Should you pay for financial advice?

Could this Insight help your clients, potential clients – and their family and friends?

On this page, I answer six questions:

- What will your audiences learn from this Insight on ‘Should you pay for financial advice?’

- How will you decide if this Insight is right for your business?

- How evergreen (long-lasting) is this Insight?

- Where in the world can you use this Insight?

- What assets do you receive when you buy a license to use this Insight?

- What’s the cost of this content compared to the cost of creating it in-house?

If you’re new here, read this summary first to decide, in general terms, if my content-to-go service could be right for you.

And be sure to sign up for my educator’s newsletter to be the first to hear about new content and updates to existing content.

1. What will your audiences learn?

This particular Insight highlights the value of good (human) financial advice, planning, or coaching while pointing to the benefits and risks of Robo Advice and DIY approaches to personal money management.

The insight points to the risks of avoiding (or receiving bad) advice and how that could mean people:

- Pay fees for essential money guidance when there’s no need to pay anything.

- Lose thousands of pounds on bad investments or scams.

- Pay thousands (or tens of thousands) in excessive fees for wealth management over time.

None of us wants anyone to fall into those traps.

In particular, this Insight looks at:

- The main free money guidance services available.

- The potential benefits and risks of using a Robo Advice service.

- The pros and cons of a Financial Life Coaching service.

- The significant benefits of taking regulated financial advice.

- The range (in shapes and levels) of advice fees.

- The need to keep an eye on costs, with examples of the long term cost of being overcharged by an (apparently) small amount.

- A reminder of the value of sound financial advice – and why advisers tend to take advice from others also.

2. How might you decide if this Insight is right for your business?

Start by reading the Insight, which starts here.

Rest assured that preparing the content for your business will only require minor edits.

You apply your preferred term (‘adviser’ or ‘planner’ or ‘coach’, etc.) and your own call to action to the content, and you’re ready to go.

If you want to make significant changes to this content, please contact me to explore that option before you purchase a license.

Minor changes that do not affect any core message should be fine, but please check with me first if you want to change some of the messages. And please be aware that a highly qualified Chartered Financial Planner has checked (and is happy with) this Insight.

Subject to my availability, we may be able to create derivative versions of this content if you feel you need those. Just be aware that such custom-made pieces will cost more than this ‘ready-to-use’ content, and we’d need to agree on how we work together to create them.

4. How evergreen (long-lasting) are these Insights?

Most of the messages in this Insight are ‘evergreen’ and will not be affected by changes in tax or interest rates, movements in markets or the winds of change in politics or economics.

In the few areas where updates may be required (as new Robo and Hybrid advice services are launched, for example), I’ll make those amends and issue the new version free of charge to all license holders.

If you spot any out-of-date information, feel free to notify me, and I’ll update them ASAP.

5. Where in the world can you use these Insights?

Most of the core messages in this Insight apply to savers and investors worldwide, although some messages and links to free support services, for example, only apply to UK residents.

In any event, if you’re a non-UK-based adviser or coach, you may license the content and edit the messages as necessary for your market.

In the future, I hope to partner with a qualified and experienced US-based financial planner to create a US-ready set of these Insights. If that project interests you, please e-mail me at hello@paulclaireaux.com

6. What assets do you receive when you purchase a license?

Once you purchase a license to use this content, you’ll receive an e-mail with a link to a folder containing:

- The consumer-facing educational Insight – with about 3,400 carefully crafted words (equivalent to around 7% of a typical non-fiction book)

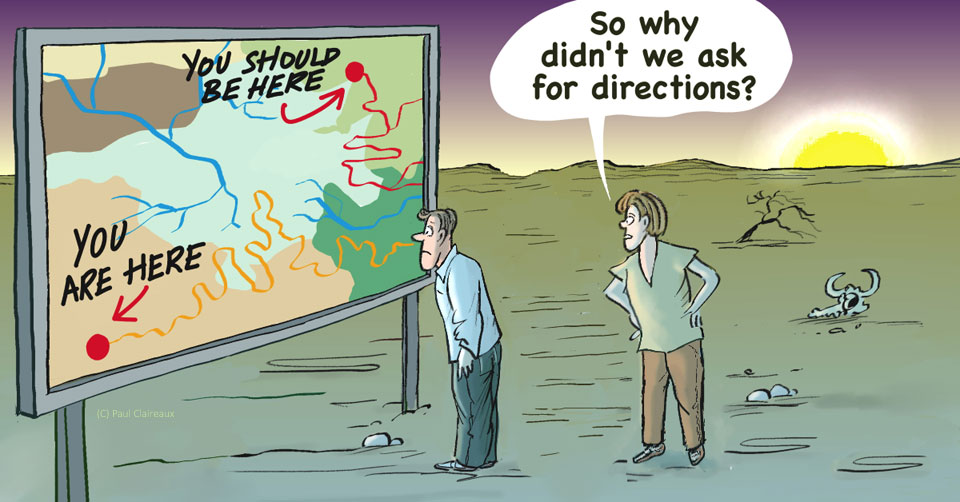

- 13 high-quality and website-optimised images to bring the Insights to life. Images are essential for boosting engagement and where you choose to present this content as a slide deck within or outside your business.

7. What’s the cost of this content versus creating it in-house?

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 17 and 34 hours of intense work to develop ideas like this, research the facts and create these Insights with all the images.

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 17 and 34 hours of intense work to develop ideas like this, research the facts and create these Insights with all the images.

Yes, it might take less (or more!) time, depending on your in-house writer’s skills – and how many drafts are needed before you’re happy with the result.

For your information, I typically create 7 to 10 drafts of my Insights before I’m happy with my work.

Different content creators (like authors and songwriters) work at different paces, and the pace varies between songs, too.

Assuming you charge that person’s time at the average adviser rate of £200 per hour (Source: Vouched For), this content set would cost you between £3,400 and £6,800 to create.

So, I’ll assume a mid-point estimate of £5,100.

Of course, you can double those estimates for a £400 hourly rate or halve them if your rate is £100 per hour.

If you hired a professional writer to create this content, you might save a third of those costs if the writer can create high-quality content faster than your in-house adviser, and their fees are less than those of an adviser – which they generally will be.

My fee today for a lifetime license to use this content (with free updates) is 95% less than the mid-point estimate cost of creating your own content.

This launch offer price equates to about 75 minutes of chargeable time for an average financial adviser and is c. 33% less than the normal price for this series of Insights.

This ‘giveaway’ offer is only available to a limited number of firms (worldwide) who license this content – and will be withdrawn without notice.

So, if you feel your clients (or their family and friends) would value this series, please grab this lifetime license now.

The price shown is for firms offering financial advice, planning, or coaching and employing less than eight client-facing staff.

If your firm is larger or you offer other financial services, please e-mail to request a price quote for this license at hello@paulclaireaux.com

Return to the store