Go one step beyond the efficient frontier

If you want to understand the Madness!

If your adviser uses the term efficient frontier when talking to you about your investments – you need to read this.

First up let’s get clear about one thing.

There are a lot of flaws in the ideas around economics and investment theory… they even made a film about that.

And at the core of all this is one fundamentally broken idea which asserts that investment prices behave according to some form of ‘normal distribution’ of returns.

This is complete nonsense… and you can learn why it’s nonsense in this lovely interview with one of the world’s leading Mathematicians, Benoit Mandelbrot. Head over here and watch the video at the base of the page

But sadly some advisers still use this idea for assessing risk in markets.

So, you need to watch out because it was this same, simple but flawed belief that sat behind the global financial crisis of 2008-09 – and brought the world economy to its knees.

Learn about that and have a good laugh at the expense of Investment Bankers here

OK, but what’s this ‘efficient frontier’ idea?

Well, it’s simply another much-used and abused investment risk modelling idea which might be used to mislead you.

To explain how, I’ll draw upon an extract from the excellent book, ‘The 3 simple rules of investing’ which, like my own work, debunks myths about investing and exposes misleading advice around it too.

This serious but delightfully easy to read book was Co-Authored by some distinguished academics:

Michael Edesess, is the lead author and an accomplished mathematician and economist. He’s also the author of The Big Investment Lie, and a visiting fellow in the Centre for System Informatics Engineering at City University of Hong Kong and a research associate of the EDHEC–Risk Institute.

Kwok L. Tsui, a distinguished statistician, expert on the problem of spurious patterns in big data and currently chair professor in the Department of Systems Engineering and Engineering Management at the City University of Hong Kong.

Carol Fabbri an experienced financial advisor, certified financial planner, certified advisor in philanthropy and managing partner of Fair Advisors, an independent financial advisory firm.

And George Peacock, principal at Compendium Financial Investment Advisory and managing editor, investments for the online financial site FrankInsight.com.

As an aside, this book also shows how DALBAR’s report produces misleading results about investor behaviour… and that’s worth knowing if that report has been used to persuade you that you need expensive investment advice.

Now, don’t get me wrong.

I absolutely do believe that most investors need intelligent guidance and or advice around their financial planning.

I just don’t think that they need help from people who use misleading reports to make their case!

Go one step beyond the efficient frontier to see the madness

Brilliant!

So, what is this ‘frontier’ thing anyway?

Well, in a nutshell, it’s a ‘theory’ about a better way to invest… and it’s a very compelling theory too.

You see, it holds out the hope that you can find an efficient Investment portfolio to beat any other portfolio you might construct – for a given amount of risk you’re prepared to take.

Sounds incredible right!

Yes, but the trouble is… it doesn’t really work… at least not in any sort of reliable way.

Here’s what Michael Edesess and Co, say about it in their book

And if this stuff bores you – just zoom in on the highlighted bits

Oh dear!

Yes, oh dear and here’s my take on it

I’m with the authors of this book when it comes to using efficient frontiers to create portfolios.

I simply cannot see how a ‘past performance’ based approach can deliver on its promise.

Yes, it might work some of the time but it will also, quite regularly, throw up some risky suggestions of asset classes that have enjoyed great performance and low volatility in the past – as most asset classes normally do up until the point when they crash.

Think property funds before 2007 or US stocks or Fixed Interest bonds over the past 8 years.

So, just when you need your portfolio to be robust, at the end of bull market, for example, it might let you down big time.

Of course, the idea of being able to create an efficient portfolio is wonderful:

And all it needs is for you to mix different assets that have little (or no or negative) price behaviour correlation.

Oops, sorry about that tech speak!

In plain English, this means that:

you just need a mix of investments where…

… when some go down in price…

… the others go up (or at least don’t fall as much) 😊

After all, no one wants to see all their assets falling in value at once.

The trouble is, as the old saying goes, when a crisis strikes – the only thing that goes up is correlation!

So sometimes, just when you need your safe assets to go up in price because your risky assets are falling in value… they don’t behave as they should do… or anything like they’re on any kind of “efficient frontier”

Here’s an extreme example from 1974

Notice how the Gilts (which are normally safer at such times) went down in value at the same time as the risky stuff (shares)

Indeed, it can sometimes be a big fall in bond prices (that drives those yields higher) that can cause a big fall in share prices.

So, yes, by all means, diversify your assets to try and reduce your risks where you need to.

But don’t expect this (not very) efficient frontier model to guarantee a good result in a crisis… and be aware that both bonds and shares are looking expensive right now.

Recently we heard that Alan Greenspan (Chairman of the Federal Reserve of the United States from 1987 to 2006) calling a bubble in bonds.

And there’s plenty of evidence to be concerned about equities too.

