How do house prices look now

And what might happen next?

With UK home prices having fallen (on both the Halifax and Nationwide indices) recently … it’s a good time for a fresh look at price prospects.

For thoughts on USA house prices go to this page

Or to see if RENTING really is ‘money down the drain’ see here

Here I want to ask if UK home prices are ‘fair’ value now and what might change that situation.

I’ll focus on the national picture because that’s what will lead the trend in most locations.

But please remember that a ‘good price’ for a home can vary (a lot) between properties in one location and between cities and regions too. So, we’ll look at regional extremes in another Insight.

The picture in a nutshell

Homes in the UK (and a few other countries) appear to be very overpriced.

At least that was the conclusion of this 2015 analysis from the Organisation for Economic Cooperation and Development (OECD) – and prices have carried on up faster than earnings since that report.

So, home prices are now ‘vulnerable’ to the risk of a price correction in the event that borrowing costs rise or income growth slows.

To be blunt – there is a real risk of a house price crash as Paul Cheshire (A professor at the London School of Economics) said on 2 July 2017.

“We are due a significant correction in house prices. I think we are beginning to see signs that correction may be starting,”

He told the Mail on Sunday that prices could fall as much as 40 per cent.

“Historically, trends seem always to start in London and then move out across the rest of the country.

In the capital, you are already seeing house prices rising less rapidly than in other parts of Britain.”

Indeed, since that prediction, prices in London have now started falling back – and quite heavily in some boroughs.

What’s more, his fellow LSE professor Christian Hilber has warned that,

“If Brexit leads to a recession and/or sluggish growth for extended periods, then an extended and severe downturn is more likely than a short-lived and mild one,”

OK, but we’ve had this risk for ages now?

So what’s new?

Well, nothing’s really new. What’s happening is that basic free market economics are starting to reassert themselves after our extended period of ’emergency’ interest rates.

I guess we all know that it’s demand and supply that drives the prices of most things in free markets. And houses are no different.

The trouble is that the housing market has not been a properly functioning ‘free’ market for some time.

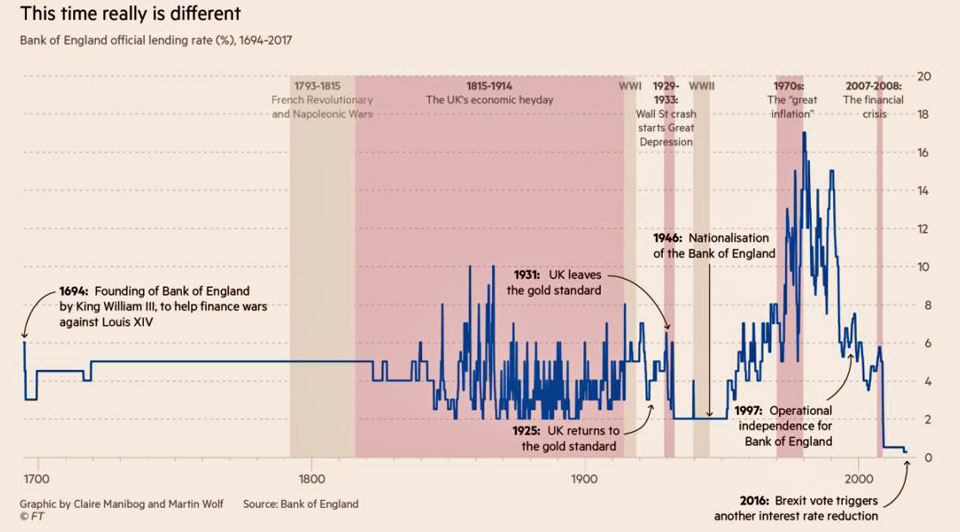

Interest rates have held down at 300-year lows for many years as this ‘shocking’ picture shows.

Just how far they fell in recent years – and how far below (what anyone would describe as) ‘normal’ they are now.

The bank rate has been raised a bit since this chart but is still less than 1%

You can access all the historical data from the Bank of England here

Obviously, super low-interest rates make mortgages easier to pay – which in turn makes homes more affordable.

And whilst that’s been good news for mortgage holders over recent years – it’s also seriously ‘distorted’ the price of houses.

I really don’t think that anyone is going to thank the Bank of England (BoE) (who control the price of money – a.k.a. interest rates) if (or as many think, ‘when’) house prices come sharply back down as a result.

The truth is that we just don’t know what will happen to house prices as the cost of borrowing (and the supply of houses for sale) start rising. But clearly, there are some big risks in this market now – as those experts above point out.

What the experts say about interest rates

Some ‘experts’ predict that interest rates will stay low for many years to come.

And that’s an interesting view, but let’s remember that very few experts predicted interest rates would stay this low for so many years back in 2009.

