Is 'Wealth Builders' the right group for you?

See the images above and the video below

Scroll down to learn more about this unique group

- Hello, I’m Paul Claireaux, I’m a writer, educator and coach and …

- I’d like to help you understand your money and make better decisions about it

- I do not sell financial products – so you can rest easy about that.

- This is about education pure and simple.

- You can learn more about me, my qualifications and experience at my about page or in FAQs further down this page

- Now let’s focus on what this Wealth-builders group could offer you.

What could Wealth Builders give you?

- More time - for those you care about and to do more of the things you enjoy

- More choice - to have, do or become more of the things you want.

- More confidence - as you learn to map out your own financial life plan

- More peace of mind - from knowing how to avoid the biggest money mistakes

- More recognition and respect - from family and friends

- More awareness - of how your attitudes and habits with money affect your results.

- And, potentially, reduced charges from advisers if you use them.

Sounds good – but how can it offer all this?

Well, here you’ll find a wealth of proven ideas (and support) all in plain English, to help you make more of the money you have – and earn more, if you need to.

You see, a lot of what’s written about money and personal achievement is just misleading nonsense – geared to selling you some kind of expensive investment or ‘scheme’ of some kind. So, you’ll obviously have a lot more time for yourself (and those you care about) if you waste less of it trying to separate the facts from the fiction out there.

You can leave that job to me. And, if you’d like my views on any ideas you uncover, I’ll be happy to help with that too.

For more on how Wealth Builders can deliver on these benefits, see the FAQ section below

IRATE: The five steps to plan your financial freedom

Join the group for the detail on all these steps

And gain access to all of these

Financial Flying Lessons

Taking off

Available at launch

How to get your finances off the ground with all the basics safely in place.

Getting there

Available at launch

How to choose the right investments for YOU and run them on autopilot.

And landing

Available after launch

How to approach and land your money safely for income in your later years.

After you join, your payments will never go up – ever!

Whether you pay monthly or annually for your wealth builder membership, your payments will never go up!

Prices for future joiners will almost certainly go up – as I develop more courses and content for the area.

So, by joining early, you could save a lot of money over time.

There’s no risk to you in joining the group because of my money back guarantee.

And if you leave the group (at any time for any reason) you’re free to go, with no extra fees or quibbles from me.

I’m here to provide ideas and support to help you achieve more – and if you’re not getting that, you’d be right to move on.

Hope that makes sense.

Is Wealth Builders right for you?

It's not right for everyone and this will help you decide

Wealth Builders will help you if:

- You're over 25 and under 55 years of age

- You want ideas to earn more in your work - or your business

- You *want* to learn how to make better decisions about money.

- You do not want to be *sold* any financial products

- You want to learn how to map out your *own* financial plan

- You do not want to disclose anything about your personal financial situation.

- You want to make more from your money without taking crazy risks

- You want to avoid the money mistakes that others make

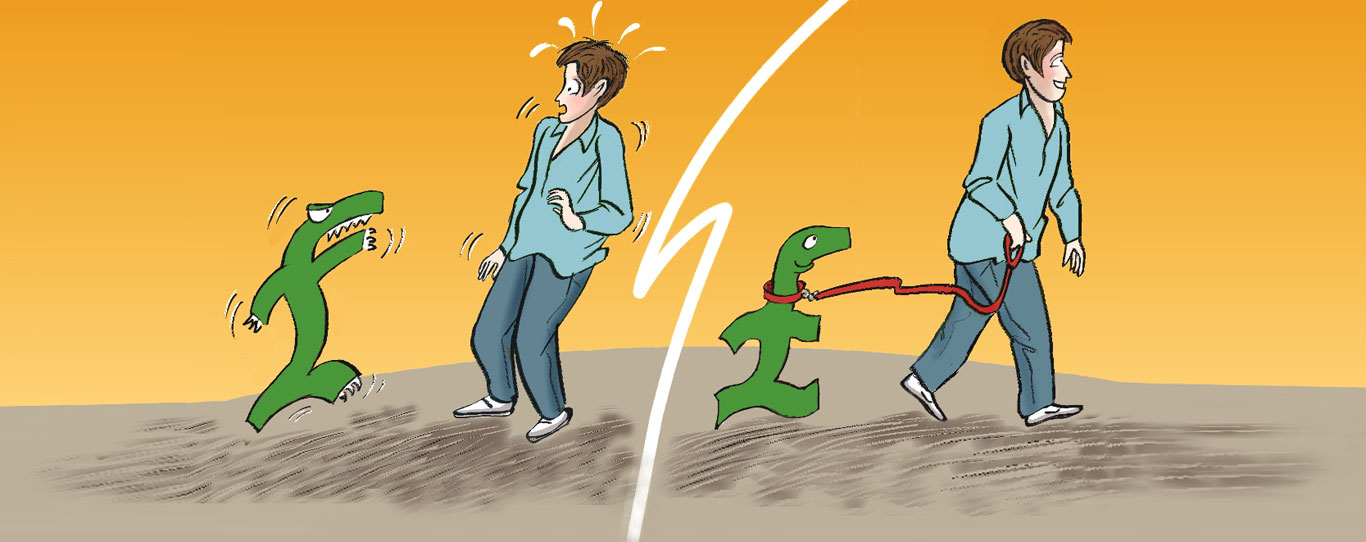

- You want to learn the behavioural science around money, so as not to mislead yourself!

- You want to focus on proven ideas

- You want access to competent and unbiased help

- You want to learn at times that are convenient to you

- You want to have a lot of fun while you learn

Wealth Builders might not be for you if:

- You're under 25 or over 55 years of age

- You know all of this stuff already.

- You have all aspects of your money in good order

- You earn more than enough for your needs

- You're not interested in learning about money

- You prefer to leave all *your* financial planning to other people

- You want to be told where to invest

Get your free download now

and future ideas via newsletter

and future ideas via newsletter

Sign up to our educators newsletter now

and receive updates about future content releases

and receive updates about future content releases