Why it can be boring, expensive or dangerous to learn about money

and how you can change all that

If you really want to learn about money – but find the subject leaves you baffled or bored – you’re not alone and this Insight is for you.

(Financial experts might find it interesting too)

Warning: Chunky read ahead…

Just to say, before we get started, I do realise the irony of writing a long blog about boredom 😉

The reading time for this one is between 5 and 15 minutes (depending on your reading speed) plus any time you give to the videos.

That said, if these issues affect you, your family or friends, the ideas you’ll find here could save you hundreds of hours of wasted time… and hundreds (or even thousands) of pounds in unnecessary charges and other financial losses over the coming years.

So, you might want to give this Insight a go 🙂

Yes, learning about money is (usually) boring

When I first meet people, they often say to me,

‘Oh, I should really learn more about money,

but all that budgeting, pension planning and investing stuff is just so boring and complicated’

Which is true, wouldn’t you agree?

Most of what’s written (and said) about money matters is horribly complicated and deadly dull.

In fact, I feel so strongly that this is one of the biggest challenges we face around money, that I produced this video about it!

Important note: The open learning workshops I mention in that video are not running at the moment. For updates on these and my online learning programme, launching this year, sign up to my newsletter here

Find a safe, solid and fun place to learn

You know that getting your finances badly wrong is a serious issue – but that does not mean you can’t have fun learning about it.

Indeed, let me warn you right away that the ‘serious-faced’ money people who might baffle you with all that technical jargon are, in many cases, simply hiding the fact that they don’t really understand the issues themselves.

Trying to blind someone with science is usually a giveaway sign – as Einstein observed a long time ago. More on that anon…

Anyway, the key message here is that you absolutely can have fun learning about money.

This is precisely why I built this site – to help people like you, get to grips with the big issues around this stuff.

This is a fun place for you to learn about money and, more importantly, it’s a safe place too.

How is it safe?

Well, here you can learn the essentials about money – without telling anyone anything about yours.

So, this is completely different from learning about money from a financial adviser – even if that were an option for everyone, which it isn’t, as I explain below.

You see, if you want advice on where to invest your money, your financial adviser will have to delve deep into your personal financial situation, your attitudes to money and your personal life goals.

The financial regulator won’t let them recommend investments or pension plans to you unless they do this, and and quite right too!

Unless your adviser knows all your personal details, they can’t be sure that their recommendations will be suited to your particular circumstances.

By the way, this is also the reason why…

you will never find a financial plan that works for you in any blog or book

…and that includes my own books, which I’m told are some of the best 🙂

The essential point to understand is that your financial life plan needs to be connected to your life, so it must be unique to you because you are different from anyone else

The problem is that a full financial planning process can be a lengthy and expensive process to work through.

Once you engage with a regulated adviser (and I’d suggest that most people do) – they will need to:

- Conduct a full financial and personal ‘fact find’ of your circumstances.

- Assess your attitude to investment risk

- (Possibly) do an analysis of your potential future cash flows.

- Explore your financial options – to optimise your financial outcomes – taking account of different tax wrappers and investment choices.

- Write this all up into an understandable report with recommendations

- Have another conversation to discuss this with you – take your feedback – and possibly refine the plan.

- Conduct some brokerage (if you’re dealing with an independent adviser) to find the best financial products from the whole market – and

- Set those products up for you.

The scale of this process is a big reason why very few of the best (and most sought after) financial advisers have enough time to spend teaching people the fundamentals about money.

Certainly, the reasons for the advice they give should be spelt out in their recommendations, but this won’t, on its own, help you to understand the wider concepts around planning your money.

And it’s these fundamental concepts that are essential for you to understand before you take advice.

Education is not where most advisers focus

In fairness, a small number of financial advisers (and some financial product providers and investment houses) do offer some very useful financial educational materials to help you get to grips with the key issues around your money. But these advisers are the exception, not the rule.

Most advisers will want to move you through their advice process (to invest your money or buy any other financial products you need) as quickly, and as comfortably, as possible.

This is perfectly reasonable. You go to an adviser for ‘advice’ – not education. So, they don’t want you to incur additional fees (of hundreds of thousands of pounds) to get a full education around money – and I assume you don’t want to incur those fees either.