Most of them expected that the ’emergency’ measure of super-low interest rates would be just that, an emergency short term measure.

They thought that we’d have returned to more ‘normal’ interest rates long before now.

They were wrong back in 2009 and they might be wrong now.

So, it’s always safest to take predictions (from any ‘expert’) about interest rates (or asset prices generally) with a pinch of salt 😉

We just need to be aware of, and manage our risks.

One potential shock to our financial system could come from the falling pound.

And this is because the BoE may decide to intervene, to prevent a currency collapse.

They don’t like the risks to inflation caused by the pound falling against other currencies.

And the costs of our imports – which make up a large proportion of what we buy – goes up as our currency falls.

So, they could intervene – by raising interest rates – as they’ve done in the past when the pound has collapsed.

And if, as we might hope, we survive relatively unscathed from Brexit, the BOE will raise interest rates as the economy picks up.

So, it looks like rates will go up whatever happens.

Let’s remember history

In the past, short sharp rises in interest rates were quite common – increasing by:

- 12% in around two years in the late 1970s

- 5% in less than one year in the mid-1980s and

- Nearly 7% in just over one year in the late 1980s.

So don’t believe anyone who says they’re sure that rates will stay down for a long time.

Of course, I’m not suggesting that such massive increases in interest rates are on the cards today. But I am pointing out that even a very small increase from today’s very low rates would create a lot of pain for borrowers.

A 2% increase to a 2% mortgage rate

means a 100% increase in interest payments

OK but are house prices really out of line?

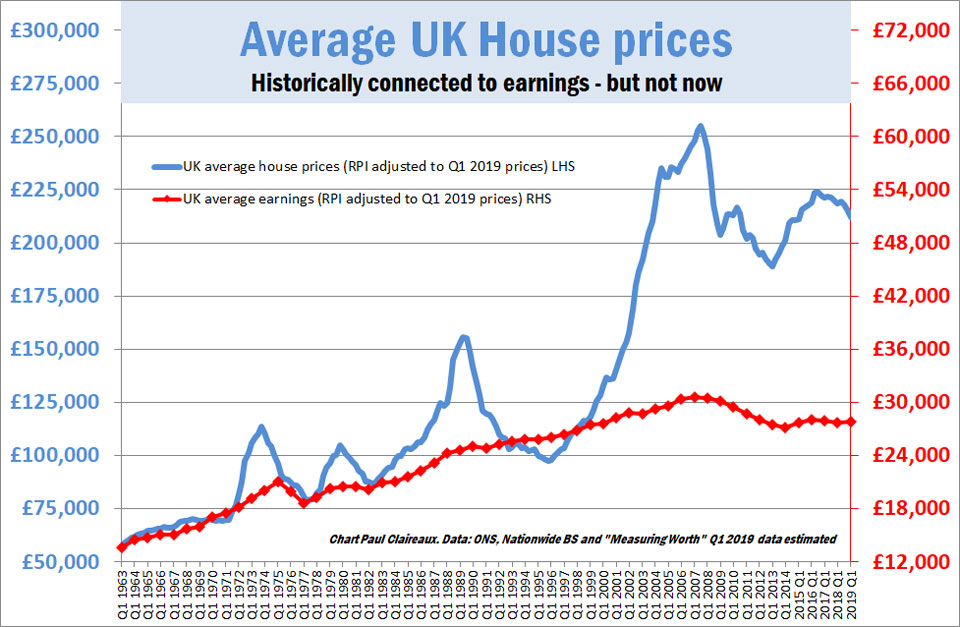

Well, take a look at these two charts and make up your own mind.

This first chart …

… tracks average house prices (in blue) against people’s average earnings (red) all in today’s money terms, over more than 50 years.

Note how average earnings rose (in real terms) by about two and a half times up to the peak in 2007 …

… whilst house prices rose by a factor of four.

That suggests (to me) a need for a ‘correction’ which could either come slowly over time (if real wages continue rising steadily) …

… or, more quickly, if house prices continue falling as they are now.

