust.

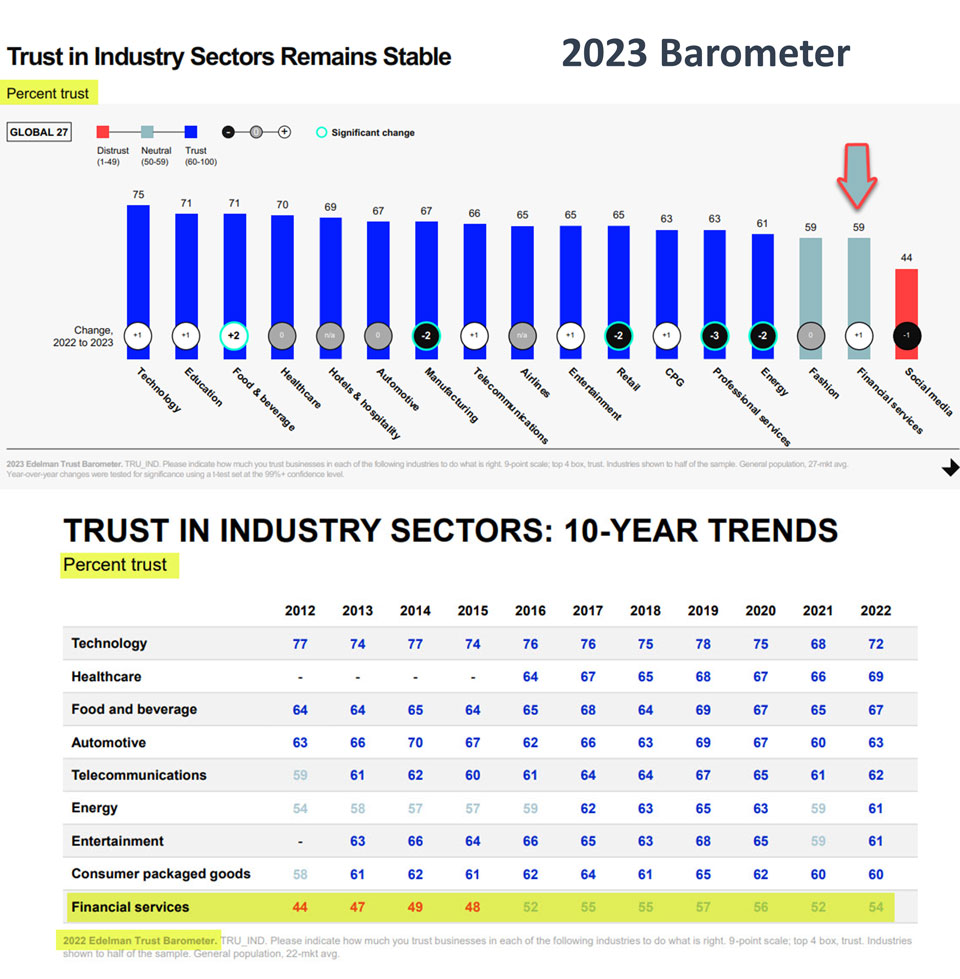

The trust problem evidence.

We’ve known this for years: a great many people (worldwide) don’t trust financial service firms of any kind.

The sector (as a whole) has been at the bottom of the Edelman Trust Barometer forever!

So, if we get our education and engagement programmes right – and change people’s perception, the only way is up on that table.

So, if we get our education and engagement programmes right – and change people’s perception, the only way is up on that table.

Volume up!

Great quality educational content doesn’t just boost your business reputation and generate more enquiries.

It’s also about building trust in our sector which is essential for recruiting the future’s young financial planners.

And we need a lot more of those people, don’t we?

The good news from the 2023 Langcat advice gap report is that:

- Three million more people would seek financial advice if they could find someone they trusted.

- Nearly 90% of people who take financial advice feel it’s good value for money.

The problem is that there are not enough advisers in the UK to help a fraction of the three million who say they could use some advice.

Can you help more people without more time?

Yes, if you offer high-quality money Insights on your website, you’ll immediately help more people than those who become clients.

What’s more, this group will include the adult children of your clients.

Research from Schroders and Adviser Home shows that 65% of Inheritors plan to sack their parents’ advisers when their parents die!

And we can reasonably expect many of those adult children to influence their parents to change advisers earlier than that!

So, there are sound (client retention) reasons for an education-first approach to marketing.

Nowadays, consumers don’t wait around to get better service.

Most savvy people know they have the power (volume up!) to assess the value of a service without the service supplier’s knowledge – just as you’re doing now in reading this page.

Our educational Insights enable us to build and maintain trust in these invisible relationships without any effort at all!

What do we know about what builds trust?

The evidence* is clear.

It’s warmth and competence that matter most for building trust.

And our ‘warmth’ (how much we care) is the primary factor.

I’ve developed this new equation for a ‘Building Trust in Business’ workshop. If you’re interested in that, ask for details.

* The equation draws on research into Social Perceptions in: ‘Universal Dimensions of Social Cognition’ by Cuddy, Fiske and Glick.

Mind you, Teddy Roosevelt understood this concept long before the Psychologists proved it.

So, we must demonstrate our warmth and competence to our website visitors – to encourage them to come back and request our help.

So, we must demonstrate our warmth and competence to our website visitors – to encourage them to come back and request our help.

If you like this idea, where do you start?

Could you offer people more (high-value) money insights?

Doing that alone would mean you helping a lot more people, like our friend here, to transform their relationship with money.

There are, of course, hundreds of money Insights you could offer under this broad list of categories.

