This crazy way of charging for advice

is stopping most people getting the advice they need

Whether you’re rich, or of more modest means, this Insight is for you.

It’s a reasonably long read (5 to 12 minutes depending on your reading speed) but I think you’ll find it worth your time.

Get to grips with this issue and you could save yourself hundreds, thousands or even tens of thousands of pounds in advice charges – in the future.

What’s more, you’ll help others get access to the advice they need too.

Great advice at a modest price is difficult to find

Before I get into this, let me make my own position clear.

These days, my work is all about financial education. I do not offer personal financial advice.

I did work ‘on the inside’ of the Financial Services (FS) Industry for 25 years; dealt with hundreds of firms of advisers; led teams that designed the investment and pension products for a blue-chip investment house and, just for fun, passed the financial adviser exams along the way.

This knowledge and experience left me with two very firmly held beliefs:

- That most people can benefit from solid money guidance from someone competent in this area.

- For the vast majority of middle Britons (or anyone in the world), really solid financial advice (at a modest price) is almost impossible to obtain.

We’ll look at the evidence on this – and what you can do about it – in a moment.

First, it will help you to understand why this problem exists – and a good way to do that is with a thought experiment.

Imagine you’re a financial adviser

Imagine that you’re a financial adviser, a good one – the sort of dream adviser you’d want to know if you need advice yourself.

You’re a real expert and, unusually, you’re also a great communicator who translates all that technical tax and pensions gobbledegook into plain English 😉

You’re well respected by your local network of accountants and solicitors and you get as much work as you want – from those professional connections and referrals from your existing clients.

Your work life is good.

You do not (heavily) market your services because you don’t need to – but you have a nice clear website which generates the occasional new enquiry for your advice services, and today you have two such enquiries.

The first, from Samantha Smith, (aged 40) is for investment advice on a lump sum of money.

Sam wants to invest her money for about ten years – to achieve some growth and protect from inflation, but without taking ‘too much’ risk.

Her plan, after ten or more years, is to use the funds to start easing away from her current job and start a new career.

Sam has no current need for complex advice, like planning to mitigate Inheritance Tax or Pension input taxes; she just wants advice on how to invest a lump sum of money for the medium term.

Remarkably, your second enquirer, Ben Brown, (aged 39), has almost identical advice needs.

Yes, well, it simplifies this story 😉

You can assume that:

- You only have spare capacity to take on one extra client at this time.

- You’re happy to advise both men and women (curiously, some market their services to one gender)

- You’ve met and got along reasonably with both Sam and Ben…

The question is, who will you take on as a client, Sam or Ben?

It shouldn’t really matter, should it?

But what if we assumed that you found Ben slightly easier to get along with?

Would you then be inclined to offer him the advice service?

Well, before you decide, I need to tell you two more things:

- The fees you charge to give advice are based on a percentage of the value of your client’s Funds Under your Advice*

- Sam is quite wealthy and will likely invest ten times as much money as Ben.

* This Percentage of Funds Under Advice fee model is the key problem in the advice industry that we’re looking at here. So, I’ll refer to it many times in this Insight – using the acronym PFUA to avoid horribly long sentences.

This means that your prospective adviser fees are as follows:

- If you advise Sam, you’ll earn £72,000, (or more with investment growth) over 10 years. This assumes Sam invests £600,000 with you and your fees are, say, £12,000 (2% of her investment) for the initial advice plus 1% every year after that.

- If you advise Ben, you’ll earn £7,800 over 10 years. This assumes that Ben invests £60,000 with you and your fees are, say, £1,800 (3%) for the initial advice (a slightly higher initial percentage to reflect the lower amount invested), plus the same 1% every year after that.

Would you still prefer to advise Ben now?

Remember, the amount of work you’d have to do for these clients would be broadly the same, at least for a few years.

Well, unless you’re a saint (and I’m not discounting that possibility 😉), I’d guess that you’d probably take Sam on as your client – and tell Ben how sorry you are that you can’t help him at this time.

You would, of course, wish Ben ‘the best of luck’ in finding another adviser, and he’d need that luck too because, for the same reason as you, as an adviser, decided to turn Ben away, most other, busy and competent, advisers will do the same.

Now, what do you think of that?

If you were not already familiar with these charging structures, I imagine you’re shocked.

Or perhaps you’re not sure whether to believe what I’m saying?

After all, it sounds unbelievable that a professional adviser would adjust the £ value of their advice fees according to how much someone is worth, doesn’t it?

What other profession does that?

- Your dentist?

- Your private surgeon?

- Your fitness instructor?

- Your accountant?

- Your solicitor?

- Your hairdresser? *

*OK, I accept that I don’t have much recent experience of hairdressers!

*OK, I accept that I don’t have much recent experience of hairdressers!