You’ll probably get a free* hour or so with your adviser when you first enquire about advice and in that hour, you might get one or two broader ideas around money.

However, you can’t expect to learn many financial concepts in a few minutes. In any event, you’ll spend most of the time at a first meeting, providing your adviser with the information they need to know about you.

Your advisers main objective at a first meeting is to determine whether their services are right for you and if you can afford them. If the answer to either of those questions is no – they need to shuffle you out of the door and get the next person in as quickly as possible; sorry, but that’s just business.

If you’re a good match for your adviser then, after your initial ‘free’ chat, you’ll start to pay something between £75 and £350 per hour (£150 is the average) for any personally delivered financial advice and education you seek.

In summary: If you want to learn about money rather than simply take advice on what to do, then learning within a financial advice process is a very expensive way to do it.

You certainly won’t learn what you need to in that ‘free’ hour (or so) upfront.

* Let’s talk about ‘free’ baby

There are two sides to this ‘free’ issue.

Firstly, the app promise

There’s an app for everything right?

Yes, of course, and there’s a never-ending supply of new ones!

So, don’t expect them all to be around for long – the competition is brutal in this space.

The fact is that, for now, our ‘millennials’ (those born in the 1980s and ’90s) are now turning to these online apps for money guidance.

A fact neatly outlined by Ioana Bain here, ‘Where Millenials turn for financial advice’ (Financial Times, 15 March 2019)

The important question is whether these new apps are helping people to learn about money?

Certainly, some of them have some super useful features to help you monitor your spending and some apps give you ‘access’ to a lot of financial products – and we all know that more choice is a good thing – right?

Wrong.

Research shows that having an abundance of options actually makes it more difficult for you to make choices at all – and, even if you manage to decide, you’ll end up less satisfied with your decision than if you’d had fewer options in the first place.

If you need to learn the basics around money – it’s like you need bread and water.

Does it really help to be offered 20 different brands of coffee?

No, it doesn’t.

What’s more, if you’re just getting started with your finances – like getting out of debt or building up an emergency/home deposit fund… or, frankly, at any stage in your financial life journey… I really don’t think that an app which lists cryptocurrency or other high-risk investment accounts – is what you need in your pocket 🙁

There’s quite clearly a risk of people thinking that because a particular financial product is listed on a popular app, it must be something they need – which is clearly not true.

We only ever need a few financial products but we need to make sure that those we have:

- Are suitable for our (personal) needs and

- Amongst the best in class.

(The number of ‘likes’ given to a financial product on an app – is not the way to answer these questions)

What’s more, according to that FT article, it’s the crypto stuff that’s dominating young user’s interest – and that can’t be a good thing.

So, if you rely on an app for education – watch out.

Do not expect to learn many deep Insights from all those high-frequency snippets pinging on your phone.

And think carefully about how your favourite money app earns its money. Does it rely on selling financial products – from the links you might click? If so, how does that influence the educational messages it sends you?

Be careful that your money decisions don’t just become another number on your app’s ‘click’ statistics.

Second – the free advice time promise

Yes, you can learn some things about money from a good financial adviser but few of them will spend much time on your education without you paying through the nose for it.

Some advisers will tell you that you can have as much time as you like – to learn what you need from them, which all sounds very generous, but I know you’re too smart to believe that.

You know that the TNSTAAFL rule (there’s no such thing as a free lunch) almost always applies in life.

So, if you do get a lot of free time with your adviser (and assuming you take up their services – which you’re very likely to do if you spend a lot of ‘free’ time with them) you will pay for that time through advice ‘charges’ at the back end.

These charges are typically taken from your investment or pension plan as you invest and, very often, again, every year after that.

This is not to say that all financial advisers overcharge. They do not.

However, you need to be smart to find good quality advice – at a very fair price – and to do that, you need to look very carefully at what you’re being charged. Sadly, most people don’t bother!

If you can’t understand your adviser’s fees, you should ask them to:

- Spell them out in £ terms and

- Separate their charges for your initial advice from what they’ll charge you for ongoing advice or other services.

The adviser is obliged to tell you this stuff – by the regulator.

