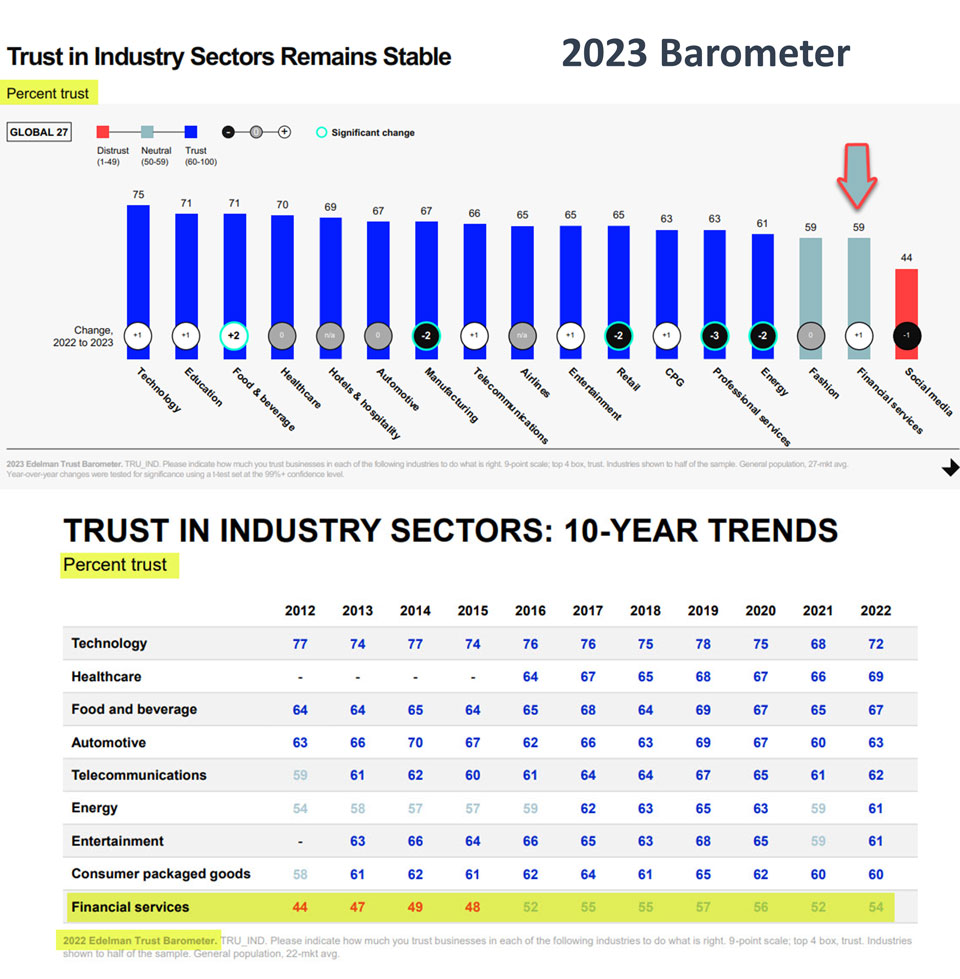

The confusion between the various advice services and the concern about value for money are really just parts of a bigger issue in financial services: a lack of trust.