However, I’ve had dealings with all those other professional types, including a world-leading surgeon who’s operated on various levels of my spine over the past 10 years. And I can confirm that none of these other professionals varies their charges according to what their clients/patients are worth.

You might say there’s an exception with Lawyers offering ‘contingent’ fee arrangements (CFAs) when dealing with claims for damages.

In those (no win, no fee) CFAs, people of limited financial means can get professional support in taking on deeper-pocketed negligent parties.

Of course, the Solicitor needs to take a reasonable percentage slice of your award for damages, in order to pay both for their work on your case and to cover the unpaid work on the cases they lose. There’s a cross-subsidy there.

Financial advice is very different though.

You’re not looking to eliminate a risk of being out of pocket (to pay your own and the defendant’s legal fees) if you lose your case.

You’re simply looking for advice on how to arrange your finances efficiently.

There’s no need for adviser fees to be contingent on the sale of financial products. This is just a hangover from the days when commissions were paid on the sale of investment and pension products.

The odd thing, despite commission being banned at the end of 2012, is that it’s effectively still paid on this PFUA basis.

So, while it’s true to say that these fee amounts are now, in theory, agreed between you (the client) and your adviser, this is really no different to the flexible commission and product charge structures that we had decades ago.

I know I was there,

designing the products!

I also know that it cost hundreds of millions of pounds to change hundreds of investment and pension provider systems – to cope with fees instead of commissions.

I’m just baffled as to how you, the consumer, have benefitted from the switch to fees in 2013.

Ho-hum.

Anyway, the key problem with contingent charging is that advisers don’t get paid anything for the advice they provide unless you invest some money with them.

This compounds the risk of overcharging because a great deal of adviser time is wasted advising clients who don’t take up the advice… an event so common that there’s even a shorthand term ANTU (advice not taken up) used to describe these cases.

Obviously, someone has to pay for that wasted time, so it’s charged to the few who ‘take up’ the advice and buy the financial products.

Simples!

Some might argue that contingent charging gives a lot of less wealthy people access to ‘free’ advice and financial education but that argument simply doesn’t hold water.

When an adviser is paid a bonus on landing financial product sales (and their job is at risk if they don’t) they will, understandably, ‘move on’ very quickly if they find out that your ‘wealth level’ does not meet their minimums. They’re not paid to sit around and educate you – and most won’t.

This is just how things work… or should I say, don’t work in large parts of the financial advice and wealth management industries, across the world.

In many cases, you will incur fees as a ‘percentage of funds under advice’ (PFUA), but only once you take up a financial product or investment service.

Are there exceptions?

Yes, some advisers who charge on the PFUA basis, discount their percentage rate of charge on larger funds – or on the top slice of larger large funds.

The idea here is to prevent the charges from becoming ‘excessive’… by the adviser’s own definition, of course.

Other advisers might offer to charge you at a rate of £X per hour (or £Y per project) as in some other professions – which can make it easier to see what you’ll pay for advice if you get an estimate of the time that will be spent advising you on a particular issue.

Note:

On hourly charged fees, the transparency of the £ fee amounts can make them look expensive, but don’t run for the hills before comparing those fees to what you’d incur under a PFUA fee basis – over a number of years.

Your prospective adviser should be able to help you with that – and you might be surprised at the comparison.

In any event, fees (without discounts) as a percentage of your fund value remains a common way to charge for financial advice today. So, watch out for these PFUA fees – especially if you have a lot of money invested.

Are PFUA fees all bad news?

Well, not in all individual cases but for the industry as a whole, I’d say yes.

PFUA based fees are not necessarily bad for people of more modest means who can find a good adviser.

Take Ben, for example.

If Ben could find a good quality adviser, he might be able to get help with a full financial planning exercise (including investment advice and the necessary financial product brokerage) for around 2% (£1,200) or 3% (£1,800) of his investment.

Yes, that might sound like a lot if you’re unfamiliar with advice costs – but it’s really very fair for the work and value-added – provided that the help comes from a solid adviser.

What’s more, if Ben had no need for ‘ongoing advice’ for a while, he might (with the right adviser) be able to avoid the other £6,000 (or more in total) of ongoing fees for that.

He could perhaps agree to pay an hourly fee for any additional advice – as and when he needs it – in the future.

The problem is that there just aren’t enough good advisers out there who are prepared to offer this kind of ad hoc advice service (as opposed to a PFUA ongoing charge) to the likes of Ben. There are some, but not enough, because most are too busy working with, (or tracking down) much richer people.

The rich could change this market

Hopefully, you can see by now that if nothing changes in the ‘face to face’ financial advice market – and rich people carry on (happily and knowingly?) paying ten, twenty or even fifty thousand pounds a year for their ‘wealth management’ … then people like Ben will, for the most part, continue to be left to fend for themselves.

