Investment risk bubbles are everywhere

But, incredibly, not all the experts believe they exist

Hey guys, I’ve just (October 2020) updated some parts of this long post on investment risks.

The last time I updated it properly, was in February 2018.

I may update it again, at some point, when something significant changes.

For now (October 2020) my message is simply this:

The risks in markets are getting higher

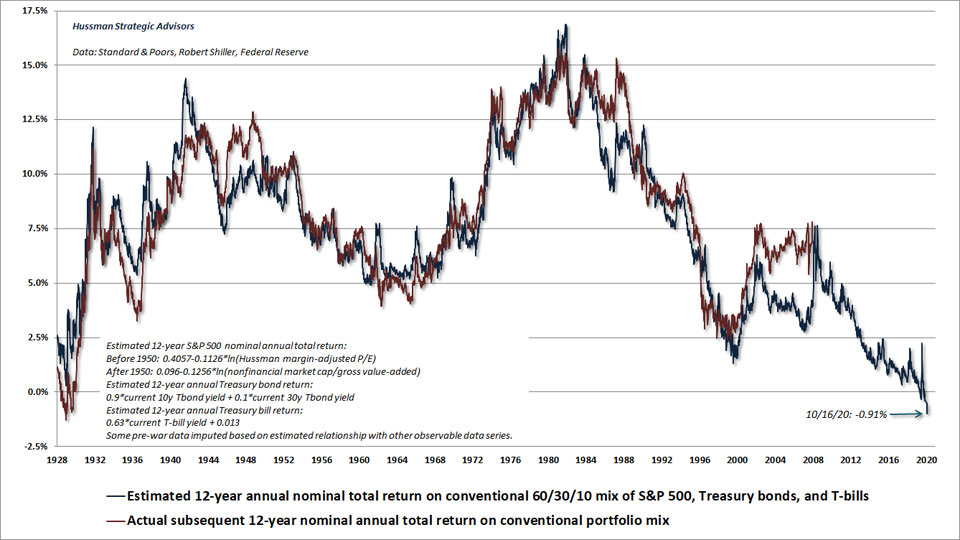

I’m sorry if this is the first time you’ve seen these warnings because market overvaluation (esp. in the USA), which briefly started down in late 2018, is now even more extreme – as this article from John Hussman illustrates well.

So, please read this carefully if you want to rationally consider the risks on your money.

Do this before you talk to your usual financial adviser – and be especially wary of advisers or wealth managers (or bloggers) who tell you to ‘relax’ and ignore market risk.

That sort of attitude might be fine for some of the time. Indeed, the statistics show that it works fine, most of the time – because most of the time stock markets don’t sit at extreme valuations.

It just rarely works (and never for long) when stock markets reach the extreme levels they have done (again) recently.

Any reasonable person can see that price bubbles do ‘blow up’ from time to time, whether it’s in the prices of bonds or equities (aka stocks) or homes or commercial property.

It’s just that right now, in many places, a lot of these assets are sitting at absurdly high prices – and for one simple reason.

Central banks have distorted the prices in all these assets by taking the returns on your ‘safe’ alternative (Cash deposits) down to zero.

Before the last few years,

interest rates have never

been at these super-low levels.

So, if your adviser tells you that these times are ‘normal’ or they try to assure you that they know exactly how this interest rate (and QE) experiment is going to play out, you can take that with a pinch of salt – because we’ve simply NOT been here before.

What’s more, with economies crushed by Covid and government debt going through the roof (see this from the FT 19 October 2020) let’s be honest…

No one – and I do mean ‘no one’ knows what will happen next.

What we do know is that the risks in markets are high right now – very high indeed.

What’s that quote about?

Well, although most people haven’t heard of John Maynard Keynes it’s worth remembering that he was (and still is) considered by many to be one of the greatest economic thinkers of all time.

And yet, he made that ‘don’t worry’ type of statement just two years before the start of the great depression.

Between 1929 and 1932 the price of the wider US stock-market fell by 85%.

What’s more, a lot of companies listed on the US Stockmarket went bust in that depression.

So, investors in those particular shares lost all their money – which I guess is what happened to the guy in this famous image.

So, my first message here – for when markets go haywire and investors panic is this:

Calming words from experts

Count for nothing

Interestingly, from the middle part of 2016, some ‘experts’ did start to warn about the increased risks in markets.

