Why financial education is key for employers

And three ways to ensure that yours is the best

If you’re an employer, HR manager, or an affinity group leader, this is for you.

In this post I’ll explore why financial education is key to people’s well-being in the workplace.

I’ll also outline a simple (ABC) checklist to help you test whether your education programme is one of the best.

This is a 10 to 15 minute read, depending on your speed.

This is for financial educators too

If you’re like me and care passionately about financial education, I hope you’ll find some valuable ideas in here too.

So, whether you lead or work in any financial service business (in employee benefits, pensions, fund management, personal financial advice or planning or coaching) , please read on.

We all want to help ordinary people to understand their money and make better decisions about it.

And, I guess we all need to design great content, and deliver it well.

Financial well-being is the biggest challenge for many now

Money worries were a massive issue for employees and business owners, long before 2022.

The fact that interest rates have risen (above the near-zero rates of the past 14 years) and stock and bond markets fell hard in response to higher inflation, just makes the issue more urgent now.

Estimates by a leading provider of workplace-based financial products suggest that, on average, employees with money worries are:

- Fifteen times more likely to lose sleep over this issue.

- Unproductive for c. 5% or more of their working week.

- Less likely to produce high-quality work.

- Nearly eight times more likely to have troubled relationships with colleagues.

- About 50% more likely to be looking for another job.

And various research shows that money worries are now:

- More common than worries about health, relationships, and careers.

- Affecting 50% or more of all employees.

- Creating enormous costs to employers.

Money worries are common at all income levels

Money worries are common at all income levels.

What surprises some people is that these worries are higher in low and high-income groups than average earners.

The media help us understand the challenge for those on lower incomes, although, I think more could be done to point people to reliable (and free) sources of help, like Step Change, Turn2US and National Debtline.

But let’s remember that middle managers, and especially parents, have good reason to stress about money too.

Marginal tax rates of 70% or more, can apply to those whose income rises above c. £50,000 a year. And 60% (effective) tax rates apply on incomes over £100,000.

Higher earners tend to invest money too. So, some may be stressed about investment fund losses and property prices too.

Indeed, it’s difficult to escape money worries with wealth – because the more you have, the more you can lose.

And, as was widely reported some time ago, the rich and famous can lose millions too, like these who lost fortunes in Bernie Madoff’s Ponzi Scheme.

- Steven Spielberg: Academy Award-winning director.

- Eric Roth: Screenwriter for “Forrest Gump” and “A Star Is Born”.

- Larry King: Emmy-winning American television and radio host.

- Kevin Bacon and Kyra Sedgwick: Golden Globe-winning actors.

- Zsa Zsa Gabor: Former Miss Hungary (1936) who starred in Moulin Rouge (1952)

- John Malkovich: American actor, director and producer.

Bringing this closer to home, it’s worth remembering the thousands of Brits who, collectively, lost millions after being badly advised on tax avoidance schemes. And among them were these one hundred famous Brits.

So, your education must be transformative

And here’s the crazy thing.

All of those people above, knew they should have been better advised.

What they didn’t know is that there’s a simple process which they could have followed to avoid those losses.

And I outline that process in one of my core lessons on:

How to select a financial product…

before you jump into it.

It’s an essential lesson for everyone, regardless of their wealth.

The point is that most of us worry about money. So, we must equip ourselves and our people (our employees and friends and family) to take more control of it.

