12 reasons to offer Financial Education

and one reason not to.

Creating (or helping others to create) an engaging financial education programme delivers enormous value to any financial services business.

It’s a great way to contribute to making the world a better place too.

If you offer financial advice or products or both or you provide Marketing, Website Design, Videography or Speaker training services to this sector, this Insight is for you.

Make your business the ‘go-to’ place

Here we’ll explore 12 big business benefits of putting financial education (in articles, guides or videos) at the heart of your marketing.

In a nutshell, these programmes (if delivered well) will help you build your business and retain more of your existing clients for longer.

So, what’s not to like about becoming, (or enhancing your position as) a ‘go-to’ provider for ideas on money?

It’s served Martyn Lewis extremely well, and he’s not even an expert on investment, tax or pensions matters!

Build resilience now while you have time?

Some advisers I talk to say they don’t need (or want) to invest in educational materials (or any other marketing for that matter) because they don’t need to build their business any further – at least right now.

“Things are just fine as they are”

This view is not unique to the Financial Advice sector, but after ten years of strong (and relatively stable) growth in asset markets (at least before Covid) I can understand why some advisers might think that way.

The rate at which clients change their adviser has probably been lower than in more normal, bumpier, times, and asset price growth has also driven (fund based) fees a lot higher too.

However, the only constant is change – in life, or any business environment.

Markets fall hard sometimes; the competition gets better and clients get itchy feet if they sense an advice offering is falling behind, on price or value add, so ignoring this trend to offer more educational materials to your clients might not be a great move.

In any event, it’s always best to prepare for a change-storm before the storm hits, right?

Yes, I know how the saying goes…

‘If it ain’t broke, don’t fix it’

But the winners in most games tend to say,

‘If it ain’t broke, there’s still time to fix it!’

And there are some broken parts that need fixing.

Build trust – your industry needs it.

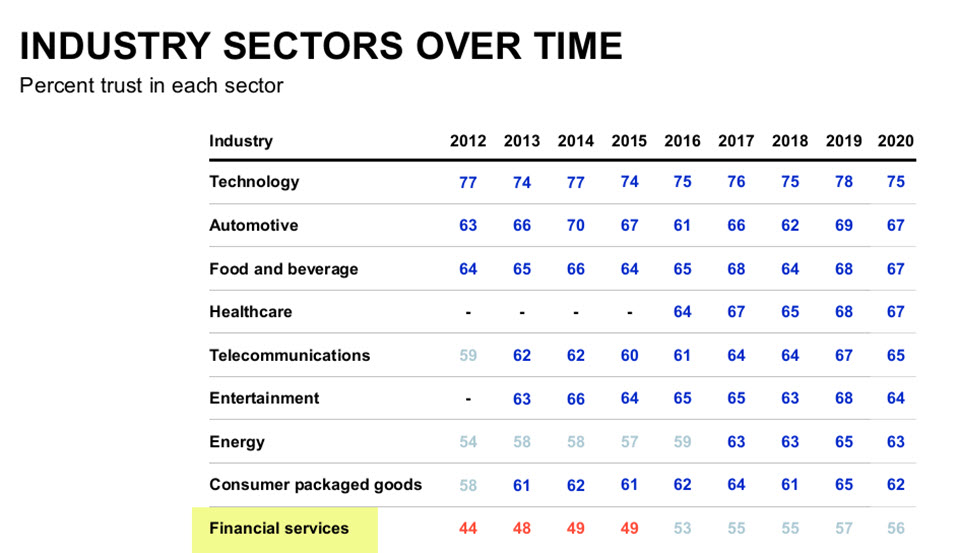

You know, despite all the regulatory interventions of recent years, that the FS industry gets consistently low scores for Trust.

The evidence is in Edelman’s excellent annual trust ‘barometer’ – from which this image is taken.

Trust is an issue I explored in this other Insight

Indeed I wrote a whole book on the subject.

So, I won’t go over it all again here, although there is one shocking finding from that Edelman report which bears a repeat mention.