Warning 1 – the experts have been worried for some time

In the Financial Times, October 14, 2016, Gillian Tett shared the concerns of Axel Weber (head of UBS and former head of Germany’s Bundesbank) about what’s really shaping markets now.

Their shared concern – in a nutshell – was this:

“markets are not true

(free) markets now”

And “this point needs to be proclaimed with a megaphone”’, said Tett.

I agree (and have done for some time) and I think most informed commentators agree too.

The actions of the world’s central banks have distorted markets for years but we (and they!) only now seem to be fully waking up to the RISKS of their actions.

Mohamed El-Erian, commenting on an FT article on 17 October 2020 – talked about how officials at the US Central bank were now becoming concerned that

“low interest-rate policies could encourage excessive risk-taking”

What might they do about it?

That will be interesting to see. I’m not sure there are any easy answers – once you’ve painted yourself into the corner we’re in now.

They’ve known about this problem for a while; the Office of Financial Research (an independent arm of the Treasury in the USA) cited the record-high valuations in the US stock market a couple of years back stating that very high recent returns – alongside low volatility – have encouraged investors to load up on riskier strategies – which could unravel in a tumultuous trading environment.

Specifically, they said:

We know that markets work in cycles.

Booms end; corrections happen.

Market valuations tend to return to long-term trends over time…

Market risks — risks to financial stability from movements in asset prices — remain high and continue to rise.

Yes, well…

And back in the summer of 2017, (FT, 25 June 17), all major central banks were warned by their central bank – the Bank for International settlements (BIS) that:

Keeping interest rates too low for long could raise financial stability and macroeconomic risks further down the road,

as debt continues to pile up and risk-taking in financial markets gathers steam

What actions were taken? None, as far as I’m aware.

Meanwhile, again in 2017, back here in the UK, we saw worrying signs of a bubble in commercial property with local councils adding to the ‘froth’ see here.

I can’t imagine those investments can be looking healthy now, either – with all the Covid shutdowns…

You may recall that councils were heavy depositors of taxpayer funds in risky Icelandic banks before the last big crisis – in 2007.

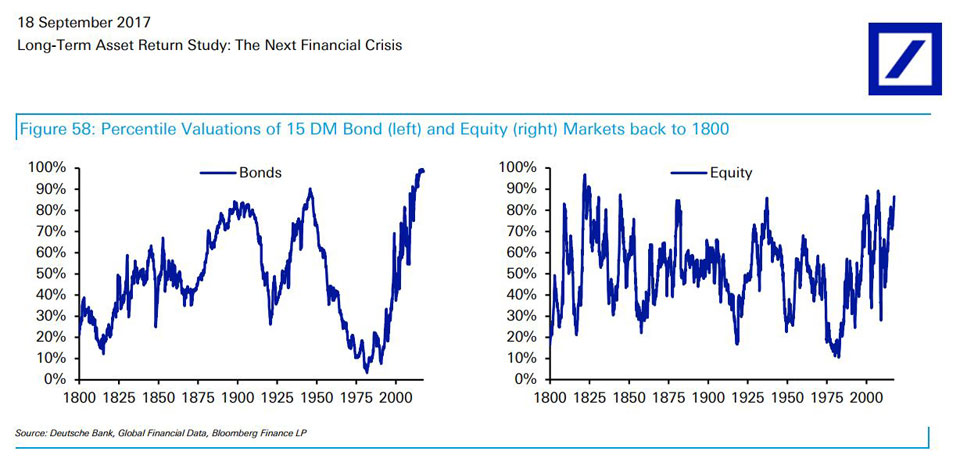

The prices of shares (equities) and bonds were ‘stretched’ three years ago.

These images from Deutsche Bank’s warning note in September 2017.

And even the normally ‘bullish’ Goldman Sachs gave a similar warning. See the chart below. And, according to the FT, Brian Levine, co-head of global equities trading at Goldman Sachs, emailed their bigger clients on Friday 9 Feb 2018 to warn that the market has probably still not hit its bottom.

“Historically, shocks of this magnitude find their troughs in panicky selling,” he said.

“I’ve been amazed at how little ‘capitulation selling’ we’ve seen on the desk . . .

The ‘buy on the dip’ mentality needs to be thoroughly punished before we find the bottom.”