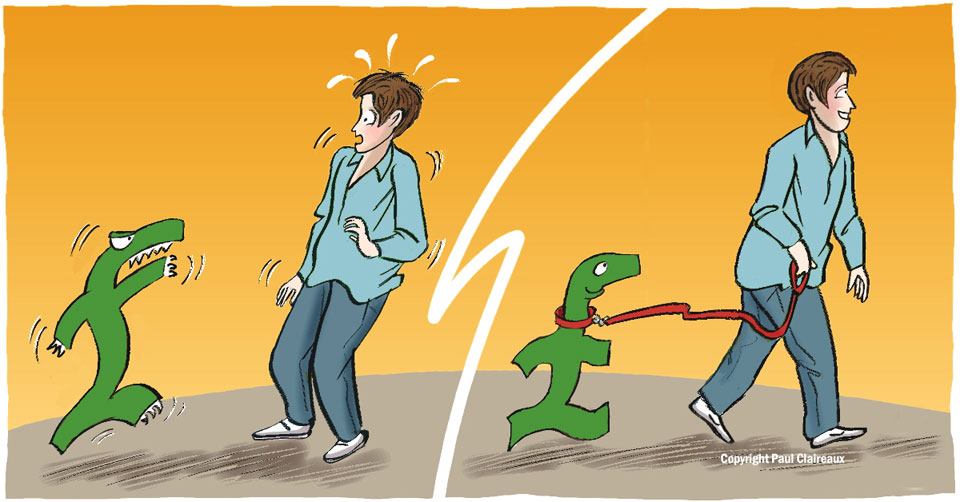

In short, your financial education programme must help people to make this shift.

If it doesn’t, why would you offer it?

Is financial well-being all about education?

That’s a very good question, and the answer you’ll get might depend on who you talk to, and the services they offer.

The institute for financial wellbeing, here refers to research to show that accumulating wealth (for its own sake) won’t make us happy, and that the quality of our relationships are key.

Yes, that’s true enough, but if we’re to start by understanding the broader subject of ‘Well-being’ / ‘Life-Satisfaction’ or ‘Happiness’, as Richard Layard calls it, we need to know it can be driven by a great many things.

And here’s a longer list from Action for Happiness

Action for Happiness was founded in 2010 by Lord Richard Layard, Sir Anthony Seldon, Sir Geoff Mulgan and Dr Mark Williamson.

Their vision is for a happier world, where everyone can thrive. And their patron is the Dalai Lama.

To dig deeper into their research, I recommend ‘Can we be happier?’ by Economist, Lord Richard Layard.

What else is *Well-being* about?

It surprises many to learn that the Dalai Lama is also a keen follower of the work of Neuroscientist, Richard Davidson who, in this short video, outlines what his research tells him are the four key constituents of Well-Being.

Not surprisingly, they have nothing (directly) to do with money.

It’s a fascinating short talk, and shocking in places, as when Davidson talks about ‘Attention’, his third element of well-being.

Note the research telling us that ‘A wandering mind is an unhappy mind’ !

And how, in the US, at least, it seems that adults are spending about half of their waking lives, not paying attention to what they’re doing!

Imagine the gains we could achieve (in well-being and productivity at work) if we could move the dial, just a little, on that challenge!

Well it seems that it’s possible. So, do take a look.

On the work of the Gallup organisation

Researchers from ‘Gallup’ have also explored the demands of a life well-lived for decades, and recently, partnering with economists, psychologists, and other scientists, have found common elements of well-being that transcend countries and cultures.

These five elements, claim Gallup, are the the currency of a life that matters. They don’t include every nuance of what’s important in life, but represent what’s essential to most people.

And their five elements are:

- Career Well-Being: How we occupy our time and like what we do each day.

- Social Well-Being: Having strong relationships and love in our life.

- Financial Well-Being, which they define as effectively managing our economic life.

- Physical Well-Being: Having good health and energy to get things done each day.

- Community Well-Being: Our sense of engagement with others where we live or who have shared interests.

In this 2010 article, Gallup say 66% of people are doing well in at least one of these areas. But just 7% are thriving in all five.

So, most of us could strengthen our well-being in some of these areas – and give ourselves a lift.

Shall we focus on the evidence?

A great many Psychologists, Psychiatrists and other scientists have worked and continue working on the question of what makes us happy.

So, there’s plenty to read, from good scientists, on this topic without listening to un-evidenced ideas or ‘personal truths’ of others.

A personal truth is like research with a sample of n=1. And we wouldn’t take that seriously.

So, I’m dismayed at this trend towards sharing personal truths, aren’t you?

To me it makes sense to follow the evidence on all matters, as far as there is any.

And I’d say this is especially important on matters of the mind and happiness. An area where we seem to be millions of self-appointed experts!