Some advisers do spend some time with people like Ben, but even if they gave free advice to one Ben for every rich client on their books, it still wouldn’t make a dent in the enormous need for advice that we have in the UK.

That’s why financial education is so important!

You really need to understand the basics of how to plan your money… and that includes knowing how to avoid unnecessary charges on it.

If you like the sound of that – just sign up to my newsletter.

You’ll only receive solid ideas (to help you make better choices about your money or to earn more of it!) and I will not sell you any financial products or investment services.

This is about education,

pure and simple.

Also, if you’re on my newsletter list, I can send you updates about the NEW courses I’m planning to launch early next year.

Is this advice shortage problem NEW?

Oh no, this issue has been around for longer than the 35 years that I’ve been around, inside and out of the financial services industry.

Despite, or in some areas, because of regulatory changes, the problem is getting worse.

In 2014 about half of all Financial Advisers said they would be happy to take on clients with less than £100,000 to invest.

5 years later, in 2019, that number had fallen by two thirds – to just one in six advisers. The evidence is here from Canada Life

In short, the availability of good quality, face to face, financial advice, for ordinary people with good levels of savings is collapsing here in the UK.

What else is causing this advice shortage?

Well, as you’ve seen, the PFUA model does incentivise advisers to focus their time on wealthier clients, but this is not the whole story.

Here are three other factors pushing the market in the same advice-shortage direction.

First, the regulation around financial advice is complex and burdensome – which means advisers have to spend a great deal of time documenting the information obtained and the advice given.

These regulations are intended to help protect you from bad advice. So, you probably can’t expect many simplifications (or adviser cost reductions) in this area anytime soon.

Second, the UK’s tax rules are way too complex and burdensome – especially around pensions (as we saw with the Doctor’s pensions crisis ) and financial planners have to undertake an enormous amount of work to, quite rightly, help their clients to arrange their affairs tax efficiently.

Will this change?

Well, some complexities of our current tax system are just so silly (or in certain cases flawed and abusive) that they simply must be changed.

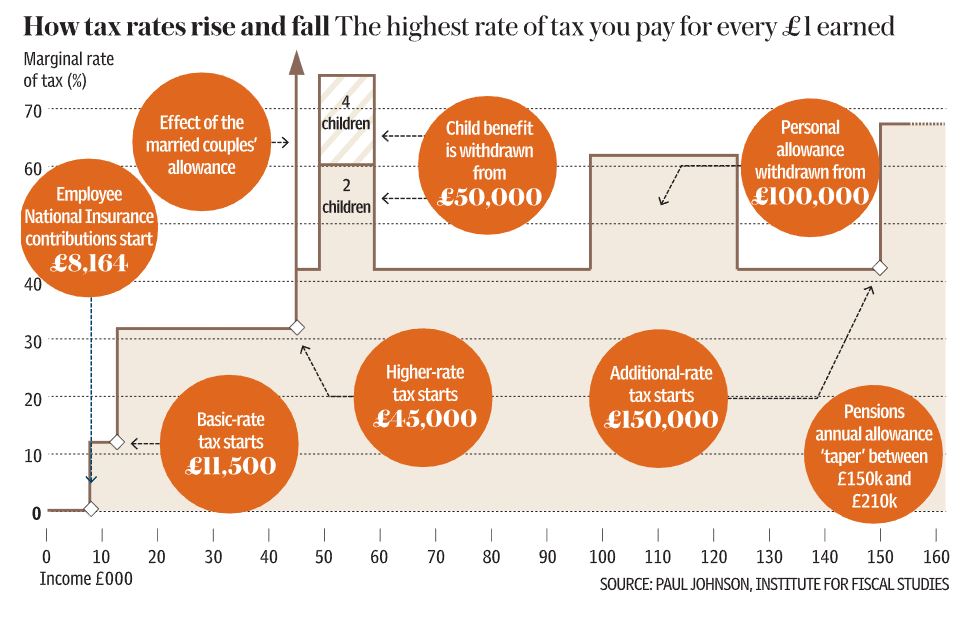

This chart gives you a clue to our current marginal tax rate silliness – but it only scratches the surface of the rules on all taxes – for individuals, companies and trusts.

The complexity of the complete picture is mind-boggling.

You might like to think that one of our governments would recognise the madness of these tax traps and ‘cliff edges’ and commit to simplifying our tax system… or at least to doing so once the Brexit shenanigans are over.

Yes, you might hope, but I’d not hold your breath.

If Labour gets into power at the next election you can expect higher taxes on folk with higher levels of income and wealth.

That will mean more work, not less, for the best financial advisers and the advice shortage will get even worse.

Third, there’s a lack of supply of young new advisers coming into the industry to replace the ageing and retiring adviser population.

This is an enormous problem made worse by the poor trust rating of the wider financial services (FS) industry which, like the Curate’s egg, is good but only in parts.