So, whichever way you read it – shares and bonds have not been this expensive at the same time for more than 100 years – and possibly a lot longer.

Prices are clearly ‘off the scale’ against any normal measure.

So, it now seems clear to most that the central banks of ‘so-called’ developed countries let this super low-interest rate ‘game’ run on for way too long.

They’ve painted themselves – and investors into a corner – and I don’t think they know how to get out of it, which means that financial markets could get seriously messy as investors scramble to get out of their positions.

When leading investment bankers and fund managers issue warnings – as they started doing in 2017, there’s cause for concern.

So, let’s look further at the evidence.

Warning 2 – the Economic expansion lasted too long

This expansion was very ‘long in the tooth’ when the Covid Crisis brought it to a halt. It was already overdue a breather.

But what’s more interesting is to ask what caused all those long expansions since the early 1980s?

We’ve had one after another, with barely a let-up as if the ‘business cycle’ had been banished to history.

What drove all this growth (in the economy and asset prices) in the US, the UK and elsewhere, for the past 40 Years?

Has it all come from the ‘white heat’ of technological advancement?

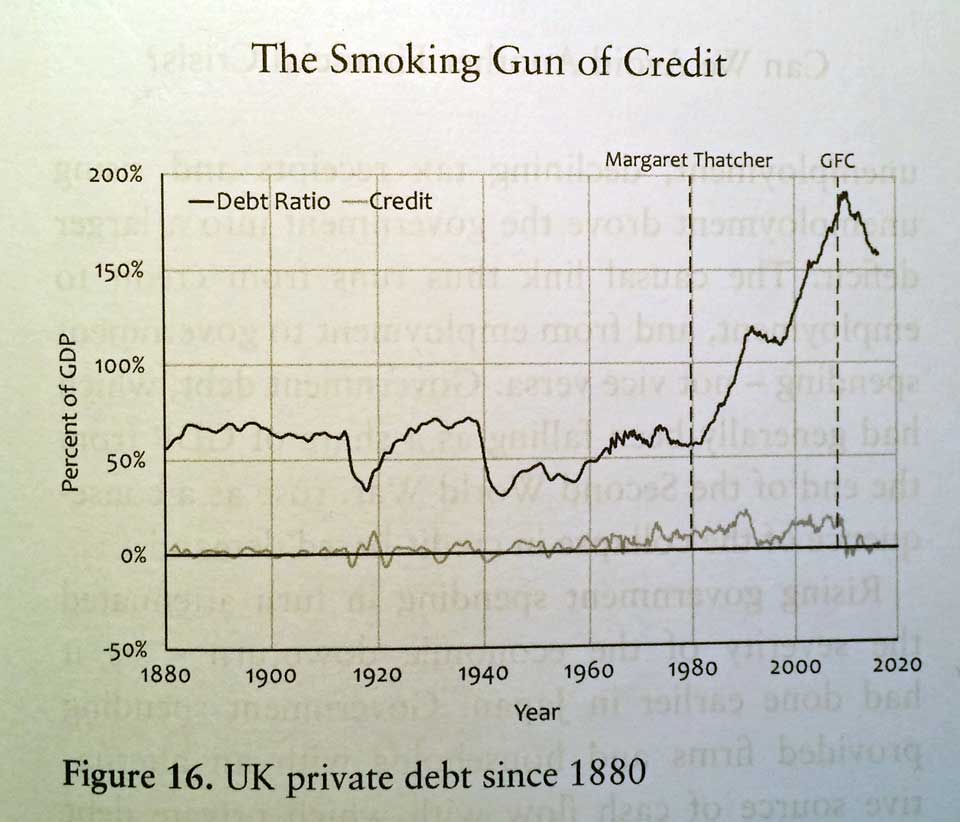

Well, yes, some of it has for sure – but if you read Professor Steve Keen’s excellent new book, ‘Can we avoid another financial crisis?’ you’ll find these charts which reveal another, more disturbing reason for it.

A lot of growth in recent decades has been an illusion

It’s come about because of consistently increasing levels of private debt, and that’s simply not a trend that could have carried on indefinitely.

Warning 3 – investors have borrowed too much

Now whilst borrowing generally has been ramping up for 40 years, there’s another shorter-term indicator to worry about here.