When it comes to Financial Services, compared to the world’s other large economies:

the UK has the widest gap in trust between ‘informed’ and ‘mass population’ groups.

Why is that?

One reason could be that we don’t have enough relationships between advisers and consumers in the UK.

Without relationships, you can’t have trust.

Only one in six UK advisers are happy to take on clients from the wider public; those with less than £100,000 to invest (Source: Canada Life. August 2019) – and this lack of interest problem has been getting worse. Five years ago, three times as many advisers were happy to advise such clients.

There are many reasons for this advice gap, but they include the following:

- UK Financial Services regulation is complex and costly to cope with.

- The UK’s tax rules are now so complicated (esp. on pensions annual and lifetime allowances) that advice takes more time per client.

- The recent decade-long boom in asset prices has boosted the incomes of advisers without them taking on more clients.

- There’s a crisis in the supply of advisers too – with many retiring but few younger people entering the profession to replace them; an issue made worse by the low trust scores.

You can be different and change this

No good adviser wants to refuse people access to financial advice and leave them vulnerable to bad advice or scammers. So, a growing number of financial firms (and esp. new entrants and FinTechs) are finding ways to offer financial information and guidance to the wider public – without necessarily offering advice in all cases.

These companies are out there now, demonstrating their desire to help and support, where they can.

The best firms, who offer high-quality education as an integral part of their proposition, find that these programmes help them grow their core business too.

Is there a better way to build trust?

Is there a better way to build trust?

Is there a better way to build trust with your existing and prospective clients than by:

- Giving people a regular flow of engaging, solid and insightful ideas?

- Helping people, and their family and friends, to make better decisions about money?

- Demonstrating your desire to help and support people – without asking for anything in return?

I honestly can’t think of one.

Boost your image – and your income

Doing your bit to make the planet a better place is bound to make you feel good, and you can point to the fact that Education sits top centre on the UN’s sustainable development goals too.

That said, I suspect you might feel even better if your investment (in time, money or both) offers some real prospect of driving higher numbers of more suitable (and more enthusiastic) advice enquiries into your business, yes?

Well, a well-executed educational programme can do this for you too – just ask Pete Matthew (great website BTW, Pete)

Let’s look at 12 more ‘reasons why’

1 – You’ll reinforce your existing client relationships

Solid educational content shows off your expertise and commitment to client wellbeing.

Solid educational content shows off your expertise and commitment to client wellbeing.

It also reminds clients where to come when they need additional advice on past work or advice in a NEW area, and nudges them to send their family and friends to you too.

You know that financial advice clients can forget the detail of your value-added services, and often not long after they implement their plan!

Most of your work (and the future value you could add) will go unseen unless you share the secrets (the smart processes you use) to help your clients map out their plan… and you explain the extraordinary way they benefit from your work.

Just be careful if you outsource this educational writing. You need to work with someone who’s both proven at writing and qualified in this area.

If you don’t, you could end up pulling your hair out with frustration and re-writing most of the work you pay for.

I know, I’ve done this myself, in my former life as a Product Development Manager, at Clerical Medical… and just look at my hair! 😊

2. You’ll attract new clients to your business

By sharing valuable ideas, you’ll make the value of your services clear to all, so the benefits of building an educational programme, extend well beyond your existing client relationships.

3. You’ll attract clients to NEW services and offers

You’ll get much more interest in any new services you launch – or offers you make – if you adopt a subtle communications approach.

You’ll get much more interest in any new services you launch – or offers you make – if you adopt a subtle communications approach.

Develop a reputation for sharing solid, generic solution ideas to common financial planning challenges, and you can simply drop a mention of your services into regular helpful posts in passing.

That’s much better than a hard sell. No one wants to be ‘sold to’ but most of us are up for learning smart tips and tricks for solving life’s challenges – especially if they come from competent people.

So, go ahead and explain your solution ideas; you’re more likely to be asked for help.

Do this well enough and you might never need to ‘sell’ again.

Just be sure your communications are clear and engaging.

Frankly, not all of what sits on adviser websites today is that… sorry guys but it’s true.

You might need help to plan what to write about, to structure and format the content, or to write each post from scratch.