You might be shocked – most people are – by how a small percentage charge – can crush your funds over time but that’s the truth of it.

Indeed, it’s such a KEY issue that I produced another short video on it here.

Get Newsletter updates on future workshops and the online learning programme

Summary – separate education from financial product selling

To learn the essentials of how to plan your money and make good financial choices,

you need to learn from someone who can teach you those things,

who has no interest in selling you any financial products…

… directly or via link clicks!

Can you even find someone to learn from?

Hopefully, by now, I’ve put you off the ideas of;

- Relying on ‘apps’ for much guidance on your money or

- Spending hundreds (or thousands) of pounds on face to face / personal financial education from a financial adviser.

There’s no question that some advisers love offering financial education – but this is just a very expensive way for you to get it.

In any event, this is something of an academic question because… unless you have a ‘sizeable’ sum to invest (typically £100,000 minimum and often more) you’re unlikely to find a highly competent adviser who wants to spend much time with you at all… whether to provide you with education or advice.

What?

Oh, yes, sorry… perhaps I should have mentioned this earlier – but I kind of did.

You see, this is just how the market for Financial Advice has developed in the UK over the past decade.

Highly competent advisers are in very short supply and have more than enough work with wealthier clients to keep them busy – and earn a good living.

What’s more, this problem is getting worse as illustrated by a report from Canada Life (August 2019) which suggests that

only one in six (16%) of UK advisers are happy to take on clients with less than £100,000 of investable capital.

In 2014, about half of all advisers; (three times as many as in 2019), were happy to advise such clients.

So, the availability of good quality face to face financial advice – for the masses – is literally collapsing here in the UK.

Why not ‘Google’ for guidance from adviser (and other) websites?

Hang on a blinking minute…

Setting aside the tons of misleading ideas scattered all over the internet – which I’ll assume you know how to filter out…

… you’re going to struggle to find what you need simply by trawling through a collection of adviser websites.

Yes, some advisers have some really useful information for you to read for free on their websites. However, this information is, understandably, structured towards promoting the particular services of the adviser.

Except in a tiny minority of cases, it’s simply not designed to give you a complete set of lessons on personal finance matters.

It’s also, sadly, the case, that much of that information you’ll find on adviser websites is out of date.

Side note to advisers and product providers

If you need help in updating or upgrading the educational materials on your website – give me a call.

That’s a large part of what I now do and this work is being very well received by leading financial providers.

What’s more, you cannot rely on every ‘lesson’ you get from every financial adviser being grounded in solid science – or good for your financial health.

Too many, allegedly educational but misleading ideas are used for one simple reason – to sell you into an investment service.

This classic ‘Missing the best days’ example is still widely used today.

So, where can you learn?

Well, I’d certainly encourage you to bookmark these two sites for reference on questions around money and pensions.

They were set up by the government, are focused entirely on education and are free to access.

The Money Advice Service offers guides, tools and calculators aimed to help you with your finances.

The Pensions Advisory Service offers impartial guidance on workplace and personal pensions for everyone.

Those sites will be merged at some future date – but if you follow them now – they’ll tell you when that happens.

The information you’ll find there is comprehensive, to say the least.

Though whether it’s all engaging and well written is another matter – I’ll let you be the judge of that 🙂

I might be a ‘teeny’ bit biased but I think if your mission is to learn about money then what you read needs to be both factually correct and ‘engaging’ – fair?

This is a blog about ‘boredom’ – and how to solve that problem – after all.

If you want someone qualified (who knows the money industry inside out- and can help you cut through all this fog) stick with me too – and grab my occasional newsletter so you don’t lose out on updates and New Ideas.

If you want someone qualified (who knows the money industry inside out- and can help you cut through all this fog) stick with me too – and grab my occasional newsletter so you don’t lose out on updates and New Ideas.

You have nothing to lose and plenty to gain.

How this is different to financial advice

Well, quite simply because I’m not trying to sell you financial advice or financial products.

That means I won’t ask you anything about your personal financial situation.

This site is about education pure and simple.

You know that there’s an awful lot of awful information about money out there.

And my aim is simply to help you separate the facts from the fiction.

To cut through all the boring complexities around money – to get to the essential, evidence-based, facts – in plain English.

