The sales person’s favourite chart

And why it's no use to you

24th February 2018

The sales person’s favourite chart

And why it's no use to you

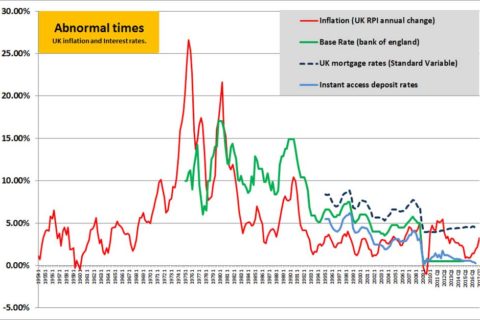

24th February 2018The red line chart below is the financial sales person’s favourite chart about stock-market investing. Let’s see why it’s most likely NO use to you at all.