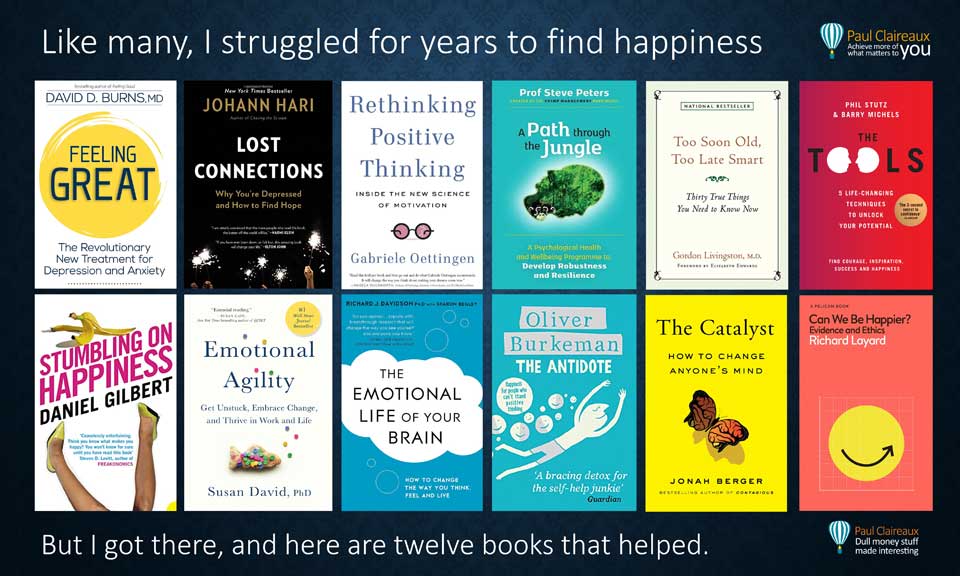

Here are some books I recommend.

They’re written by world leading experts, or, in ‘Lost Connections’ and ‘The Antidote’, report on the work of those experts.

For example Steve Peters, (who also wrote Chimp Paradox) is a Psychiatrist and was the mind coach to Ronnie O’Sullivan (world snooker champion) and to the British Olympic Cycling team that won all those Gold Medals.

Where to start?

They’re all great books, but unless you have a special interest, you could start with ‘Stumbling on Happiness’ by Psychology Professor, Daniel Gilbert.

It’s a highly amusing summary of the research into happiness.

And, among other things, Gilbert reveals that we humans are very poor at remembering the past and predicting what will make us happy in the future!

On the link between happiness and motivation

Some Psychologists have claimed that what matters most for our happiness is to satisfy our four Intrinsic motivators – which I think they list as:

Relationships, Autonomy, Mastery and Purpose.

OR:

Connection, Choice, Competence and Community.

Same things – different Mnemonics.

However, Psychologist Steven Reiss says there’s no evidence to support the idea that those four are more important than our other motives.

His research found that we’re all motivated to varying degrees, by a set of 16 basic desires – many of which we share with other animals.

Those motivators are listed below.

Reiss also contends that we’re motivated to act in alignment with our values.

So, understanding our values might help us on this happy/motivated journey, and when we develop and review our financial life plans.

To Reiss, our personality differences can also be understood by knowing the extent to which we’re motivated by those 16 items above.

But now I’m digressing into Personality Profiling.

And this is a big problem area in industry. So, we’ll come back to that topic another day!

Happiness = Reality minus expectation

So, our happiness (or life satisfaction) can be driven by many things which matter in different proportions to each of us.

And money (beyond a certain level) doesn’t seem* to have much to do with it.

* As with most things, Psychologists are reviewing the research around that. So, watch this space!

In any event, of everything I’ve read, the most interesting thing I’ve found is this simple idea.

Happiness = your reality minus your expectations.

The idea is evidence based, of course. It comes from years of research by Manel Baucells and Rakesh Sarin, and is outlined in their book ‘Engineering Happiness: A New Approach for Building a Joyful Life’

It’s actually quite an old book now, but interestingly, the same idea crops up in Mo Gawdat’s, more recent, book ‘Solve for Happy’.

So, perhaps he borrowed the research and developed the idea.

Anyway, I think equation tells us a lot, and here are some of my conclusions:

First, we don’t necessarily need to have ‘more’ (stuff, knowledge or skills) to be happier.

We can, instead, lower our expectations or let go of the attachment as Buddhists like to say.

And this idea, most surely, explains the happy faces we see in poorer parts of the world, where, you’d think people have very little to be happy about.

These people know how set their expectations low.

Whether that mindset is best for raising living standards across a society, is another question.