- Money Mindsets

- Financial Planning

- Borrowing & Credit Scores

- State Pensions & Benefits

- Intentional Spending (or budgeting)

- Life & Health Insurance

- Emergency Funds

- Home Buying & Mortgages

- Investing

- Building a Pension Pot

- Taking Income from Pensions

- Later Life Planning

I typically give my clients that list when we start work to help them consider the scope of their educational programme. You must decide how to describe these categories and which you want to cover in your programme.

For now, to show the work required to develop a broad program, let’s explore just one of those twelve categories.

I’ll take Money Mindsets as an example.

Do you think we could engage your potential (and existing) clients in the value of financial planning with Insights into:

- How our ability to manage our money affects (and is affected by) our personality, outlook, resilience, attention, work performance, relationships, motivations, life satisfaction (general happiness), habits, emotionality and several hundred behavioural biases.

- How our life story and experiences forge our money scripts (what we tell ourselves about money), and how we might undo any unhelpful beliefs.

- How worries about money affect people all the way up the income and wealth scales. And how the financial planning process helps to reduce those worries.

- The NEW Psychological research on how embracing the obstacles to our life challenges improves our chances of success.

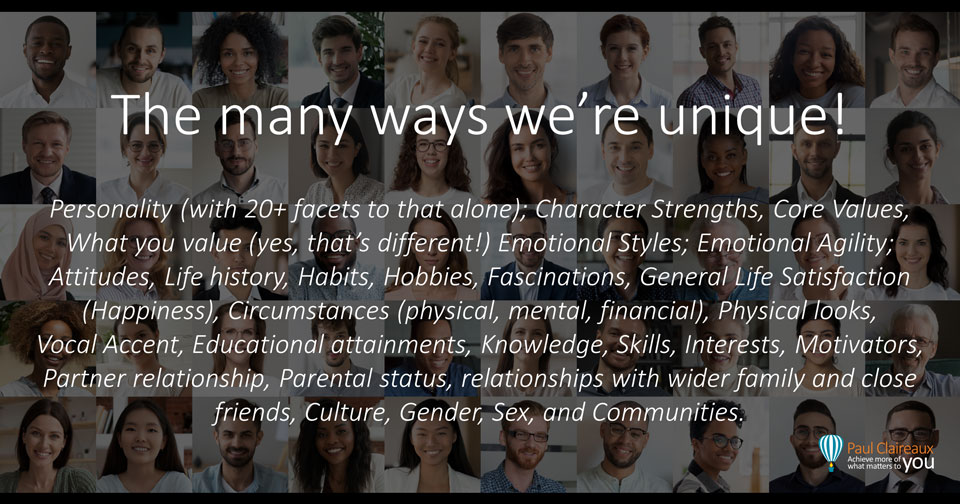

- How each of us is unique (in at least 30 ways, see below) and why this makes the personal nature of financial planning so valuable.

Of course, there are many more Insights we could add under the Mindsets category alone.

Of course, there are many more Insights we could add under the Mindsets category alone.

For example, you might want to cover ten or twenty (of the 200 or so) behavioural biases related to spending control and financial planning.

So, there’s an almost limitless list of potential Insights we could offer around money.

Most importantly, from your point of view, every Insight can be linked back to a need for your valuable financial planning, advice, or coaching services.

Developing your own (or using some of those) content categories is, therefore, one of the first tasks for building a market-leading (potentially award-winning) financial education library.

And I’m ready to help you do that.

Just book some time in my diary here.

Examples of market-leading engagement content

You choose where to start creating an educational library.

From my recent experience, I’d say Insights into money mindset questions are a great place to start.

After all, many people don’t even want to talk about money, and they’ll not seek advice, planning, or coaching unless that changes.

This is why some of the early content I’m offering is to get people thinking about why we don’t talk about money!

I’ve also written a series of guides on the human side of money – for Fidelity Advisor Solutions.

These guides have been extremely well-received by Financial Planners across the UK, and if you’d like those guides rewritten or to have Insights on similar topics to post on your website – with your branding and unique calls to action – we can discuss creating those for you.

(You can’t white-label the Fidelity Guides, by the way)

How could I help you?

I help financial service firms become go-to places for trustworthy and fascinating ideas about money in a variety of ways – as listed here:

- I review and refine target audiences.

- I develop or refine the business proposition.

- I develop a briefing document for an educational program – that any content creator could use.

- I develop a business (or educational programme) proposition name and strapline.

- I develop content ideas (and a logical sequence) for their educational programme.

- I draft and refine specific Insight/lesson outlines. (I have more than sixty of these, which we could re-work)

- I develop high-impact Insight titles and imagery (vital for engagement)

- I write the full (presenter-ready) Insights/lessons for live or recorded presentations.

- I assess the options for video formats. (Video can be extremely expensive, but it does not need to be)

- I can source a capable (and good value) animator if required.

- I storyboard creative ideas and scripts for animated videos.

- I oversee the production and editing of videos.

- I develop ‘outreach’ (Social Media / Newsletter) message/image sets

- I can review, restructure and sharpen the messages on your existing content.

All my new educational Insights point consumers to professionals for help where it makes sense to take guidance or advice.

And I now have two content creation services for professional firms:

- My Content-to-go service offers high-quality (lifetime) licensed educational content – for around 90% less than it costs firms to create their own.

- My Custom-made service is for those firms who want help creating unique educational content.

You can view the licensed content currently available in the Content Store here.

I plan to add a lot of new content to that store over the coming weeks and months.

So, sign up for my Educators Newsletter to be the first to see the new content.

You can also request examples of videos and written guides I’ve created by emailing me at hello@paulclaireaux.com

Or, if you’d prefer to explore your ideas in conversation, book a meeting directly into my diary here.

Thanks for dropping in and for your interest in my work.

And please remember…

You can also follow me on ‘X’ (Twitter) or Linkedin from the links below.

You can also follow me on ‘X’ (Twitter) or Linkedin from the links below.