Clearly, the FS industry does not enhance its reputation by charging PFUA fees at high rates on wealthy people and ignoring the vast majority of ordinary people.

A lot of young savvy people today look for good, purposeful work. If they see the face-to-face part of the advice industry as being focused on making the rich richer, they’re unlikely to want to join.

So, something needs to change here.

Will the regulator ban PFUA?

Possibly, but unlikely.

The UK’s financial regulator (the Financial Conduct Authority or FCA) is unlikely, in my view, to ban PFUA based advice fees any time soon.

They had a chance to do so when they (supposedly) banned commission payments on investment and pension products at the end of 2012 but didn’t do it, probably because they feared it was too big a risk to the adviser market at that time (and they were probably right).

However, this is a specific (bad incentive) issue they’re seeking to address and I’m not aware of any plans to extend that ban to other areas of advice or to ban PFUA shaped fees.

Generally speaking, the FCA takes the view that fees are a matter for you, the client, to agree with your adviser.

I tend to agree – but that does mean you need to learn enough about charges to make sure you’re not being ‘stitched up’

At a very high level then, I don’t see any market or regulatory drivers on the horizon that will significantly drive up the availability of advice for ordinary people.

The ironic thing is that we need more ‘wealthy-advised’ investors to demand lower rates of fees (if their current PFUA based fees are excessive) to drive efficiency in the advice market and make advice more available to everyone else.

This is therefore likely to be a ‘slow burn’ type of market shift… unless this Insight goes viral of course – and that’s down to you 😉

Summary and action plan

- Please help to fix the Financial Services Industry. Don’t overpay for advice. When you cut out excessive fees for advice or ongoing services, you help to drive much-needed efficiencies in the industry and help to clear away some ghastly charging practices. That, in turn, will make the industry more attractive to the young (purposeful) talent that it so desperately needs for the future to provide more ordinary people with solid financial advice at a fair price.

- Learn how small unnecessary charges add up. A 1% p.a. charge might not sound much for ongoing services but it can take an enormous chunk from your wealth over time as we saw in Sam’s example in this post. You can see the effect of an excess 1% p.a. charge on other lump sum and regular savings amounts here.

- If you receive valuable ongoing services from your adviser or wealth manager, pay for them. Just don’t pay thousands for a statement and an annual chat. And if you really don’t need regular ongoing help, don’t pay for it with a PFUA based fee. Many good advisers offer a fee basis that charges you only for help when you need it but again you need to take care – as some firms might have a minimum annual fee for you to be retained as a client.

- Accept that you might have to pay high fees for certain complex advice. Whilst you might pay, say £100 to £150 per hour for advice arising from uncomplicated finances – this might increase to £200 to £300+ p/h. if your advice needs are more complex. Think about this in ‘brain surgeon’ terms. You wouldn’t want to hire one of those on the cheap!

- Remember that Quality doesn’t always match the price in areas of financial advice! Some advisers are less capable than others. So, if you’re not sure, learn what good looks like, and learn how to find and interview an adviser – from an experienced financial coach.

- Learn to draw up your own (basic) financial life plan. This sets out your financial situation, your financial life goals and some ‘rough’ estimates of the investments or savings you’d be happy to allocate to each of your goals. It’s a very valuable item and better equips you to engage directly with a product provider or a financial adviser if you need one. What’s more, if you create your own outline plan you could negotiate a discount on any advice charges you later incur – because you’ve already done part of the adviser’s job for them.

- Make sure that your initial, outline plan is aligned to the way professional advisers work. This will help your understanding of your plan and help you to share it with your partner if you have one. It’s also the best way to plan if you’re going to need advice later on. If you don’t know how to do this, seek help from a financial planner or coach who’s qualified in financial planning matters.

- Sign up to my occasional newsletter for more (mostly shorter 😊) Insights. These ideas will help you make more of the money you have – and to make more money too, if you need to. If you’re not (yet) wealthy, you’ll want to learn the fundamental lessons here, because as we’ve seen, you might struggle to find high-quality advice at a modest price. Or, if you are wealthy and you have an adviser, the ideas you’ll find here will help you to check if the advice you’re getting is worth what you’re paying for it!

Final thought for Financial Services Professionals

I know that no good adviser likes to refuse people access to good quality financial advice – because that only leaves the enquirer vulnerable to bad advice or scammers.

However, I also know that this is just how it has to be. There are only so many hours in the day, right?

Thankfully, increasing numbers of solid (value-based) financial firms now offer financial information to the wider public.

Whilst the best have developed high-quality educational programmes as an integral part of their business proposition, and are delighted to see how these programmes help them to grow their core business.

If you’d like help in developing your own educational programme – let’s talk about that

My work is proven in this area and you can check that out if you connect via LinkedIn.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article