Second, if we hold our expectations far above our current situation, we risk being permanently unhappy.

And third, thinking on the flip side, if we can pay attention at those times when our reality falls short of our expectations, our modest discomfort may spur us on, to find a better place.

Paying attention and acknowledging some discomfort, seems to be key to our personal development.

We just need to be careful not to take this search for unhappiness too far!

We don’t need to be constantly setting goals that are a long way from our current reality.

SMART Goals are ‘attainable’ – among other things.

Rome can’t be built in a day, and if we expect it to be so, we’ll be unhappy.

However, if we want to improve our reality, we need to move out of our comfort zone.

Bottom line on happiness: don’t pursue it directly

I guess we all know that happiness is a slippery subject!

And, I’m happy to take (Psychiatrist and Holocaust survivor) Viktor Frankl’s advice that, like success, happiness is usually found when we’re not pursuing it!

Christopher Plummer summed up Frankl’s point here also, as he played Professor Coreman, in ‘Hector and the Search For Happiness’, a lovely film with Simon Pegg in the lead role – of an unhappy Psychiatrist!

And stay with that short video, for the brilliant (Frankl-like) Insight at the end:

Oh, no.

We should concern ourselves not so much with the pursuit of happiness.

And more with the happiness of our pursuits.

OK. So what (exactly) is financial wellbeing?

Well, it’s just part of our overall Well-being, but, given that money worries affect so many people, it’s a big part.

Without doubt, for wealthy people, or those with more income than they need, their wellbeing can be improved by aligning the allocation of their money (and time) to activities that make them (and those they care about) happier.

And that’s something I wish I’d understood better as a young man.

We just need to accept that the happiness needs of each person vary!

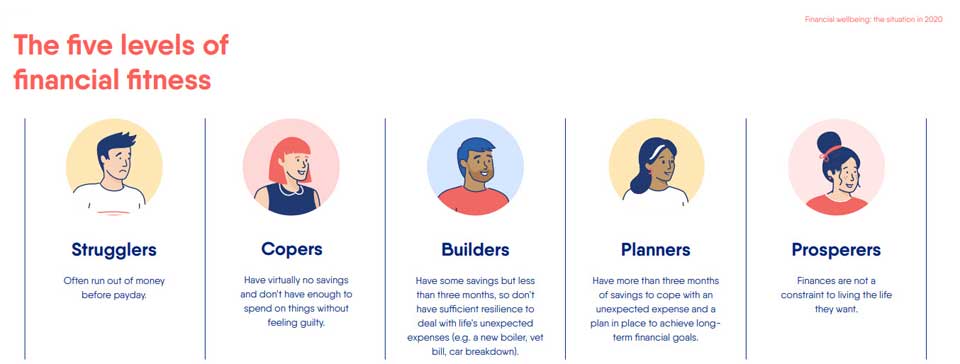

For most of of us however, I think it helps to see financial wellbeing as a direction of travel with our finances.

About having, or moving towards having, enough money for our needs and wants, including:

- Covering your essential outgoings.

- Controlling your discretionary spending.

- Building savings for emergencies.

- Insuring yourself against the risks of losing your health or your life.

- Building and maintaining a good credit score.

- Building funds to pay for what you (or your loved ones) really want (to have, do or become) in the future.

Or satisfactorily dealing with other financial challenges at other life stages too, as summarised in this picture:

I think it’s vital to understand our current financial situation and our direction of travel.

And, Salary Finance’s financial fitness levels are a great way to look at this.

I’ve worked with Salary Finance on their educational content.

They’re a leading financial service provider and have won various awards for Innovation and Social Purpose

What matters to Employees and Employers?

As with our health, our progress (forwards or backwards) between fitness levels, will depend in part on our attitude to money, and our ability to manage it.

So, a great educational programme shows us how to plan our money, make good financial decisions, and find (and manage) an adviser, if we need one.

Which aligns with research from Nudge Global, another leader in financial education, which shows that 80% of employees consider financial knowledge and skills to be the most important factor for financial well-being.

Interestingly, that same research shows that more than 90% of employers believe it’s important for their education provider to have no bias to any financial product or service provider.

And, while I generally, agree with that, I’d say there are providers, like Salary Finance, who are totally focussed on helping people to improve their financial fitness.