You don’t want financial gobbledygook and you don’t need any adverts or links to whisk you away to buy any financial products. So, you won’t find those things here either because that’s not what I’m about.

I hope you’re OK with that 😊

For more on me, my background, qualifications and experience head over to my about page.

So, what could you learn here?

Well, that list of lessons is a long one – and to see which topics I cover – click on the ‘Insights’ tab at the top of this page.

In a nutshell, this is what you can learn here:

- How to plan your money – at a high level before you engage an adviser – if you need one and can afford one.

- How some experts might mislead you about money – and how you can mislead yourself (I wrote the book on that!) and

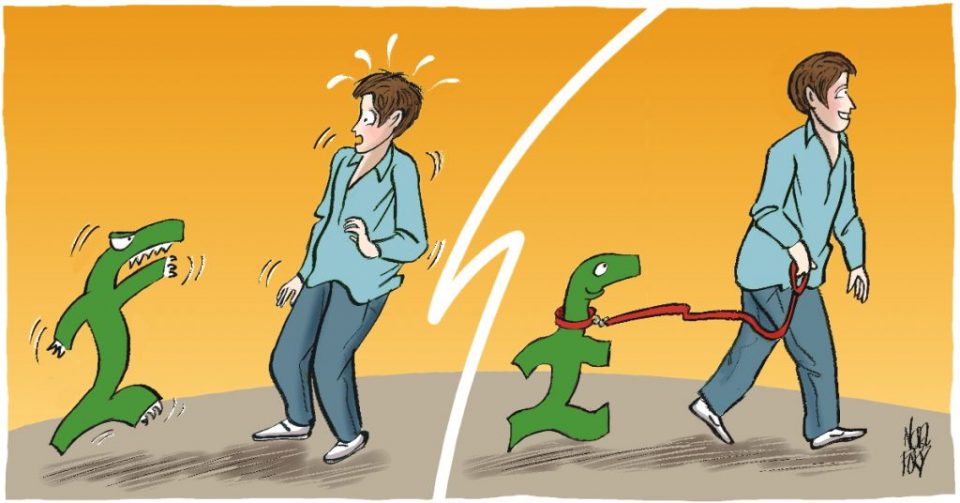

- How to rate any investment that anyone could put to you, before you jump into it – and that’s really important, as this image shows!

You’ll also learn how to spot and avoid any overcharging or incompetent financial salesperson – like that Rhino – who also ‘charges’ too much 🙂 … and how to find a good adviser to give you solid advice at a fair price – if and when you need it.

Just be absolutely clear – I’m not here to ‘advise’ you.

This is just about education – to help you make more informed choices with or without an adviser.

Examples of what you could learn here

Here are a few example Insights that might interest you.

Some of these are available now, others I’m planning for the future.

- A three-part mini-series on financial secrets that all thirty and forty-somethings need to know.

- How to make arguments about money (with your partner, if you have one) a thing of the past.

- How you could build a ‘nest egg’ of £50,000, by saving the price of cappuccino each day.

- How to cut the headline cost of a pension in half. If you only learn one lesson – make it this one.

- How to spot the psychological tricks that advertisers play – to get you spending your money on things you don’t really need.

- How different investments behave and how to choose the right type of ‘money box’ for holding your investments.

- Where to find clues of overpriced stock markets that could expose you to nasty losses.

- The four big factors to consider when working out how much investment risk is right for you.

- How to save hundreds or thousands of pounds in financial advice charges.

- The financial traps that the financial regulator cannot protect you from.

- The big tax traps to avoid and why you should not use ‘aggressive’ tax avoidance schemes.