You may only need that help until you’ve got a high-quality production line up and running. But the thing is, just as you tell your clients to get expert help, this is an area where you might need to take your own advice.

So, just ask for help if you need it.

4. You’ll deliver more consistent client messages

How often do you explain basic concepts around financial planning?

Concepts around investing, pensions, estate planning (and so on) – either face to face or via e-mail?

Perhaps you enjoy writing up all those repeated explanations – and if so, don’t let me stand in your way. You will, however, find that job a lot easier when you have your own library of (evergreen and fundamental) lessons in place.

At that point, you can just link your clients to the relevant Insight to read in their own time.

In a business with multiple advisers – you’ll get a significant message consistency benefit here too.

5. You’ll save LOTS of adviser time

Building on the previous point, you’ll save on costly adviser time if you help your clients get to the first base of understanding with your educational materials.

Building on the previous point, you’ll save on costly adviser time if you help your clients get to the first base of understanding with your educational materials.

Face to face teaching within a financial planning (or advice) process can be fun, for sure.

However, it’s also very time-consuming (which means expensive) and, as already mentioned, it poses big risks to your business, unless your core messages are consistent, and written down.

So, build a robust set of materials to explain the key areas you regularly talk about with your clients – and save your advisers a lot of costly time.

6- Your clients will get more value-added advice

Once you have your core educational materials in place, you (or your advisers) can focus on higher-value client conversations.

Once you have your core educational materials in place, you (or your advisers) can focus on higher-value client conversations.

Now you can build on improved client knowledge around the core financial planning concepts.

You can send your clients links to these Insights, to improve their understanding, a few days before your meetings, so the essential points will be fresh in their minds and your meetings will be more valuable.

Your clients will spend less time relearning basics and more time discussing the finer points of their particular situation.

More importantly, you’ll get to spend more time outlining how your services will help your prospective clients solve their financial life challenges.

7 – Your sales conversion rates will increase

When you reassure your prospects about your knowledge and skills upfront, more of them will convert, faster to clients.

We might argue about the statistics, and they will vary by industry, but in our information-rich, digital world, it’s thought that as much as 70% of a buying decision takes place before a customer contacts you.

It’s how most of us go about choosing a new service supplier these days; first, we check to see what they have to say (and others have to say about them) online, right?

And that’s what your prospective (and existing) customers are doing right now, so your digital presence needs to be smart and informative.

Of course, higher conversion rates also mean higher referral rates. People want to like and share clear and engaging Insights with their friends and family too; that’s just how it is.

8 – Your staff training might be more engaging

No offence intended, but with more engaging educational content, those often-dull, training sessions could be more engaging…

Learning new concepts and skills is never easy, but there’s really no need to make this a grisly experience. You just need the right content.

Starting a conversation with ‘why’ is not only the best way to motivate clients, it’s also the best way to engage the thoughts and ideas of your team.

Start more of your training sessions with fundamental benefit-focused, client-facing messages, and your staff will almost certainly engage more. Which means more effective, more consistent – and lower-cost training.

Simply re-use your new educational content in your training.

9 – You’ll retain your best (and recruit better) staff too

OK, I know what you’re thinking – I’m ‘over-egging’ the benefits here now.

OK, I know what you’re thinking – I’m ‘over-egging’ the benefits here now.

Well, no, the evidence is right here:

Millennials (and that’s everyone less than nearly 40 years old, now) put corporate learning and company purpose right at the top of their feature list when searching for jobs.

This is not just about millennials, either… who doesn’t want to work in a business that understands the value of client and staff education, and does great work in that space?

10- Your professional introducers will find it easier to send you clients

Sorry, yes, I know that’s a grumpy face but be honest, are all of your Solicitor and Accountant introducers always smiling?

The point here is about making it easy for these professionals (smiley or otherwise) to refer clients to you, and you can make their life easier by offering them links to your educational Insights on various topics.

These materials need to demonstrate your command of key subjects and your ability to communicate them clearly.

Do that and you’ll find it easier to impress new introducers about your business services too.