So, don’t dismiss all product providers as bad actors.

The truth is that very few are.

What’s my aim?

Well, I do not sell or advise on financial products – so you can rest easy on that, if it concerns you.

I had a successful career of 25 years, in financial services (FS) and escaped a few years ago, to focus on creating powerful educational content (guides and video scripts) for good FS companies.

My educational content equips people with the knowledge, tools and skills they need to make better money decisions now – and to plan their money for the future.

That’s it.

I’m a financial educator, pure and simple.

The ABC tests of what good looks like

There are a lot of financial education suppliers in the UK, and across the world.

And, not surprisingly, the quality of the content, and it’s delivery, varies – a lot.

This is one reason I’m now offering my financial education to employers who might not otherwise have access to the best. And, if that’s of interest, let’s talk.

Of course, I can’t deliver my lessons to everyone… not yet anyway!

So, here’s what I suggest you look for, from anyone offering to give financial education to your people.

Their credentials (knowledge, experience, qualifications, books written, testimonials etc) are vital of course.

And, assuming those things check out, you then need to check that their content (the slide decks and worksheets, if they have any) and their delivery is accurate, balanced and compelling.

Sadly, too much of what’s offered as financial education, fails one or more of those (ABC) tests.

Established financial education providers should deliver accurate and balanced information. Which means they’ll take care to explain the risks, as well as the benefits, of any financial product solution ideas.

However, accuracy and balance may not be enough, if some of your people are distracted and fascinated by high-octane, but flawed and misleading ideas out there.

And this is a big issue for many – esp. young men. If it were not, the clowns and scammers would not survive.

Sadly they do, and the crazy ideas are especially prevalent on Social Media, where – the regulators are always playing catch up.

So, your financial educator needs to make a compelling case for solid financial planning.

The essential lessons must be high impact.

Your educator must know how to detonate ideas in the minds of your people, to protect them from making big mistakes with their money.

You need outcomes from this programme.

‘Accurate and Balanced’ should be a given with many educational programmes, but it’s the ‘C’ (for Compelling) in our ABC test, that will make the difference to your people.

So, this matters, and it’s worth exploring what ‘Compelling’ means.

What does compelling look like?