This is about investor borrowing, the level of which has ‘flashed red’ before previous crashes and has been flashing bright red for some time now – which proves that, like earthquakes, hidden pressures in market systems can build, but we will never be able to predict when a crash will strike.

And that’s absolutely right.

Incidentally, we know from the data that the frequency and size of stock market moves are similar to those of earthquakes. Market movements do not follow a ‘normal distribution of returns’ and that’s contrary to what is taught to investment advisers in their exams!

However, what we know for sure is that markets do crash (very quickly) from time to time. And those falls normally come after a lot of buying pressure has built up – to take the market well above it’s normal valuation range.

So, take a look at this chart (from Doug Short at Advisor Perspectives) on ‘margin credit’ which shows how much investors are borrowing, to invest!

I think it tells a powerful story (and if you click it – you’ll be taken to updates on Doug’s site)

What the chart tells us

Well, sorry to state the obvious but the blue line (of the price of the S&P 500, representing the US stock market) has a nasty habit of overheating when investors borrow a lot (the red bars)

Note that these are inflation-adjusted borrowing numbers too. So, clearly, investors have borrowed much more heavily in recent years.

And that’s not surprising given that the cost of borrowing is at all-time lows. Interest rates are several per cent below what anyone would describe as ‘normal’

Borrowing has been mega cheap, while the return on your money left in the bank has been mega awful!

So, there’s been a double incentive to borrow to invest!

Warning 4 – interest rates could rise – a lot

Of course, interest rates are super low at the moment, and they could possibly stay low for some time to come.

But at some point interest rates will need to normalise, if depositors are to be rewarded for saving. And they won’t have to rise by much for the yield on shares to start looking very unattractive – which makes shares at current levels very sensitive to moves in medium to longer-term interest rates.

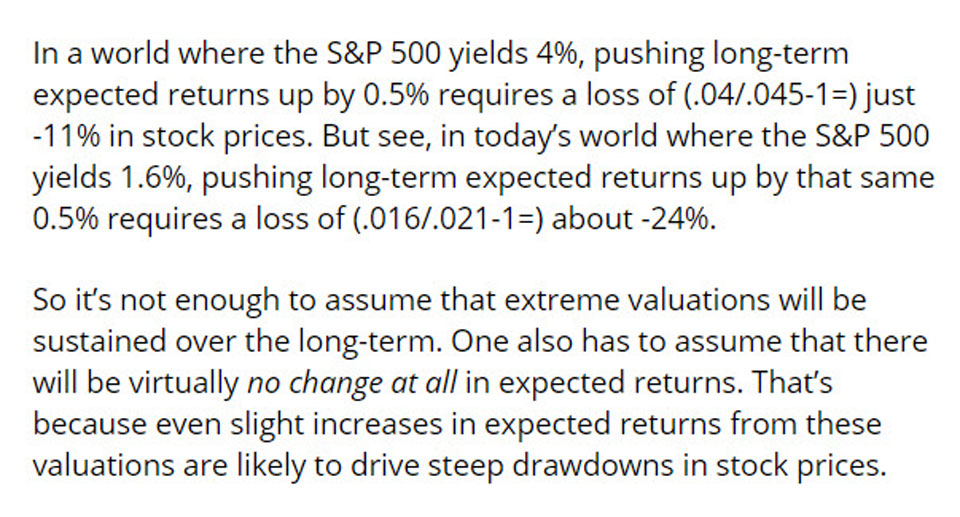

If you want the maths behind that statement, an extract of the relevant bit is here taken from John Hussman’s excellent October 2020 post on herding

Of course, this just reinforces what The Bank for International Settlements said in December 2017 when they warned:

of frothy valuations in financial markets

of consumer debt reaching unhealthy levels and that

our current, short-run calm could come at the expense of long-run turbulence.

So, they realise that raising rates too quickly could cause a panic in markets that have grown used to cheap central bank cash, but they were (before Covid) also suggesting no delay to rate increases to avoid rates having to rise further and faster in the future.

In a nutshell…

The mood music around interest rates had changed – and quite dramatically – before Covid – and it looked as though the cost of borrowing would rise which would stem the flow of money into the stock market and other risky assets – as investors found better returns on nice safe money held in the bank.

But that’s not happened yet.

So, for now, while main street burns (or sits indoors wondering if they can find a job) the Wall Street party continues, and stock market valuations get stretched ever higher.