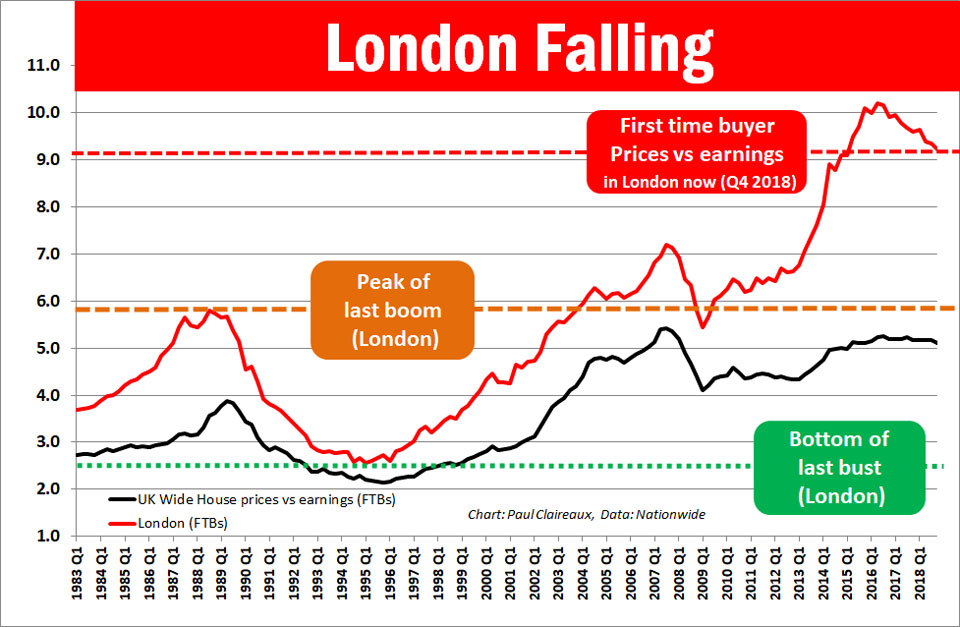

This second chart looks at first-time buyer home prices relative to their earnings

And it’s this ratio (of prices relative to earnings) that tells you about value.

Home prices relative to earnings of the prospective buyers (as above) OR to the rental ‘earnings yield’ of the properties … give useful clues to value in times of normal interest rates.

The trouble is that recent times have not been ‘normal’ and in hot spots (like London) home prices (especially for first-time buyers) went quite mad for a while.

Here’s the London data So, what do these charts tell us?

So, what do these charts tell us?

Well, I think they tell us that UK house prices went into outer space!

And, what’s more they were well on their way by 2005.

This initial ‘take off’ came off the back of interest rates being drastically reduced to fend off the effects of the dot.com bust in the stock market.

Having seen a bubble in technology stocks, our central banks then helped to create another one in property.

And, as you can see, since around 2003, UK house prices became completely detached from people’s earnings.

The charts also prove that this ‘disconnect’ can persist for a very long time when it’s supported by super-low interest rates.

But of course, at some point, some kind of connection has to be re-established because it’s only peoples’ earnings that can support house prices over the long run.

The crash that never happened (2008-09)

Notice how the wider UK first time buyer ratio ran back up to its 2007 peak and now appears to have rolled over.

Whilst the same ratio in London barely paused for breath after the last crisis in 2008-09 – before powering on up ever new highs.

And notice how in that 2008-09 crisis, none of these ratios fell back to their peak levels during the late 1980’s boom.

So, UK house prices did NOT really crash in the financial crisis of 2008-09.

They did in the USA and other countries with house price bubbles – but not in the UK at that time.

The previous boom, by the way, topped out in 1989 and ended, as they all tend to, in a crash.

I was there for that one – and it really wasn’t much fun 🙁

Here’s some slightly old data from ‘The Economist’ to show how British (and Australian) home prices became detached from reality after the 1990’s crash.

So are we due another crash?

Well, I don’t know, and nor does anyone else but, as those professors from the LSE are warning – it does look increasingly likely.

We could potentially escape one if people’s earnings grew fast enough – to bring that ‘ratio’ back into a more normal range.

And whilst there has been some improvement in people’s earnings recently, it remains to be seen if that’ll be enough (and quick enough) to prevent a crash.

And while this could change (relatively quickly if inflation spiked upwards due to our falling pound) the Bank of England would then be under pressure to push inflation back down again with higher interest rates.

So, I really do think we’re caught – in a tricky place right now.

We’ve painted ourselves into a corner of high asset prices with these ultra-low interest rates. And while that might feel just fine for those holding assets (houses or stocks) it’s not feeling very good for the majority.

What we do know is that House prices are sticky on the way down – because sellers don’t like to sell into a falling market.

So price crashes only tend to happen when sellers are forced to sell.

Of course, ‘Buy to Let’ owners have been feeling the heat of property ownership for a while now – and many have been looking to sell out.

The nasty dynamics in that sector are outlined here in an article that needs an update

I hope that this Insight has shown you some of the risks in house prices . . .

And, if it could be useful to your friends, please share.

They might thank you for it 🙂

Thanks for dropping in

Paul

For more ideas to make more of your money and earn more of it too …

Join my Facebook Group or sign up to my Newsletter and… as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ … and the first chapter of my book, ‘Who misleads you about money?’

If you’d like more frequent ideas (and more interaction) …join my facebook group here

If you’d like more frequent ideas (and more interaction) …join my facebook group here

And feel free to share your thoughts in the comments below

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article