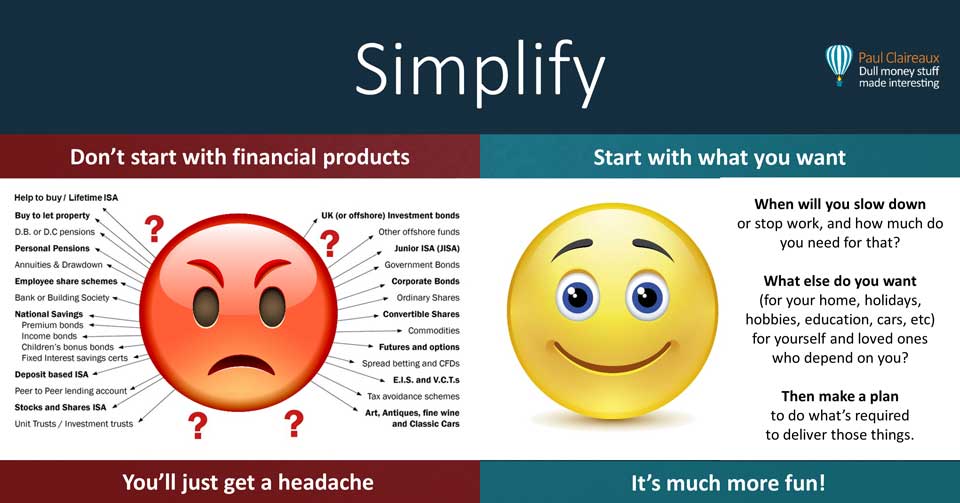

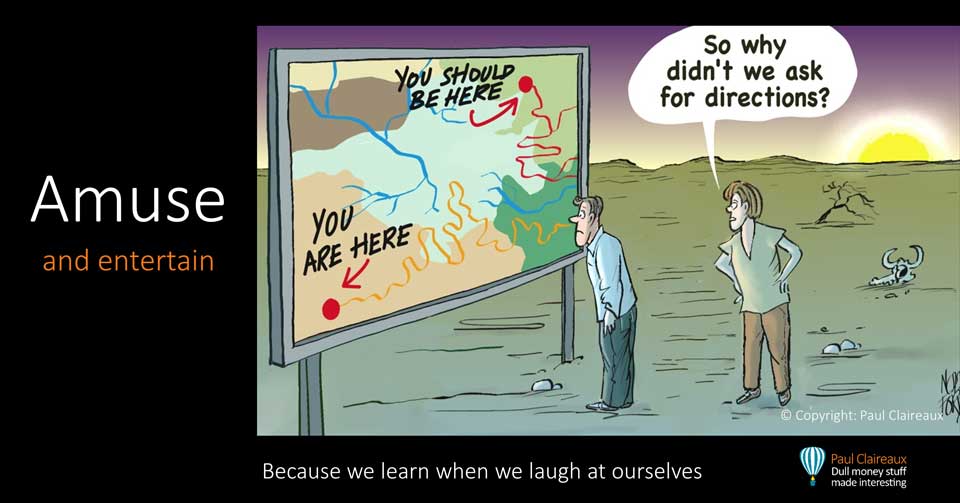

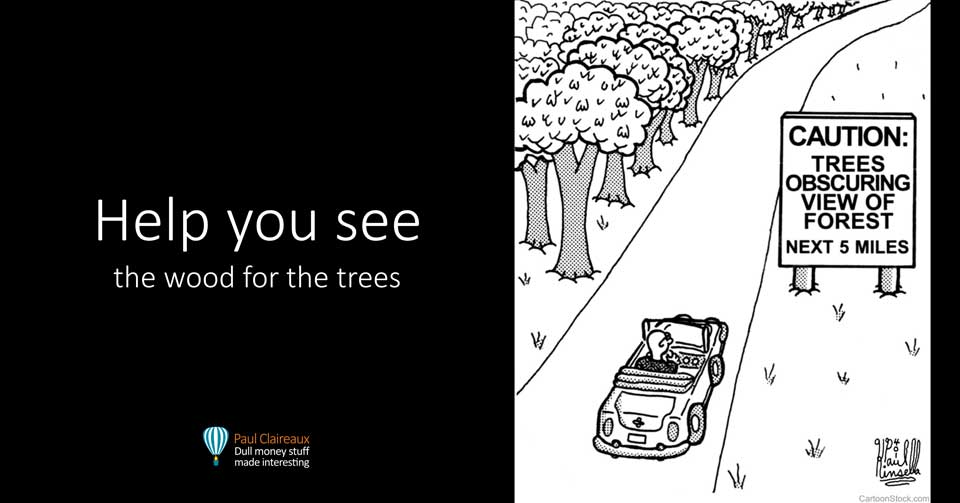

In this last section, I’m having a bit of fun in trying to illustrate (purely with pictures) what an educational programme should do – for you, and your people.

To be clear, these descriptions are an ideal and no financial educator could achieve all of this – all of the time.

That said, it’s worth asking yourself, and your people, if your financial education supplier is hitting the mark on many of these points.

Because you need an educational programme that will:

Does some of this make sense?

I’m grateful to you for reading this far.

I know it was a long post, and perhaps I’ll split out the piece exploring happiness in the future – do you think I should?

Anyway, if you like a bottom line, just remember that:

- Extremely high quality financial education is key to the wellbeing of your people.

- Not every educator can create and deliver compelling educational gigs – that equip (and inspire) your people to make good money decisions.

So, it’s worth the effort of finding the right supplier.

Your people will thank you for arranging those sessions, and they’ll tell you about the fun they had while learning too.

Which means Financial Education, done well, makes your people feel more valued.

And that could save you a ton of money and hassle on staff retention and recruitment challenges.

Next steps

I hope this post resonated with you, in which case:

- If you’re an employer (or other group leader) and want to discuss the possibility of me sharing some financial insights with your people, let’s talk, explore the topics to cover and see if I’m right for your group

- If you’re an education provider, and you’d like to upgrade or refresh your educational content, let’s talk to see if I could help with that.

- If you run a financial advice/planning/coaching business, and want to know how an education-first approach to marketing could transform your business, let’s talk about that.

And thanks for dropping in

You can sign up to my newsletter here,

And, as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article