Will the markets ‘defy gravity’ for much longer.

The key point to note here is that big market crashes tend to come when those borrowing investors ‘cash out’ of their shares to pay back their debts.

So, this potentially nasty situation is just getting worse, day by day.

And while it’s true that some big risks in stock markets never materialise, it’s clear that this (borrowing) indicator is not looking good (again) right now.

Warning 5 – stock-markets have risen – a lot

Now before we get into this one, let’s be clear about one thing. If you don’t yet have a large sum invested and you’re saving regularly over the long term – then this issue may be less of a worry for you. Indeed, a big market correction early on in your regular savings journey could very well be to your advantage – as you get to buy in at lower prices.

On the other hand, if you do have a lot invested in the markets and, especially if you might want to cash in some or all of that over the next few years (perhaps for your retirement income) then market risks are much more important, as I explained here.

Asset price parties usually end abruptly.

The US stock market is up by more than 400% (including reinvested income) since March 2009.

That’s an incredible return compared to what you’d have earned from money at the bank, and while it’s all very nice for those lucky enough to have been fully invested over that time – the important question for investors is:

Can such returns

be repeated from now?

Well, as you may have guessed, I’m in the camp of people who think that’s unlikely.

Yes, it’s possible but it seems extremely unlikely given how ‘stretched’ the valuations are today.

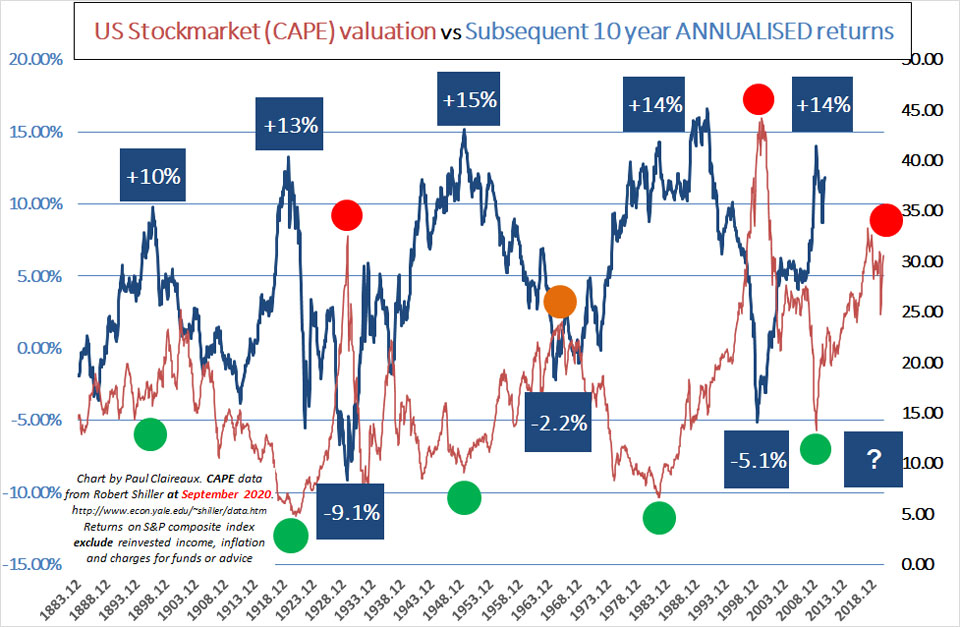

We need to remember that – the US stock-market has only been up at current valuation levels on two previous occasions in the past 130 years.

As you can see, those years were 1929 and 2000 – and both occasions were followed by a crash!

You can read more about CAPE – which is a powerful market valuation indicator here