- How a £4,000 ‘day trade’ could lose you £8,000! – and how to avoid all the big SCAMS

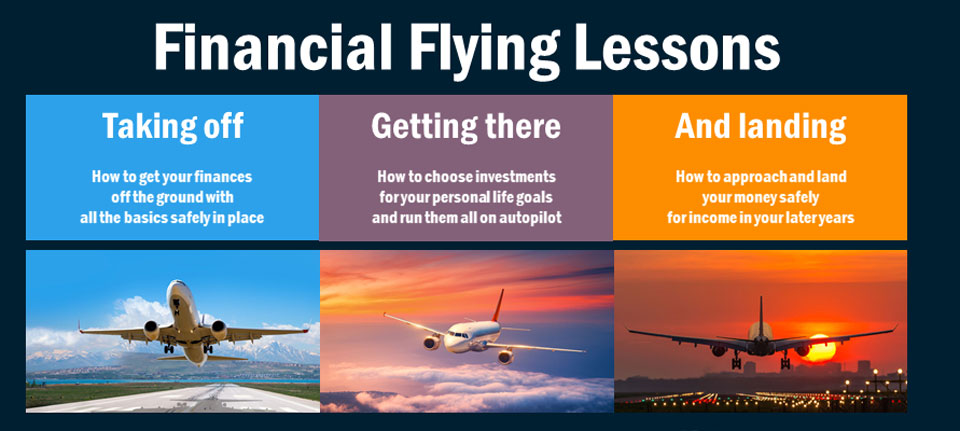

You will find these and many more Insights here either now or in the future as we uncover all the big issues of financial life planning across all these key stages.

Get updates on these and new lessons via Newsletter

How else are you going to learn about money?

Well, beyond searching on the Money Advice Service or Pensions Advisory Service websites – I can think of 5 ways.

First – talk to family and friends.

Yes, you could rely on family and friends, as many people do, for advice about money

These people should, of course, have your best interests at heart but are they the ideal people to learn from?

- Are they qualified to teach you what you need to know?

- Are their ‘opinions’ coloured by their own personal experiences?

- Are the events of the past, that helped or hindered their financial goals, likely to be repeated from this point in time?

More here

Second, you could try those free seminars

You could attend some of the many ‘free’ seminars that are available on ‘property investing’ or ‘day trading’ …

… but I’d strongly caution you against those as I outlined in this short video!

Third – you could read a lot of books.

If you really want to learn about money matters, you could read the many turgid textbooks that are available on financial planning, investments, tax, pensions and life assurance… and a pile of books on classical and behavioural economics.

Just be warned, that’s a very big job (I know, I’ve done it) and you’ll need at least twenty books to cover the ideas you’ll find in here.

What’s more, some of those textbooks are over 800 pages long – and they don’t contain videos, cartoons or any jokes either!

Now, that would be a marathon task – but imagine if you actually read all those books only to discover that traditional investment theory is flawed – which it is!

Imagine how ‘fecked off’ you’d feel then?

And what would you do?

Read another 20 books to understand where the first lot misled you?

Or just give up on all of this?

Well, if you want some good books, try these for starters

However, just be sure you want to spend all your time reading all those books – when all the key concepts are summarised here – in plain English – and updated over time?

Am I joking?

Well, I certainly hope you’re smiling whilst reading this, but no, I’m not joking here.

The consequences of getting your longer-term finances wrong, either on your own or by taking bad, or expensive advice, are very serious.

However, it is possible to have fun whilst you learn.

Option four – talk to an expert?

Well, I think we covered this option already – and you now know that you need to learn the ‘basics’ about financial planning – for yourself because:

- Good quality advice at an affordable price is not available for most people today.

- It’s very expensive to take personal lessons on money from a financial adviser.

Yes, it’s possible to get good quality financial advice but you really need to know how to look for it – and be wealthy enough to cover the fees.

Option 5 – follow along here…

If you are quite wealthy, and you have an adviser – the Insights you’ll find here will help you consider the quality of advice you’re getting today – and whether the fees you pay are reasonable for the work being done.

If you’re not very wealthy, then these Insights are essential for you because there are so few reliable sources of financial education.

Your next steps

If any or all of this sounds interesting – be sure to stay in touch.

If you actually want to learn the fundamentals about long-term money management, you’re in the right place.

This really isn’t as complicated as many people make it out to be.

You can learn about this in plain English and, as I hope you can see, you can have some fun whilst learning it too.

Thanks for dropping in,

Paul

For updates on these Insights and New ideas, sent straight to your inbox, get my occasional newsletter

And, if you sign up today, I’ll send you:

- An outline of my 5 step process for planning your own financial freedom and

- The first chapter of my acclaimed book, ‘Who misleads you about money?’

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article