11 – You could also improve your client reports

How long are your, typical client reports?

How long are your, typical client reports?

How long? 😉

Well, by developing high-quality educational materials, your business proposition could be helped in this area too.

The phrases (or whole lessons) that you, or your writer, create – to explain all the key financial planning concepts – can be drawn into your client reports, to refresh those standard paragraphs.

You might also find you can shorten the main body of the reports, by referring to your educational materials for explanations of evergreen concepts.

Message consistency is important here too, isn’t it?

12 – You’ll save time in engaging other suppliers

The final reason (that I can think of – you might have more) to focus more on financial education is that it’s easier and quicker to engage with other marketing suppliers.

The final reason (that I can think of – you might have more) to focus more on financial education is that it’s easier and quicker to engage with other marketing suppliers.

You’ll make the job of your Website or brochure designer (or a videographer if you take that route) much easier if you provide them with clear and helpful content.

Your marketing people might be great at helping you create client testimonials and posts about you and your team. But many struggle to help financial services businesses with educational content because, like the general public, they’re not qualified in (and don’t understand the benefits of) solid financial planning and advice.

However, if you provide your marketing team with the words you want to use, written in the style you want to say them (in text, audio or video) then they should be able to help you convert those words into engaging, technicolour marketing assets.

Just ask, if you’d like me to send you an example of what I mean.

The key points here are to approach your content writing carefully, to use good writers, if you outsource part or all of the work.

You also need to employ great quality web developers and videographers – who don’t need to cost the earth.

Get this right upfront and you’ll save a ton of time and money down the line.

Do you have questions?

I said at the top that I’d outline 12 reasons to develop educational materials and one reason not to, and there’s no prize for guessing that.

I said at the top that I’d outline 12 reasons to develop educational materials and one reason not to, and there’s no prize for guessing that.

Yes, it’s the cost to create this programme, but then all unique and valuable works have a cost, don’t they?

If you wanted to write a book (perhaps you have already) it would cost you a great deal of time – perhaps 6 to 12 months of solid, full-time work to create something of substance.

So, think about the earnings you’d lose if you spent a year writing your educational programme.

What might that cost you?

£75,000, £150,000… £250,000?

Sure, if you outsourced the writing of your educational programme, it might not be cheap, but it should not cost you anything like the lowest of those numbers.

In any event, you’ll want to build your programme over time, to build a reputation for consistent delivery of great new ideas.

So, you’ll want to pay for the creative writing monthly, not all in one go. In which case you can hire a great writer for less than you’d pay to hire an average, junior marketing assistant.

There’s really no comparison is there?

What’s more, unlike the big marketing agencies, a professional writer will not charge you any fat (percentage of project) upfront fees, either.

Worth thinking about, right?

Plan this carefully

Plan the build of this programme carefully and you’ll minimise your initial costs – and cut your ongoing costs (to maintain the content) to next to nothing.

Again, that’s not a pricing structure you’ll find with most other services, is it?

Your planning approach to your educational project, especially around the content you go for, is critical.

Whether you want to develop a brand NEW educational programme, add to, or improve the materials you already have, you’ll get a lot more value from your investment if you’re clear up front on some key questions; here are some of the main ones:

Do you have a good website platform for these lessons?

Is the design, user-friendliness (navigability) and load speed of your website up to the job? Visitors to your site will read great content – if it loads fast and looks OK on both laptop and phone. They won’t if they have to wait 30 seconds for it to load.

Does your web platform help you optimise your presence on search engines… that SEO thing?

WordPress.org is the platform of choice in this regard but there’s a lot more than this to think about, so get a good designer and developer (they’re different roles, by the way) if you don’t already have them.

Are you clear on who you want to help through your educational works?

This might sound like a daft question but it’s easily (and often) overlooked.

If you write to someone in a post (like this) you need an idea of who they are.

This is not just about their knowledge or experience of financial planning or investments or their personal financial circumstances. You should also have a sense of their interests and values – and about the topics that might engage them most.

You also need to decide whether your educational programme will include lessons (I call them Insights) for those who can’t (yet) afford your services?