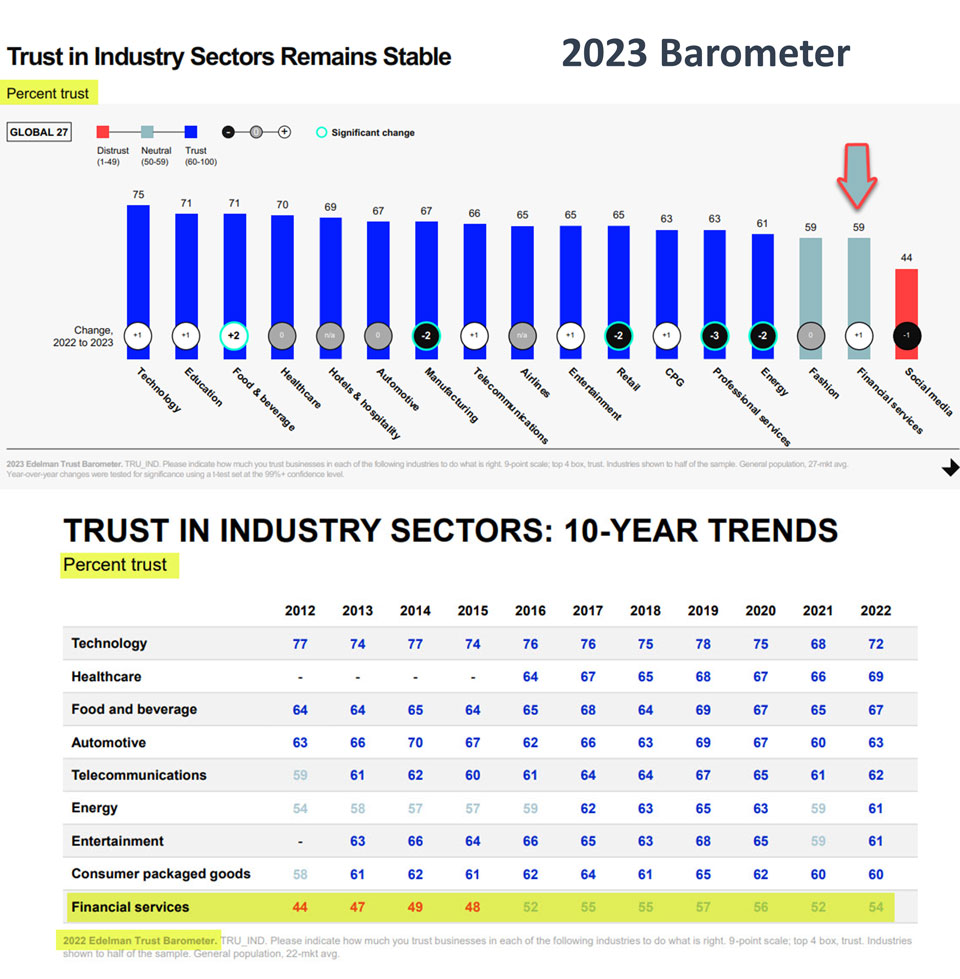

Yes, well-advised clients trust their advisers, but we cannot ignore the fact that, in general, trust in financial services has sat at the bottom of the Edelman Trust barometer for years.

Indeed, financial services only got off the bottom of the table in 2023 when Edelman added a new industry sector: Social Media!

Of course, this begs the question of whether it makes sense to focus on direct-to-consumer platforms if very few people trust them, but we’ll save that issue for another day.

More importantly, there’s some fascinating research* into how we’re perceived by others, which can inform what we should focus on to build more trust with consumers.