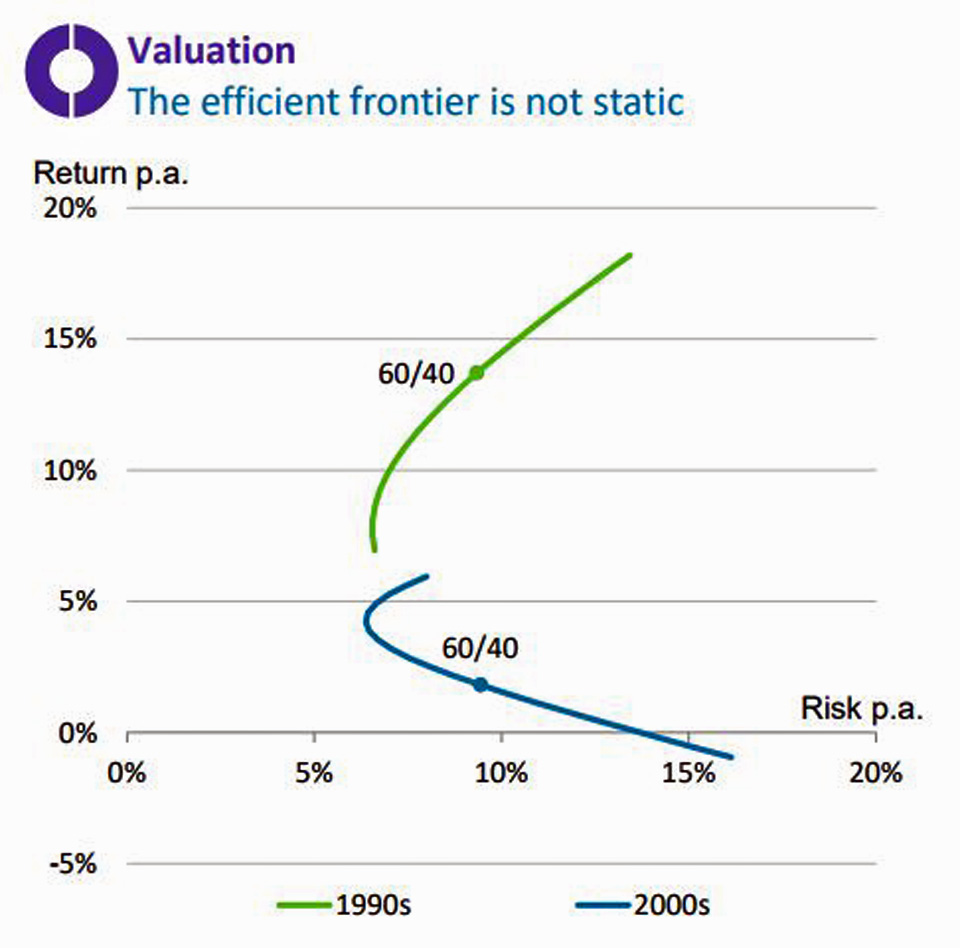

The efficient frontier moves – a lot – over time

The key lesson here is that what worked in the 1990’s did NOT work in the 2000’s.

Indeed, in the first 10 years of this millennium, you were rewarded for taking less risk in your funds…

… and that’s very different to the ‘more risk=more return’ idea that applies a lot of the time.

This wonderful chart from Schroder’s – which I picked up at one of their presentations (October 17) makes the point.

Okay, so that’s enough on the efficient frontier.

Now back to that book, ‘The 3 simple rules of investing?’

Would I buy it?

Yes, I have done and, if you’re an investor, I suggest you get a copy too because it explains some key concepts very well.

You just need to be aware that it’s aimed primarily at US investors… and, for my taste, puts a bit too much trust in markets and, thus, Index Tracking funds.

Index trackers can get very risky at times. So, I suggest that you read this piece too.

And finally, when you plan your money for the long term please get some intelligent and personal guidance on that.

You should have an outline of your financial life plan before you get into any questions of which funds to use.

To plan the other way round is to put the ‘cart before the horse’ and that really doesn’t work well.

Think about funds and other financial products after you’ve developed your financial life plan.

Only then can you know what sort of funds might help you achieve your various goals.

And, please remember that NO book, not even one of mine 😊 can give you the answers for your particular situation.

Personal Financial Plans need to be… well ‘personal’… to your unique circumstances.

That said, I’d encourage you to get a copy of, ‘The 3 simple rules of investing’

And for a ‘taster’ of my own book – sign up for newsletters and I’ll send you the first chapter for FREE

Just click the image below

Thanks for dropping in,

Paul

For more ideas to make more of your money and earn more of it too … Join my Facebook Group or sign up to my Newsletter and…

as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ … and the first chapter of my book, ‘Who misleads you about money?’

If you’d like more frequent ideas (and more interaction) …join my facebook group here

If you’d like more frequent ideas (and more interaction) …join my facebook group here

And feel free to share your thoughts in the comments below

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article