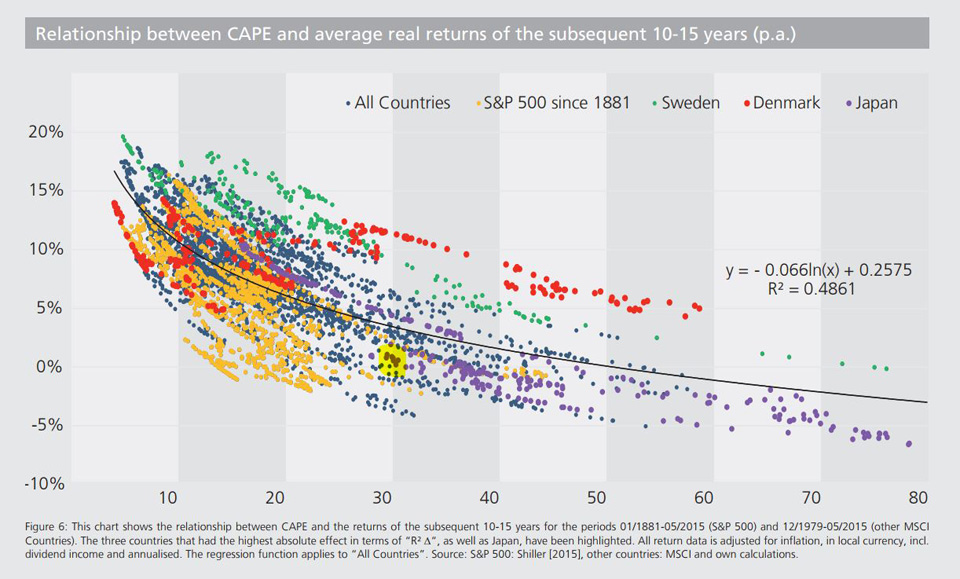

For now it’s worth remembering what Professor Robert Shiller, the Nobel Prize-winning creator of the CAPE indicator, was expecting as a return on the broad US stock market going forward from 2017 when he said, that real returns on the US stock-market might only be around 1% p.a. over the next 10 years.

Deduct ‘typical’ charges for most retail investment products from that – and it means Zero or negative real returns for most investors if he’s right.

Obviously, as we’ve seen already, there’s no certainty in that estimate – and returns could be higher or lower than that. But this picture borrowed from Star Capital gives you a feel for the range of investment returns that have occurred in the past depending on the Shiller CAPE starting point.

Look at the chart

Ignore those ‘outlier’ red dots, which are for the Danish stock market (not relevant in world capitalisation terms, though the data illustrates unpredictability)

And focus on the orange and purple dots, which show the returns from the world’s largest stock markets of the past 50 years (The USA and Japan)

They should give you an idea of how Professor Shiller arrived at his estimate of 1% p.a. – a point above the number 30 that I’ve highlighted in yellow.

Today. 19 October 2020, that Shiller CAPE indicator stands at around 32. So, the prospects for great – if any returns are not great. And according to Hussman’s model (a development from CAPE) the prospective returns are currently negative – before inflation!

So, what does all this mean for YOUR money?

Well, as ever that depends on your capacity to endure market downturns, and without knowing anything about your personal situation, no one can advise you on that.

That said, if you take Shiller or Hussman’s estimates for little or no returns on the US stock market over the next 10 or so years. And you factor in the possibility of some very big bumps along the way. Well, it might make you question the wisdom of betting the farm, on stock markets right now.

The bottom line is that you must decide, with or without guidance, what to do with your money.

My general guidance about investing is clear and it’s this.

The right answer depends completely upon your personal circumstances. There’s no silver bullet and no single investment to suit everyone’s situation – because we’re all so very different.

Just follow a solid four-stage process to work out what’s right for you. More on that here.

This is about understanding your own personal ‘appetite for investment risk’, and, more importantly, your personal ‘capacity for risk (and loss’ on each of your financial life goals.

Only when you know these things can you invest intelligently.

Warning 6 – some financial advisers ignore market valuations!

Possibly the strongest warning I can offer you is this.

Not all financial advisers deal with investment risk in the same way – and sadly, quite a few ignore market valuation extremes when giving advice.

This group of advisers – and they are something of a group – will tell you that stock markets are priced perfectly at all times – to produce good long term returns, regardless of when you go in.

Now, I have to tell you – that’s NOT clever advice. And if that’s what you get told at a time of extreme valuation, as now, it could seriously damage your wealth.

It’s this adviser behaviour that’s partly to blame for the reality in this cartoon.

(read the signs in this cartoon carefully- it’s how a lot of people invest)

So be careful how you choose your adviser/wealth manager and know what to ask them – before you appoint one.

All advisers are not the same and nor are their fee levels.

A quote to finish on?

If you follow my work, you’ll know I love a good quote, so let’s finish with one more on an issue of behavioural science – from long before the term was invented.

Of course, this is not going to stop me from issuing these warnings.

And I urge you to take extra care out there right now

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article