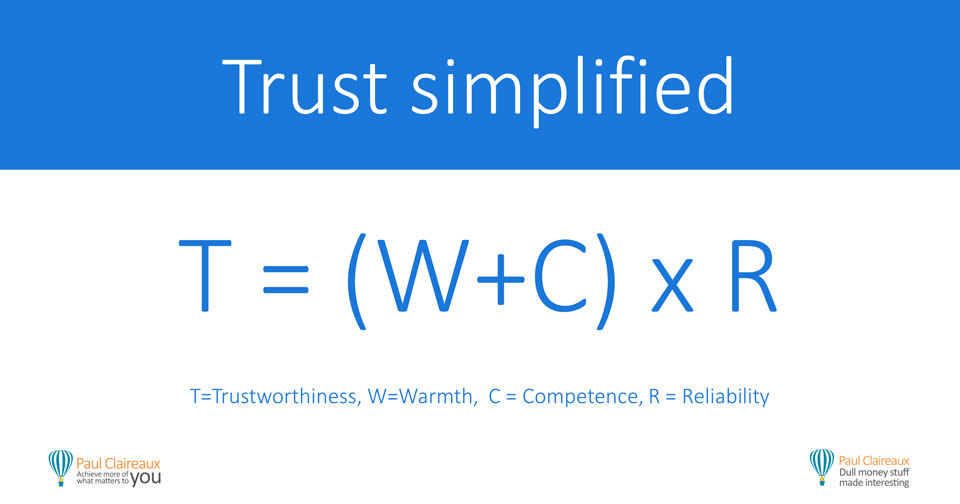

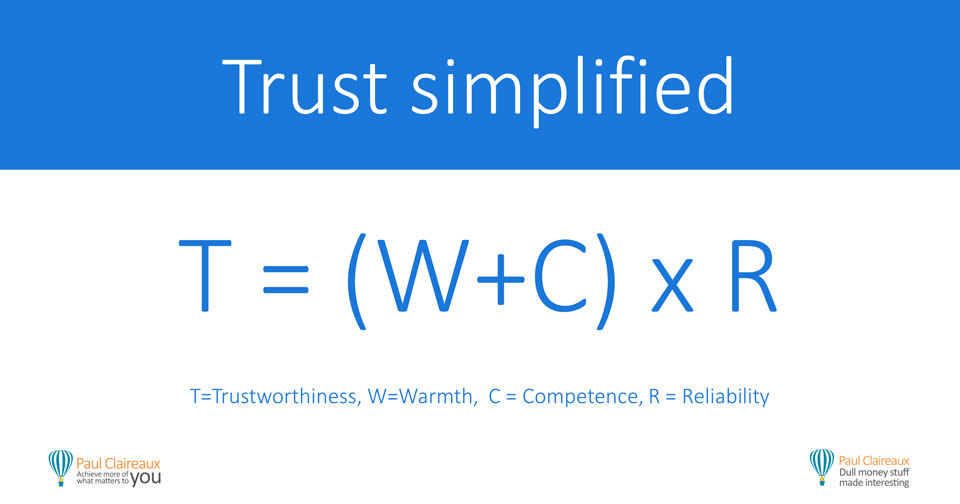

And it turns out that two factors (our ‘Warmth’ and ‘Competence’) have the biggest positive effect.

So, I developed this simplified version of a trust equation for business.

You’ll notice it’s similar to (but simpler than) the trust equation in the Trusted Advisor book by Maister, Green and Malford – and I’m happy to explain my thinking for that – if you wish to explore it further.

In short, I’m broadly with Charles Green on what drives trust in business. I’ve just simplified the equation!

Unsurprisingly, there are other formulae for trust, like this one, which uses the words ‘Benevolence’ instead of ‘Warmth’, ‘Ability’ instead of ‘Competence’ and ‘Integrity’ as an additional factor.

And that all makes sense, too, but I view someone’s integrity (the fact that they adhere to good behaviour principles) as a combination of their warmth (do they care about our well-being?) and their competence.

More importantly, the research* clearly shows that we are judged by our warmth before our capability is considered, which makes perfect sense from an evolutionary perspective.

We survived in the past by first asking – are they friend or foe?

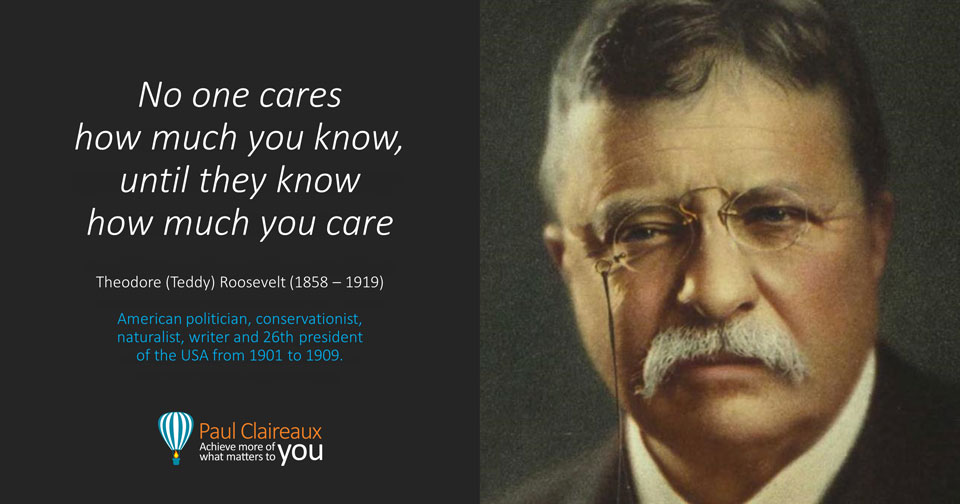

Of course, some wise people worked this out long before the Psychologists proved it.

Given that most buying decisions are made before we’re contacted, the critical question for us is how we demonstrate warmth and competence before a conversation.

Testimonials and other forms of social proof are helpful, of course.

However, you can’t beat relevant money Insights, written in plain English and a warm conversational style, to show you genuinely care for your audience.

How many financial websites offer that?

* Research reference: Fiske, Susan T., Amy J. C. Cuddy, and Peter Glick. “Universal Dimensions of Social Cognition: Warmth and Competence” Trends in Cognitive Sciences 11, no. 2 (2007)