Does your adviser really understand risk?

And should you find out sooner rather than later?

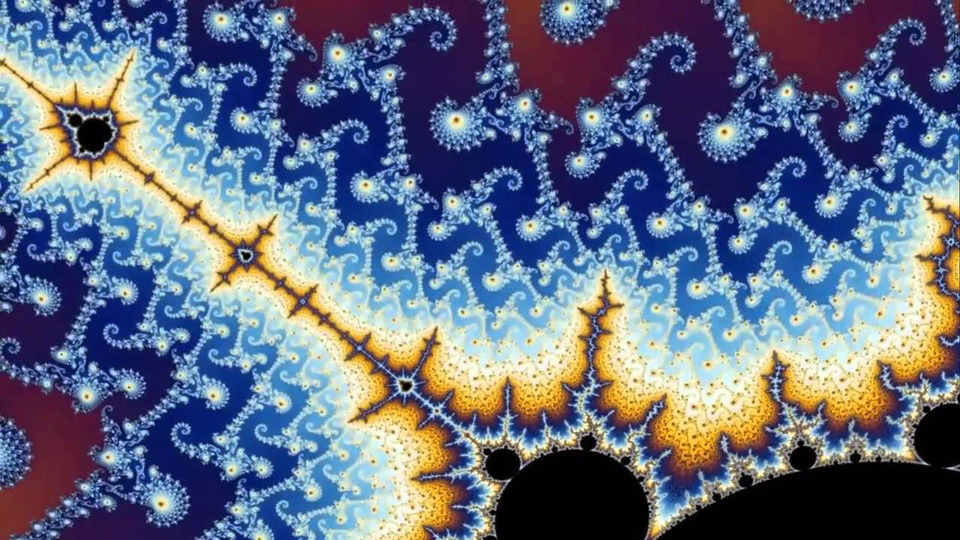

Benoit Mandelbrot had a beautiful mind for risk.

A Polish-born, French and American mathematician – he was the guy who discovered the idea of “self-similarity” in nature.

You may have heard the term ‘Fractal’ which he coined to describe the beautiful and ‘apparently complex’ shapes in nature.

This extraordinary simple concept explains how snowflakes are formed – and why trees and leaves are shaped the way they are.

It even helps to explain how our lungs and the veins in our bodies acquire their ‘tree-like’ shapes.

The truly fascinating thing about all these beautiful shapes is that they’re all, fundamentally, very simple.

They just repeat the same shape, over and over again – and if you’re not familiar with these shapes, watch the video above. They are really quite wonderful.

Mandelbrot’s explanations for how these shapes are formed (from simple repeating processes) have opened up whole fields of understanding in science and nature.

(and as a side effect, they’ve also enabled computer graphic designers to create the incredible, natural-looking images we see in computer games and film special effects today)

Okay, so what has this got to do with money or investing?

Well, as long ago as the 1960s, Mandelbrot was challenging the ‘models’ being used to explain the price behaviour of markets (shares, commodities etc.)

Unfortunately, for all of us, his ideas were ignored. Our ‘establishment’ of economists, bankers and regulators failed to properly manage the risks building up in asset prices.

So what?

Well, the result was the (almost) complete collapse in our financial system in 2008-09.

Okay, but that was back then – and it’s all fixed now, right?

No, sorry it’s not been fixed.

We still have a fragile banking system today. This is in the nature of banking.

So, what’s been going on?

Well, for most of the last 60 years, or so, our banks and regulators have chosen to base their rules (or rather their lack of rules) on a flawed theory about self-righting markets, but as Mandelbrot points out in the wonderful video below – the accepted theory of risk just hides the ‘hard to explain’ stuff… under the carpet!

The carpet is up now

Mandelbrot’s ideas are not ignored any more – at least not by central banks. It does seem to be taking a very long time for his ideas to be understood more widely – and taught to financial advisers and those ‘perfect market’ fanatics out there.

Examination authorities, it seems, take a very long time to ‘move on’ from old ideas.

In the meantime, it seems that you really do need to look out for yourself when it comes to investment risk

You need to choose your adviser carefully because some don’t really understand risk and some are happy to mislead you about it

Final thought

Sadly, Benoit Mandelbrot passed away in October 2010 so we’re especially lucky that the F.T. managed to capture this interview.

Let’s hope that the world of risk managers and investment advisers catch up with Mandelbrot’s evidence before another 50 years passes!

In the meantime, you might like to read ‘Black Swan’ and ‘Antifragile’ by Nassim Taleb which you’ll find listed among the books IRATE here.

And, if you’re a bit worried about your investment adviser’s knowledge – here’s how you can test them.

Thanks for dropping in,

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article