If you want to do your bit, to help a wider section of society – and protect more people from being misled by others, the answer is YES!

What lesson areas do you want to include?

It’s easy for those of us (who’ve studied financial planning) to forget what an enormous range of topics there are under the ‘money questions’ umbrella.

If you’re not sure where you might focus your educational efforts, initially, drop me a line at hello@paulclaireaux.com with the message line, ‘What can I teach people about?’ and I’ll send you a simple list of 20+ topic areas to help your thinking.

I generally divide these topics into two broad areas:

- Money basics/Getting started

- Wealth building/Preservation

and I overlay lessons in money Psychology/behavioural science across both areas.

I see a lot of adviser firms writing occasional posts across a wide, and unconnected, range of topics and that’s not a great way to engage an audience – of any type.

So, if you’re interested in developing a programme of lessons, ask someone who’s done this well before, I’d be happy to help.

How complex do you want to make the content?

Anyone qualified in the various aspects of Financial Planning can write complex content.

The trouble is, complex content doesn’t sell.

It won’t help you sell your financial planning services or your financial products. And it won’t win you followers on Social Media either!

You need to show your communication skills, and your competence around complex issues without making things complicated!

That’s tricky to achieve.

In general, where complex issues come up (e.g. optimising profit extraction for company directors or tax considerations for non-UK residents), I suggest that the ‘call to action’ in your lessons should always be to take advice.

In general, where complex issues come up (e.g. optimising profit extraction for company directors or tax considerations for non-UK residents), I suggest that the ‘call to action’ in your lessons should always be to take advice.

There is a ton of educational value you can add on all 20+ of the categories on my lists without going into grisly detail; No one wants to hear that.

Indeed, if your lessons are complicated and boring, you’ll just put people off financial planning altogether, and you don’t want to do that.

So, focus your writing on high-level ideas to help people approach their financial life challenges.

You can help your prospective clients sort out their finances if they like what you write about – and decide to work with you.

What tone and style of writing work best?

This is a big subject and one I might come back to another time, but I’ll be open with you here, I tend to write in one style.

I’m told it’s engaging and conversational, but you must be the judge of that. I guess if you’ve read this far, you agree 😉

My writing style has two benefits:

First, almost everyone who reads your materials will understand what you’re saying… and that kinda matters!

Second, you can reuse the content (with little or no editing) to record audio or ‘piece to camera’ video lessons, if you want to work in those formats. And, without question, the value of your work is vastly increased if you do.

You can even get others to do the presenting or voiceovers for you – provided that your content is easy to read.

The truth is that a lot of people are nervous about presenting and, trust me, video recording can be a bit daunting.

Although for some, like Jason Butler, video presenting seems to be a breeze. Here he is, presenting the first of 20 money lessons that I wrote for Salary Finance a while back.

Evergreen and Attenborough

You’ll note that the content of that lesson is evergreen, so it won’t go out of date, and that’s quite deliberate.

I focus my efforts on fundamental, evergreen lessons because they offer the greatest value to your readers (or viewers) AND they eliminate any updating costs, for you.

I also think it’s worth aiming for a David Attenborough style of writing lessons – whether you record them or just leave them as text on the page.

What’s a David Attenborough style?

Well, if you’ve watched his documentaries, you may have already spotted his secret.

Attenborough uses short paragraphs of short sentences.

He does not use smart-arse words or TLAs

Oh, sorry, slipped into the jargon there.

TLAs = Three-letter acronyms; those ghastly things that so often pepper the content and confuse the reader on financial blogs!

Bottom line

It’s not easy to create high quality great educational Insights, in blogs or guides, and least of all as videos.

So, few people manage it, but those who do stand head and shoulders above the competition.

You just need to get the right team on board, to make this a relatively pain-free process, and if you like what you’ve read here – and believe I could help you, let’s chat about that.

Either way, I wish you the best of luck on the next stage of your journey.

Thanks for dropping in,

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter

As a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Also, for more frequent ideas – and more interaction – you can join my Facebook group here

Share your comments here

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article